New York Small Business Accounting Package

What is this form package?

The New York Small Business Accounting Package is a comprehensive collection of essential forms designed to help small businesses manage their accounting needs effectively. This package differs from others by providing a tailored set of documents specifically created for New York businesses, ensuring compliance and relevance. These forms can be easily adapted to fit your particular business circumstances, helping you maintain accurate financial records and streamline your accounting processes.

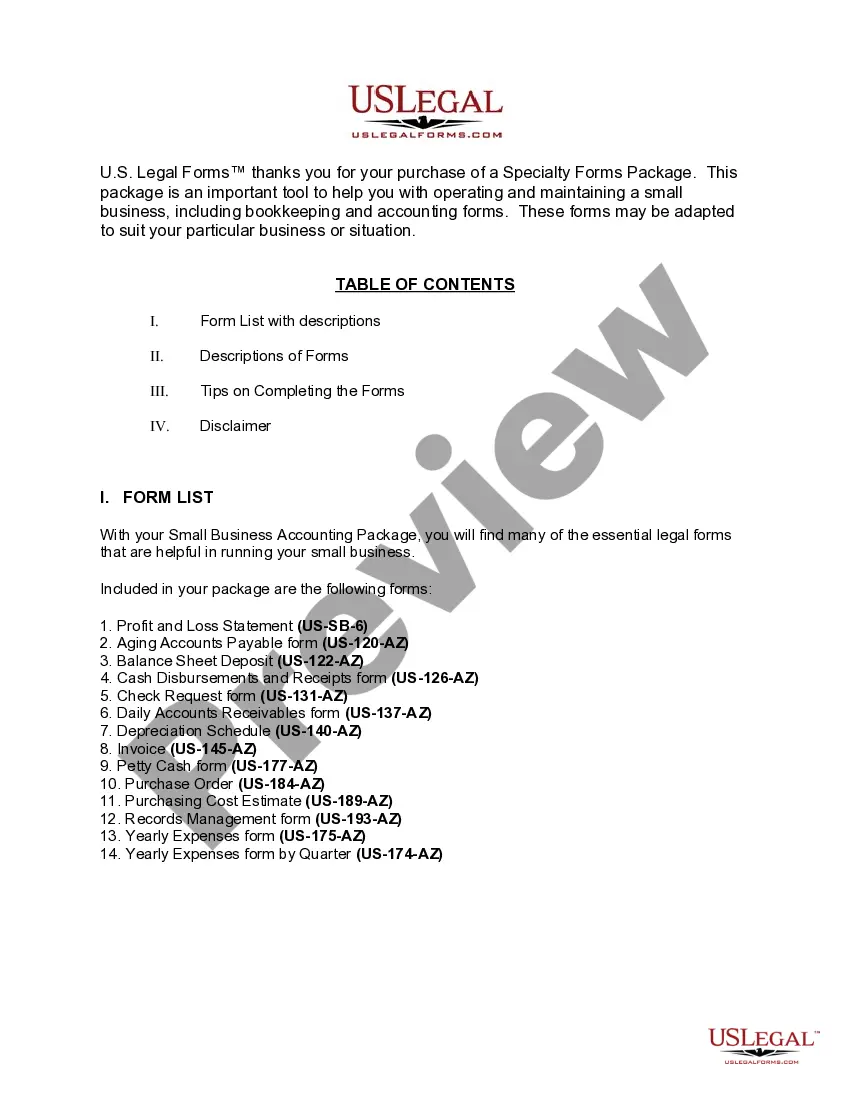

Forms provided in this package

Common use cases

This form package is ideal for small business owners who need to maintain thorough accounting records. You should consider using it when:

- You are starting a new small business and need to establish your accounting framework.

- You are tracking daily transaction activities and need to monitor your cash flow.

- Your business is preparing for tax filing or financial reporting.

- You want to evaluate the financial performance of your business through profit and loss statements.

- You are managing vendor payments and need to track accounts payable.

Who can use this document

- Small business owners and entrepreneurs in New York.

- Startups looking for structured accounting methodologies.

- Business managers responsible for financial records and reporting.

- Freelancers or sole proprietors in need of tracking their income and expenses.

- Individuals who wish to maintain compliance with New York's accounting requirements.

How to prepare this document

- Review the included forms thoroughly to understand their purpose.

- Identify your specific business needs and select the applicable forms.

- Enter all necessary information into the form fields provided.

- Double-check your entries for accuracy before finalizing any documents.

- Save and store completed forms in a secure location for future reference.

Notarization requirements for forms in this package

Forms in this package usually don’t need notarization, but certain jurisdictions or signing circumstances may require it. US Legal Forms provides a secure online notarization option powered by Notarize, accessible 24/7 from anywhere.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Avoid these common issues

- Failing to update forms with the most current financial information.

- Not customizing forms to fit specific business circumstances.

- Neglecting to track expenses accurately, leading to misleading financial statements.

- Overlooking compliance with local regulatory requirements.

Benefits of using this package online

- Convenience of downloading forms at any time without physical visits.

- Editability allows you to tailor forms to your specific needs easily.

- Reliability of attorney-drafted documents, ensuring legal integrity.

- Immediate access to documents that streamline your business operations.

Looking for another form?

Form popularity

FAQ

1Pay Close Attention to Receivables.2Keep a Pulse on Your Cash Flow.3Log Expense Receipts.4Record Cash Expenses.5Know the Difference Between Invoices and Receipts.6Keep Personal vs.7Hire a Professional to Handle Your Taxes.13 Accounting Tips for Small Businesses to Keep the- ScaleFactor\nscalefactor.com > scaleblog > 13-accounting-tips-help-keep-books-balanced

Choose Cash or Accrual Accounting. Set Up a Business Bank Account. Pick a Bookkeeping Software Package for Small Businesses. Create a Chart of Accounts. Set Up an Expense Tracking System. Prepare Your Bank Reconciliation Process. Set Up Your Reporting System. Getting help.

1Hire somebody a little different:2Deploy Marketing That Actually Helps Them.3Let them Hunt at Your Events.4Trade Shows:5Calls:6Boots on the Ground:7Solicit Honest, Objective Feedback:8Partnerships:

1Update your website. Take an objective look at your firm's website to determine what updates needed.2Get to the top of local search results.3Start (and maintain) a regular blog.4Use social media effectively.5Maximize email marketing efforts.

Create a New Business Account. Set Budget Aside for Tax Purposes. Always Keep Your Records Organised. Track Your Expenses. Maintain Daily Records. Leave an Audit Trail. Stay on Top of Your Accounts Receivable. Keep Tax Deadlines in Mind.

Generally, a small business is not required to have a CPA or certified public accountant.Although most small businesses are not required to have a CPA involved, a small business may engage a CPA to review its internal controls, evaluate accounting software, obtain tax advice, and so on.

Understand the purpose. One thing that has helped a lot of our clients is understanding why they're doing their books in the first place. Review the reports. Take small bites. Utilize software. Hire someone else. Digitize everything. Perform regular audits. Take a course.

Business Bank Reconciliations. Credit Card Management. Accounts Receivable. Accounts Payable. Sales Tax. Payroll.

Go the Extra Mile. Even if they do their research, small business owners don't have a financial advisor's level of expertise when it comes to small business finances. Referrals & Reviews. Word of mouth is everything these days. Don't Be Afraid of Social Media. Generate and Share Engaging Content. Bottom Line.