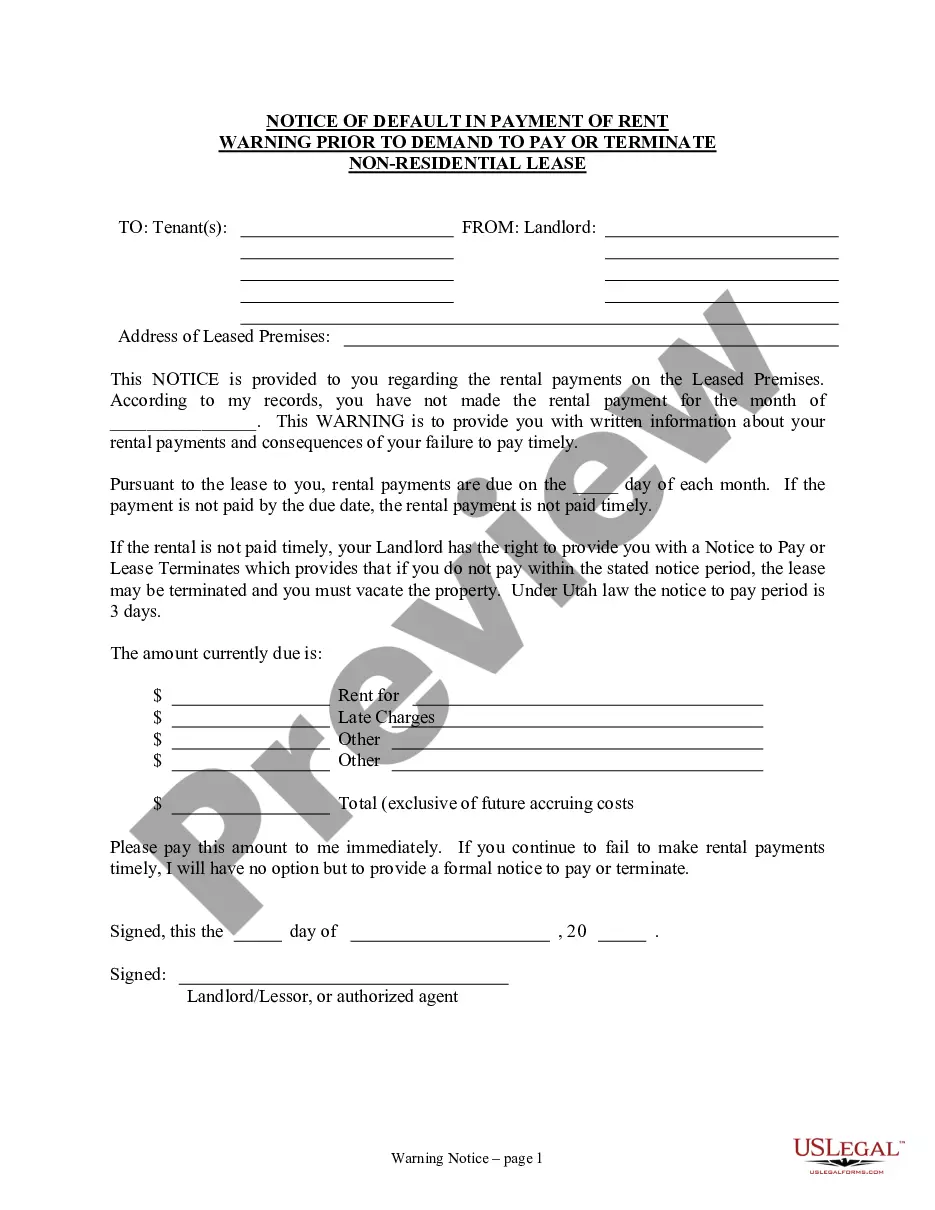

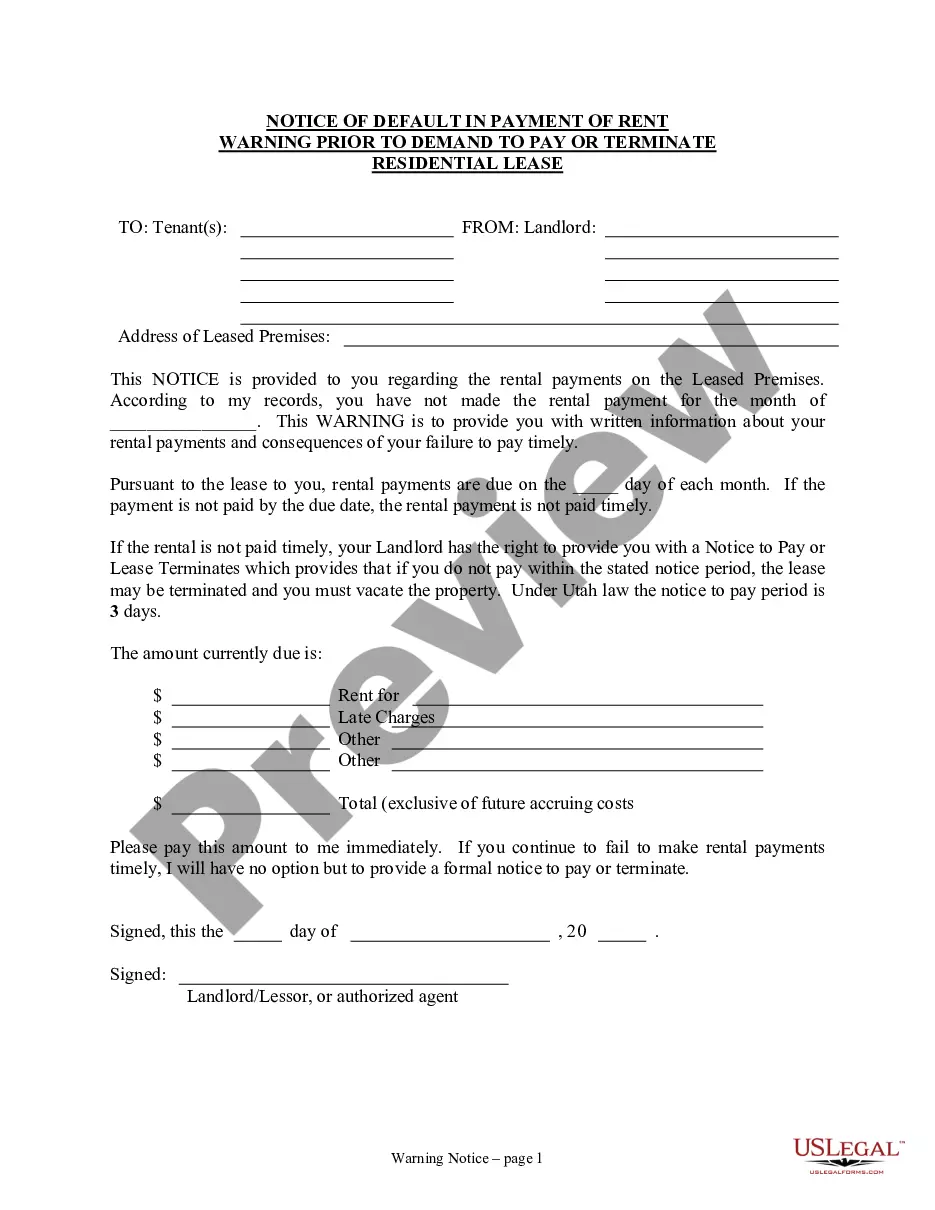

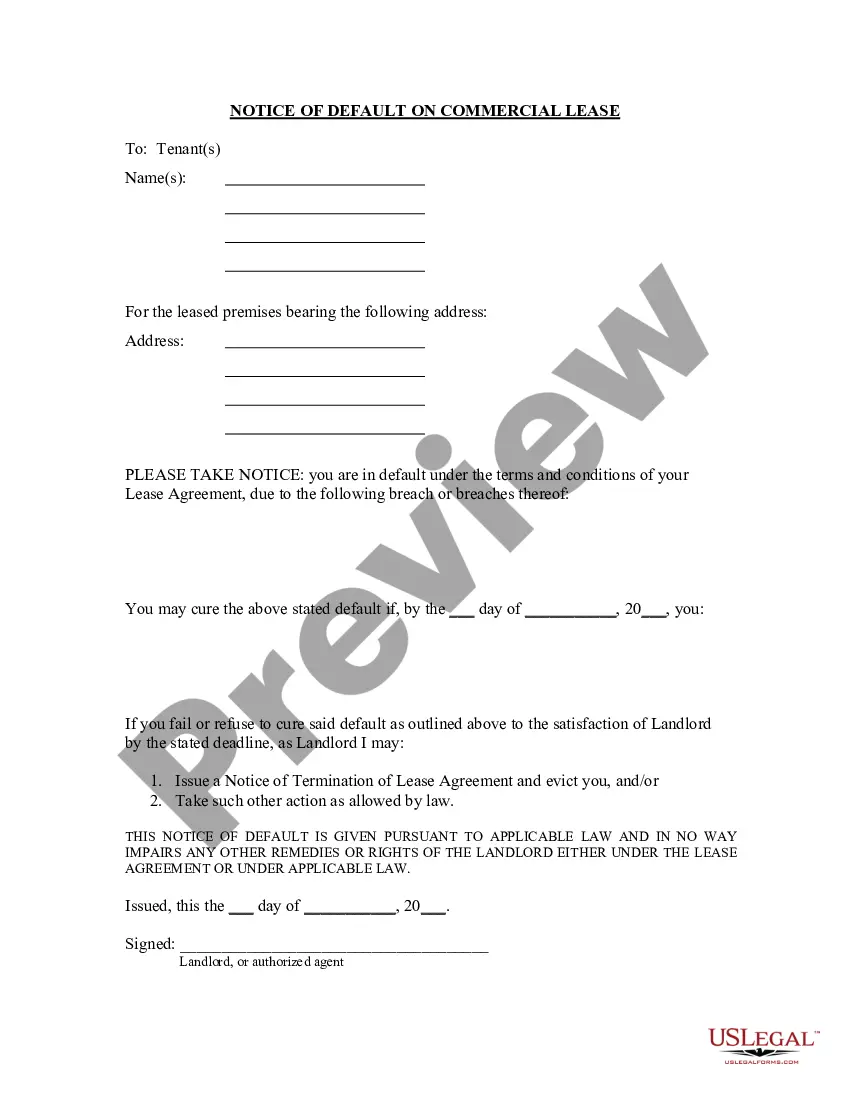

This Notice of Default in Payment of Rent as Warning Prior to Demand to Pay or Terminate for Non-Residential or Commercial Property form is for use by a Landlord to inform Tenant of Tenant's default in the payment of rent as a warning prior to a pay or terminate notice. The form advises the Tenant of the due date of rent and the consequences of late payment. This form may be used where you desire to remind the Tenant of payment terms, the default, demand payment and inform the Tenant that under the laws of this state or lease, the Landlord may terminate if rent is not paid timely.

Utah Notice of Default in Payment of Rent as Warning Prior to Demand to Pay or Terminate for Nonresidential or Commercial Property

Description

How to fill out Utah Notice Of Default In Payment Of Rent As Warning Prior To Demand To Pay Or Terminate For Nonresidential Or Commercial Property?

Looking for a Utah Notice of Default in Payment of Rent as Warning Prior to Demand to Pay or Terminate for Nonresidential or Commercial Property on the internet can be stressful. All too often, you find papers which you think are ok to use, but find out afterwards they’re not. US Legal Forms offers over 85,000 state-specific legal and tax forms drafted by professional legal professionals according to state requirements. Get any form you’re looking for within minutes, hassle-free.

If you already have the US Legal Forms subscription, just log in and download the sample. It will instantly be added in to your My Forms section. In case you do not have an account, you must register and pick a subscription plan first.

Follow the step-by-step instructions listed below to download Utah Notice of Default in Payment of Rent as Warning Prior to Demand to Pay or Terminate for Nonresidential or Commercial Property from the website:

- Read the document description and hit Preview (if available) to check if the template meets your requirements or not.

- If the document is not what you need, get others using the Search field or the listed recommendations.

- If it’s appropriate, simply click Buy Now.

- Choose a subscription plan and create an account.

- Pay with a credit card or PayPal and download the document in a preferable format.

- Right after downloading it, you may fill it out, sign and print it.

Obtain access to 85,000 legal templates from our US Legal Forms catalogue. In addition to professionally drafted samples, users are also supported with step-by-step guidelines concerning how to get, download, and complete forms.

Form popularity

FAQ

If a borrower falls behind on his mortgage payments, the mortgage lender might file a notice of default, which is an official public notice that the borrower is in arrears. It is one of the initial steps in the foreclosure process.

1Don't ignore the problem.2Contact your lender as soon as you realize that you have a problem.3Open and respond to all mail from your lender.4Know your mortgage rights.5Understand foreclosure prevention options.6Contact a housing counselor.7Prioritize your spending.8Use your assets.Steps to prevent foreclosure - Utah Foreclosure Prevention Taskforce\nwww.utahforeclosureprevention.com > preventforeclosure

The term notice of default refers to a public notice filed with a court that states that the borrower of a mortgage is in default on a loan. The lender may file a notice of default when a mortgagor falls behind on their mortgage payments.

Legally, however, you are not required to vacate your property upon receiving a notice to sell. Depending on the timing of the required notices and previous negotiations with your lender, it can take approximately 120 days to complete a nonjudicial foreclosure.

You can stop the foreclosure process by informing your lender that you will pay off the default amount and extra fees. Your lender would prefer to have the money much more than they would have your home, so unless there are extenuating circumstances, this should work.

After the lender files the Notice of Default, you get 90 days to bring your past-due bill current. After the 90 days pass, the lender files a Notice of Sale with the clerk. The Notice of Sale displays the location, date and time of the sale. It lists the trustee's name and contact information.

The notice of default doesn't affect your credit file, but when the account defaults this will be recorded.If the debt is regulated by the Consumer Credit Act, you must be sent a default notice warning letter and have time to act on it before the default is recorded on your credit file.

Don't ignore the problem. Contact your lender as soon as you realize that you have a problem. Open and respond to all mail from your lender. Know your mortgage rights. Understand foreclosure prevention options. Contact a housing counselor. Prioritize your spending. Use your assets.

A notice of default is the first step to a bank or mortgage lender's foreclosure process.If the mortgage is not paid up to date, the lender will seize the home. A notice of default is also known as a reinstatement period, notice of public auction, or notice of foreclosure.