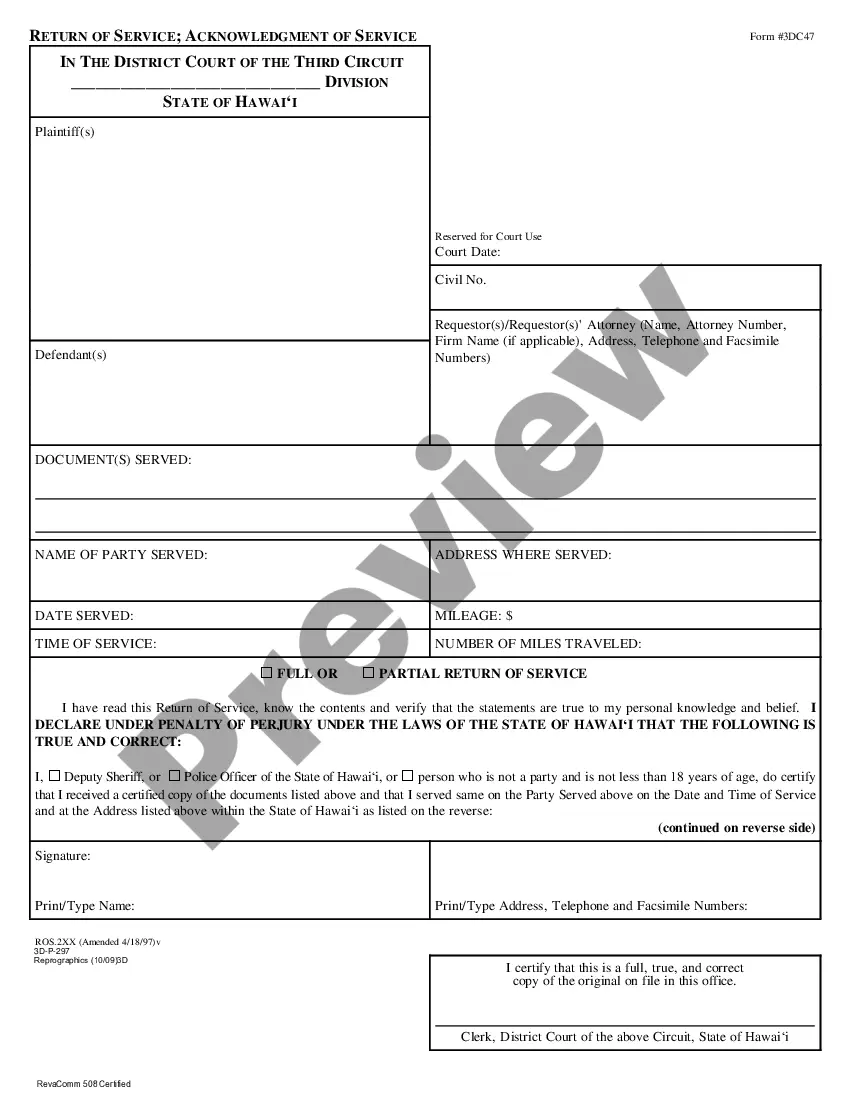

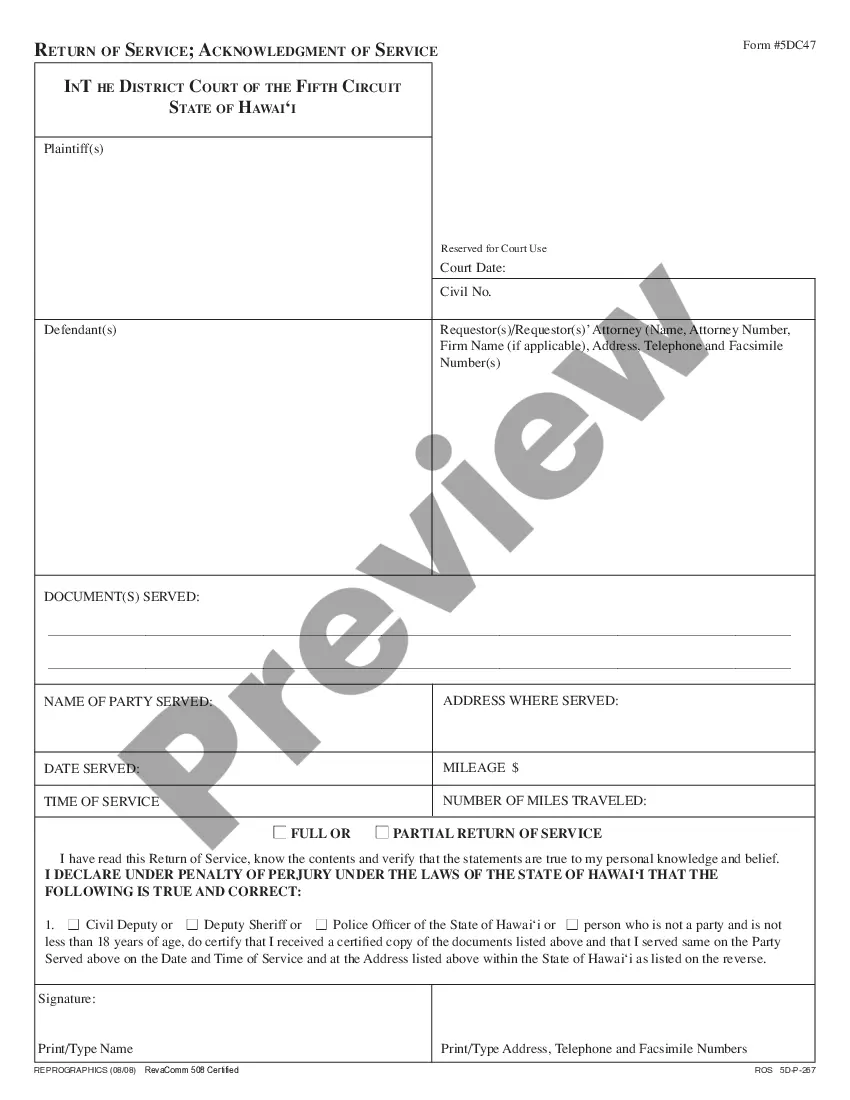

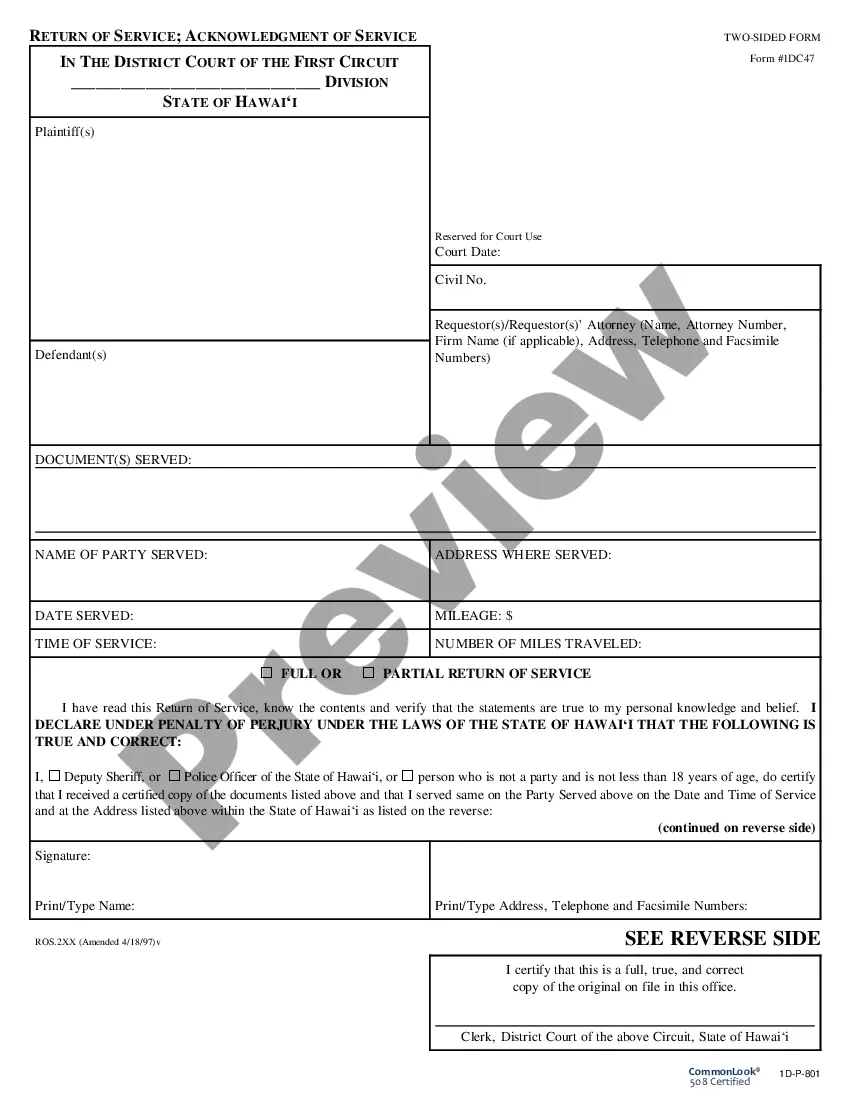

This official form should be completed by the process server once service on a party is complete. The Return of Service will identify the person served, the date and time of service, and the method of service.

Hawaii Return of Service

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Hawaii Return Of Service?

Gain entry to one of the most extensive collections of legal documents.

US Legal Forms serves as a platform to locate any state-specific file in just a few clicks, including Hawaii Return of Service forms.

No need to spend countless hours hunting for a court-admissible template.

That's it! You must complete the Hawaii Return of Service template and verify it. To ensure all is accurate, consult your local legal advisor for assistance. Register and effortlessly access approximately 85,000 useful forms.

- Our knowledgeable specialists guarantee that you receive the latest documents every time.

- To take advantage of the forms library, select a subscription and set up an account.

- If you've already registered, simply Log In and then click Download.

- The Hawaii Return of Service template will be stored in the My documents section (a section for every document you download from US Legal Forms).

- To create a new account, follow the short instructions provided below.

- If you intend to use a state-specific sample, ensure you specify the correct state.

- If possible, review the description to understand all of the details of the document.

- Utilize the Preview feature if it's available to examine the document's information.

- If everything appears correct, click Buy Now.

- After selecting a pricing tier, establish an account.

- Make payment using a card or PayPal.

- Download the document to your device by clicking Download.

Form popularity

FAQ

Some tax forms, such as certain amended returns or complex returns, cannot be filed electronically. It's crucial to check the latest regulations to ensure compliance. If you find yourself needing to file such forms, mailing them might be your only option. Platforms like uslegalforms can guide you through the necessary procedures for these cases.

The address you place on your tax return should be your current residential address. This ensures that the tax authorities can locate you if any issues arise. Make sure it’s accurate to avoid delays or miscommunication. Uslegalforms offers resources that can help you determine how to correctly fill out your return.

Yes, you can file your return electronically through various platforms that support Hawaii tax filing. E-filing simplifies the process and provides a secure way to submit your information. Many find this option reduces paperwork and speeds up refunds. Using uslegalforms can streamline your electronic filing experience.

You should send your Hawaii state tax return to the address indicated on the return form. The Department of Taxation designates the mailing addresses based on the type of return you are submitting. Accuracy is key to avoiding any delays in processing your tax return. Consider uslegalforms to help you find the right information easily.

Whether you need to file a Hawaii state tax return depends on your income level and filing status. Generally, if your income exceeds the state threshold, you must file. It's beneficial to review the specific requirements set by the Hawaii Department of Taxation. Uslegalforms can help confirm your filing obligation with clarity.

Yes, a Hawaii tax return can be filed electronically through various tax preparation software. This option is not only efficient but also designed for your convenience. Filing electronically allows for quicker processing and obtaining refunds faster. Utilizing uslegalforms can enhance your e-filing experience.

You may not have to mail your Hawaii state tax return if you choose to e-file. Hawaii allows electronic submissions, which many find to be more convenient and secure. However, if you prefer to mail your return, ensure it goes to the correct address. Using uslegalforms can help you understand your options clearly.

If you’re mailing your IRS tax return from Hawaii, you should send it to the appropriate address specified on the IRS instructions. Typically, this depends on whether you are including a payment. To ensure accuracy, check the latest IRS guidelines. Uslegalforms provides comprehensive information to guide you through your tax return mailing process.

Yes, you can e-file a Hawaii state tax return. The Hawaii Department of Taxation supports electronic filing for most residents. Using e-filing offers a quicker return processing time and often results in faster refunds. Platforms like uslegalforms make electronic filing easy with their user-friendly interface.

When mailing your Hawaii tax return, you should send it to the appropriate address found on the form. For most residents, the return goes to the Hawaii Department of Taxation. Ensure the address corresponds to your filing type to avoid delays. Using uslegalforms can simplify this process by providing ready-to-use templates and guidance.