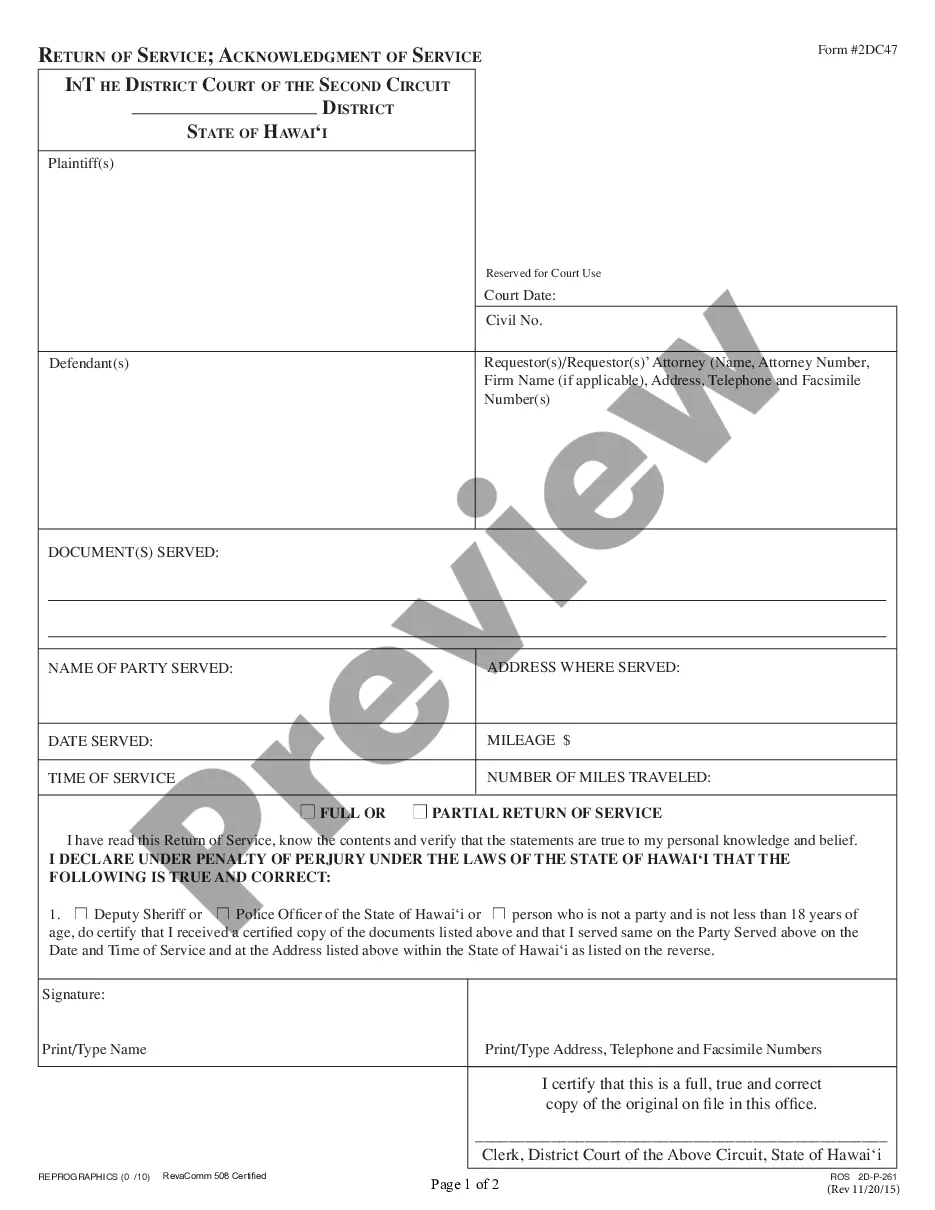

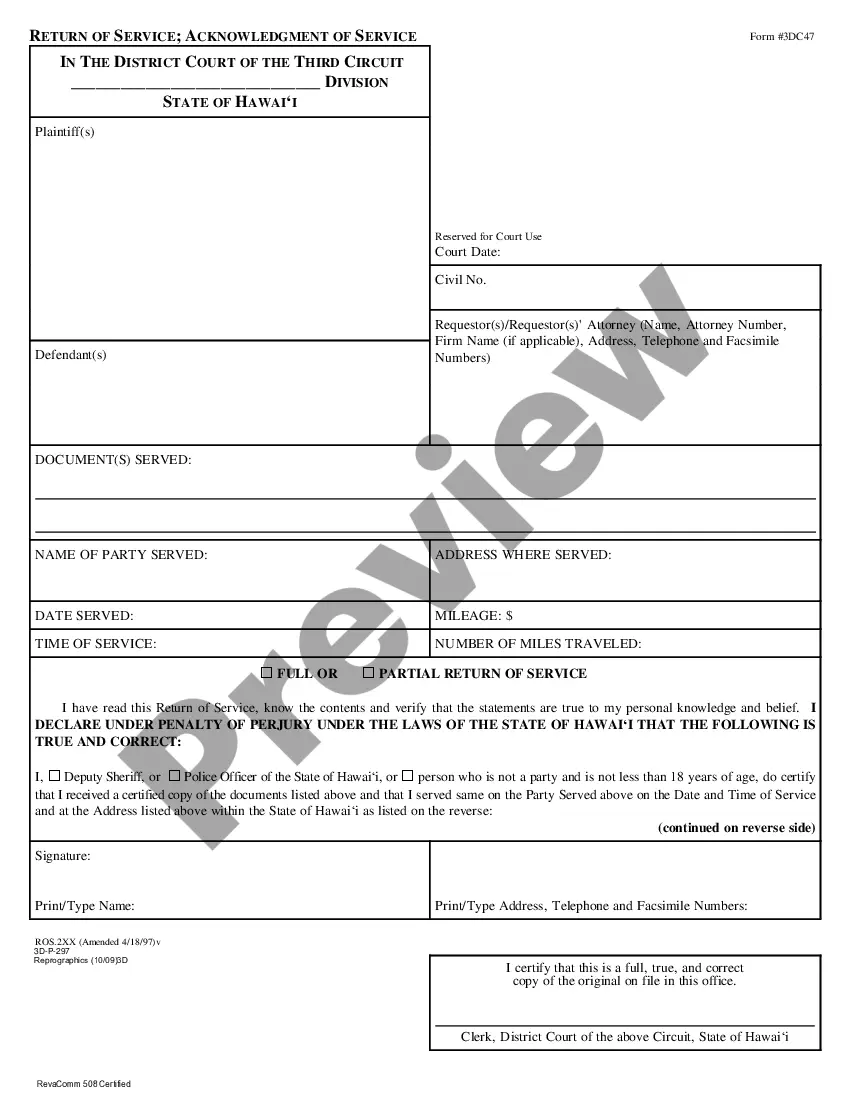

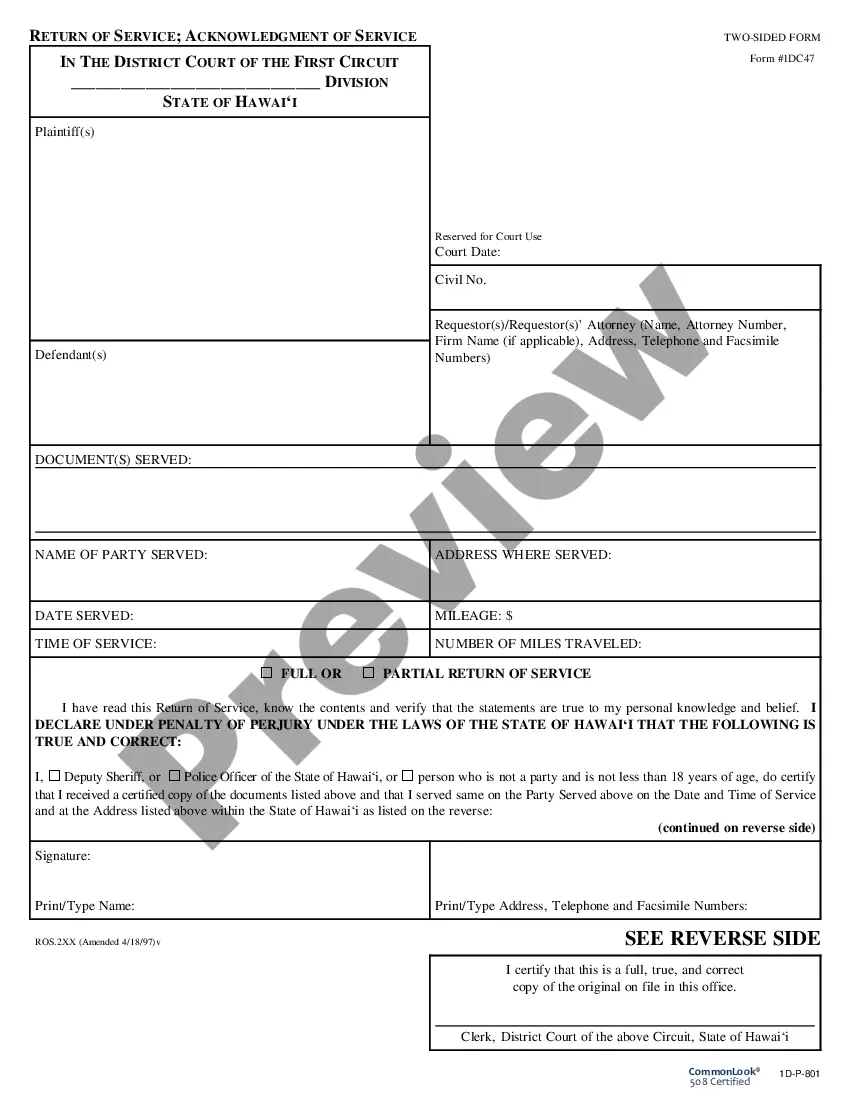

This official form should be completed by the process server once service on a party is complete. The Return of Service will identify the person served, the date and time of service, and the method of service.

Hawaii Return of Service

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Hawaii Return Of Service?

Obtain entry to one of the largest collections of legal documents.

US Legal Forms is essentially a platform to locate any state-specific document in just a few clicks, including Hawaii Return of Service examples.

No need to waste time searching for a court-acceptable form.

After selecting a pricing plan, create your account. Pay using a credit card or PayPal. Download the sample to your device by clicking Download. That's it! You need to fill out the Hawaii Return of Service form and verify it. To ensure everything is accurate, consult your local legal advisor for assistance. Sign up and effortlessly access over 85,000 valuable forms.

- Choose a subscription to access the forms library, and create your account.

- If you have registered, simply Log In and click on the Download button.

- The Hawaii Return of Service example will promptly be saved in the My documents section (a section for all forms you download from US Legal Forms).

- To set up a new account, follow the simple instructions listed below.

- If you need to use a state-specific example, ensure you select the correct state.

- If available, check the description to understand all details of the document.

- Utilize the Preview feature if it’s available to examine the document's content.

- If everything appears correct, click on the Buy Now button.

Form popularity

FAQ

Rule 58 in Hawaii pertains to the entry of judgments in court cases, ensuring that judgments are properly recorded. This rule is essential for maintaining accurate court records and understanding the outcomes of cases. For anyone dealing with Hawaii Return of Service, familiarity with Rule 58 can assist in navigating post-judgment processes effectively.

Rule 35 in Hawaii addresses mental and physical examinations of parties involved in legal proceedings. It allows one party to request an evaluation if it is relevant to a case. This rule can be significant when discussing matters relating to Hawaii Return of Service, as it may require additional documentation or evidence for certain cases.

Serving papers in Hawaii involves delivering legal documents to the other party in a lawsuit. You can do this through various means, including personal service or registered mail. Proper execution of the Hawaii Return of Service is crucial, as it affirms that the documents reached the intended recipient, ensuring adherence to legal protocols.

Rule 48 in Hawaii focuses on the requirements for the judgment following a trial, especially when a jury is present. It outlines the necessary procedures following a verdict, ensuring that both parties understand the final decisions. If you're involved in a case related to Hawaii Return of Service, following this rule can help clarify the next steps after a verdict.

In Hawaii family court, Rule 37 deals with the disclosure of information pertinent to child custody and support cases. This rule encourages open communication between opposing parties to resolve disputes effectively. Understanding Rule 37 can improve your approach during legal processes, particularly when dealing with Hawaii Return of Service.

Rule 37 disclosure refers to the requirements for sharing relevant evidence and information in legal proceedings. In the context of Hawaii Return of Service, Rule 37 ensures that parties disclose documents and evidence essential for a case. This transparency promotes fairness and efficiency in the legal process, helping both parties prepare for court.

Whether you need to file a Hawaii state tax return depends on your income and residency status. Generally, if you earn income in Hawaii, you must file a return. By determining your filing requirements, you ensure compliance with state laws and facilitate your Hawaii Return of Service. Platforms like USLegalForms can help you navigate these requirements and clarify your filing obligations.

You should send your Hawaii state tax return to the Department of Taxation. The correct mailing address may vary depending on whether you are expecting a refund or making a payment. It's crucial to verify the current address to ensure your Hawaii Return of Service is processed correctly. Consider using online services like USLegalForms for guidance on where to send your paperwork.

Yes, you can file a Hawaii tax return electronically. Many taxpayers prefer online filing for its convenience, speed, and accuracy. Electronic submission helps ensure that you receive confirmation of your Hawaii Return of Service quickly. Using platforms like USLegalForms can simplify this process, making it easier to complete your return.

To obtain a copy of your General Excise (GE) license in Hawaii, you need to visit the Department of Taxation's office or their website for specific instructions. You can also request a replacement through their online portal by providing your business details. Using the Hawaii Return of Service can help you confirm that your requests and applications are submitted and processed effectively. This approach saves you time and ensures your business remains compliant with local regulations.