Small Business Startup Package for LLC

Understanding this form package

The Small Business Startup Package for LLC provides essential legal documents tailored for limited liability corporations. Designed by licensed attorneys, this package contains a comprehensive selection of necessary forms for managing your business efficiently. By purchasing this package, you save over 75 percent compared to buying these forms individually, making it a cost-effective solution for small business owners and entrepreneurs.

Forms you’ll find in this package

- Employment or Job Termination Agreement

- Internet Use Policy

- Limited Liability Company LLC Operating Agreement

- Secrecy, Nondisclosure and Confidentiality Agreement by Employee or Consultant to Owner

- Cash Disbursements and Receipts

- Check Request

- Daily Accounts Receivable

- Job Invoice - Short

- Employment Position Announcement

- Drug Testing Policy Disclosure and Consent Form

- Yearly Expenses by Quarter

- Petty Cash Form

- Purchasing Cost Estimate

- Notice of Meeting of LLC Members - General Purpose

- Resolution of Meeting of LLC Members to Authorize Contract

- Resolution of Meeting of LLC Members to Sell or Transfer Stock

- Self-Employed Independent Contractor Employment Agreement - General

- General Trademark License Agreement

- Assignment of Member Interest in Limited Liability Company - LLC

- Employment Agreement - General

- Resolution of Meeting of LLC Members to Borrow Money

- Employment Agreement with Covenant Not to Compete

- Employee Permission to Do a Background Check

- Profit and Loss Statement

- Consultant Agreement

When this form package is needed

This package is ideal for use when you are starting a limited liability corporation. It helps in various business scenarios, including:

- Establishing ownership rights and defining member responsibilities.

- Monitoring financial health through profit and loss statements.

- Documenting employee agreements, including confidentiality and non-compete clauses.

- Managing meetings and decisions of LLC members, including resolutions for borrowing money or transferring stock.

- Drafting policies for employment practices such as drug testing and background checks.

Who should use this form package

- Entrepreneurs starting a new LLC.

- Existing LLC owners looking to streamline operations.

- Business partners needing to outline roles and procedures.

- Employers needing to formalize employment agreements.

- Individuals seeking to ensure compliance with legal requirements and protect their interests.

How to prepare this document

- Review included forms to understand their purpose and requirements.

- Identify and gather information needed from all parties involved.

- Enter precise details into the relevant fields of each form.

- Sign and date documents where required, ensuring all members are in agreement.

- Store completed forms securely and make copies for your records.

Notarization guidance for this package

Most forms in this package do not require notarization. However, local laws or specific situations may demand it. Our online notarization service, powered by Notarize, lets you complete the process through a verified video call, available anytime.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Avoid these common issues

- Failing to sign or date forms, which can render them invalid.

- Not thoroughly reviewing each form for completeness before submission.

- Using outdated forms or not updating them to reflect changes in business status.

- Neglecting to verify compliance with state-specific laws.

Advantages of online completion

- Convenience of downloading forms from the comfort of your home or office.

- Edit and customize forms to meet your specific business needs.

- Access to professionally drafted documents to ensure compliance and protect your interests.

- Cost savings compared to hiring an attorney for form preparation.

Looking for another form?

Form popularity

FAQ

Articles of Incorporation or Organization. File articles of incorporation with the state's commercial-services department to start a corporate entity. Certificate of Assumed Name. Employer Identification Number. Professional Trade Licenses. Local Licenses and Permits.

Introduction. The legal requirements for starting a business can seem intimidating, but obviously these are things you cannot afford to ignore. Licences. Depending on the nature of your business, you may need a licence from your local authority. Employment. Taxation. Insurances. Music. Intellectual Property. Health and Safety.

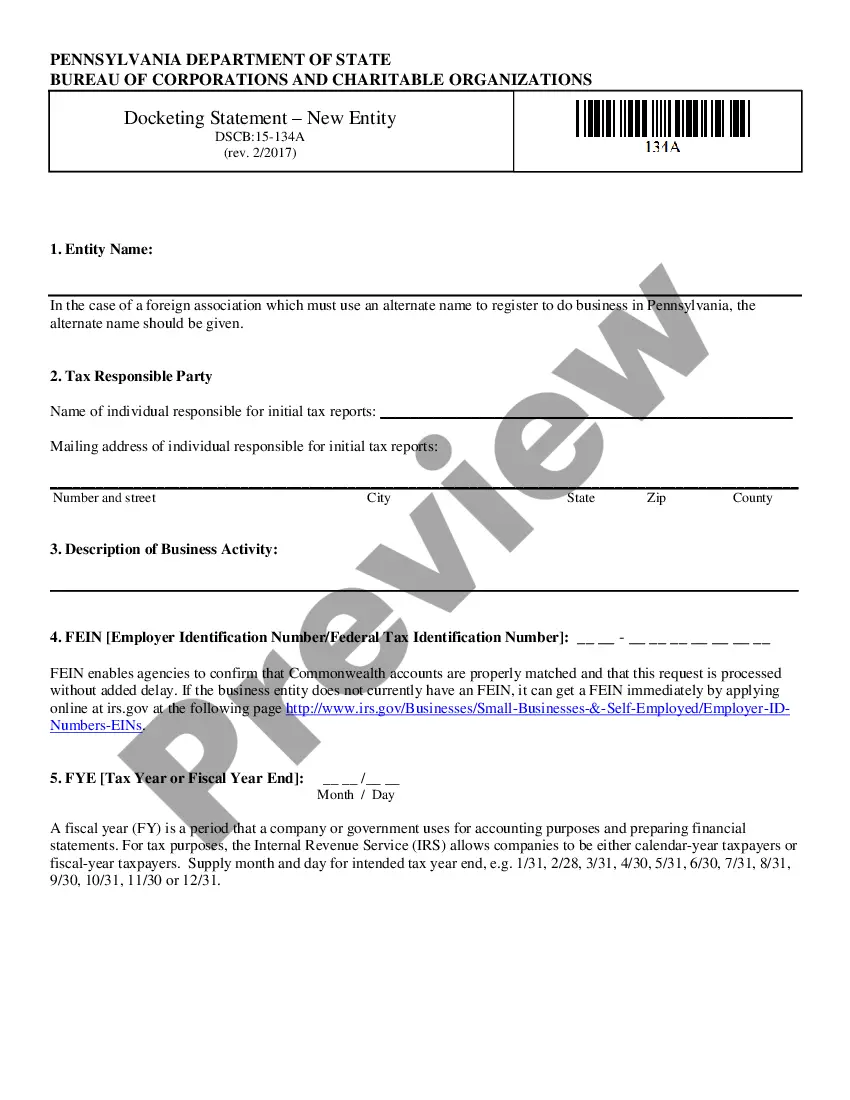

Pick the State Where You Want to Organize the LLC. Naming the LLC. File the LLC Articles of Organization. Prepare the LLC Operating Agreement. Analyze the Issues of Raising Money from Investors. Obtain an Employer Identification Number. Obtain the Necessary Business Licenses. Set Up an LLC Bank Account.

Conduct market research. Market research will tell you if there's an opportunity to turn your idea into a successful business. Write your business plan. Fund your business. Pick your business location. Choose a business structure. Choose your business name. Register your business. Get federal and state tax IDs.

Determine viability. Be brutally honest. Get family behind you. Choose a business name. Register a domain name. Incorporate / figure out legal structure. Apply for an EIN. Investigate and apply for business licenses. Set up a website.

Define your unique selling point. Find a business mentor. Create a business plan. Register web domains and trademarks. Set up your business structure. Ensure that your business will eventually be profitable. Set up a business bank account.

An LLC is a separate entity with its own assets and liabilities. States introduced the LLC structure to let small business owners shield their personal assets.The IRS calls these LLCs disregarded entities because they are not regarded as separate from their owners for tax purposes.

General business license. "Doing business as" license or permit. Federal and state tax identification number. Sales tax permit. Zoning permit. Home occupation permit. Professional/occupational licenses. Health permits.

Create a LLC or Corporation. Register Your Business Name. Apply for a Federal Tax ID Number. Determine If You Need a State Tax ID Number. Obtain Business Permits and Licenses. Protect Your Business with Insurance. Open a Business Bank Account. Consult the Professionals.