Vermont Last Will and Testament with All Property to Trust called a Pour Over Will

What this document covers

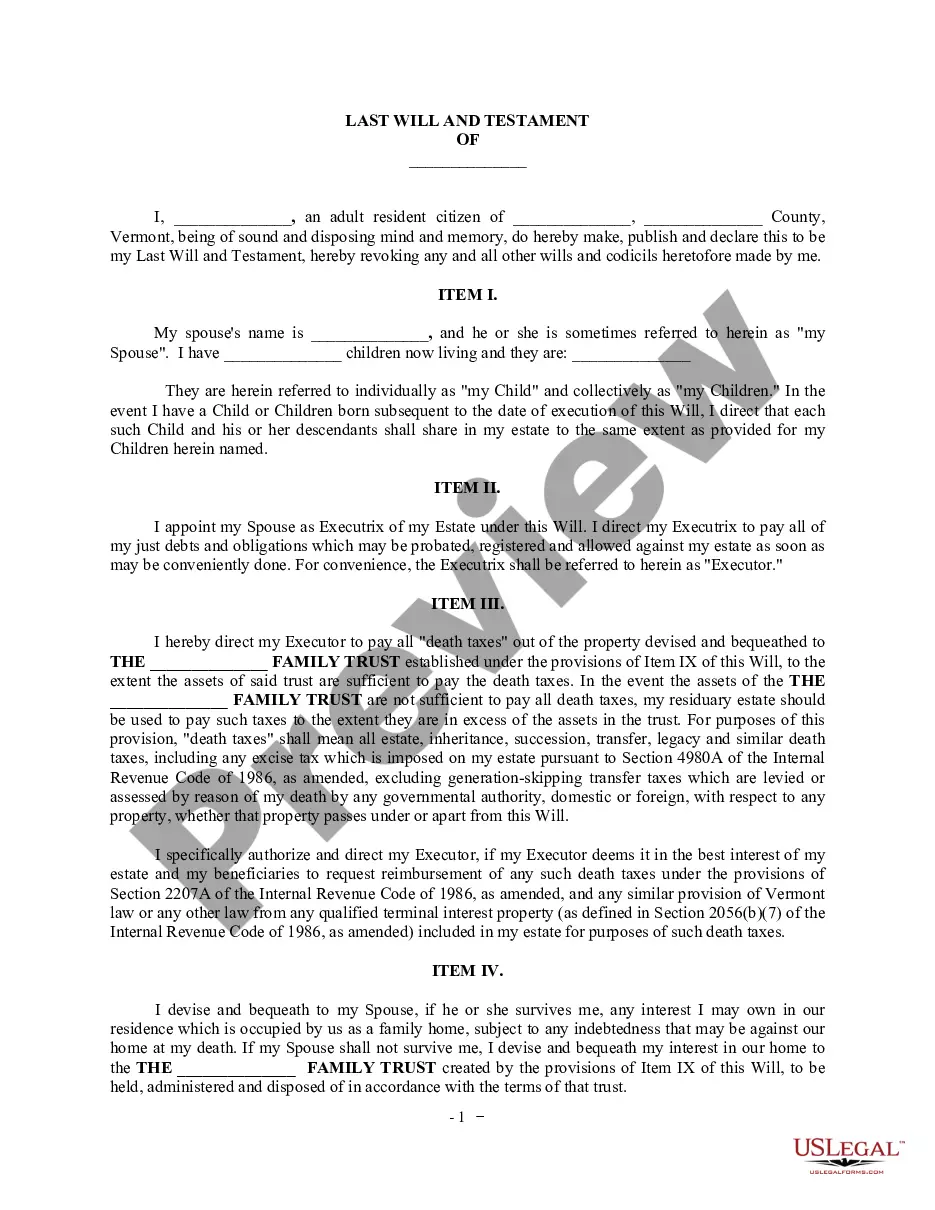

This Last Will and Testament with All Property to Trust, known as a Pour Over Will, is a legal document that ensures all assets not transferred to a living trust during your lifetime are handled according to your wishes upon your death. Unlike a standard will, this form seamlessly directs any remaining assets into your established trust, providing a cohesive approach to estate planning and ensuring that all your property is distributed according to the terms of the trust rather than state intestacy laws.

Key parts of this document

- Conveyance to Trust: Directs any assets not previously transferred to the trust to be willed to the trust.

- Debts and Expenses: Outlines how debts and expenses will be handled after death.

- Guardianship: Provides an option to designate a guardian for minor children.

- Appointment of Personal Representative: Identifies the individual responsible for executing the will.

- Waiver of Bond: Specifies that the Personal Representative does not need to post bond or prepare inventories.

- Powers of the Personal Representative: Details the authority granted to the Personal Representative in managing the estate.

When this form is needed

This Pour Over Will is ideal for individuals who have established or are in the process of establishing a living trust. Use this form if you want to ensure that all assets not already allocated to your trust are automatically transferred to it upon your death, thereby simplifying the management of your estate and ensuring that your wishes are honored.

Who needs this form

- Individuals with a living trust who want to consolidate their estate planning.

- People looking to control how their assets are distributed after death.

- Those who want to avoid the complexity of intestacy laws.

- Parents of minor children wishing to designate guardians in their will.

Completing this form step by step

- Identify yourself as the testator and within the form, clearly enter your personal details.

- Designate any assets you are transferring to the trust in the conveyance section.

- Determine how debts and funeral expenses will be managed and enter relevant details.

- If applicable, specify the guardian for any minor children.

- Choose your Personal Representative and include their information.

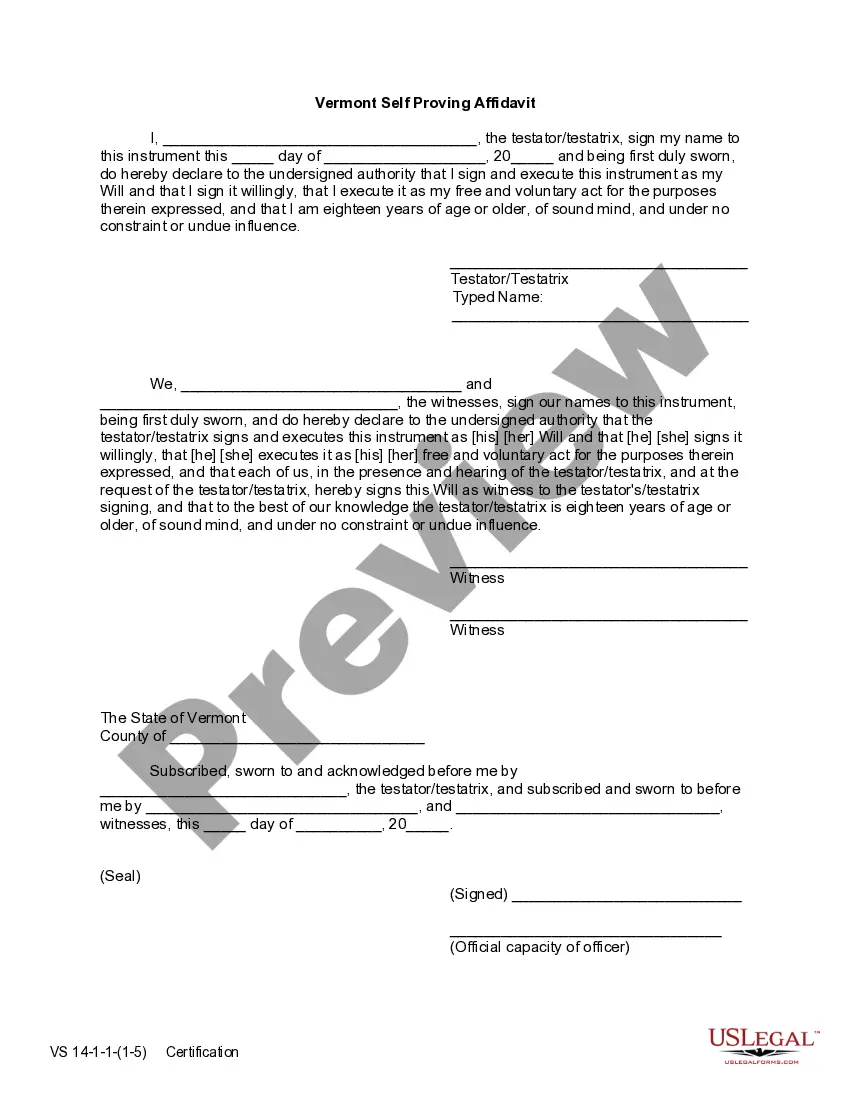

- Ensure all signatures are collected from witnesses and a notary if necessary.

Does this form need to be notarized?

Notarization is required for this form to take effect. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session, available 24/7.

Typical mistakes to avoid

- Failing to identify all assets that should be poured over into the trust.

- Not updating the will after major life events like marriage or the birth of a child.

- Omitting signatures from witnesses or the notary, if required.

- Confusing between pour over wills and traditional wills, leading to incomplete estate planning.

Advantages of online completion

- Convenience: Complete the form easily from the comfort of your home.

- Editability: Make adjustments to the document instantly as needed.

- Guidance: Follow clear instructions provided throughout the form.

- Efficiency: Save time and avoid potential errors compared to manual forms.

Jurisdiction-specific notes

This Pour Over Will is designed to comply with the laws of Vermont, ensuring that the provisions align with state requirements for wills and trusts.

Form popularity

FAQ

Pour-over wills act as a backstop against issues that could frustrate the smooth operation of a living trust. They ensure any assets a grantor neglects to add to a trust, whether by accident or on purpose, will end up in the trust after execution of the will.

In most situations, a will template is an easy and inexpensive way to make sure your wishes are known and carried out. Most people can get everything they need by using a will template, with little cost or hassle.

Bank accounts. Brokerage or investment accounts. Retirement accounts and pension plans. A life insurance policy.

Create the initial document. Start by titling the document Last Will and Testament" and including your full legal name and address. Designate an executor. Appoint a guardian. Name the beneficiaries. Designate the assets. Ask witnesses to sign your will. Store your will in a safe place.

The Free Last Will and Testament Template for Word is compatible with Word 2003 or later versions.

Pour-over wills are subject to probate since the assets have not yet been transferred into the trust. Some states also require your assets to go through the probate process any time your assets or property are over a certain value.Even though pour-over wills don't avoid probate, there is still a measure of privacy.

After reading about the benefits of a revocable living trust, you may wonder, Why do I need a pour-over will if I have a living trust? A pour-over will is necessary in the event that you do not fully or properly fund your trust.Your trust agreement can only control the assets that the trust owns.

After reading about the benefits of a revocable living trust, you may wonder, Why do I need a pour-over will if I have a living trust? A pour-over will is necessary in the event that you do not fully or properly fund your trust.Your trust agreement can only control the assets that the trust owns.

When people make revocable living trusts to avoid probate, it's common for them to also make what's called a "pour-over will." The will directs that if any property passes through the will at the person's death, it should be transferred to (poured into) the trust, and then distributed to the beneficiaries of the trust.