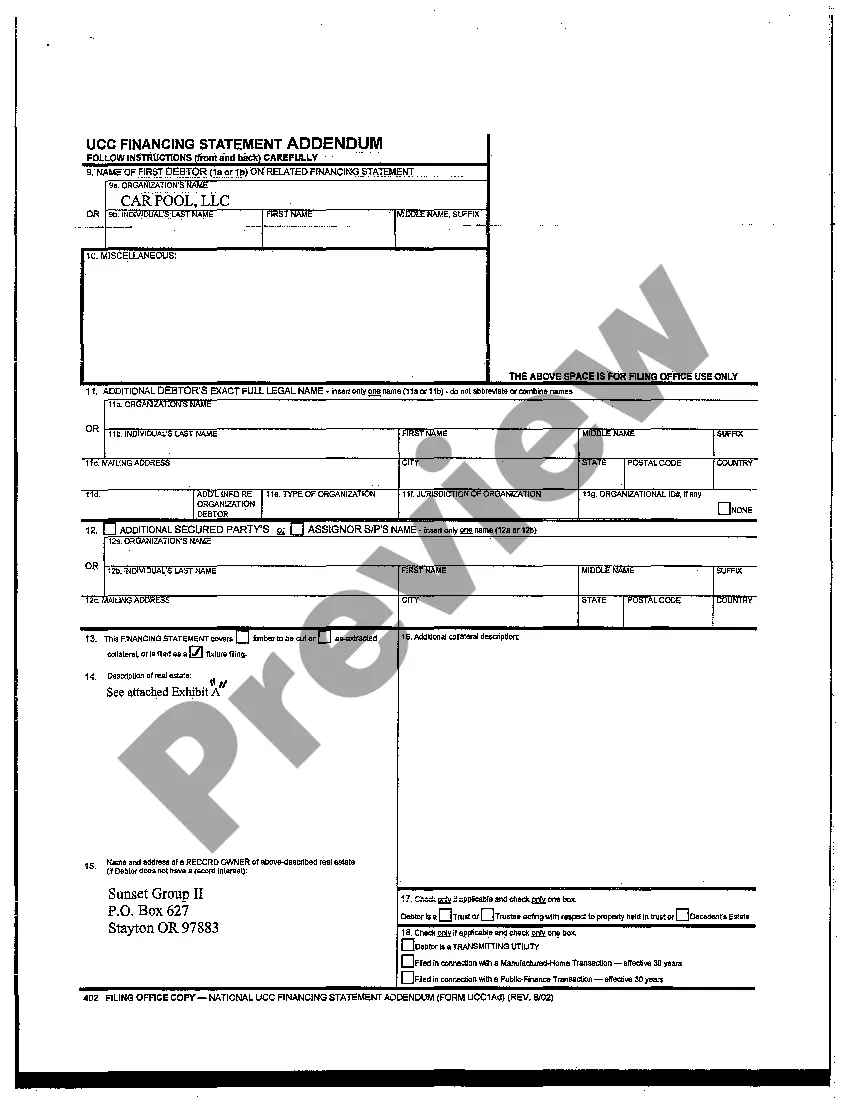

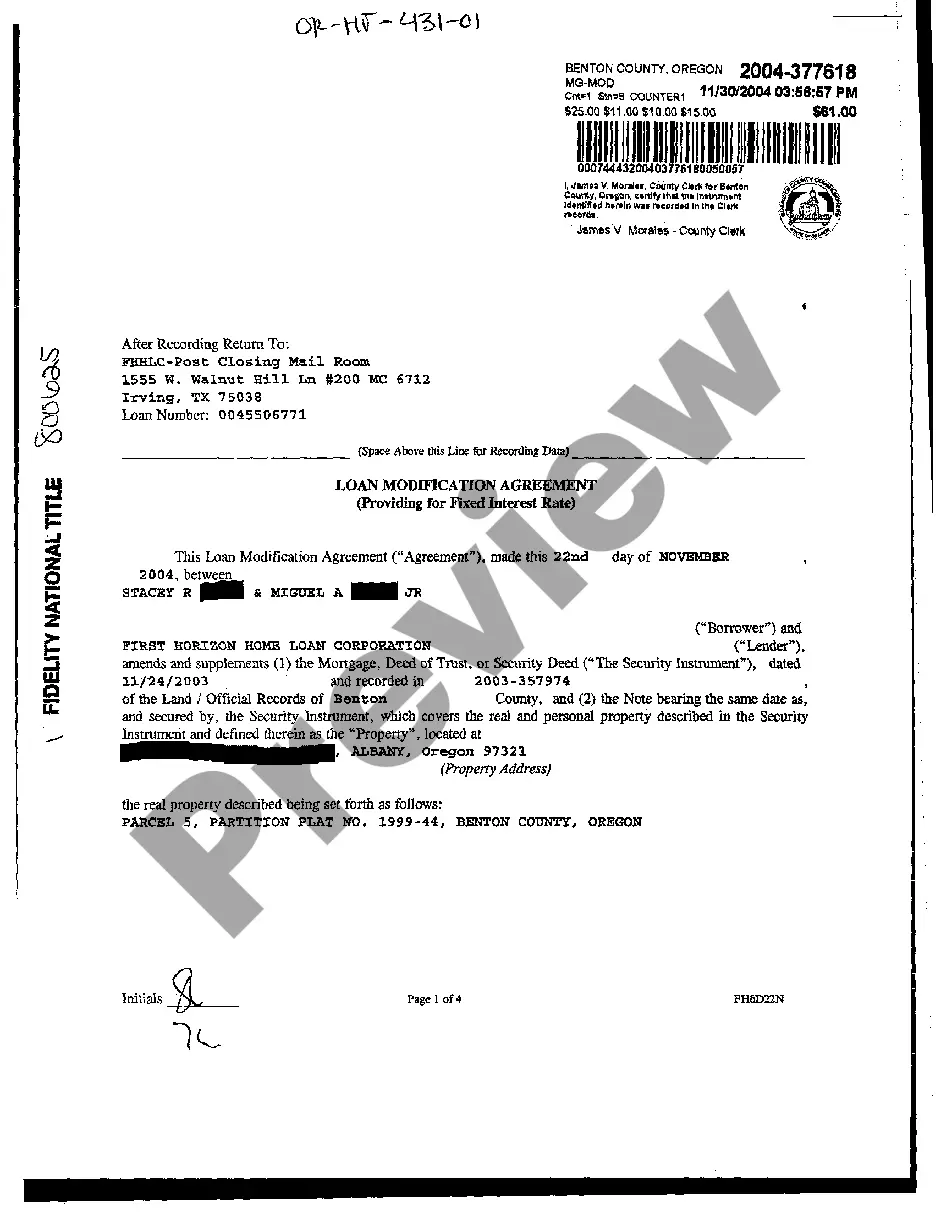

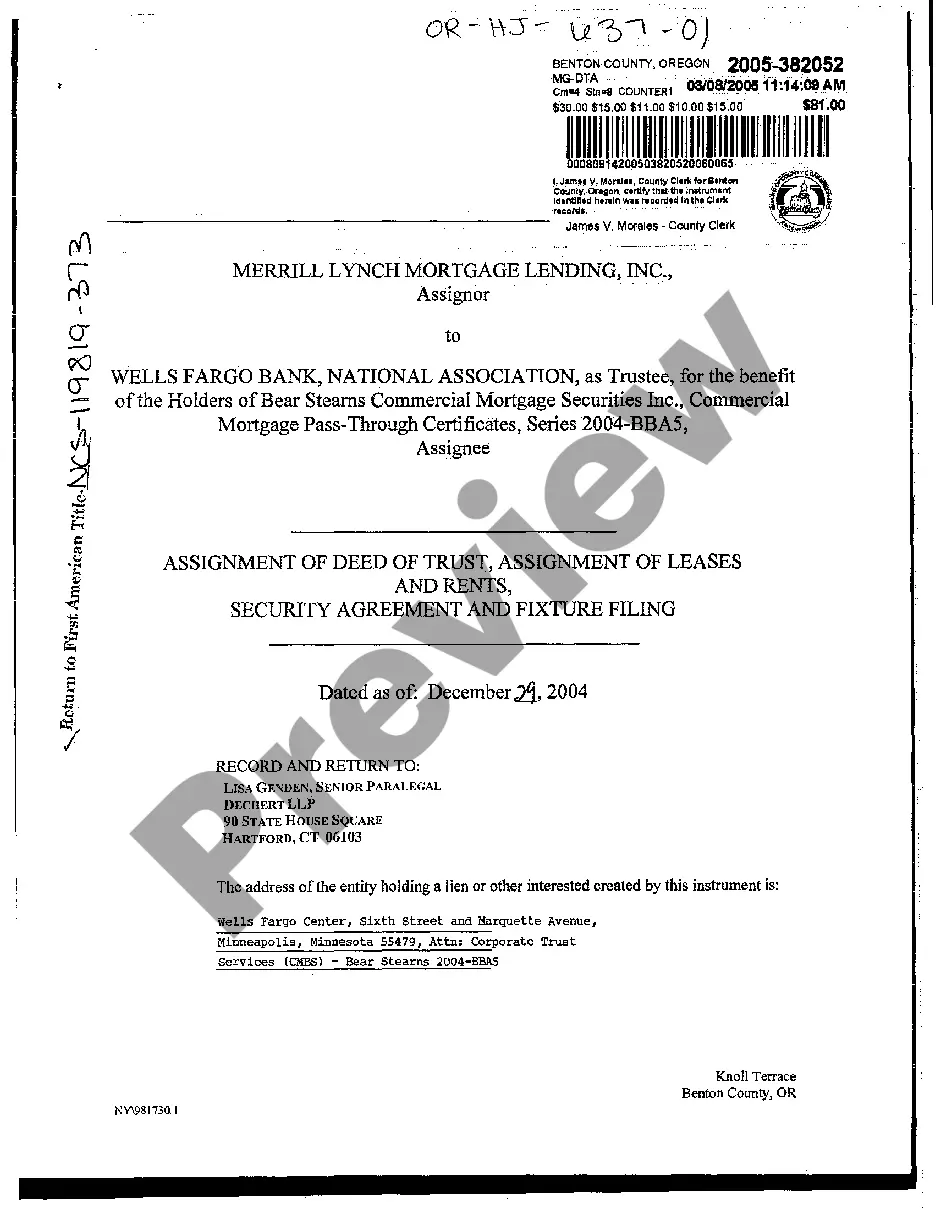

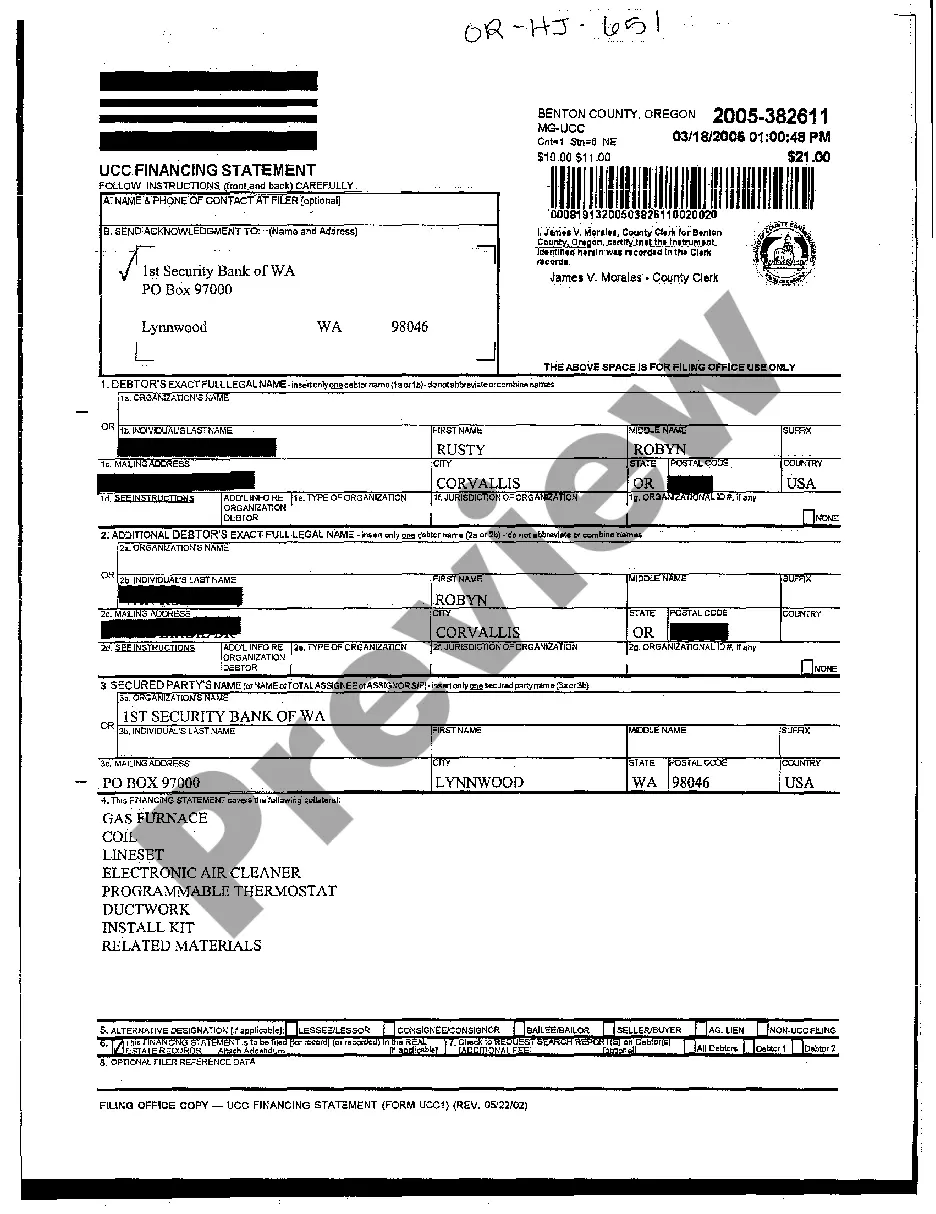

Oregon UCC Financing Statement

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

Key Concepts & Definitions

- A01 UCC Financing Statement: An official form filed to indicate a security interest in personal property, ensuring the interests of a secured party against others on the same collateral.

- UCC Office: The government facility where UCC filings are registered, usually within a states Secretary of State office.

- Real Property: Refers to real estate and any attachments that are considered permanent.

- Secured Party: The lender or entity that holds the security interest in the collateral offered by the debtor.

- Security Interest: A legal claim on collateral that has been pledged by a borrower to secure loan obligations.

- UCC Lien: A lien created under the UCC, covering personal property as collateral.

- Financing Statement: A document filed to perfect a security interest under UCC, makes the public aware of secured claims on assets.

- Small Business: Independently owned and operated companies that are limited in size and revenue based on industry.

Step-by-Step Guide to Filing an A01 UCC Financing Statement

- Identify the collateral: Detail all assets subject to the security interest.

- Ascertain jurisdiction: File the statement in the state where the debtor is located.

- Collect information: Include names and addresses for both debtor and secured party.

- Submit Form: Complete the UCC-1 form, referencing the 'A01 UCC Financing Statement' when applicable.

- File with UCC Office: Submit the completed form either online or in person at the designated state office.

- Confirmation: Receive confirmation and a filing number from the UCC office, indicating successful submission.

Risk Analysis

Legal Risks: Failing to accurately describe the collateral can lead to a weakening of the security interest. Operational Risks: Incorrect or late filings can result in administrative complications or legal challenges. Financial Risks: Errors in filing might lead to additional costs or failure to secure debts properly.

Best Practices

- Always double-check information for accuracy before filing.

- Keep a copy of the confirmation and all related documentation.

- Consider professional legal advice to navigate complex filings.

Common Mistakes & How to Avoid Them

- Not updating the statement: Regular updates are crucial as business conditions change.

- Overlooking personal rules and financial authority: Understand specific state guidelines and authority nuances to ensure compliance.

FAQ

- What is the difference between real property and personal property? Real property refers to fixed property like land and buildings, while personal property includes movable items.

- How long is a UCC Financing Statement effective? Typically, it is effective for five years from the date of filing.

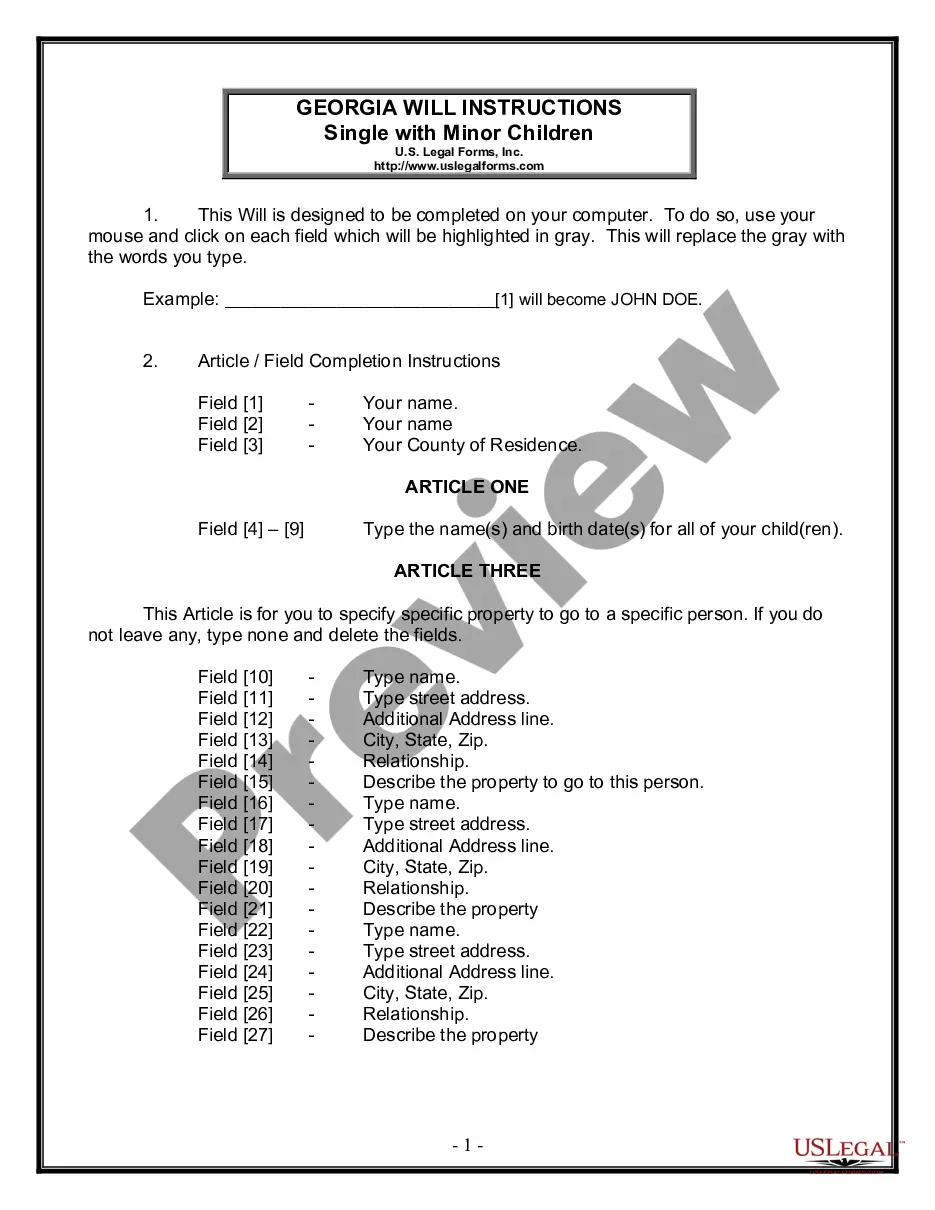

How to fill out Oregon UCC Financing Statement?

Creating documents isn't the most easy task, especially for people who rarely work with legal papers. That's why we advise using correct Oregon UCC Financing Statement samples made by skilled attorneys. It allows you to stay away from problems when in court or dealing with formal organizations. Find the samples you require on our website for high-quality forms and accurate information.

If you’re a user having a US Legal Forms subscription, simply log in your account. Once you are in, the Download button will immediately appear on the file webpage. Soon after getting the sample, it will be saved in the My Forms menu.

Customers without a subscription can easily get an account. Use this simple step-by-step help guide to get the Oregon UCC Financing Statement:

- Ensure that file you found is eligible for use in the state it is required in.

- Verify the file. Use the Preview option or read its description (if readily available).

- Click Buy Now if this file is the thing you need or go back to the Search field to find another one.

- Select a suitable subscription and create your account.

- Make use of your PayPal or credit card to pay for the service.

- Download your file in a wanted format.

Right after completing these simple steps, you are able to fill out the sample in a preferred editor. Check the filled in data and consider requesting a lawyer to review your Oregon UCC Financing Statement for correctness. With US Legal Forms, everything gets easier. Test it now!

Form popularity

FAQ

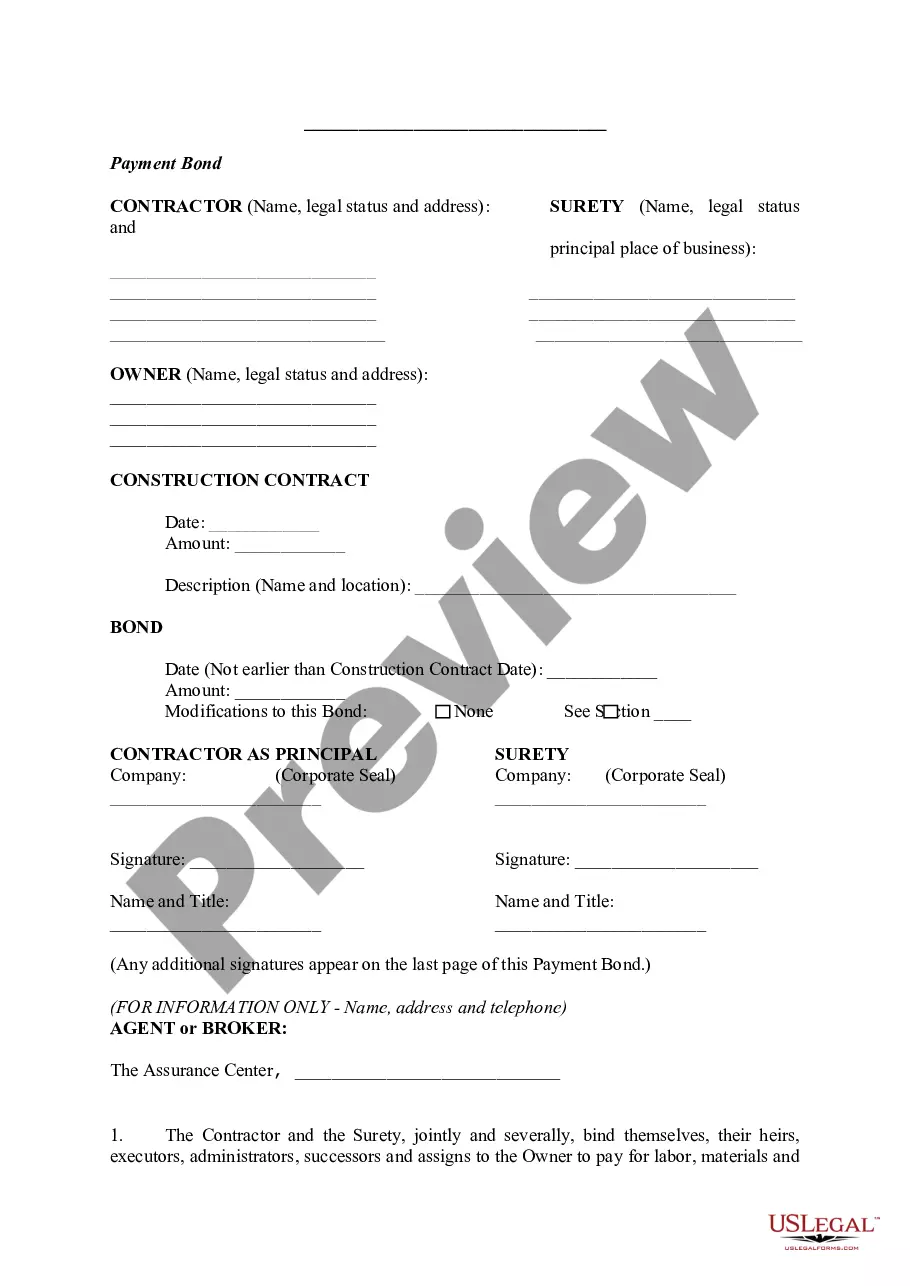

A UCC-Uniform Commercial Code-1 statement is a legal notice filed by creditors in an effort to publicly declare their right to seize assets of debtors who default on loans.These forms must be filed with agencies located in the state where the borrower's business is incorporated.

Filer Information. Name and phone number of contact at filer. Email contact at filer. Debtor Information. Organization or individual's name. Mailing address. Secured Party Information. Organization or individual's name. Mailing address. Collateral Information. Description of collateral.

In all cases, you should file a UCC-1 with the secretary of state's office in the state where the debtor is incorporated or organized (if a business), or lives (if an individual).

UCC-1 Financing Statements do not have to be signed by either the Debtor or Secured Party; however, they must be authorized.Although the UCC-1 Financing Statement does not require signatures, any attachment such as the legal description or special terms and conditions may require the signature of the Debtor.

The UCC-1 Financing Statement is filed to protect a lender's or creditor's security interest by giving public notice that there is a right to take possession of and sell certain assets for repayment of a specific debt with a certain debtor.

Filer Information. Name and phone number of contact at filer. Email contact at filer. Debtor Information. Organization or individual's name. Mailing address. Secured Party Information. Organization or individual's name. Mailing address. Collateral Information. Description of collateral.

A UCC filing is a legal notice a lender files with the secretary of state when they have a security interest against one of your assets. It gives notice that the lender has an interest, or lien, against the asset being used by you to secure the financing. The term UCC filing comes from the uniform commercial code.

Why file a UCC-3 form? The UCC-3 is the Swiss-Army-Knife of forms. Unlike a UCC 1, a UCC 3 can be used for multiple purposes. The actions one can take are Amendment, Assignment, Continuation, and Termination.