New Hampshire Overtime Authorization Form

Description

How to fill out Overtime Authorization Form?

It is feasible to dedicate time online searching for the authentic document model that aligns with the state and federal requirements you require.

US Legal Forms offers thousands of authentic templates that are examined by experts.

It is easy to acquire or create the New Hampshire Overtime Authorization Form from your service.

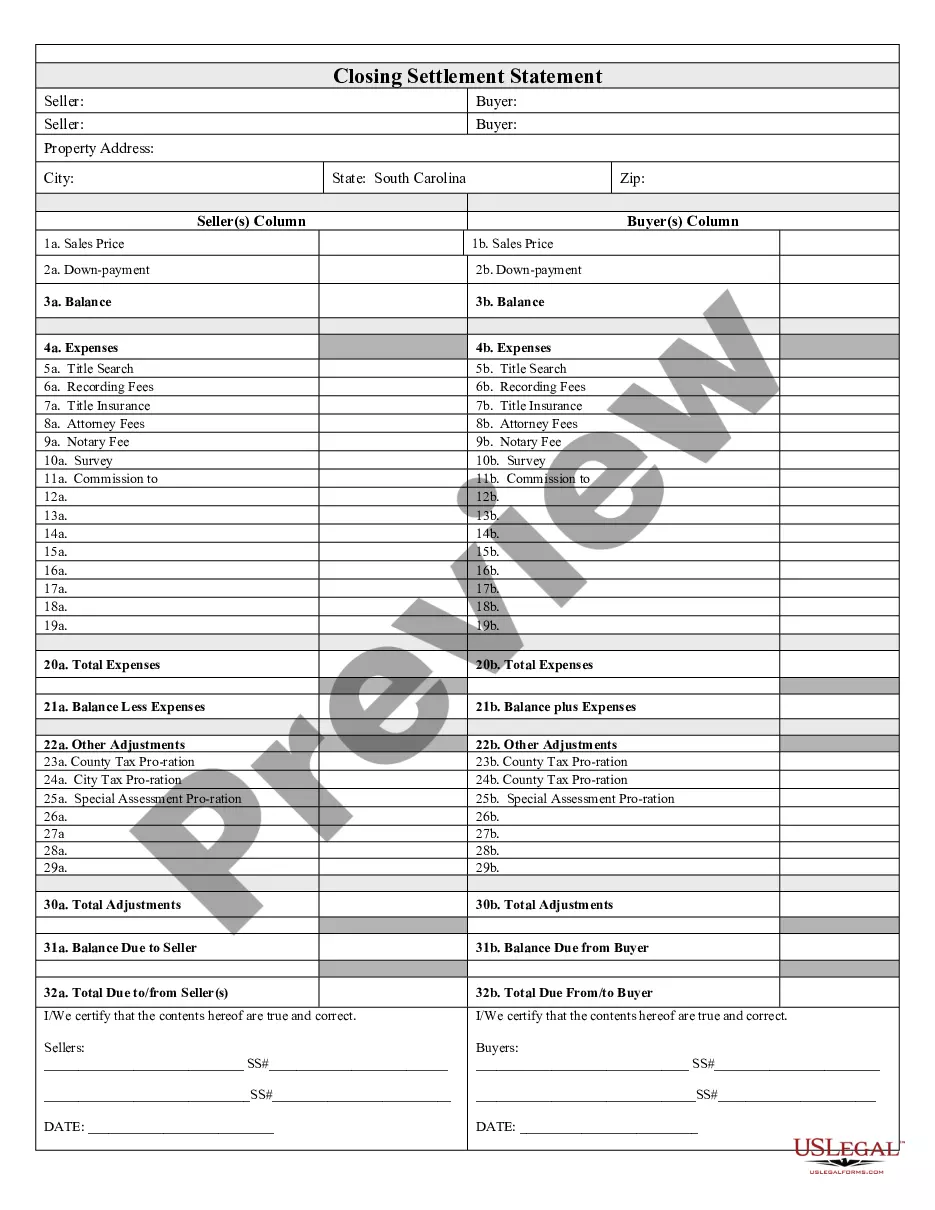

If available, utilize the Preview button to review the document template as well.

- If you already possess a US Legal Forms account, you can sign in and click on the Download button.

- Subsequently, you can complete, alter, create, or sign the New Hampshire Overtime Authorization Form.

- Every single authentic document template you obtain is yours permanently.

- To obtain an additional copy of the acquired form, navigate to the My documents section and click on the relevant button.

- If you are using the US Legal Forms website for the first time, follow the straightforward instructions below.

- First, ensure you have selected the correct document template for your state/city of choice.

- Review the form details to ensure you have chosen the appropriate type.

Form popularity

FAQ

In New Hampshire, full-time hours typically amount to 40 hours per week. Employers often define full time based on the standard work schedule, which generally consists of eight-hour days, five days a week. It is important to understand that exceeding these hours may require the completion of a New Hampshire Overtime Authorization Form for proper compensation. By using the right forms, you can ensure compliance and protect your rights as an employee.

Employers must allow their employees to have at least 24 consecutive hours off from work in every seven-day period.

The federal overtime provisions are contained in the Fair Labor Standards Act (FLSA). Unless exempt, employees covered by the Act must receive overtime pay for hours worked over 40 in a workweek at a rate not less than time and one-half their regular rates of pay.

Employees who usually work more than 35 hours per week (at all jobs within an establishment) regardless of the number of hours actually worked. Persons who were at work for 35 hours or more during the survey reference week are designated as working full time.

Much like federal law, the state requires an employer to pay 1.5 times an employee's regular pay rate for any hours worked over 40 a week. However, New Hampshire law does not require overtime pay for working on weekends or holidays, or more than eight hours a day.

Legally, your employer can't make you work more than 48 hours a week, including overtime. If they want you to work more than that, your employer has to ask you to opt out of the 48-hour limit.

New Hampshire's Overtime Minimum Wage Overtime pay, also called "time and a half pay", is one and a half times an employee's normal hourly wage. Therefore, New Hampshire's overtime minimum wage is $10.88 per hour, one and a half times the regular New Hampshire minimum wage of $7.25 per hour.

New Hampshire labor laws require an employer to pay overtime to employees, unless otherwise exempt, at the rate of 1½ times the employee's regular rate of pay for all hours worked in excess of 40 hours in a workweek.

When must overtime be paid? Unless exempt by the Fair Labor Standards Act, overtime is paid to hourly employees at the rate of time and one half of the employees regular rate of pay for all hours actually worked over forty in any one week (FLSA) (RSA 2,VIII).

The FLSA exempts employees from the minimum wage and overtime requirements who are paid a salary of not less than $455 per week, or $23,660 per year, and who are employed in a bona fide executive, administrative, professional, certain computer professions or creative professions, or outside sales capacity as defined