New Hampshire Employee Time Sheet

Description

How to fill out Employee Time Sheet?

If you need to finalize, acquire, or produce sanctioned document templates, utilize US Legal Forms, the most extensive assortment of legal forms, accessible online.

Employ the site's simple and effective search feature to locate the documents you require.

A collection of templates for business and personal use are organized by categories and states, or keywords.

Step 4. After finding the form you need, click on the Get now button. Choose the payment plan you prefer and enter your information to register for an account.

Step 5. Complete the payment process. You may use your credit card or PayPal account to finalize the transaction.

- Utilize US Legal Forms to retrieve the New Hampshire Employee Time Sheet in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and then click the Get button to obtain the New Hampshire Employee Time Sheet.

- You can also find forms you previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the guidelines below.

- Step 1. Ensure you have selected the form for the correct area/state.

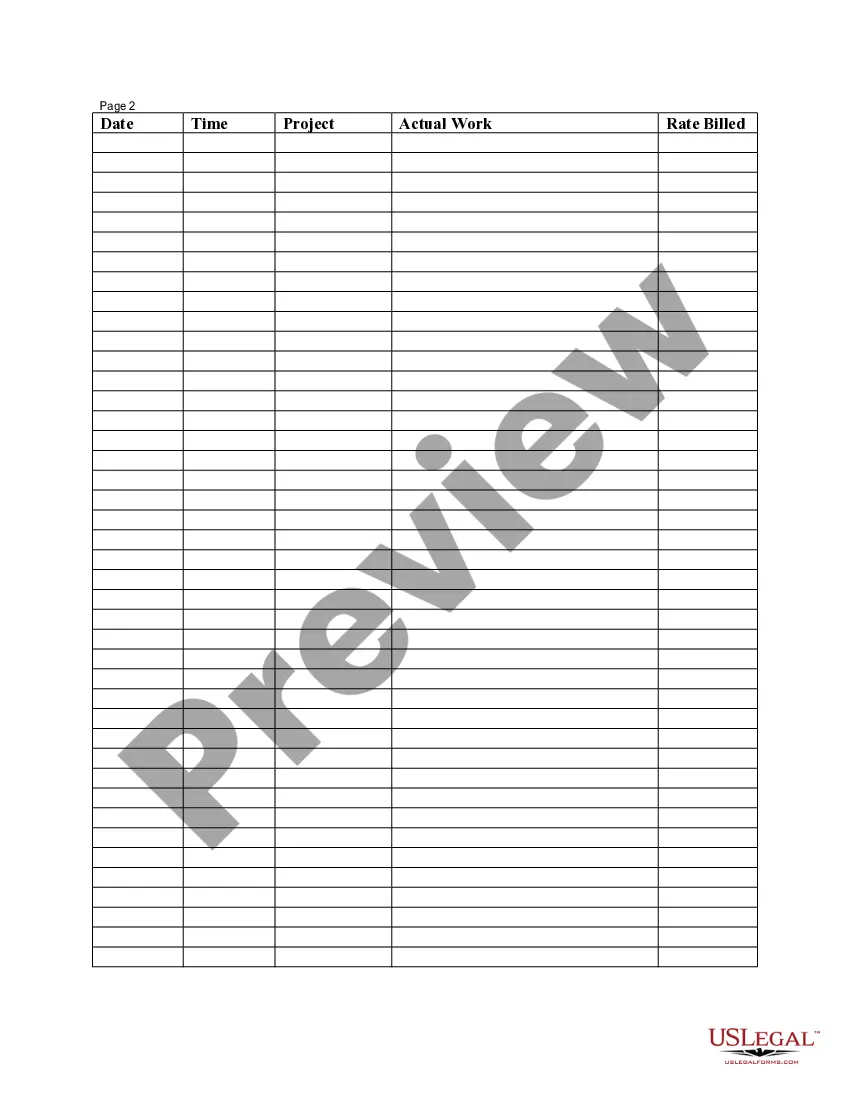

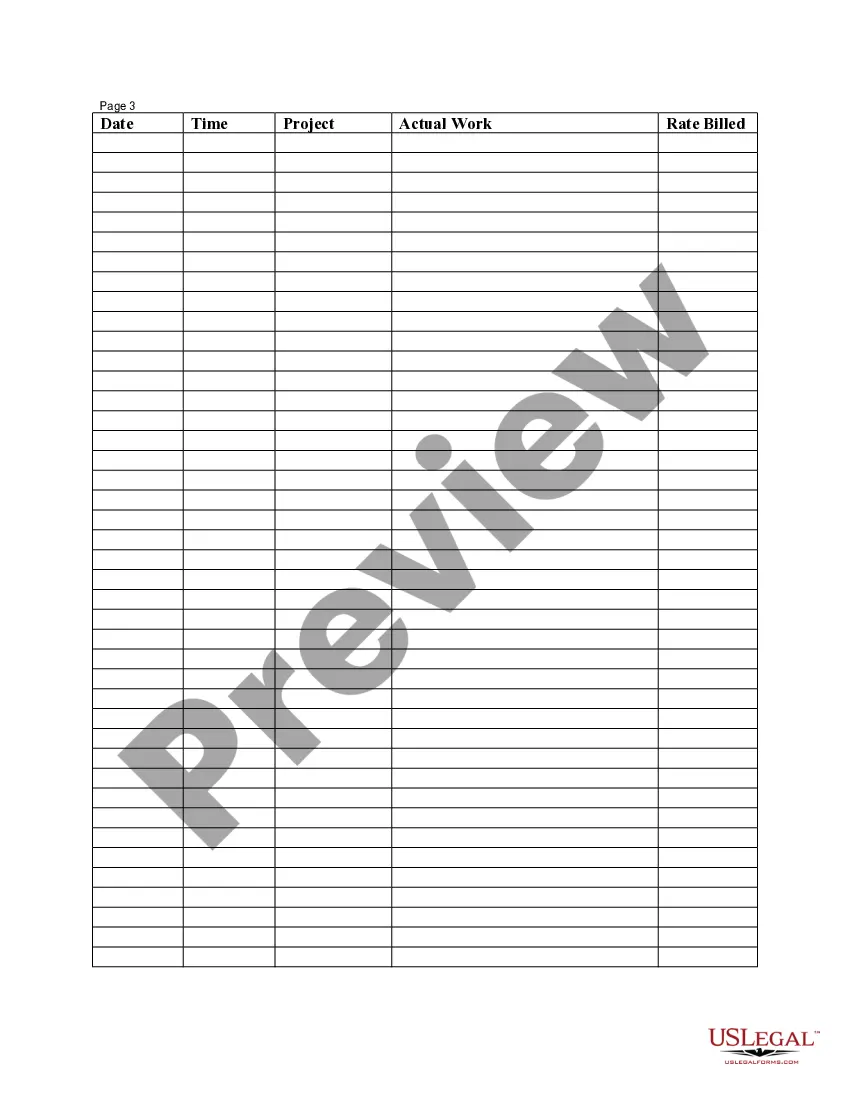

- Step 2. Utilize the Review option to check the content of the form. Don’t forget to read the instructions.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the page to find different versions of the legal form template.

Form popularity

FAQ

Employees who usually work more than 35 hours per week (at all jobs within an establishment) regardless of the number of hours actually worked. Persons who were at work for 35 hours or more during the survey reference week are designated as working full time.

Employees who usually work more than 35 hours per week (at all jobs within an establishment) regardless of the number of hours actually worked. Persons who were at work for 35 hours or more during the survey reference week are designated as working full time.

Salaried and Hourly/Exempt and Non-exemptTypically salaried employees are full-time because they are managers and professionals, but a salaried employee could be part-time if they are in a job-sharing situation.

Employers must allow their employees to have at least 24 consecutive hours off from work in every seven-day period.

Destroy paper and electronic personnel records and confidential employee data after the retention deadlines have passed. Because employment records contain confidential and sensitive information, employers should establish specific policies and procedures for disposing of records safely.

No federal or state law in New Hampshire requires employers to pay out an employee's accrued vacation, sick leave or other paid time off (PTO) at the termination of employment.

How long should I keep employee personnel files? You should keep an employee's personnel files for six years after the employee has left your organisation. The reason for this is that up until six years has passed, the former employee may sue you for breach of contract in the county court.

This is usually calculated on a weekly basis and could be, for example, anything between 30 to 40 hours per week, although a full time worker will usually work 35 hours or more per week.

The employer must keep a true and accurate record of all hours worked and all wages paid each employee. These records must be kept for a minimum of at least 3 years (RSA 2).

A: The definitions of full-time and part-time can vary depending on law and policy. Most employers determine full-time status based on business needs and typically consider an employee to be full-time if they work anywhere from 32 to 40 or more hours per week.