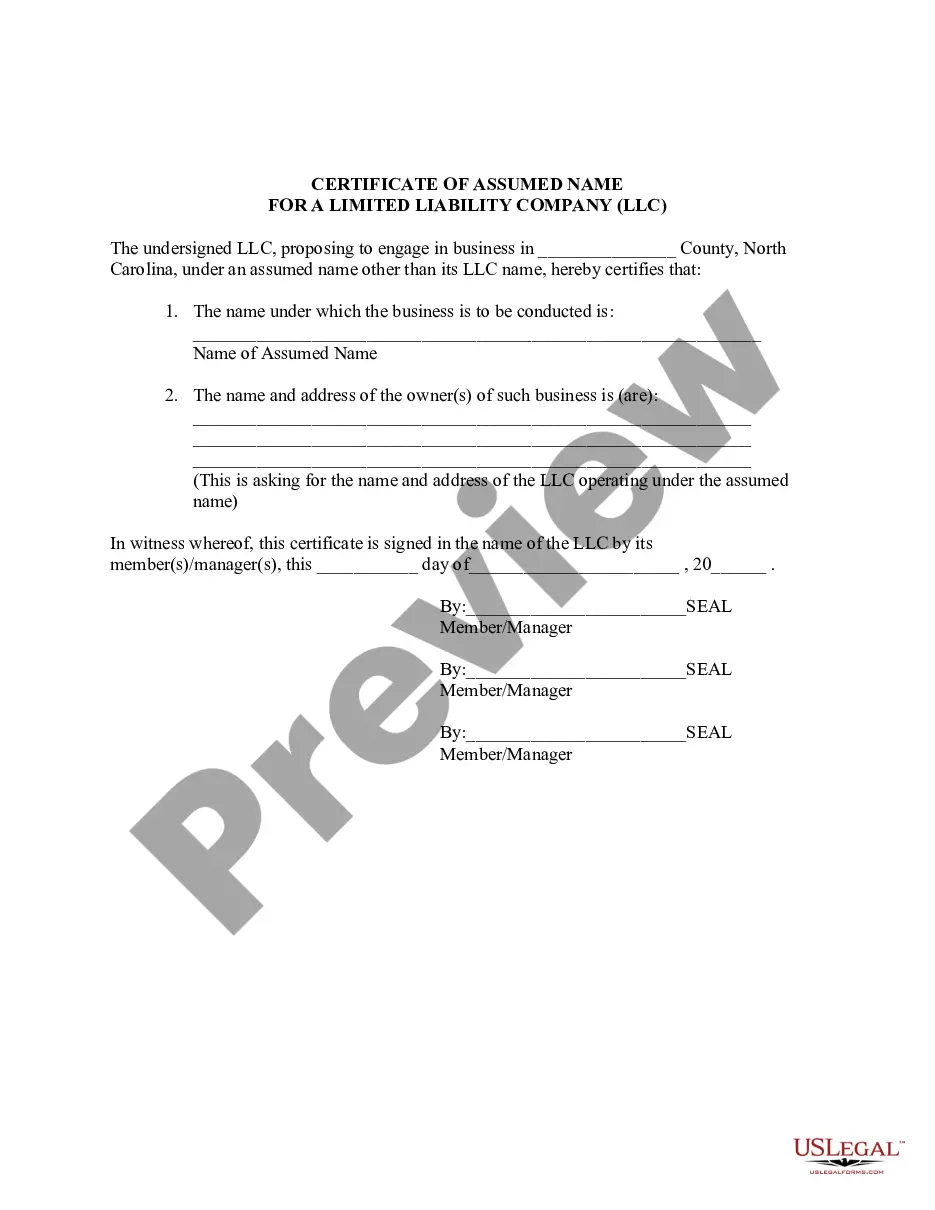

This form is required by state law to be filed with the county Register of Deeds Office in which business is conducted if the company does business in other than its LLC name.

North Carolina Certificate of Assumed Name for a LLC

Description

How to fill out North Carolina Certificate Of Assumed Name For A LLC?

Avoid pricey lawyers and find the North Carolina Certificate of Assumed Name for a LLC you want at a affordable price on the US Legal Forms website. Use our simple groups functionality to search for and obtain legal and tax documents. Read their descriptions and preview them well before downloading. Moreover, US Legal Forms provides customers with step-by-step instructions on how to obtain and fill out every single template.

US Legal Forms clients basically have to log in and obtain the specific form they need to their My Forms tab. Those, who haven’t got a subscription yet should follow the guidelines below:

- Ensure the North Carolina Certificate of Assumed Name for a LLC is eligible for use where you live.

- If available, look through the description and use the Preview option before downloading the sample.

- If you’re confident the document is right for you, click Buy Now.

- If the template is incorrect, use the search field to find the right one.

- Next, create your account and choose a subscription plan.

- Pay out by card or PayPal.

- Select download the document in PDF or DOCX.

- Just click Download and find your form in the My Forms tab. Feel free to save the template to the device or print it out.

After downloading, it is possible to fill out the North Carolina Certificate of Assumed Name for a LLC by hand or with the help of an editing software. Print it out and reuse the form multiple times. Do more for less with US Legal Forms!

Form popularity

FAQ

Lack of tax benefits: A DBA is not a corporation, so merely filing a DBA that is not part of a corporate umbrella like an LLC will not give you any special tax benefits. If you are only doing business as a DBA, any money your business makes passes through to your individual tax return and is taxed accordingly.

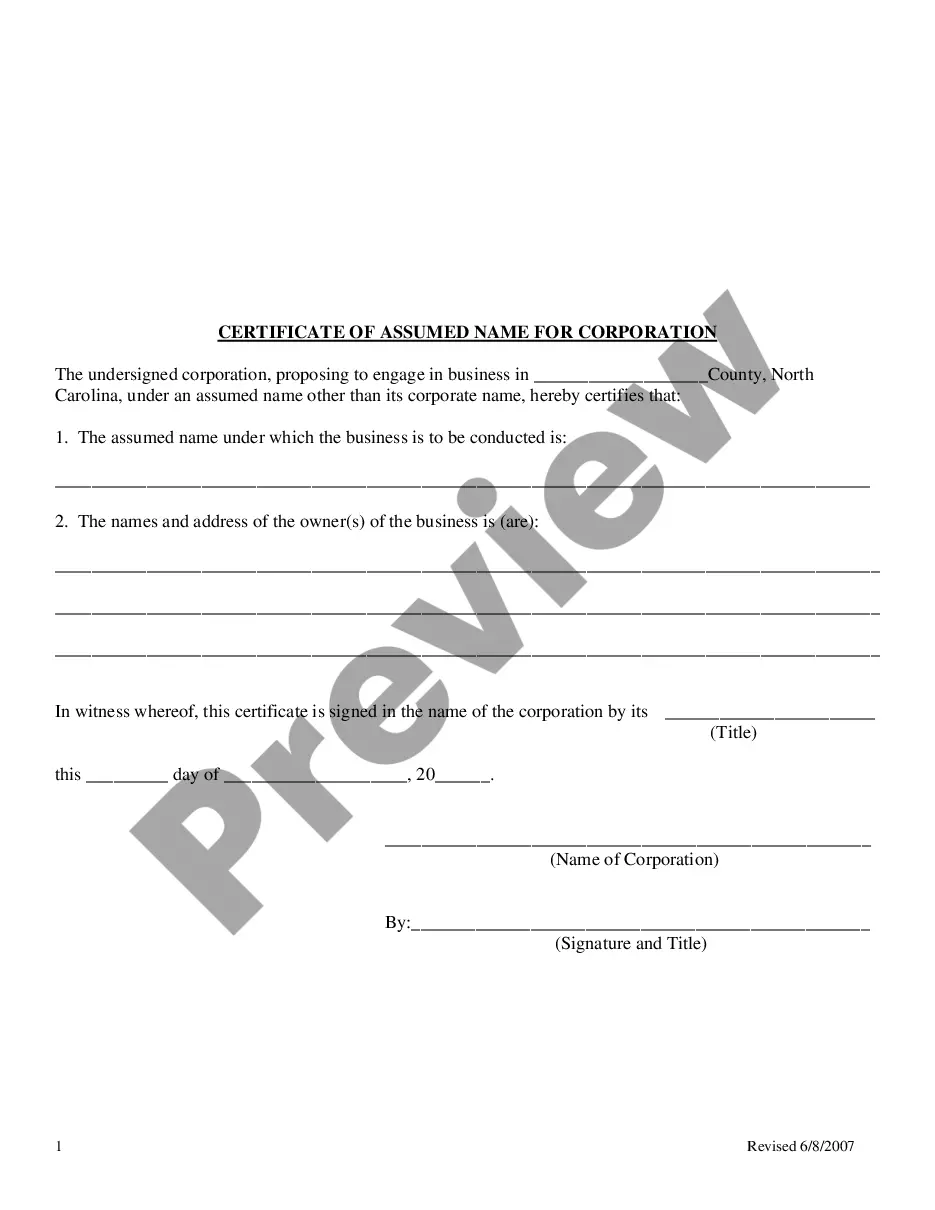

In North Carolina, you register your DBA with the Register of Deeds office in your business' home county. You must complete the Assumed Business Name Certificate form and return it to your local office.

The proper way to write your Legal name for DBA is to write your doing business as name exactly the way you register it. For example, if John H. Doe is a sole proprietor and he wants to open a barber shop under the name Precision Barber Shop, he can register the name with her State.

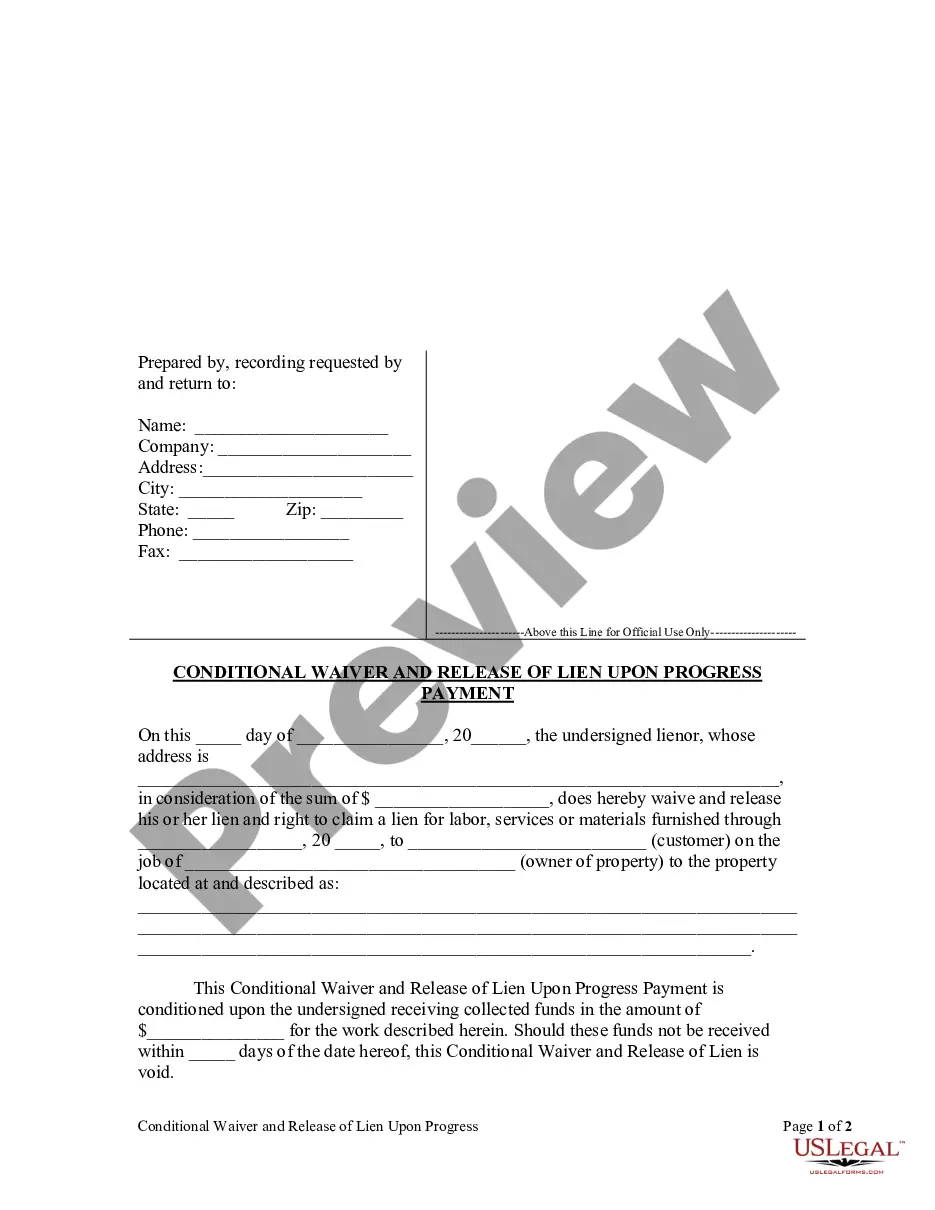

Obtain the appropriate forms. First, acquire the appropriate forms for registering a DBA in your jurisdiction. Complete the forms. Provide all required information on the DBA forms. Provide your business entity type. Provide any other information. Sign the forms. Pay the fee and file the forms.

A limited liability company can register a DBA, or "doing business as" name and still do business using the official LLC name. A DBA operates much like a personal nicknameyou may use your nickname for some purposes and your full legal name for others.

An assumed name is also called a DBA (doing business as) name.Regardless of your form of businesscorporation, limited liability company, partnership or sole proprietorshipyou need to comply with your state's assumed name statutes if you do business using any name other than your legal name.

To do business under a DBA, you must complete and file the appropriate DBA forms and pay a filing fee, after which point you receive a DBA certificate. Depending on the state you may be able to file with a local or county clerk's office, with a state agency, or both.

For LLCs or corporations, a DBA will let you operate more than one business without having to form a separate LLC or corporation for each one.He can create a corporation with a relatively generic name and use a DBA for each individual business.

For example, business owner John Smith might file the Doing Business As name "Smith Roofing." Corporations and limited liability companies (LLCs) may register DBA names for specific lines of business. For example, Helen's Food Service Inc. might register the DBA "Helen's Catering."