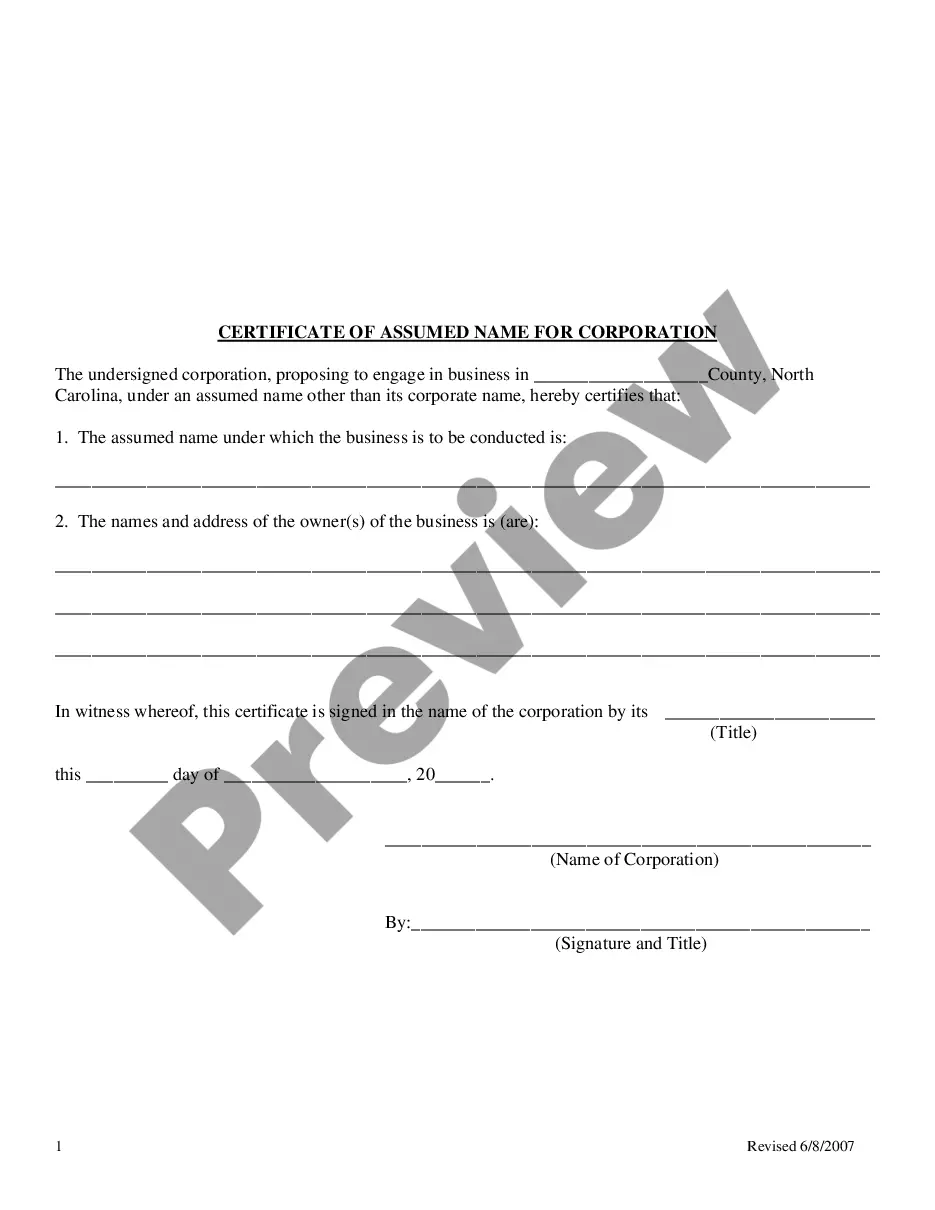

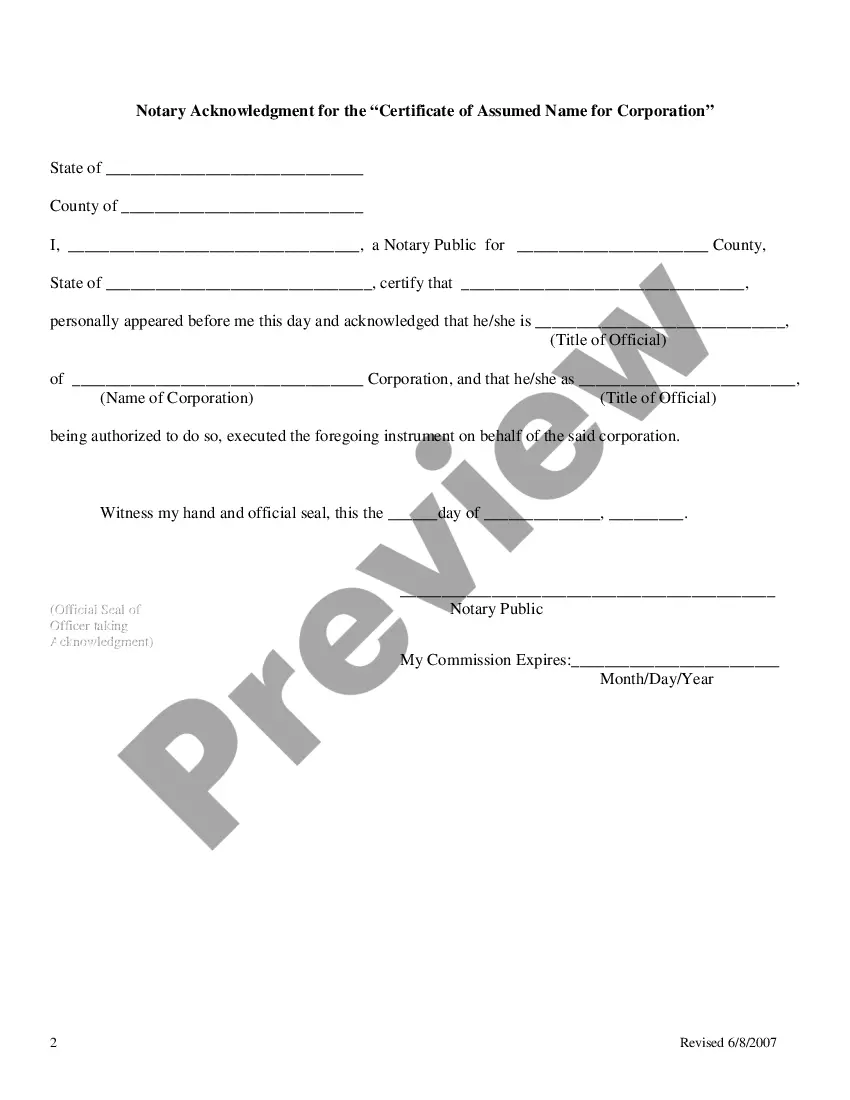

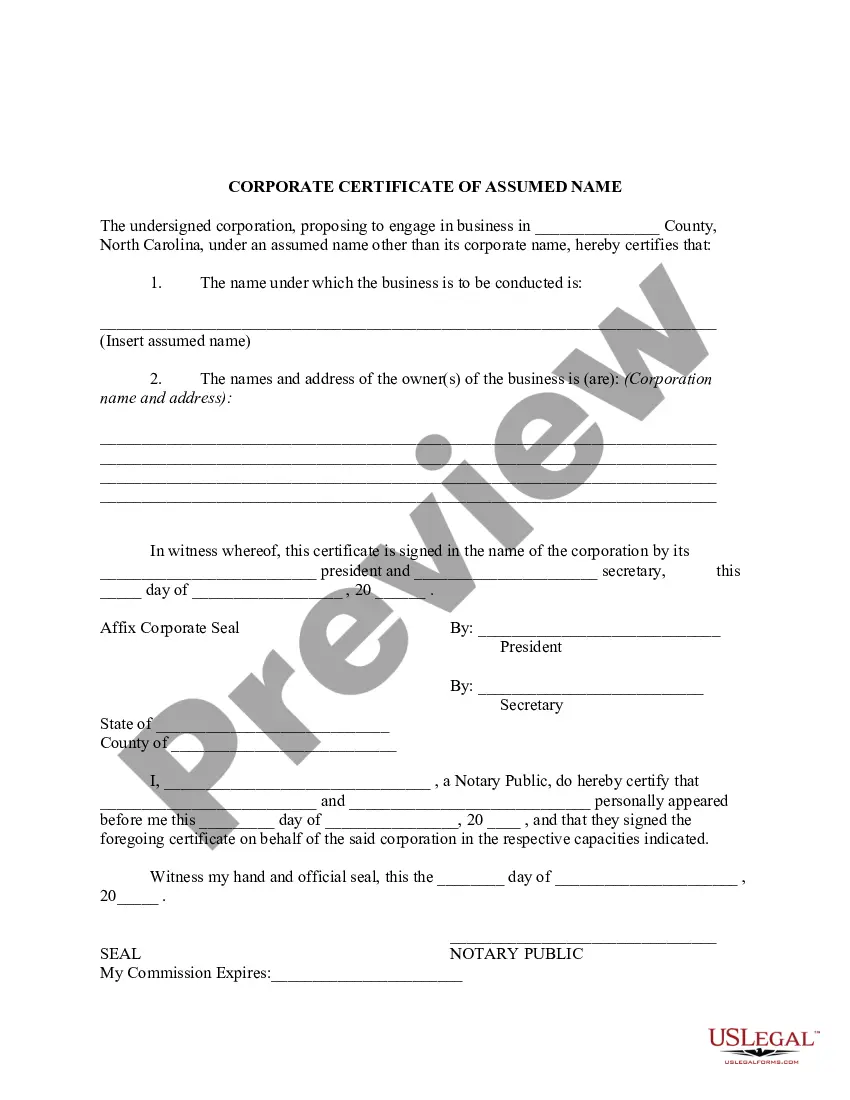

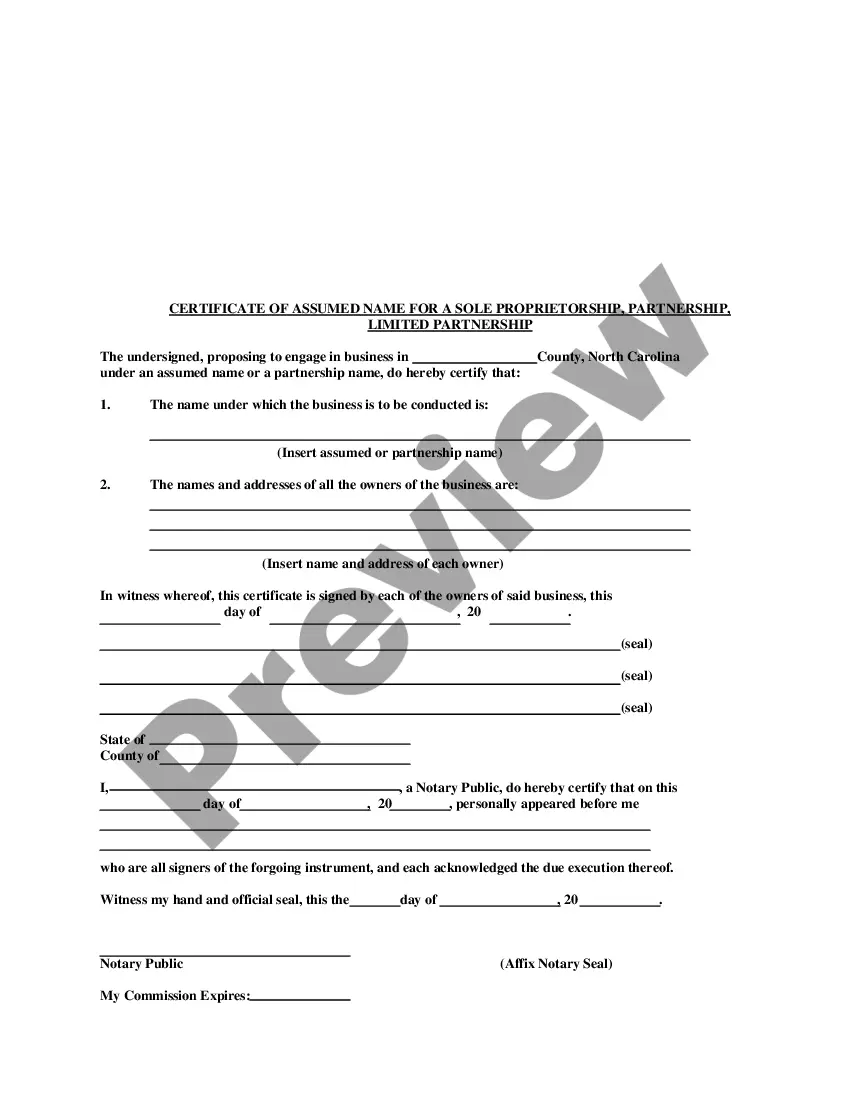

This form is required by state law to be filed with the county Register of Deeds Office in which business is conducted if the company does business using an assumed name.

North Carolina Certificate of Assumed Name for a Corporation

Description

How to fill out North Carolina Certificate Of Assumed Name For A Corporation?

Avoid pricey attorneys and find the North Carolina Certificate of Assumed Name for a Corporation you need at a affordable price on the US Legal Forms website. Use our simple categories function to look for and obtain legal and tax documents. Read their descriptions and preview them well before downloading. Moreover, US Legal Forms provides customers with step-by-step instructions on how to obtain and complete each and every template.

US Legal Forms clients simply need to log in and get the particular form they need to their My Forms tab. Those, who haven’t obtained a subscription yet need to follow the guidelines listed below:

- Ensure the North Carolina Certificate of Assumed Name for a Corporation is eligible for use in your state.

- If available, look through the description and use the Preview option just before downloading the templates.

- If you are sure the document fits your needs, click on Buy Now.

- In case the template is wrong, use the search engine to get the right one.

- Next, create your account and select a subscription plan.

- Pay by card or PayPal.

- Choose to download the form in PDF or DOCX.

- Simply click Download and find your form in the My Forms tab. Feel free to save the template to the device or print it out.

Right after downloading, it is possible to fill out the North Carolina Certificate of Assumed Name for a Corporation by hand or with the help of an editing software program. Print it out and reuse the template multiple times. Do more for less with US Legal Forms!

Form popularity

FAQ

For example, business owner John Smith might file the Doing Business As name "Smith Roofing." Corporations and limited liability companies (LLCs) may register DBA names for specific lines of business. For example, Helen's Food Service Inc. might register the DBA "Helen's Catering."

When to Renew Your DBA If registering in Texas, you can use the DBA for 10 years, and in New York, no renewal is necessary as there is no expiration date. As long as you stay on top of your DBA's expiration date, you can continue to renew it as long as you like.

It is NOT a separate entity. A Sole Proprietor fills out Schedule C as part of your Form 1040. You will also fill out Schedule SE for your employment taxes on your net profit.

The DBA has to be filled out and notarized with no errors due to the fact that it is recorded with the County. Filing for a DBA allows you to do business under a different name.The name of your business is up to you, but it needs to be properly registered with the state of California.

If you're a sole proprietor or a partner with the authority to sign contracts for the partnership, you sign using your own name. Then, UpCounsel says, you add the "doing business as" name. DBA examples are "Bert Smith, DBA Steel IT Security" or "Helen Marker, DBA The Best Vintage Jewelry."

The form is presented to a clerk for filing. The cost to file your DBA is $33 for an Individual DBA and $34 for a Partnership DBA (which includes the filing fee, a copy for the filers records and a certified copy for proof of filing).

A DBA can be filed in order for a company to transact business under the company's domain name. This is especially helpful when your company name is not available as a domain name. For example, you may want to operate another business or website in addition to your existing one.

1Obtain the appropriate forms. First, acquire the appropriate forms for registering a DBA in your jurisdiction.2Complete the forms. Provide all required information on the DBA forms.3Provide your business entity type.4Provide any other information.5Sign the forms.6Pay the fee and file the forms.

Obtain the appropriate forms. First, acquire the appropriate forms for registering a DBA in your jurisdiction. Complete the forms. Provide all required information on the DBA forms. Provide your business entity type. Provide any other information. Sign the forms. Pay the fee and file the forms.