Massachusetts Amendment to Living Trust

About this form

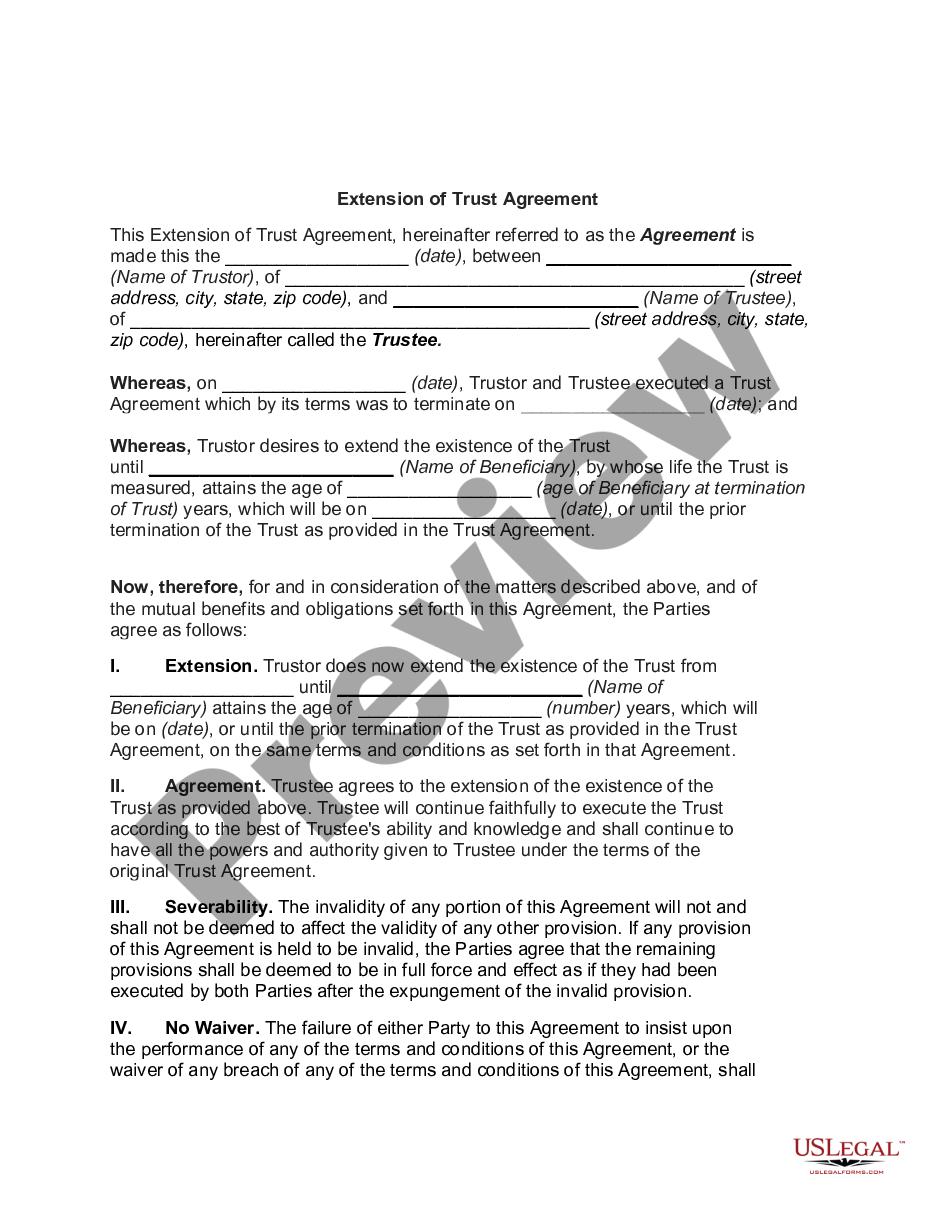

The Amendment to Living Trust is a legal document used to modify an existing living trust without altering its core purpose. A living trust, established during a person's lifetime, allows individuals to manage their assets while planning for estate distribution. This amendment form enables the Trustor to amend specific provisions within the trust, ensuring that all other terms remain effective and enforceable.

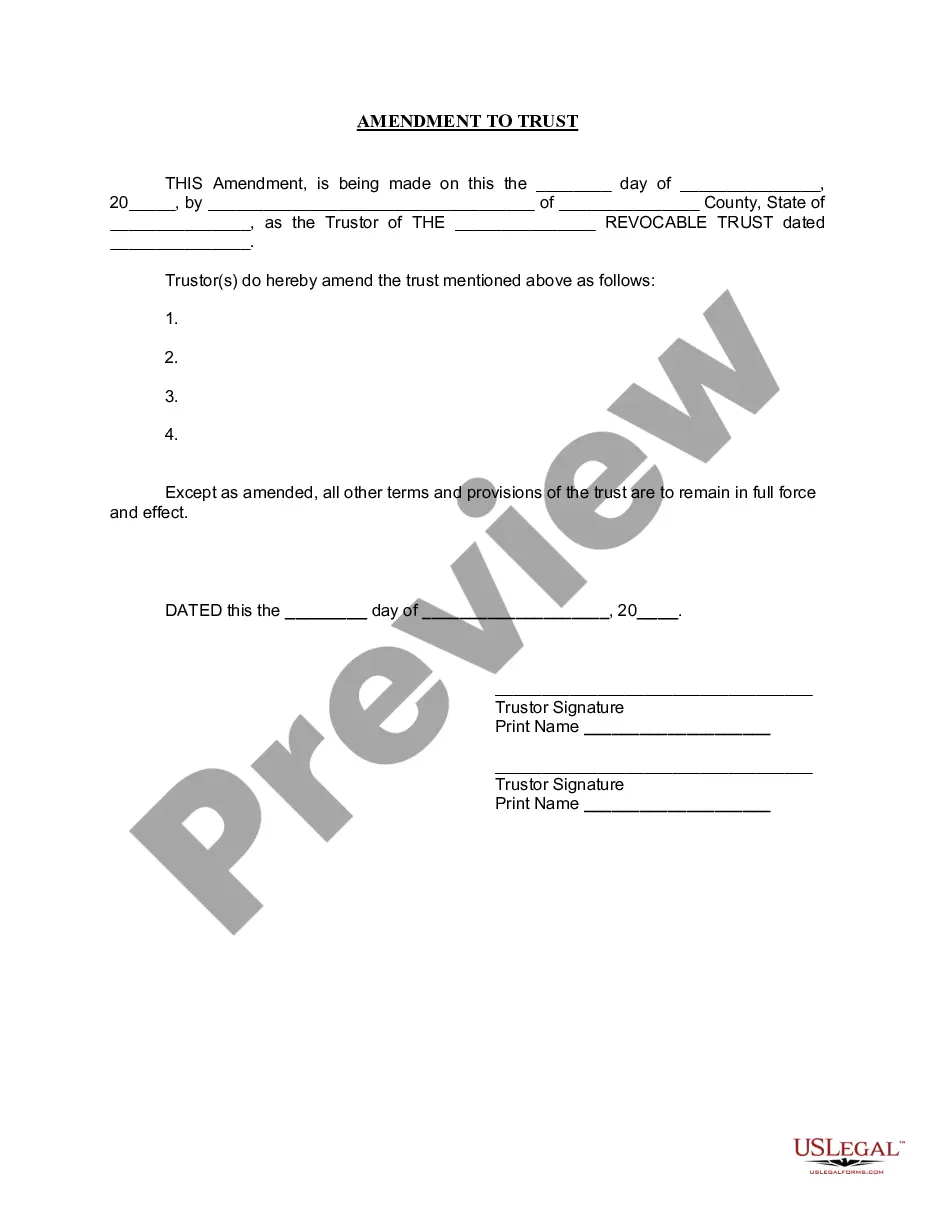

Key components of this form

- Identification of the Trustor and the revocable trust being amended.

- A specific section to outline the changes being made to the trust.

- Signature lines for the Trustor(s) to validate the amendment.

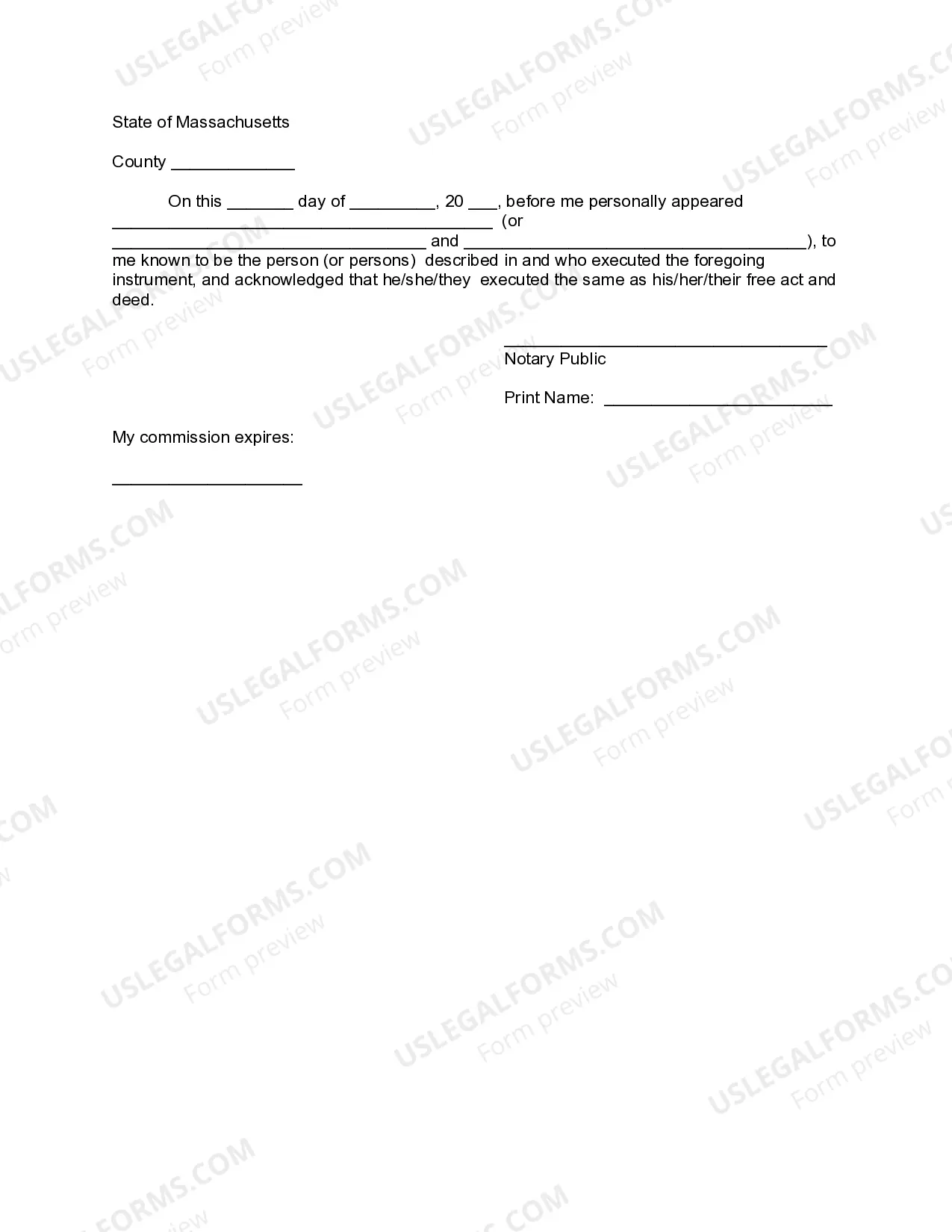

- Notary acknowledgment section to verify the identity of the Trustor(s).

Situations where this form applies

This amendment form is necessary when a Trustor wishes to update their living trust. Common reasons include changing beneficiaries, altering asset allocations, or updating terms based on life events such as marriage, divorce, or the birth of a child. This form ensures these changes are officially documented and recognized.

Who this form is for

This form is suitable for:

- Individuals who have established a living trust and need to make changes.

- Trustors who want to ensure their estate plan reflects their current wishes.

- Persons involved in estate planning in jurisdictions that accept this form.

How to prepare this document

- Enter the date the amendment is being made.

- Clearly identify yourself as the Trustor and provide your county and state.

- Specify the name of the living trust and its date of establishment.

- Detail the amendments being made to the trust provisions.

- Sign and print your name, ensuring the signatures are completed in front of a notary.

Does this document require notarization?

Notarization is required for this form to take effect. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Mistakes to watch out for

- Failing to accurately specify the changes being made to the trust.

- Not signing the document in the presence of a notary public.

- Leaving out essential personal information, such as the Trustor's name or trust details.

Benefits of completing this form online

- Convenience of downloading and completing the form at your own pace.

- Editable format that allows you to make changes easily before finalizing.

- Reliable access to forms drafted by licensed attorneys, ensuring compliance with legal standards.

Looking for another form?

Form popularity

FAQ

Locate the original trust. The grantor must locate the original trust documents and identify the specific provisions that require amendment. Prepare an amendment form. Get the amendment form notarized. Attach amendment form to original trust.

An amendment to a trust is not required to be notarized or witnessed unless the terms of the original trust require it.

You can change your living trust, usually without incurring lawyer bills.Because you and your spouse made the trust together, you should both sign the amendment, and when you sign it, get your signatures notarized, just like the original. Another way to go is to create a "restatement" of your trust.

So, going back to the question, the Trustor(s) or creator(s) of the document are the ones who have the power to make changes or even revoke it during their lifetime, and the Trustee(s) sign onto any changes made. But, when a person passes away, their revocable living trust then becomes irrevocable at their death.

When you create a DIY living trust, there are no attorneys involved in the process. You will need to choose a trustee who will be in charge of managing the trust assets and distributing them. You generally name yourself as the initial trustee.

A court can, when given reasons for a good cause, amend the terms of irrevocable trust when a trustee and/or a beneficiary petitions the court for a modification.Such modification provisions are common with charitable trusts, to allow modifications when federal tax law changes.

Locate the original trust. The grantor must locate the original trust documents and identify the specific provisions that require amendment. Prepare an amendment form. Get the amendment form notarized. Attach amendment form to original trust.