Massachusetts Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with Children

Description

How to fill out Massachusetts Living Trust For Individual Who Is Single, Divorced Or Widow (or Widower) With Children?

Greetings to the most extensive legal documentation repository, US Legal Forms. Here you can locate any example including Massachusetts Living Trust for Individual Who is Single, Divorced, or Widowed (or Widower) with Children templates and retain them (as many as you desire). Prepare official paperwork within hours, rather than days or weeks, without having to spend a fortune on an attorney. Obtain your state-specific example with just a few clicks, assured in the knowledge that it was crafted by our licensed legal experts.

If you’re already a registered user, simply Log In to your account and click Download next to the Massachusetts Living Trust for Individual Who is Single, Divorced, or Widowed (or Widower) with Children template you require. Since US Legal Forms is an online platform, you’ll always have access to your downloaded documents, regardless of the device you are utilizing. Review them in the My documents section.

If you don’t possess an account yet, what are you waiting for? Follow our guidelines below to get started.

After you’ve finalized the Massachusetts Living Trust for Individual Who is Single, Divorced, or Widowed (or Widower) with Children, send it to your attorney for validation. It’s an additional step, but a vital one to ensure that you are completely protected. Join US Legal Forms now and gain access to a vast number of reusable templates.

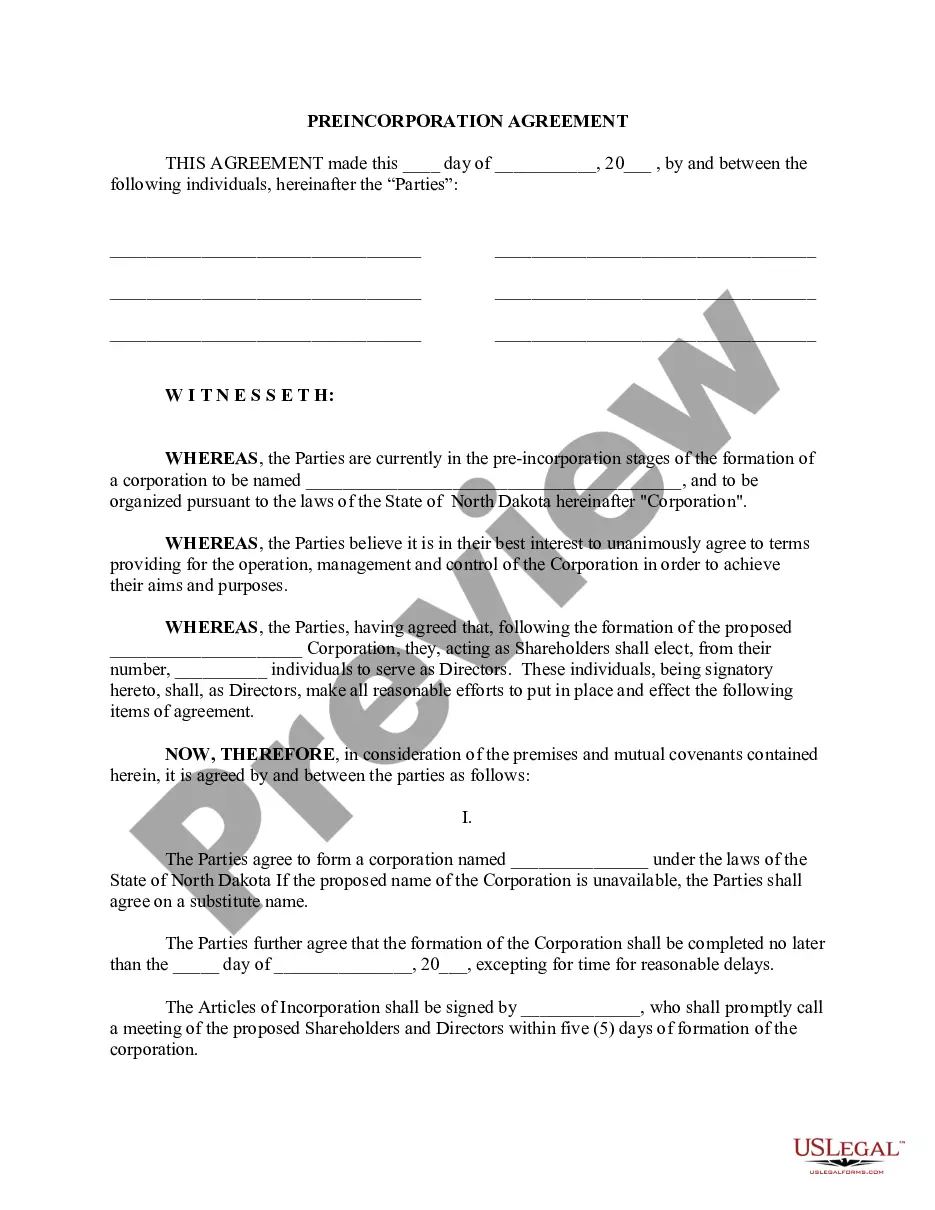

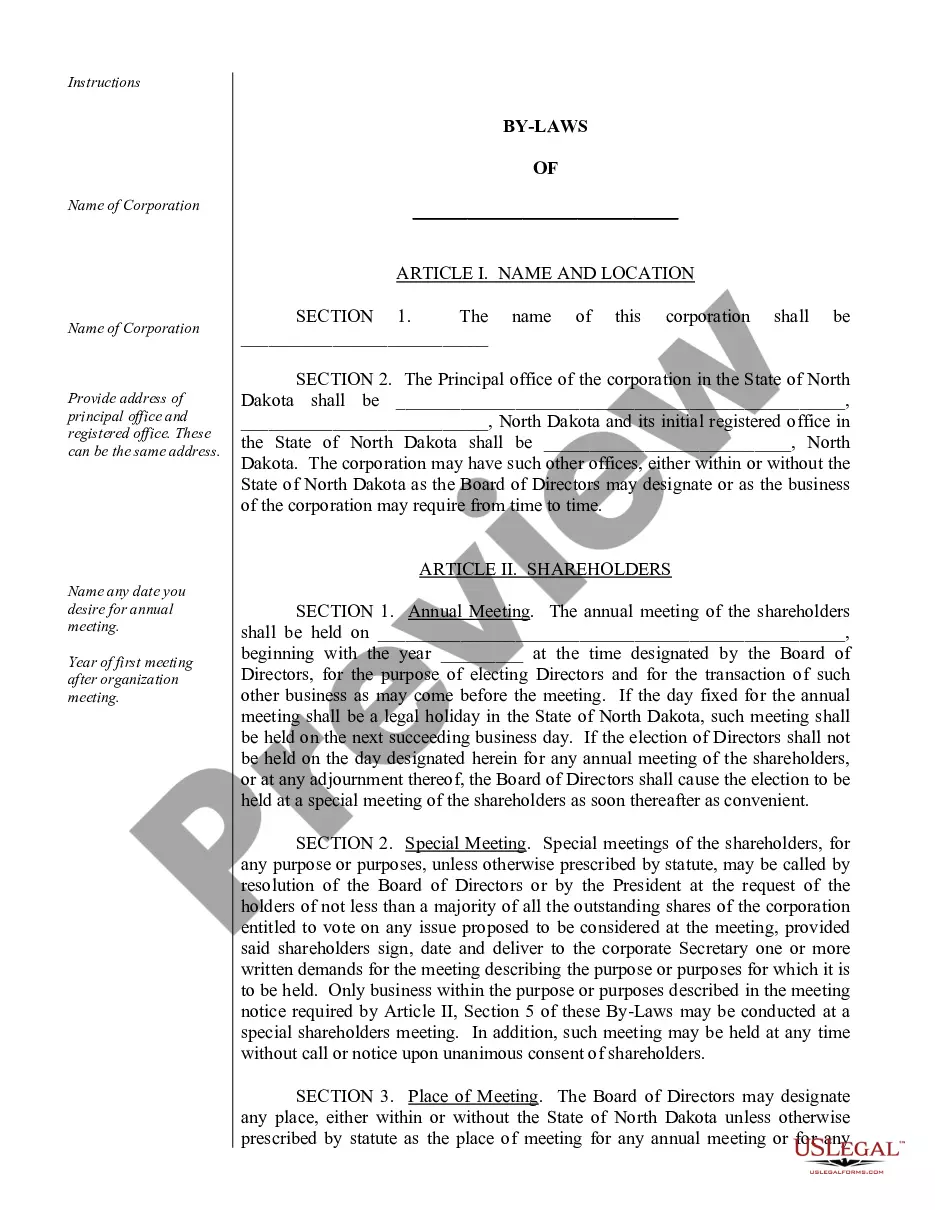

- If this is a state-specific document, verify its relevance in your residing state.

- Read the description (if provided) to determine if it’s the appropriate template.

- View more content using the Preview option.

- If the document fulfills all your conditions, click Buy Now.

- To create your account, select a pricing plan.

- Utilize a credit card or PayPal account for subscription.

- Download the template in your preferred format (Word or PDF).

- Print the document and fill it out with your or your business’s details.

Form popularity

FAQ

Using a revocable living trust instead of a will means assets owned by your trust will bypass probate and flow to your heirs as you've outlined in the trust documents. A trust lets investors have control over their assets long after they pass away.

Paperwork. Setting up a living trust isn't difficult or expensive, but it requires some paperwork. Record Keeping. After a revocable living trust is created, little day-to-day record keeping is required. Transfer Taxes. Difficulty Refinancing Trust Property. No Cutoff of Creditors' Claims.

A living trust holds your assets during your lifetime and allows them to be distributed to the people you choose upon your death. To more easily understand how a living trust works, think of a trust as an empty box. You can put your assets into this box, including financial accounts and real estate.

When it comes to protecting your loved ones, having both a will and a trust is essential. The difference between a will and a trust is when they kick into action. A will lays out your wishes for after you die. A living revocable trust becomes effective immediately.