Mississippi Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with No Children

Description

How to fill out Mississippi Living Trust For Individual Who Is Single, Divorced Or Widow (or Widower) With No Children?

Obtain a printable Mississippi Living Trust for Individuals Who Are Unmarried, Divorced, or Widowed with No Offspring in just a few clicks from the largest collection of legal electronic documents.

Locate, download, and print expertly prepared and certified templates on the US Legal Forms website. US Legal Forms has been the leading provider of cost-effective legal and tax documents for US citizens and residents online since 1997.

After downloading your Mississippi Living Trust for Individuals Who Are Unmarried, Divorced, or Widowed with No Offspring, you can fill it out in any online editor or print it out and complete it manually. Utilize US Legal Forms to access 85,000 professionally crafted, state-specific documents.

- Users with an existing subscription should Log In to their US Legal Forms account, download the Mississippi Living Trust for Individuals Who Are Unmarried, Divorced, or Widowed with No Offspring, and find it saved in the My documents section.

- Those without a subscription must complete the following steps.

- Ensure your document complies with your state's regulations.

- If available, read the description of the form for more information.

- If provided, examine the form to discover additional content.

- Once you are confident the document suits your needs, simply click Buy Now.

- Create a personal account.

- Select a payment plan.

- Complete the payment via PayPal or credit card.

- Download the document in Word or PDF format.

Form popularity

FAQ

If you can't find original living trust documents, you can contact the California Bar Association for assistance. Trusts aren't recorded anywhere, so you can't go to the County Recorder's office in the courthouse to ask to see a copy of the trust.

In this article: A living trust is a type of estate planning tool that allows you to transfer ownership of your assets to a separate fund while you're still alive.In some circumstances, you can use a living trust to protect money you owe to creditors.

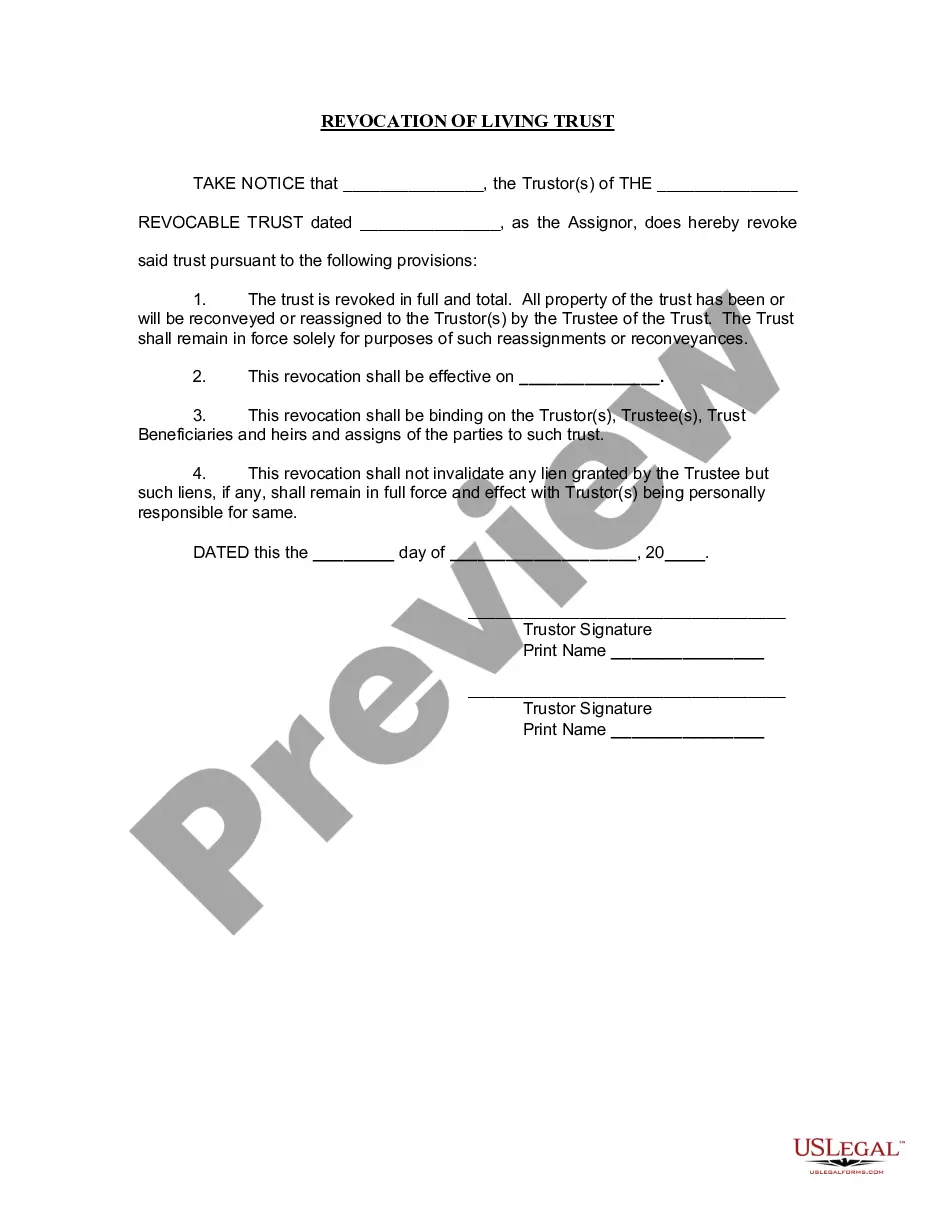

Benefits of a Revocable Trust Many grantors create a revocable trust to avoid probate, which it certainly does, but an irrevocable trust accomplishes that as well. A revocable trust specifically works well for a client who doesn't have serious tax issues, but wants to maintain control of his or her assets.

Livings Trusts. A living trust is usually created by the grantor, during the grantor's lifetime, through a transfer of property to a trustee. Testamentary Trusts. Irrevocable Life Insurance Trust. Charitable Remainder Trust.

Why Everyone Needs a Living Revocable Trust "A living revocable trust serves as far more than just where assets are to go upon your death and it does that in an efficient way," she said. Unlike a will, a living trust also covers you while you are still alive, Orman noted.

A revocable trust and living trust are separate terms that describe the same thing: a trust in which the terms can be changed at any time.Trusts are also a way to reduce tax burdens and avoid assets going to probate.

When it comes to protecting your loved ones, having both a will and a trust is essential. The difference between a will and a trust is when they kick into action. A will lays out your wishes for after you die. A living revocable trust becomes effective immediately.

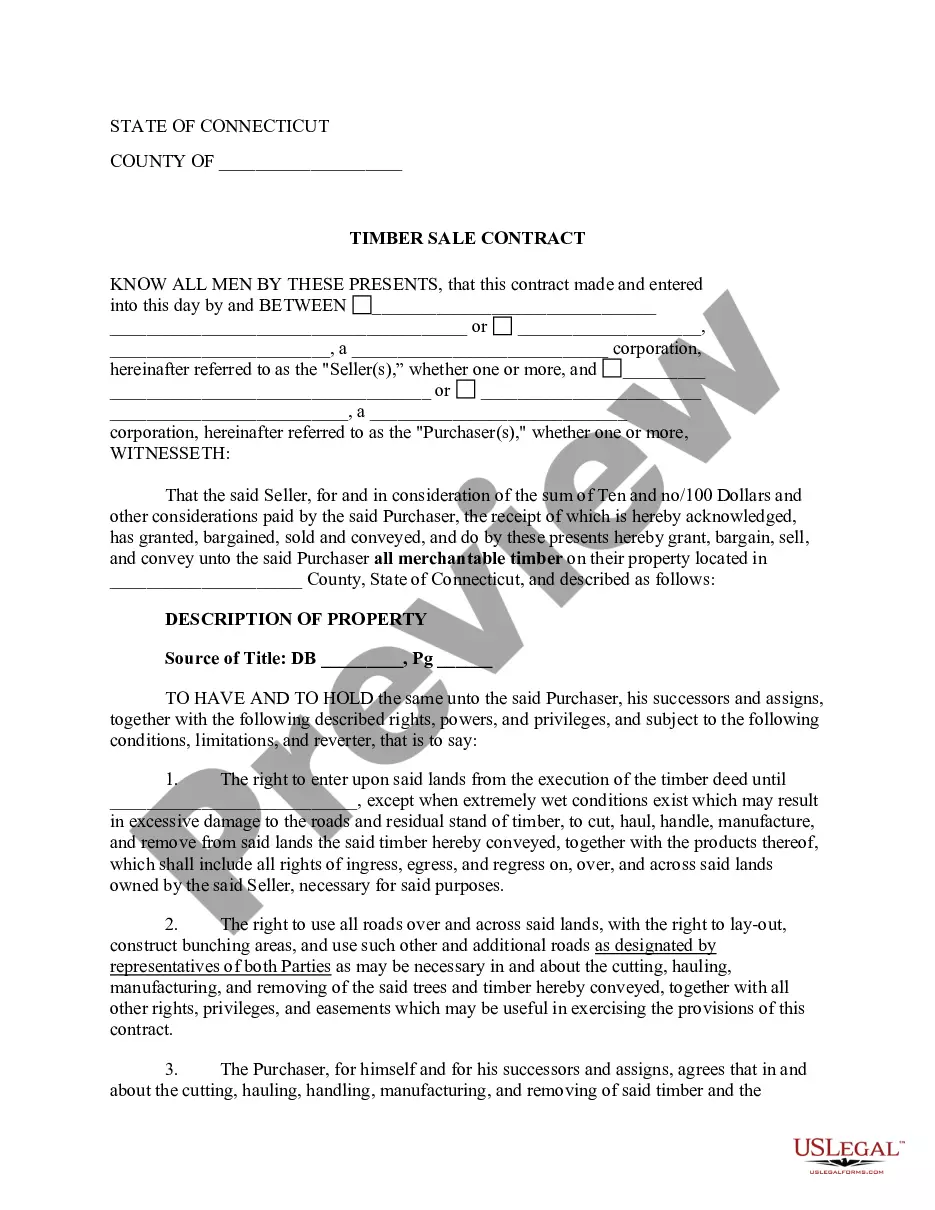

Paperwork. Setting up a living trust isn't difficult or expensive, but it requires some paperwork. Record Keeping. After a revocable living trust is created, little day-to-day record keeping is required. Transfer Taxes. Difficulty Refinancing Trust Property. No Cutoff of Creditors' Claims.

There is no difference between a trust and a living trust.Trusts are considered separate entities that manage a person's assets. The person who manages the assets of a trust is called a trustee, who manages the assets based on the terms of the trust document.