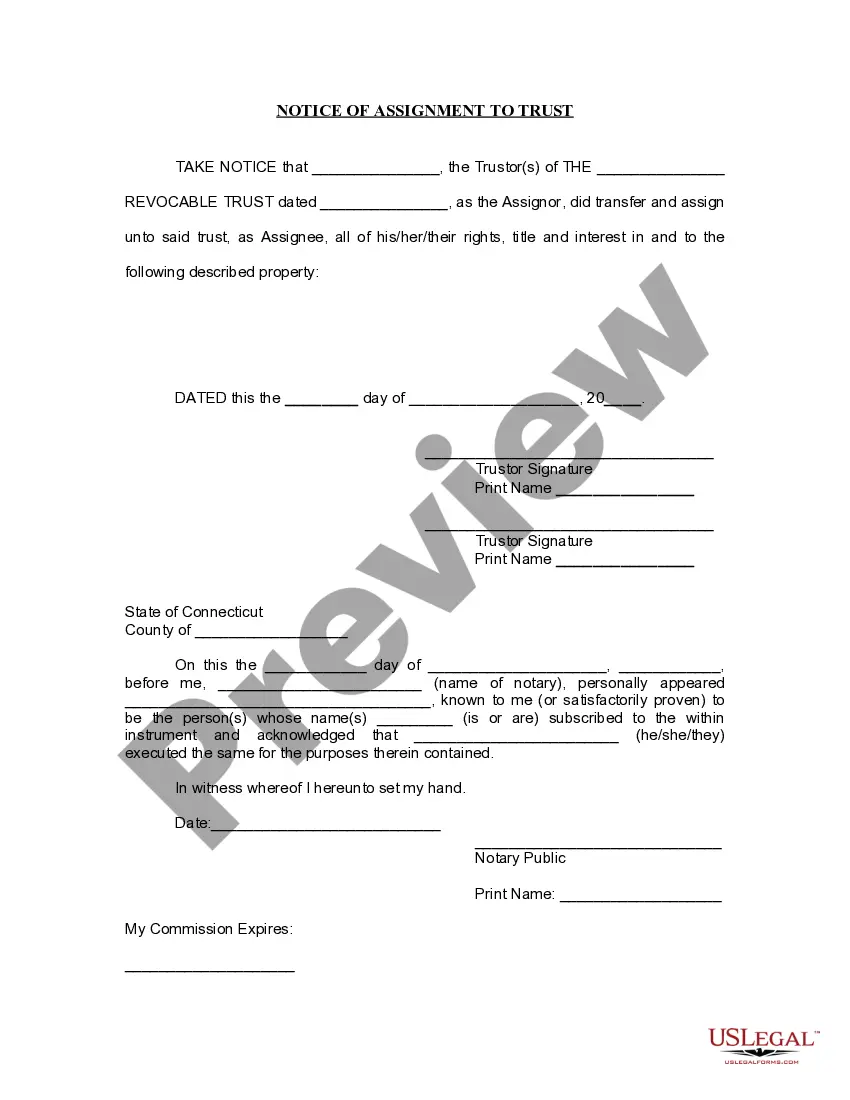

Notice of Assignment to Living Trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form serves as notice that the

trustor(s) of the revocable trust transferred and assigned his or her or their rights, title and interest in and to certain described property to the trust.

Connecticut Notice of Assignment to Living Trust

Description

How to fill out Connecticut Notice Of Assignment To Living Trust?

As you require more documents, your anxiety increases.

You can find numerous Connecticut Notice of Assignment to Living Trust templates online, but it's uncertain which ones are reliable.

Eliminate the complications and simplify the process of obtaining samples using US Legal Forms.

Submit the required details to create your account and pay for the order using your PayPal or credit card. Select a convenient document format and obtain your template. Access all samples you receive in the My documents section. Simply go there to generate a new copy of your Connecticut Notice of Assignment to Living Trust. Even when working with professionally drafted templates, it is still advisable to consult a local attorney to verify that the completed form is filled out accurately. Achieve more while spending less with US Legal Forms!

- If you already hold a subscription to US Legal Forms, Log In to your account, and you will see the Download button on the Connecticut Notice of Assignment to Living Trust page.

- If you are new to our platform, complete the registration process by following these steps.

- Verify that the Connecticut Notice of Assignment to Living Trust is applicable in your state.

- Double-check your selection by reviewing the description or utilizing the Preview option if available for the selected document.

- Click on Buy Now to initiate the registration process and choose a payment plan that suits your needs.

Form popularity

FAQ

To put your house in a trust in Connecticut, you need to create a living trust document that outlines how your property will be managed. Once you have established the trust, you will complete a Connecticut Notice of Assignment to Living Trust to officially transfer the title of your home into the trust. This process protects your assets and simplifies the management of your property. Utilizing a service like USLegalForms can help you navigate and streamline these legal steps.

An assignment to a trust is a legal process that transfers ownership of property or assets into a trust. This transfer allows the trust to manage these assets according to your wishes and can provide benefits such as avoiding probate. The Connecticut Notice of Assignment to Living Trust formally documents this transfer, ensuring clarity and legality. By using platforms like USLegalForms, you can easily create the necessary documents to make an assignment to a trust.

A common mistake parents make when setting up a trust fund is failing to fund the trust properly. Many think that simply creating a trust document is sufficient, yet they often overlook the essential step of transferring assets. Without executing the necessary paperwork, such as the Connecticut Notice of Assignment to Living Trust, the trust won't function as intended.

Transferring a living trust involves updating the trust document and recording a Connecticut Notice of Assignment to Living Trust for each asset. You’ll need to list the assets you wish to place in the trust and create or amend any necessary legal documents. It’s often helpful to enlist the aid of a professional to ensure every step is handled correctly.

One of the main downfalls of having a trust is the complexity involved in its management. Maintaining compliance with the terms of the trust requires ongoing effort, such as ensuring that all necessary assets are transferred properly. Additionally, the initial paperwork, like a Connecticut Notice of Assignment to Living Trust, can be overwhelming without professional help.

To place your house in a trust in Connecticut, you first need to create a living trust document. This document outlines how the trust operates and names the beneficiaries. Once completed, the next step involves executing a Connecticut Notice of Assignment to Living Trust, which legally transfers the ownership of the property to the trust.

It's beneficial for your parents to consider putting their assets in a trust. A trust can help manage and protect their assets, especially in case of incapacitation or death. Additionally, a Connecticut Notice of Assignment to Living Trust can streamline the transfer of assets, ensuring their intentions are fulfilled without court intervention.