Sometimes, a prior demand by a potential plaintiff for an accounting, and a refusal by the fiduciary to account, are conditions precedent to the bringing of an action for an accounting. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Demand for Accounting from a Fiduciary

Description

How to fill out Demand For Accounting From A Fiduciary?

Aren't you sick and tired of choosing from countless samples each time you require to create a Demand for Accounting from a Fiduciary? US Legal Forms eliminates the lost time millions of Americans spend searching the internet for ideal tax and legal forms. Our professional team of attorneys is constantly modernizing the state-specific Forms catalogue, so that it always has the proper files for your scenarion.

If you’re a US Legal Forms subscriber, simply log in to your account and then click the Download button. After that, the form are available in the My Forms tab.

Users who don't have a subscription should complete simple actions before being able to download their Demand for Accounting from a Fiduciary:

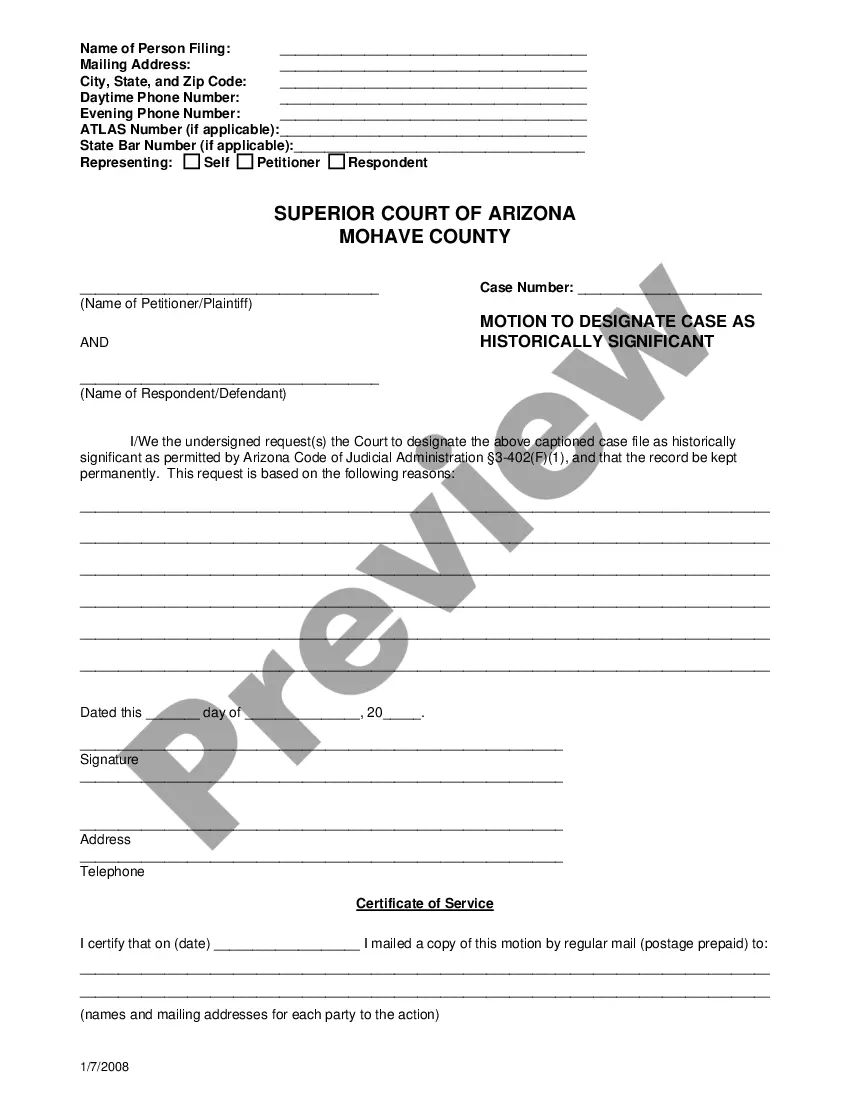

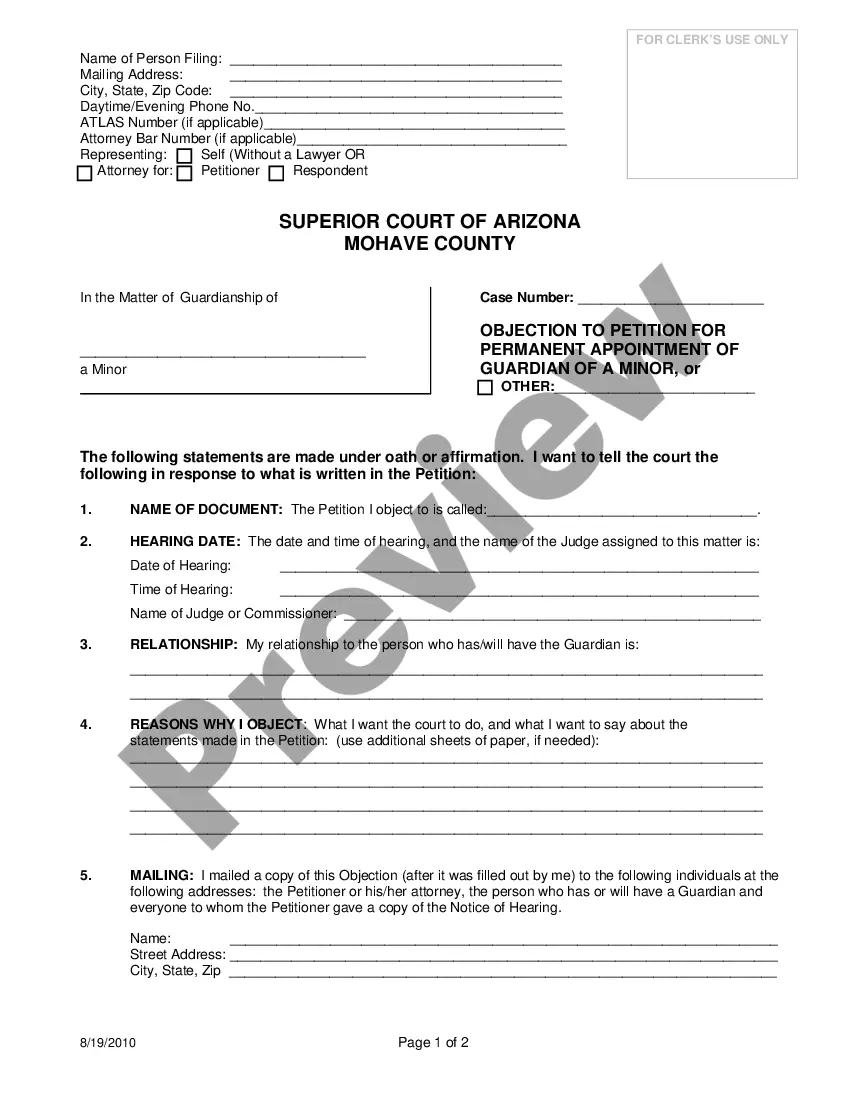

- Make use of the Preview function and read the form description (if available) to make certain that it is the appropriate document for what you are looking for.

- Pay attention to the applicability of the sample, meaning make sure it's the proper example for your state and situation.

- Use the Search field on top of the webpage if you want to look for another document.

- Click Buy Now and select a convenient pricing plan.

- Create an account and pay for the service using a credit card or a PayPal.

- Get your sample in a required format to complete, create a hard copy, and sign the document.

Once you’ve followed the step-by-step recommendations above, you'll always have the ability to log in and download whatever document you want for whatever state you need it in. With US Legal Forms, finishing Demand for Accounting from a Fiduciary samples or any other legal documents is easy. Get going now, and don't forget to look at your samples with accredited lawyers!

Form popularity

FAQ

If the trustee fails to account, he or she is in violation of the statute and his or her fiduciary duty. If the beneficiaries are harmed by the lack of accounting, the trustee may be liable. Further, the court may become involved, may levy sanctions and could even remove the trustee.

Generally, the trustee only has to provide the annual accounting to each beneficiary to whom income or principal is required or authorized in the trustee's discretion to be currently distributed. The trust document has to be read and interpreted to determine who is entitled to accountings.

Before distributing assets to beneficiaries, the executor must pay valid debts and expenses, subject to any exclusions provided under state probate laws.The executor must maintain receipts and related documents and provide a detailed accounting to estate beneficiaries.

A fiduciary accounting is a comprehensive report of the activity within a trust, estate or conservatorship during a specific time period. It shows all of the receipts and disbursements managed by the executor or trustee, properly allocating all transactions between principal and income.

Basic accounting refers to the process of recording a company's financial transactions. It involves analyzing, summarizing and reporting these transactions to regulators, oversight agencies and tax collection entities.This is why businesses must be proficient in accounting in order to make good decisions.

Create a New Business Account. Set Budget Aside for Tax Purposes. Always Keep Your Records Organised. Track Your Expenses. Maintain Daily Records. Leave an Audit Trail. Stay on Top of Your Accounts Receivable. Keep Tax Deadlines in Mind.

Employee Timesheets. Train your employees to consistently keep track of daily, weekly and monthly amounts of time spent in office or on the clock. Income Statement. Journal Sheet. Bank Reconciliation Form. Balance Sheet. Delivery Docket.

Accounting forms are used to record and report these economic transactions that are a combination of accounting registers. These are also used to depict the financial condition of a company and to manage the business in avoiding or eliminating costly mistakes.