An accounting by a fiduciary usually involves an inventory of assets, debts, income, expenditures, and other items, which is submitted to a court. Such an accounting is used in various contexts, such as administration of a trust, estate, guardianship or conservatorship. Generally, a prior demand by an appropriate party for an accounting, and a refusal by the fiduciary to account, are conditions precedent to the bringing of an action for an accounting.

Demand for Accounting from a Fiduciary such as an Executor, Conservator, Trustee or Legal Guardian

Description

Key Concepts & Definitions

The demand for accounting from a fiduciary such as an accountant or financial advisor revolves around the need for transparent, ethical financial management. A fiduciary is legally bound to act in the best interests of their clients, prioritizing client needs over their own. In the context of accounting, fiduciaries ensure accurate reporting and advise on financial decisions that align with their clients goals.

Step-by-Step Guide

- Identify Your Needs: Assess what financial services you require from a fiduciary accountantbe it tax planning, investment management, or estate planning.

- Choose the Right Professional: Select a certified fiduciary who has a strong track record and specializes in the services you need.

- Review Their Credentials: Verify the fiduciary's certifications, such as CPA (Certified Public Accountant) or CFP (Certified Financial Planner), and check their regulatory compliance status.

- Engage and Communicate: Clearly communicate your financial goals and expectations. Regularly review performance and adjust strategies as needed.

- Monitor and Evaluate: Periodically review your fiduciarys performance to ensure your financial goals are being met in compliance with fiduciary standards.

Risk Analysis

- Conflict of Interest: Fiduciaries might face conflicts between their duties and personal interests, which is a risk to client interests.

- Compliance Risk: Fiduciaries must adhere to a variety of regulations. Failure to comply can lead to legal repercussions for both the fiduciary and their clients.

- Market Risk: Investment decisions made by fiduciaries are subject to market conditions that can affect financial outcomes.

- Reputational Risk: Inadequate management or ethical breaches can tarnish the reputation of the fiduciary and result in trust erosion among clients.

How to fill out Demand For Accounting From A Fiduciary Such As An Executor, Conservator, Trustee Or Legal Guardian?

Aren't you sick and tired of choosing from countless samples each time you want to create a Demand for Accounting from a Fiduciary such as an Executor, Conservator, Trustee or Legal Guardian? US Legal Forms eliminates the lost time countless American people spend exploring the internet for appropriate tax and legal forms. Our professional team of attorneys is constantly updating the state-specific Forms library, so it always offers the appropriate documents for your situation.

If you’re a US Legal Forms subscriber, just log in to your account and then click the Download button. After that, the form can be found in the My Forms tab.

Users who don't have a subscription should complete a few simple steps before being able to get access to their Demand for Accounting from a Fiduciary such as an Executor, Conservator, Trustee or Legal Guardian:

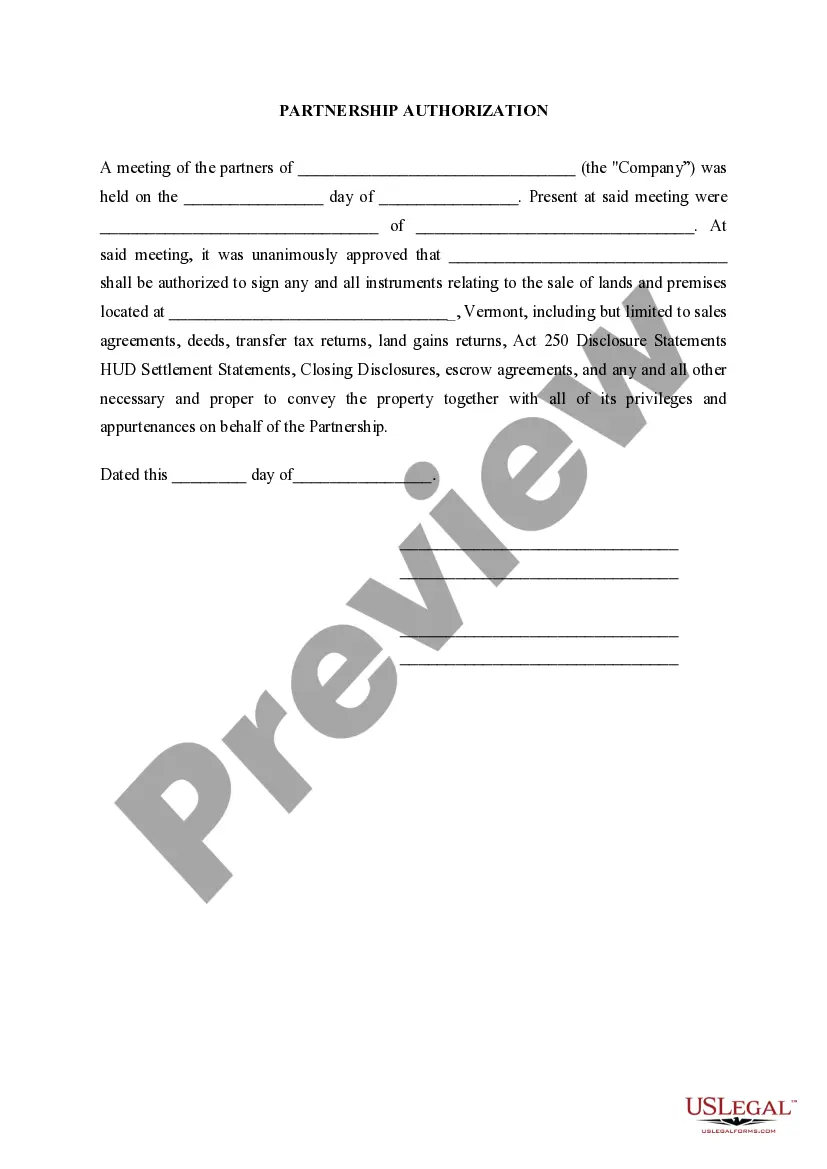

- Utilize the Preview function and look at the form description (if available) to make sure that it’s the right document for what you are looking for.

- Pay attention to the applicability of the sample, meaning make sure it's the appropriate template for your state and situation.

- Utilize the Search field on top of the webpage if you have to look for another file.

- Click Buy Now and choose a convenient pricing plan.

- Create an account and pay for the service using a credit card or a PayPal.

- Get your document in a needed format to complete, print, and sign the document.

Once you’ve followed the step-by-step recommendations above, you'll always have the capacity to log in and download whatever document you will need for whatever state you require it in. With US Legal Forms, finishing Demand for Accounting from a Fiduciary such as an Executor, Conservator, Trustee or Legal Guardian samples or any other official files is simple. Begin now, and don't forget to look at the examples with certified attorneys!

Form popularity

FAQ

If the trustee fails to account, he or she is in violation of the statute and his or her fiduciary duty. If the beneficiaries are harmed by the lack of accounting, the trustee may be liable. Further, the court may become involved, may levy sanctions and could even remove the trustee.

To familiarise itself with the terms of the trust especially beneficiaries and trust property; to act honestly, reasonably and in good faith; to preserve and not waste the value of the trust assets; to accumulate or pay income as directed by the trust instrument;

Generally, the trustee only has to provide the annual accounting to each beneficiary to whom income or principal is required or authorized in the trustee's discretion to be currently distributed. The trust document has to be read and interpreted to determine who is entitled to accountings.

The trustee's fiduciary duties include a duty of loyalty, a duty of prudence, and subsidiary duties. The duty of loyalty requires that the trustee administer the trust solely in the interest of the beneficiaries.

Before distributing assets to beneficiaries, the executor must pay valid debts and expenses, subject to any exclusions provided under state probate laws.The executor must maintain receipts and related documents and provide a detailed accounting to estate beneficiaries.

Before distributing assets to beneficiaries, the executor must pay valid debts and expenses, subject to any exclusions provided under state probate laws.The executor must maintain receipts and related documents and provide a detailed accounting to estate beneficiaries.

Taxes paid, disbursements made to trust beneficiaries, and gains and losses on trust assets. Fees and expenses paid to advisors of the trustee, such as attorneys, CPAs, and financial advisors.

The executor of a will has a fiduciary duty to act in the best interest of the estate. This means that the law prevents you from acting in your own interest to the detriment of the estate. As an extension of this duty, executors also have several responsibilities to the beneficiaries of the will.

The executor gathers assets, pays bills and taxes, and eventually distributes what's left to the people who inherit it. We may not be so familiar with the person who has the comparable role when someone uses a trust, not a will, to leave property. That person is called a successor trustee.