Registration Rights Agreement between Visible Genetics, Inc. and the purchasers of common shares of the company

Description

How to fill out Registration Rights Agreement Between Visible Genetics, Inc. And The Purchasers Of Common Shares Of The Company?

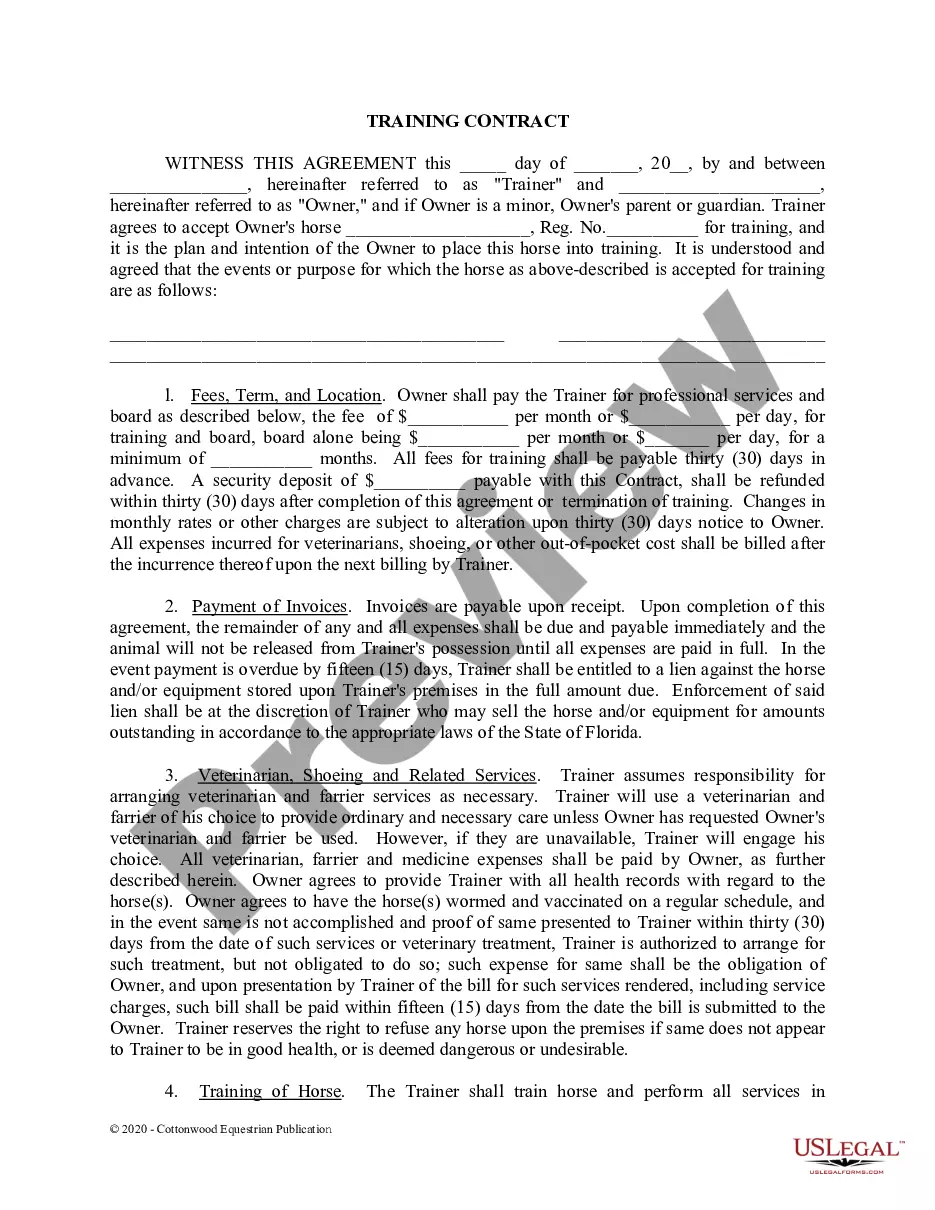

When it comes to drafting a legal document, it is better to leave it to the experts. However, that doesn't mean you yourself cannot get a sample to utilize. That doesn't mean you yourself cannot find a sample to utilize, nevertheless. Download Registration Rights Agreement between Visible Genetics, Inc. and the purchasers of common shares of the company from the US Legal Forms site. It provides numerous professionally drafted and lawyer-approved forms and samples.

For full access to 85,000 legal and tax forms, users just have to sign up and choose a subscription. As soon as you’re registered with an account, log in, search for a specific document template, and save it to My Forms or download it to your gadget.

To make things much easier, we have provided an 8-step how-to guide for finding and downloading Registration Rights Agreement between Visible Genetics, Inc. and the purchasers of common shares of the company fast:

- Be sure the form meets all the necessary state requirements.

- If possible preview it and read the description before purchasing it.

- Press Buy Now.

- Choose the suitable subscription for your requirements.

- Make your account.

- Pay via PayPal or by debit/bank card.

- Choose a preferred format if several options are available (e.g., PDF or Word).

- Download the document.

After the Registration Rights Agreement between Visible Genetics, Inc. and the purchasers of common shares of the company is downloaded you can fill out, print out and sign it in almost any editor or by hand. Get professionally drafted state-relevant papers within a matter of minutes in a preferable format with US Legal Forms!

Form popularity

FAQ

A registration statement is a filing with the SEC making required disclosures in connection with the registration of a security, a securities offering or an investment company under federal securities laws.

Piggyback registration rights are a form of registration rights that grants the investor the right to register their unregistered stock when either the company or another investor initiates a registration.

Piggyback registration rights are a form of registration rights that grants the investor the right to register their unregistered stock when either the company or another investor initiates a registration.

A registration right is a right which entitles an investor who owns restricted stock the ability to require a company to list the shares publicly so that the investor can sell them. Registration rights, if exercised, can force a privately-held company to become a publicly-traded company.

With demand rights, investors are given the right to force a company to register shares of common stock so that the investor can sell them in the public market without restriction. This effectively causes the company to undertake an IPO if the company isn't already public.