Connecticut Revocation of Living Trust

About this form

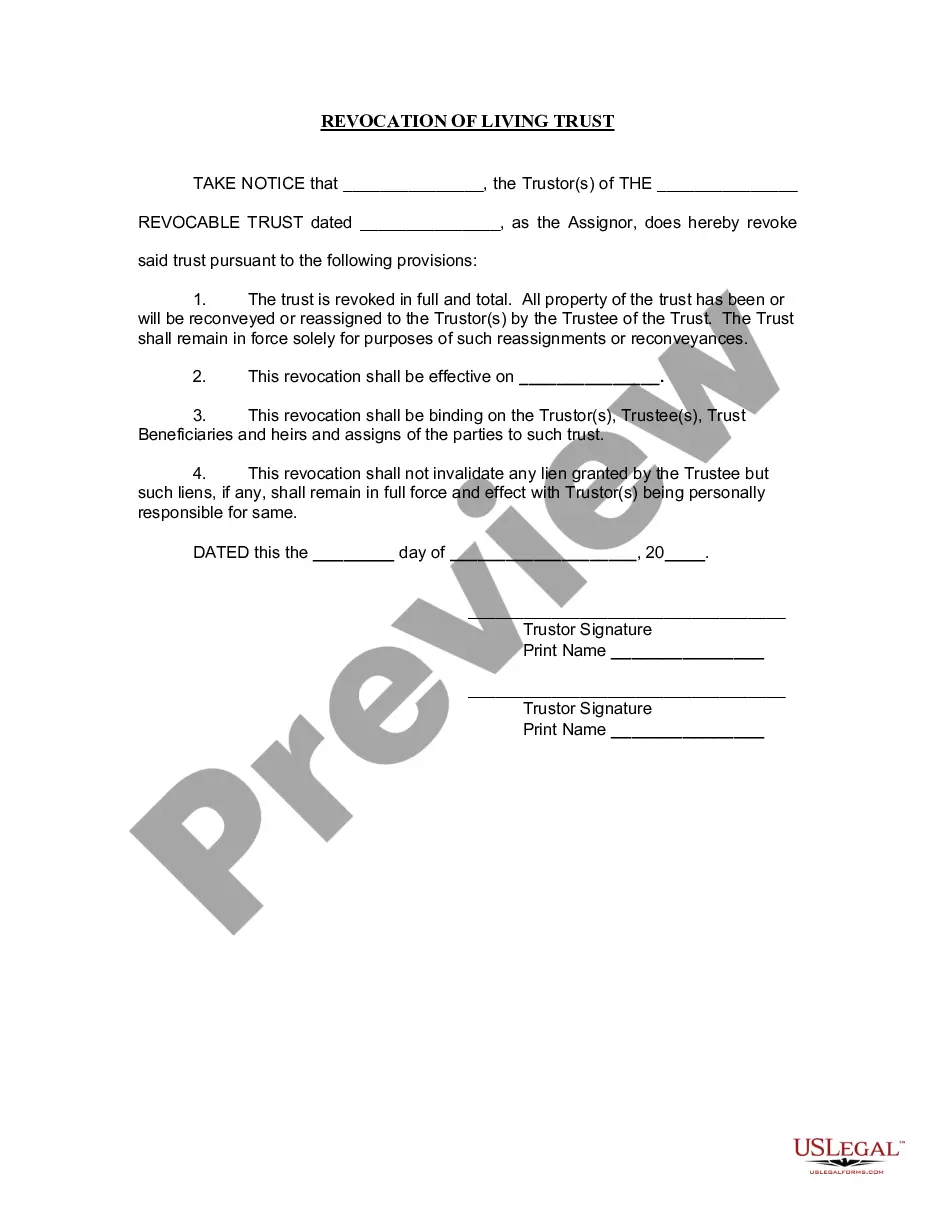

The Revocation of Living Trust form is a legal document used to formally revoke an existing living trust. This type of trust is established during a person's lifetime to manage their assets and property for estate planning purposes. By using this form, the trustor declares a complete revocation of their living trust, allowing for the return of trust property to themselves. This form is essential for those wanting to nullify a trust while ensuring their wishes are documented properly.

Key components of this form

- Identification of the trustor(s) and the specific living trust being revoked.

- Declaration of full and total revocation of the trust.

- Provisions for the reconveyance or reassignment of trust property to the trustor(s).

- Effective date of the revocation.

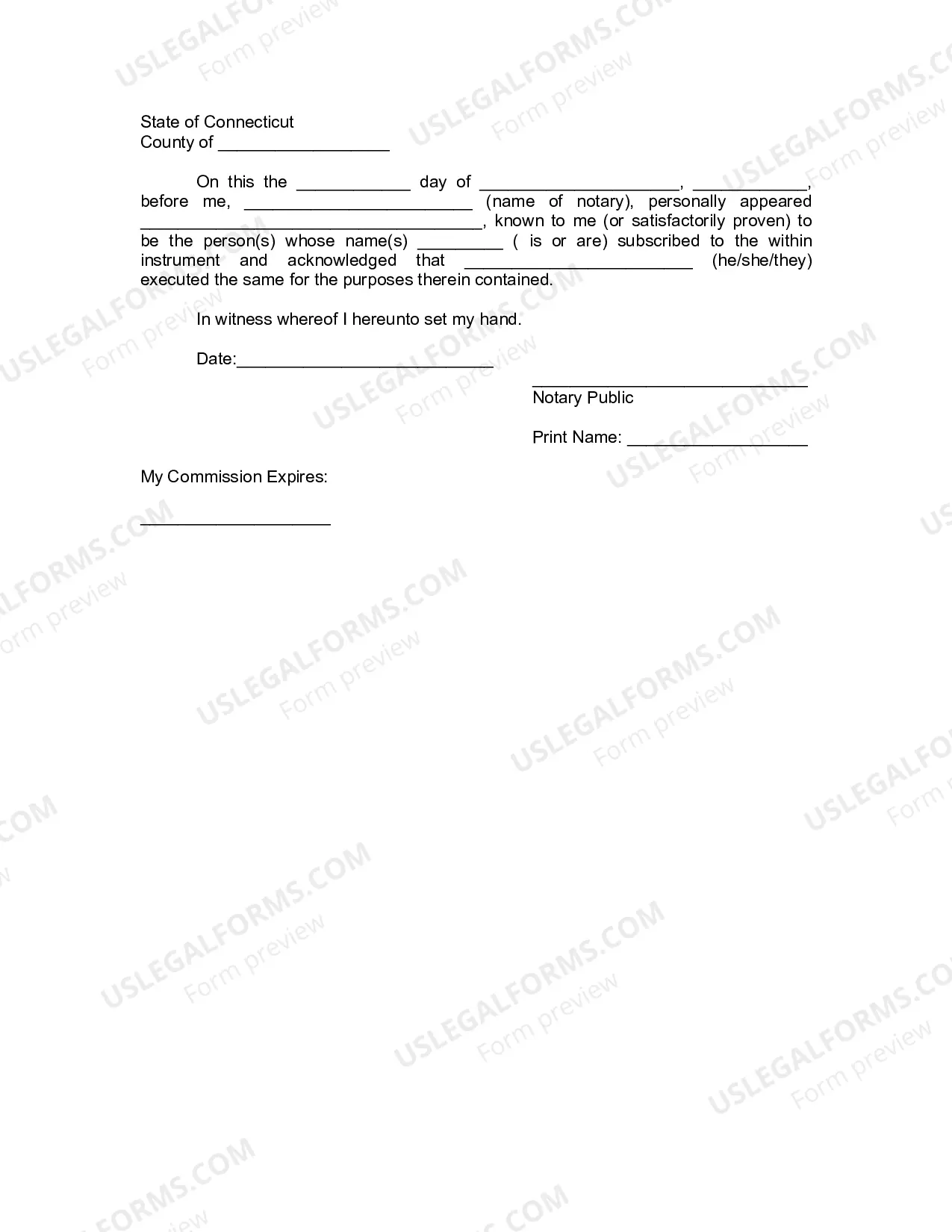

- Signatures of the trustor(s) witnessed by a notary public.

When to use this form

This form should be used when a trustor decides to dissolve an existing living trust. Common scenarios include changes in financial circumstances, a shift in personal relationships, or a desire to alter estate planning strategies. Revoking a living trust ensures that the trustor's current wishes regarding asset distribution are clearly stated and legally recognized.

Who this form is for

This form is intended for:

- Individuals who are the trustor(s) of a living trust that they wish to revoke.

- People seeking to manage their estate planning more effectively.

- Those wanting to simplify their asset distribution by nullifying a previous trust arrangement.

Completing this form step by step

- Identify the trustor(s) and fill in the name of the living trust being revoked.

- Clearly declare that the trust is revoked in full and total.

- Specify the effective date of the revocation.

- Obtain signatures from the trustor(s) in the designated areas.

- Have the form notarized, confirming the identities of those who signed.

Does this document require notarization?

To make this form legally binding, it must be notarized. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Avoid these common issues

- Failing to include the effective date for the revocation.

- Not notarizing the document, which can invalidate the revocation.

- Leaving fields blank or improperly completing the trustor signatures.

Benefits of completing this form online

- Convenience of downloading the form immediately.

- Access to templates drafted by licensed attorneys, ensuring legal accuracy.

- Ability to edit and customize the form as needed for personal circumstances.

Looking for another form?

Form popularity

FAQ

Shutting down a trust involves several steps, such as gathering trust documents, informing beneficiaries, and executing a formal trust revocation. You may need to provide notice to all parties involved and follow state laws regarding asset distribution. For Connecticut residents, uslegalforms offers comprehensive tools and templates to assist in effectively managing the Connecticut Revocation of Living Trust, making the shutdown process seamless.

A trust can be terminated through several methods, including completing its purpose, revocation by the creator, or court order. It may also happen if the assets become negligible or the beneficiaries agree to terminate it. For individuals facing the need to execute a Connecticut Revocation of Living Trust, utilizing services like uslegalforms can streamline the documentation process and ensure proper handling.

While you do not necessarily need a lawyer to dissolve a trust, consulting one can provide essential guidance and simplify the process. Trust laws can be intricate, and a legal expert can help ensure you are taking the correct steps to effectively revoke your trust. For those in Connecticut, engaging with uslegalforms can provide the necessary documentation and support for a smooth Connecticut Revocation of Living Trust process.

A trust becomes null and void when its terms cannot be fulfilled or if it contravenes state laws. Common reasons include lack of legal capacity by the trust creator, improper execution, or if the trust purpose is illegal. In Connecticut, understanding the technicalities of trust law can be complex, so consider utilizing resources from uslegalforms to ensure clarity and compliance. This is especially important for anyone dealing with a Connecticut Revocation of Living Trust.

You should update a revocable trust whenever there are significant life changes, such as marriage, divorce, or the birth of a child. Additionally, reviewing the trust every few years can ensure that it meets your current wishes and complies with state laws. Keeping your Connecticut revocation of living trust updated safeguards your assets and ensures they are distributed according to your desires. For guidance on how to update your trust effectively, USLegalForms provides helpful tools and resources.

Yes, you can amend a revocable living trust at any time while you are alive and competent. This process is part of the flexibility that a revocable living trust offers. To make amendments, you typically need to draft a formal amendment document that outlines the changes. If you need assistance with this process, consider using USLegalForms to simplify your Connecticut revocation of living trust needs.

As mentioned earlier, a living trust does avoid probate in Connecticut. This efficiency allows your heirs to access their inheritances more quickly without the lengthy probate process. However, ensure all your assets are included in the trust, as anything not transferred could still go through probate. Familiarizing yourself with the Connecticut revocation of living trust can provide you with the tools to navigate these situations effectively.

A revocation of a living trust is a legal process where the trustor withdraws their authority over the trust, effectively ending its existence. This process involves creating a document that declares the trust has been revoked and ensuring that all assets are returned to the trustor. If you are considering this step, it’s wise to understand the implications surrounding Connecticut revocation of living trust to avoid complications down the road.

A trust can be terminated through revocation by the trustor, through expiration if it reaches its pre-set duration, or by court order. In Connecticut, proper procedures must be followed when revoking a trust. Understanding these methods is crucial if you are contemplating the Connecticut revocation of living trust. Consulting a qualified attorney can provide clarity on your specific situation.

While a living trust has many benefits, there are some downsides to consider. Establishing a trust can involve higher initial costs compared to a will, and maintaining it requires ongoing management. Additionally, assets not properly transferred into the trust may still be subject to probate. Be sure to weigh the pros and cons when considering the Connecticut revocation of living trust.