This form may be used to establish an Irrevocable Reversionary Living Trust, with the United States as Grantor; to provide secondary payment for medical benefits to the beneficiary named in the form.

Irrevocable Reversionary Inter Vivos Medical Trust

Description

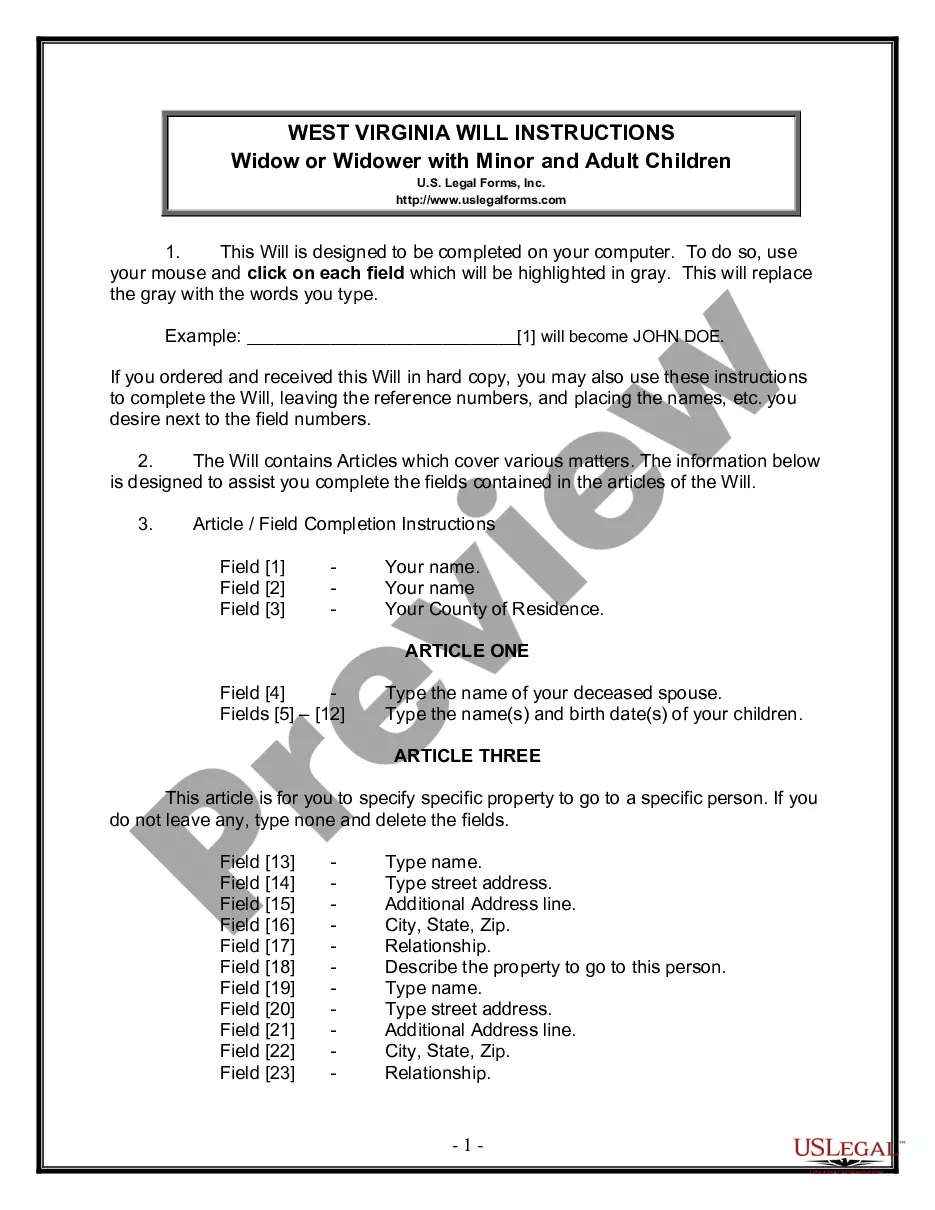

How to fill out Irrevocable Reversionary Inter Vivos Medical Trust?

Make use of the most comprehensive legal catalogue of forms. US Legal Forms is the perfect platform for finding updated Irrevocable Reversionary Inter Vivos Medical Trust templates. Our service offers a large number of legal forms drafted by certified attorneys and grouped by state.

To download a sample from US Legal Forms, users just need to sign up for a free account first. If you’re already registered on our service, log in and select the template you are looking for and purchase it. Right after buying forms, users can find them in the My Forms section.

To obtain a US Legal Forms subscription online, follow the guidelines below:

- Check if the Form name you have found is state-specific and suits your needs.

- In case the template features a Preview option, utilize it to review the sample.

- In case the template doesn’t suit you, use the search bar to find a better one.

- Hit Buy Now if the template corresponds to your requirements.

- Choose a pricing plan.

- Create an account.

- Pay via PayPal or with the debit/credit card.

- Choose a document format and download the template.

- As soon as it’s downloaded, print it and fill it out.

Save your time and effort with our service to find, download, and fill in the Form name. Join a huge number of delighted clients who’re already using US Legal Forms!

Form popularity

FAQ

Special needs trusts pay for comforts and luxuries -- "special needs" -- that could not be paid for by public assistance funds. This means that if money from the trust is used for food or shelter costs on a regular basis or distributed directly to the beneficiary, such payments will count as income to the beneficiary.

At the beneficiary's death, in most cases the SNT will be terminated. The trustee is responsible for dissolving the trust and fulfilling the instructions laid out in the trust document.In addition, the SNT will owe money to the state if the person with special needs received Medicaid benefits during her lifetime.

An irrevocable trust is taxed as a legally independent entity, in much the same way as an individual taxpayer is taxed in terms of income tax rates and available deductions. Contributing income-earning property to an irrevocable trust means that the IRS will treat the resulting income as trust income, not your income.

Frankly, just about any asset can be transferred to an irrevocable trust, assuming the grantor is willing to give it away. This includes cash, stock portfolios, real estate, life insurance policies, and business interests. Of course, some assets are better to place in trust than others.

Failure to set up a special needs trust might affect them, even if not as much as another person who receives, say, SSI and Medicaid. Even someone receiving Medicare will have some effect from having a higher income.

The trustee of an irrevocable trust can only withdraw money to use for the benefit of the trust according to terms set by the grantor, like disbursing income to beneficiaries or paying maintenance costs, and never for personal use.

Special needs trusts pay for comforts and luxuries -- "special needs" -- that could not be paid for by public assistance funds. This means that if money from the trust is used for food or shelter costs on a regular basis or distributed directly to the beneficiary, such payments will count as income to the beneficiary.

The trust can pay for any amount of medical costs, as long as the trust pays the expenses directly to the medical provider or institution. Just remember that the terms of the trust are irrevocable regardless of how much you transfer into the trust's name.

The main downside to an irrevocable trust is simple: It's not revocable or changeable. You no longer own the assets you've placed into the trust. In other words, if you place a million dollars in an irrevocable trust for your child and want to change your mind a few years later, you're out of luck.