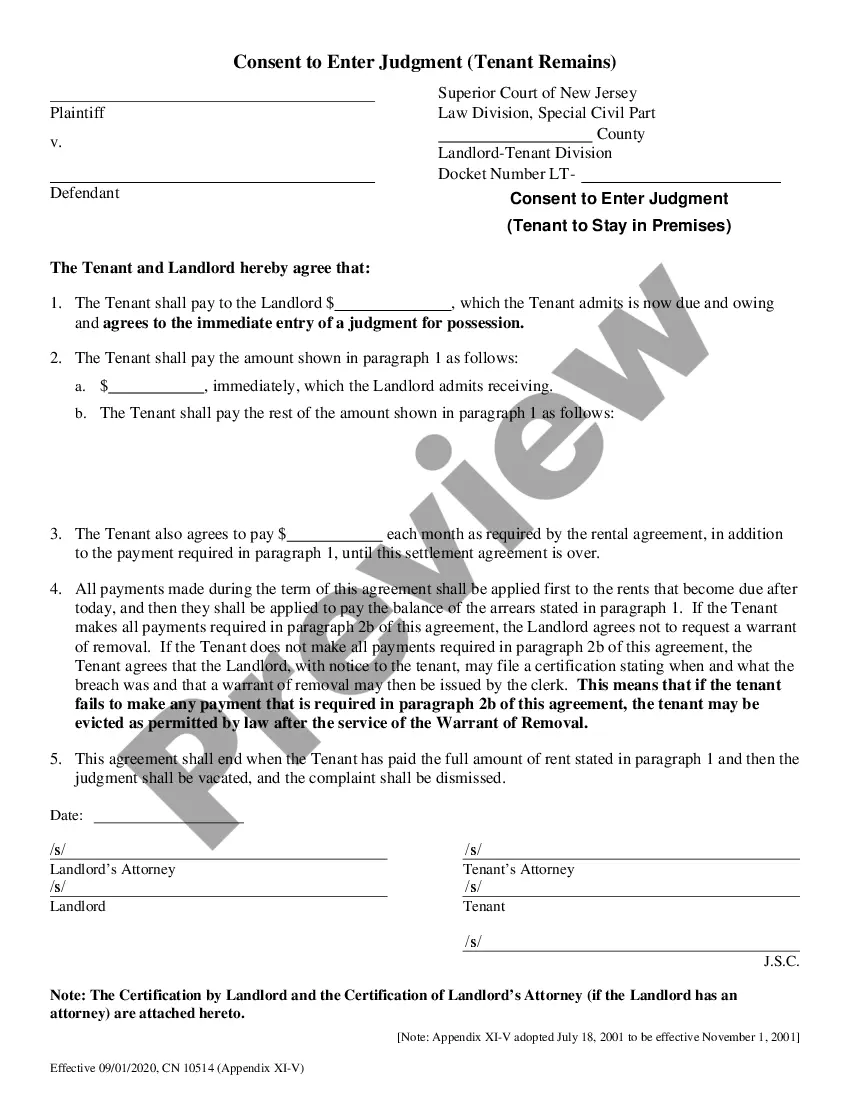

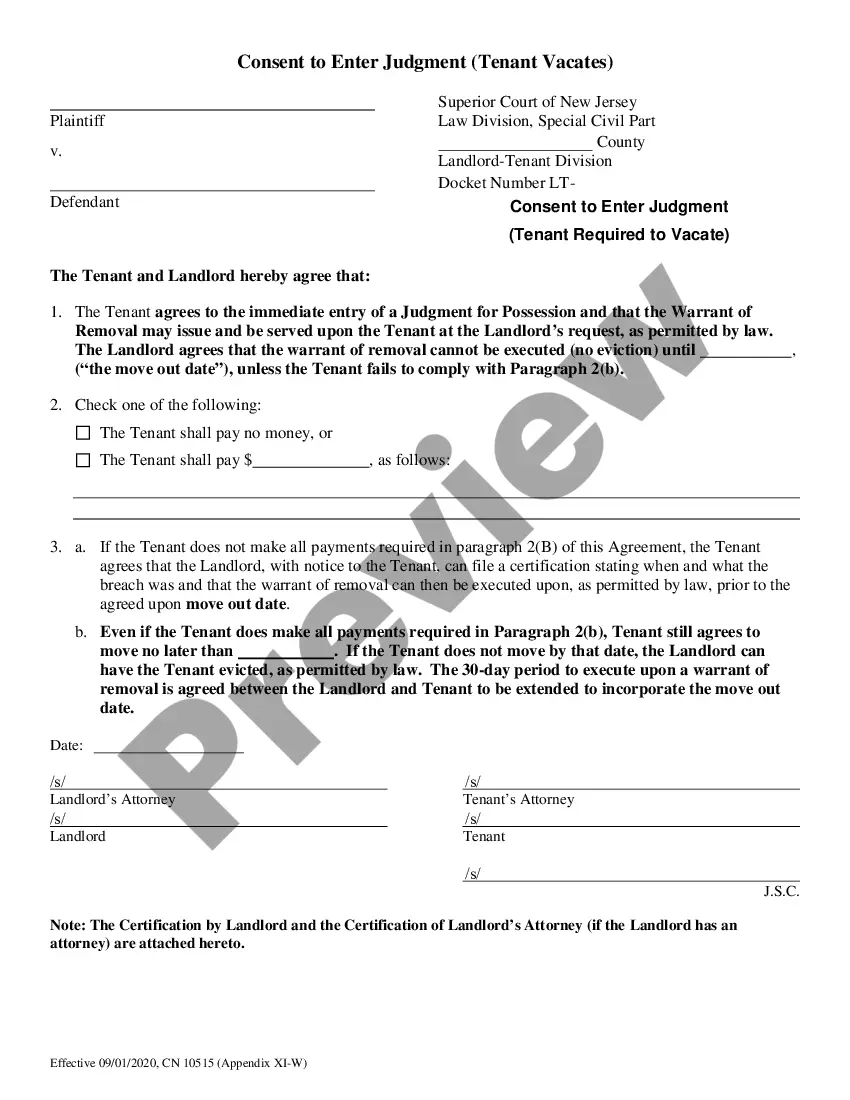

New Jersey Appendix XI - W Consent To Enter Judgment For Possession when Tenant Vacates

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out New Jersey Appendix XI - W Consent To Enter Judgment For Possession When Tenant Vacates?

US Legal Forms is really a special system where you can find any legal or tax document for filling out, such as New Jersey Appendix XI - W Consent To Enter Judgment For Possession when Tenant Vacates. If you’re tired of wasting time seeking suitable samples and paying money on papers preparation/lawyer fees, then US Legal Forms is precisely what you’re looking for.

To experience all of the service’s benefits, you don't need to download any software but just select a subscription plan and create your account. If you have one, just log in and get an appropriate template, save it, and fill it out. Downloaded documents are all kept in the My Forms folder.

If you don't have a subscription but need to have New Jersey Appendix XI - W Consent To Enter Judgment For Possession when Tenant Vacates, check out the instructions listed below:

- Double-check that the form you’re checking out is valid in the state you want it in.

- Preview the example its description.

- Click on Buy Now button to access the sign up webpage.

- Pick a pricing plan and carry on signing up by providing some info.

- Choose a payment method to finish the sign up.

- Save the file by choosing the preferred file format (.docx or .pdf)

Now, complete the file online or print it. If you feel uncertain about your New Jersey Appendix XI - W Consent To Enter Judgment For Possession when Tenant Vacates template, speak to a lawyer to review it before you decide to send or file it. Get started hassle-free!

Form popularity

FAQ

If you are an employer subject to the law, you must file an Employer Report of Wages Paid (WR-30) form within 30 days of the end of each calendar quarter. This report requires you to list all individuals who were employed by and/or received remuneration from you as employees during the calendar quarter.

If you have noticed an "SDI" contribution on your W-2, this represents the funds that you have paid into a state disability insurance program. SDI programs provide valuable financial assistance to individuals on a short-term basis who have lost the ability to work due to either a physical or mental disability.

The more allowances you claim, the less tax is withheld from your paycheck. However, fewer allowances translate into a considerable withholding amount, which could lead to a refund. You were allowed to claim 0-3 allowances on the previous W-4 form, but this depends on your eligibility.

By placing a 0 on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period.You can choose to have no taxes taken out of your tax and claim Exemption (see Example 2).

The more allowances you claim, the less income tax is withheld from your pay. Fewer or zero allowances mean more income tax is withheld from your pay. To put it another way: More allowances equal more take-home pay and money in your pocket.

A single person who lives alone and has only one job should place a 1 in part A and B on the worksheet giving them a total of 2 allowances. A married couple with no children, and both having jobs should claim one allowance each. You can use the Two Earners/Multiple Jobs worksheet on page 2 to help you calculate this.

NJ Taxation Employers must file a Gross Income Tax Reconciliation of Tax Withheld (Form NJ-W-3) each year to report the total monthly tax remitted, wages paid and withholdings. Registered employers must file Form NJ-W-3 even if no wages were paid and no tax was withheld during the year.

Most taxpayers will put a number on line 5 (indicated here by the red arrow) that will help your employer calculate how much federal income tax is to be withheld from your paycheck. That number is the number of allowances you are claiming and it's the one that gives taxpayers fits trying to get right.

Employee's Withholding Allowance Certificate (Form NJ-W4) When an employee has more than one job, or if spouses/civil union partners are both wage earners, the combined incomes may be taxed at a higher rate.Employees may also use this form to request that an additional amount be deducted from each pay.