Minnesota Appellant's Notice of Motion and Motion for Late Filing of Reply Brief

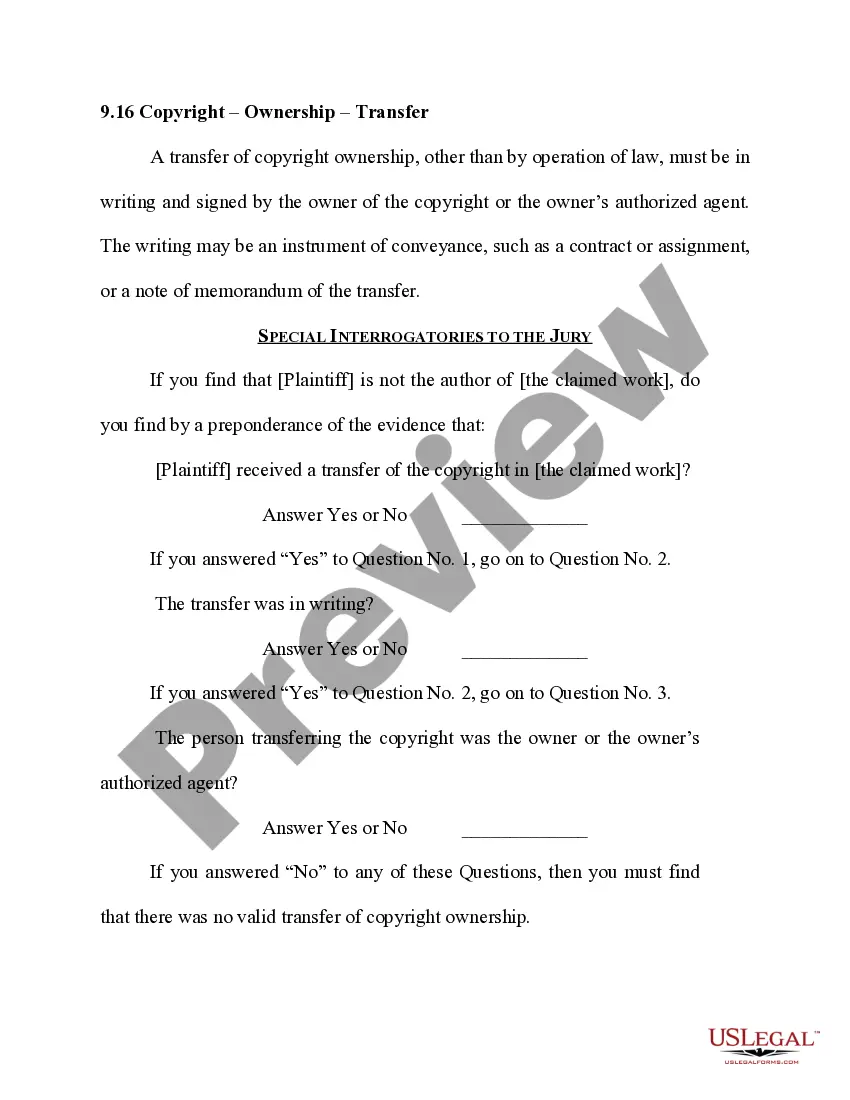

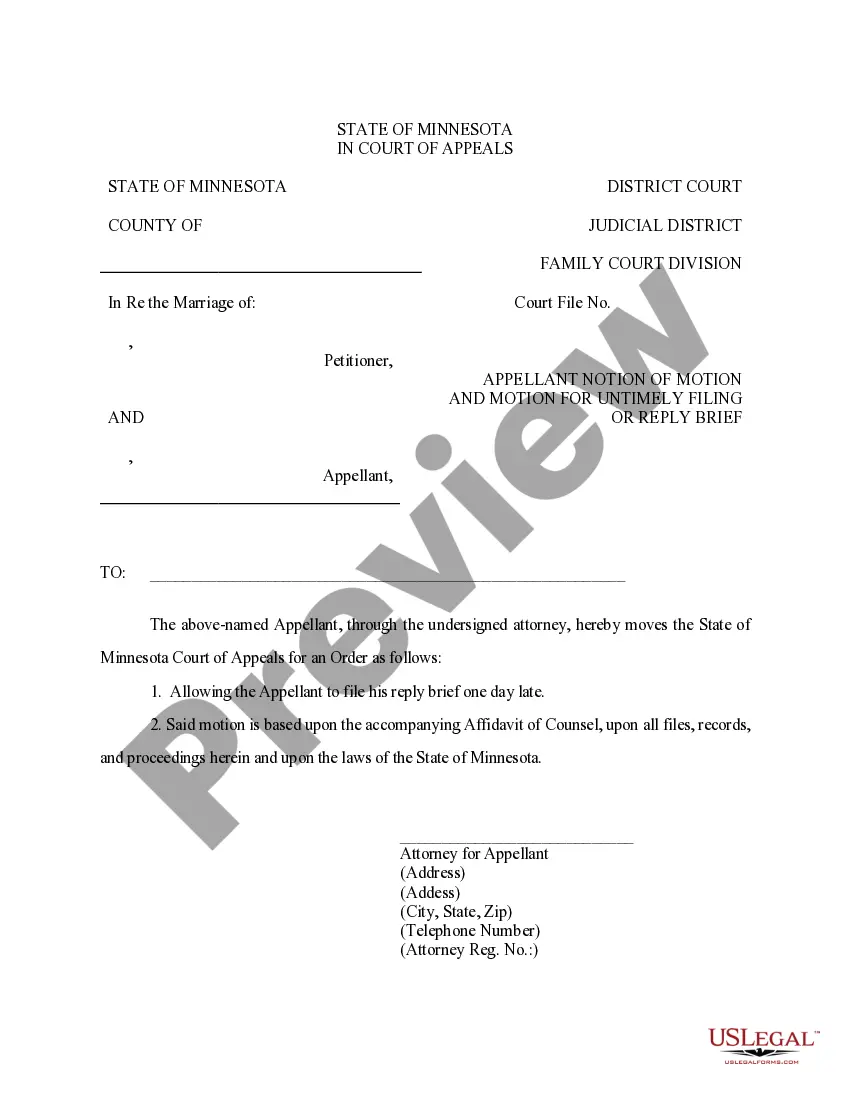

Description

How to fill out Minnesota Appellant's Notice Of Motion And Motion For Late Filing Of Reply Brief?

Obtain any type from 85,000 legal documents including the Minnesota Appellant's Notice of Motion and Motion for Late Filing of Reply Brief online with US Legal Forms. Each template is crafted and refreshed by state-authorized legal experts.

If you already possess a subscription, Log In. Upon reaching the form’s page, click the Download button and navigate to My documents to retrieve it.

If you haven’t subscribed yet, adhere to the guidelines below.

With US Legal Forms, you will always have immediate access to the appropriate downloadable example. The platform will provide you with access to forms and categorizes them to simplify your search. Use US Legal Forms to acquire your Minnesota Appellant's Notice of Motion and Motion for Late Filing of Reply Brief quickly and effortlessly.

- Verify the state-specific criteria for the Minnesota Appellant's Notice of Motion and Motion for Late Filing of Reply Brief you wish to utilize.

- Browse the description and preview the example.

- Once you are confident the example meets your needs, simply click Buy Now.

- Select a subscription plan that aligns with your financial plan.

- Establish a personal account.

- Make a payment through one of two convenient methods: by credit card or via PayPal.

- Choose a format to download the document in; two choices are available (PDF or Word).

- Download the document to the My documents section.

- When your reusable template has been downloaded, print it or save it to your device.

Form popularity

FAQ

Minnesota is allowing additional time for making 2020 state individual income tax filings and payments to May 17, 2021, without any penalty and interest being applied. This grace period does not include individual estimated tax payments.

You can file your Minnesota Individual Income Tax return electronically or by mail.You may qualify for free electronic filing if your income is $72,000 or less.

According to Minnesota Instructions, If you are a full-year Minnesota resident, you must file a Minnesota income tax return if you need to file a federal income tax return. If you are a Part year resident or nonresident, you must file if your Minnesota gross income meets the state's minimum filing requirement.

- Minnesota taxpayers can begin filing their state income tax returns today, Monday, January 27, 2020. This is the same date the Internal Revenue Service will begin accepting federal income tax returns. Taxpayers have until Wednesday, April 15, 2020, to file and pay their state and federal income taxes.