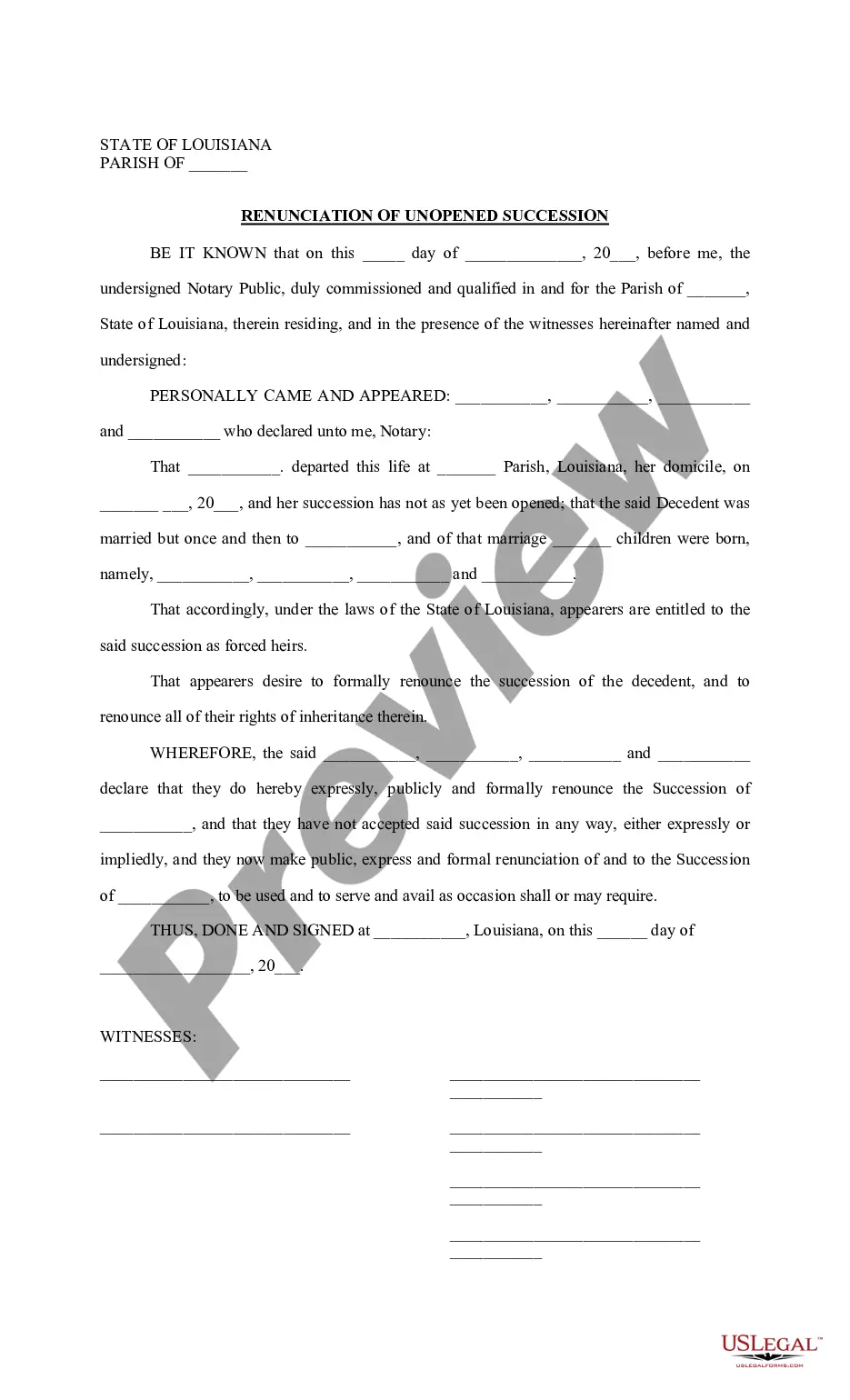

Louisiana Renunciation of Unopened Succession

Description

How to fill out Louisiana Renunciation Of Unopened Succession?

Looking for Louisiana Renunciation of Unopened Succession templates and completing them could be a challenge.

To conserve time, expenses, and effort, utilize US Legal Forms and discover the suitable template specifically for your state in just a few clicks.

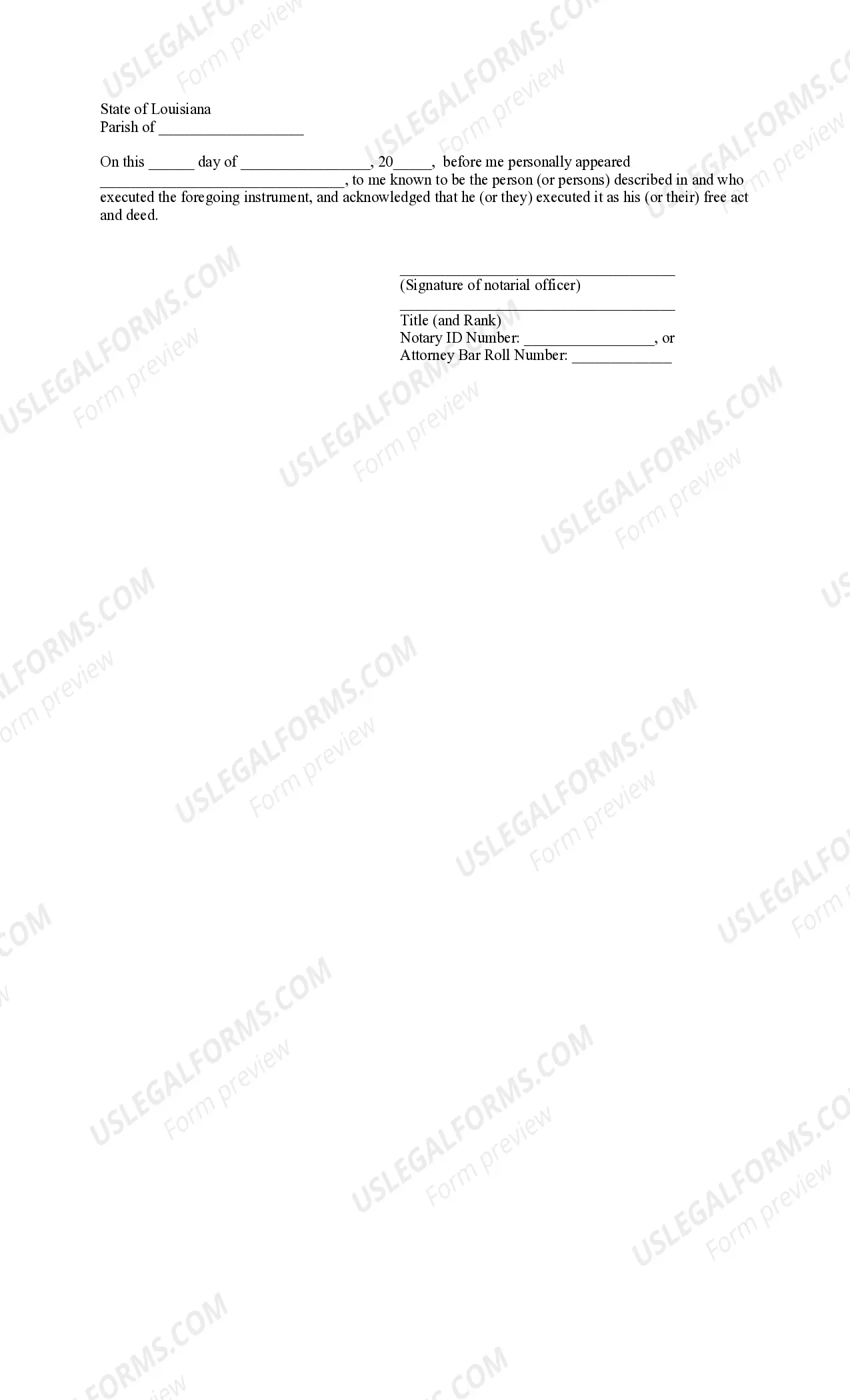

Our attorneys prepare all documents, so you only need to fill them in. It's truly that simple.

Select Buy Now if you have located what you are looking for. Choose your payment plan on the pricing page and establish your account. Decide whether to pay by credit card or via PayPal. Download the form in your preferred format. Now you can either print the Louisiana Renunciation of Unopened Succession form or fill it out using any online editor. Don't worry about typographical errors since your template can be utilized and submitted, and printed as many times as you would like. Try US Legal Forms and gain access to over 85,000 state-specific legal and tax documents.

- Log in to your account and return to the form's webpage to download the template.

- All of your downloaded samples are stored in My documents and are accessible at all times for future use.

- If you haven't subscribed yet, you must register.

- Review our comprehensive instructions on how to obtain your Louisiana Renunciation of Unopened Succession form in a few minutes.

- To retrieve a valid template, verify its authenticity for your state.

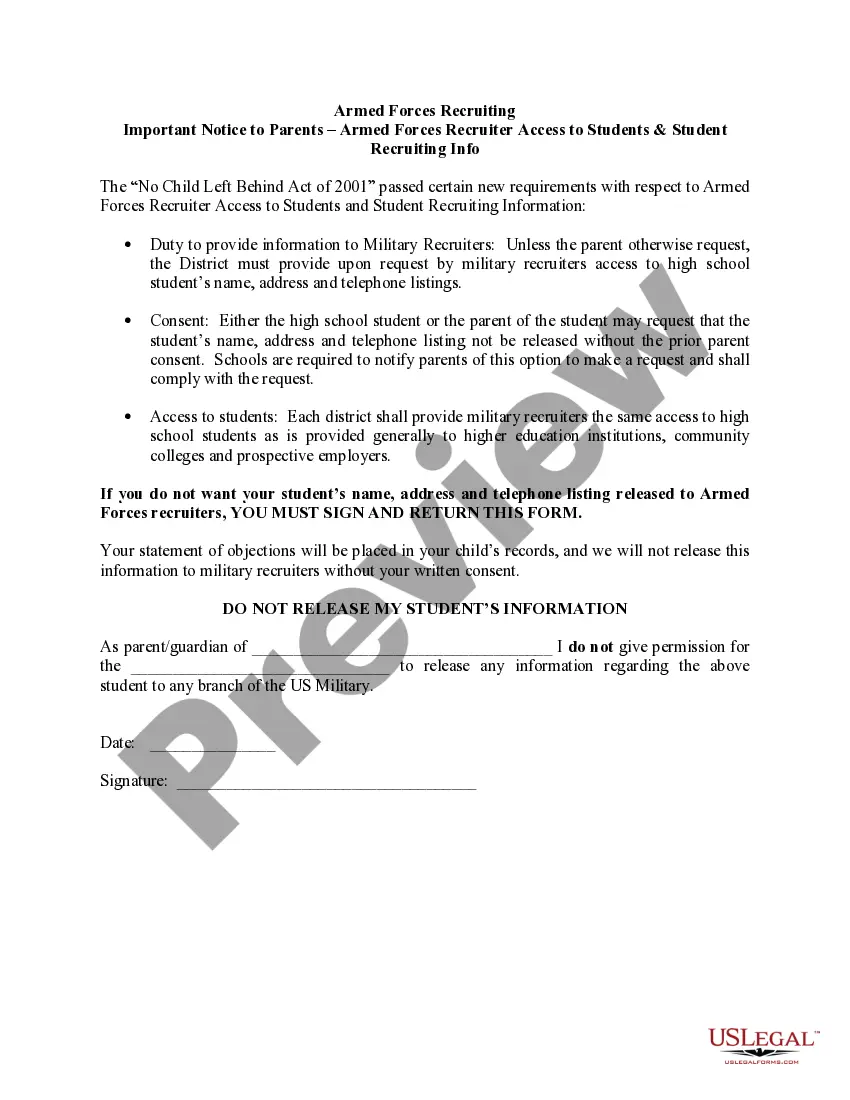

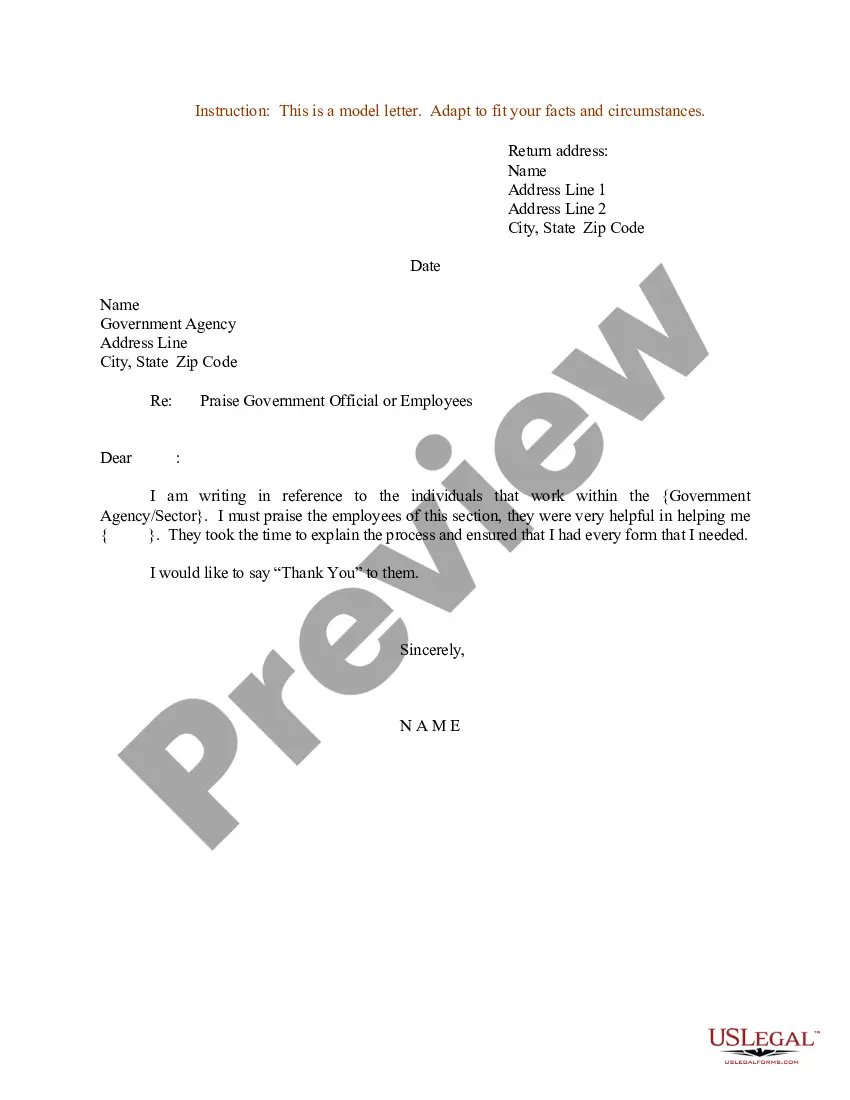

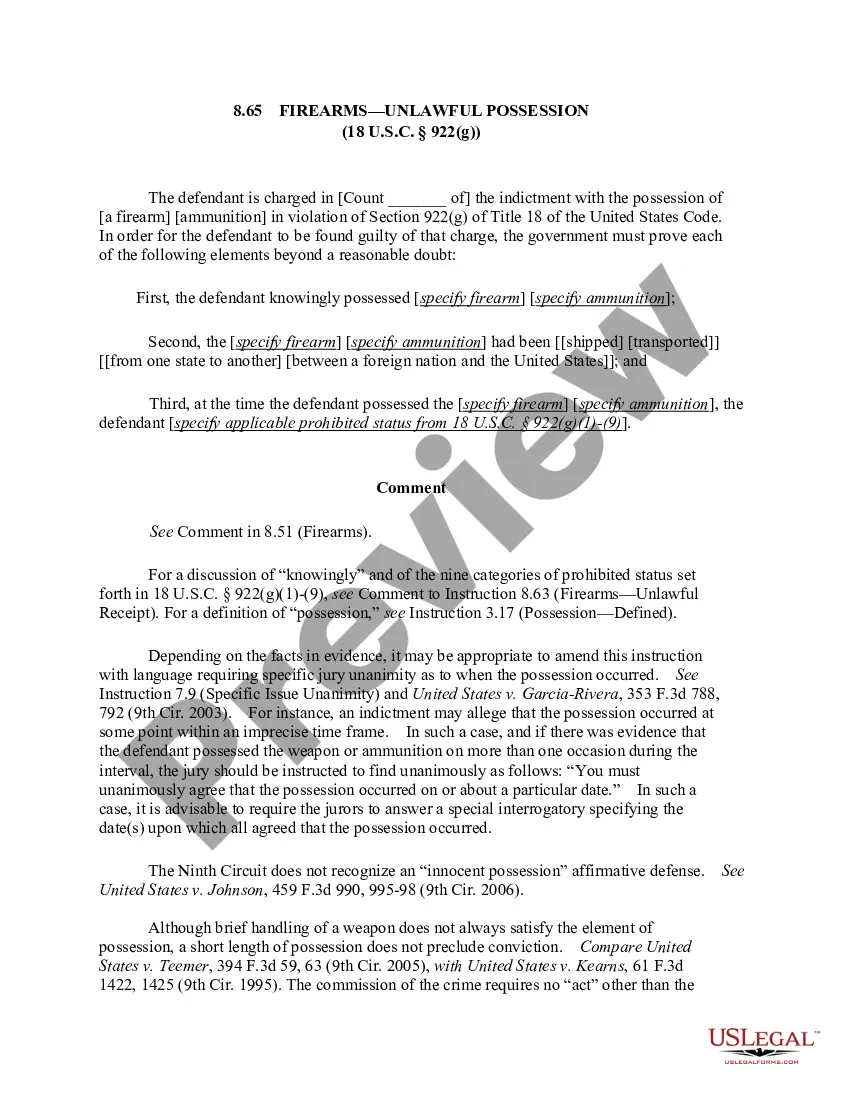

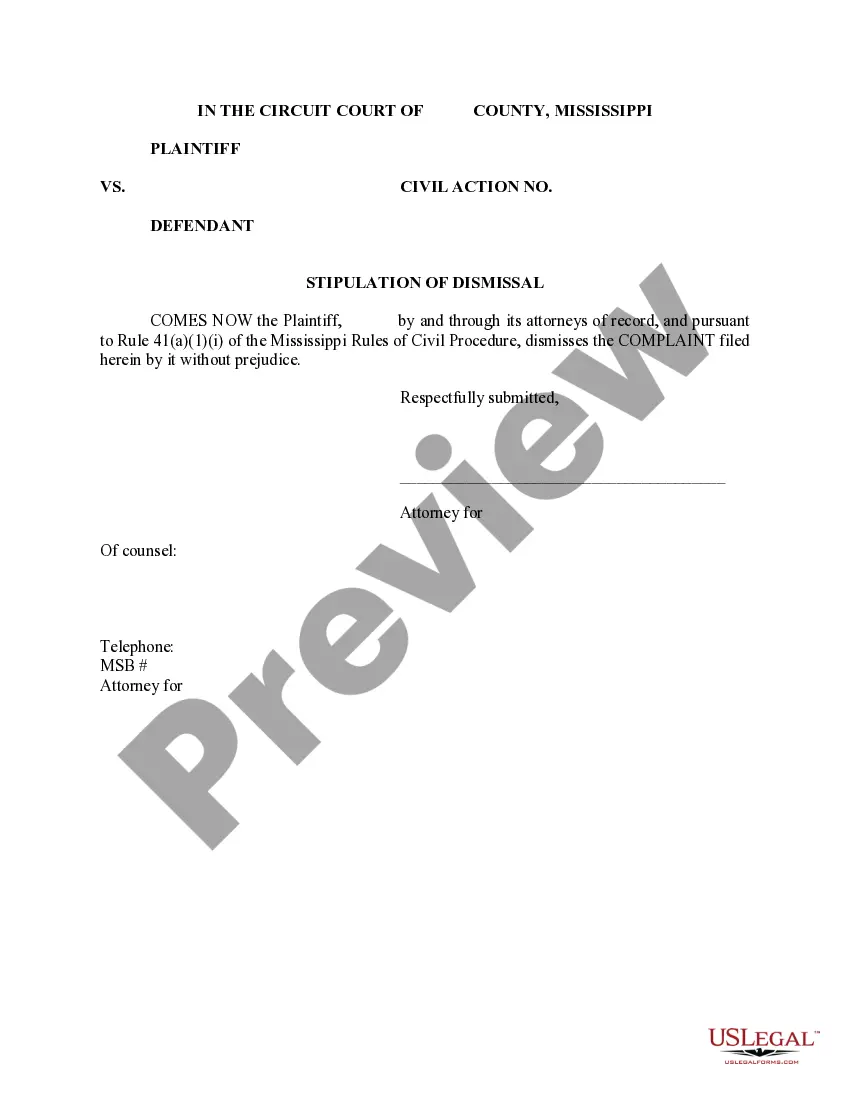

- Examine the form using the Preview function (if it’s offered).

- If there is a description, read through it to grasp the details.

Form popularity

FAQ

A beneficiary of an estate, whether by Will or the laws of intestacy is perfectly within their rights to reject their inheritance. Beneficiaries may wish to vary dispositions of property following death in order to redirect benefits to other family members who are more in need or less well provided for and to save tax.

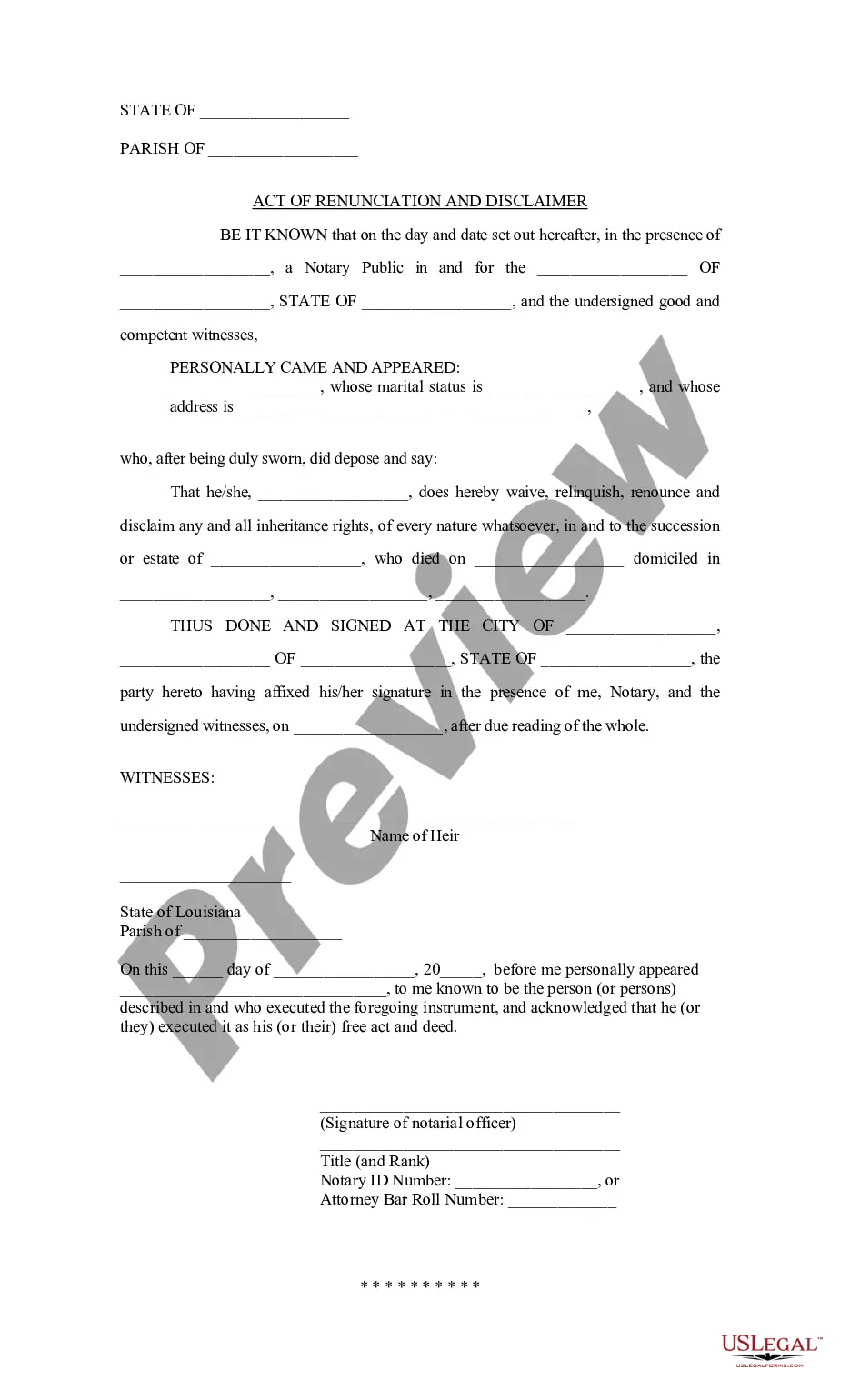

Disclaim Inheritance, Definition In a nutshell, it means you're refusing any assets that you stand to inherit under the terms of someone's will, a trust or, in the case of a person who dies intestate, the inheritance laws of your state.

If you refuse to accept an inheritance, you will not be responsible for inheritance taxes, but you'll have no say in who receives the assets in your place. The bequest passes either to the contingent beneficiary listed in the will or, if that person died without a will, according to your state's laws of intestacy.

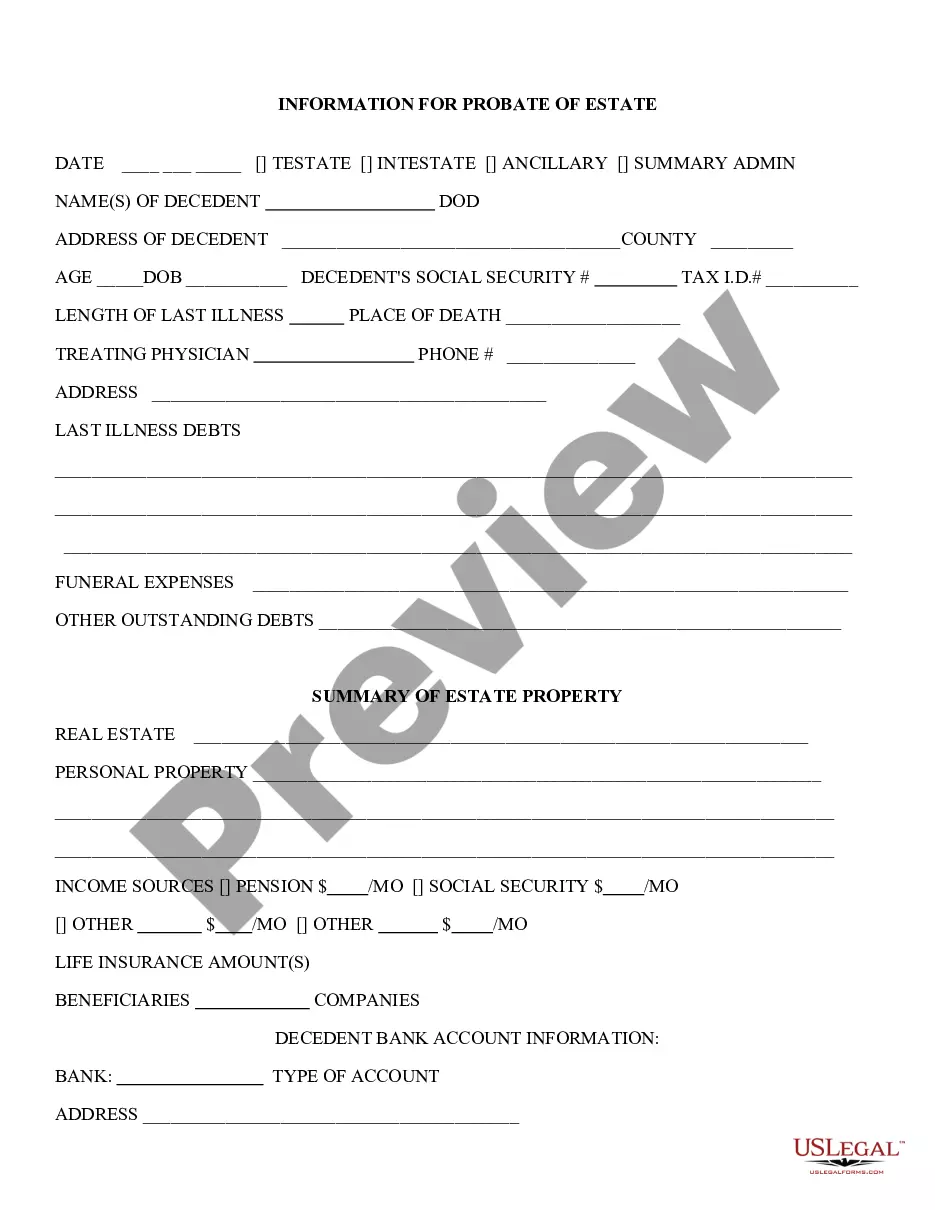

A succession (probate) is required when there is no other method to transfer a deceased person's assets to their heirs.If someone who owns real estate in Louisiana dies while domiciled in another state, a succession will have to be opened to transfer the Louisiana property to the heirs.

In the law of inheritance, wills and trusts, a disclaimer of interest (also called a renunciation) is an attempt by a person to renounce their legal right to benefit from an inheritance (either under a will or through intestacy) or through a trust.A disclaimer of interest is irrevocable.

Technically, there is no time limit on opening a succession in Louisiana. It can be done months or even years after a person's death. However, it's recommended that the probate process be started soon as possible.

When you relinquish property, you don't get any say in who inherits in your place. If you want to control who gets the inheritance, you must accept it and give it to that person. If you relinquish the property and the deceased didn't name a back-up heir, the court will apply state law to decide who inherits.

Maximum $125,000 (CCP 3421 Small Successions Defined) Laws CCP 3432. Step 1 Write in the full name of the person who died. Step 2 Write in the State and County or Parish in which the decedent resided at the time of death. Step 3 Write in the names of the two people signing the petition.