Renunciation and Disclaimer of Right to Inheritance or to Inherit Property from Deceased - Specific Property

What is this form?

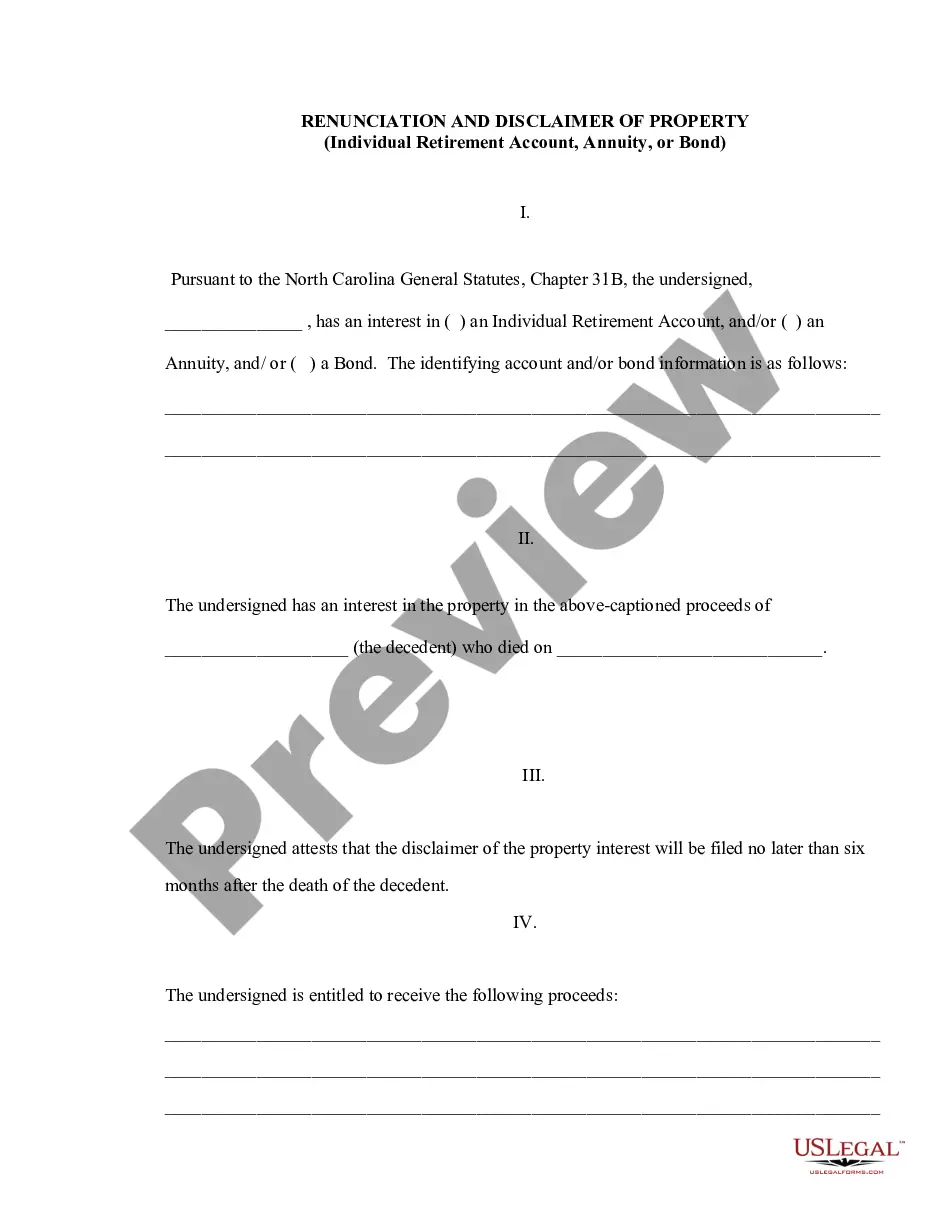

The Renunciation and Disclaimer of Right to Inheritance or to Inherit Property from Deceased - Specific Property form allows an heir to formally refuse an inheritance from a deceased individual. This form is essential for those who wish to disclaim their right to inherit specific assets, either due to personal reasons or financial implications, such as tax obligations. It differs from other inheritance forms by focusing specifically on rejecting rights to inherit particular property rather than the entire estate.

Main sections of this form

- Identification of the heir and decedent involved.

- Details regarding the decedent's will and the property intended for inheritance.

- Statement of the irrevocable disclaimer of the right to inherit specified assets.

- Legal implications of the renunciation, including how the property will be distributed to other beneficiaries.

- Notarization section for validation of the signature.

Common use cases

This form is used when an individual entitled to inherit property from a deceased person wishes to renounce that right. Common scenarios for its use include situations where the heir may be financially impacted by accepting the inheritance, such as incurring additional tax liabilities, or when the heir decides that they do not wish to take on the responsibilities associated with the property or estate.

Who can use this document

- Heirs who have received an inheritance notice from an estate.

- Individuals who wish to disclaim specific property rights due to personal circumstances.

- People concerned about tax implications of accepting an inheritance.

- Those who prefer that the inheritance transfer directly to other beneficiaries.

Steps to complete this form

- Identify the parties involved by entering the names of the heir and the deceased.

- Specify the date of the decedent's death and reference the relevant will or testament.

- Clearly outline the property or assets being disclaimed.

- Sign and date the form in the presence of a notary public.

- Submit the completed form to the personal representative of the estate for filing with the court.

Is notarization required?

Notarization is required for this form to take effect. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session, available 24/7.

Common mistakes to avoid

- Failing to clearly identify the specific property being disclaimed.

- Not referencing the correct date or version of the decedent's will.

- Omitting the signature or date in the notary section.

- Submitting the form without consulting with a legal professional for jurisdiction-specific requirements.

Benefits of completing this form online

- Convenient access to legal forms that can be downloaded and filled out at home.

- Editability of the form allows users to customize the information according to their specific situation.

- Reliable templates drafted by licensed attorneys ensure legal compliance.

State-specific requirements

This form is a general template that may be used in several states. Because requirements differ, review your state’s laws and adjust the document before using it.

Legal use & context

- The renunciation allows the property to pass to other heirs as if the disclaiming heir had predeceased the decedent.

- This disclaimer is irrevocable once executed, which means that the heir cannot later change their mind.

- Proper execution and submission of the form can help avoid conflicts among beneficiaries.

Key takeaways

- The form allows heirs to formally renounce the right to inherit specific property.

- Proper completion and notarization are crucial for its legal validity.

- Understanding the implications of renouncing inheritance can help heirs make informed decisions.

Form popularity

FAQ

Definitions of letter of renunciation a form sent with new shares that can be completed and returned as written notification that the person who has been allotted shares resulting from a rights issue refuses to accept them. The shares can then be sold or transferred to someone else.

An individual can step down without stating a reason prior to formal appointment by the court. This is known as renunciation and is a legal document providing the person named in the will is not going to act as executor.

Put the disclaimer in writing. Deliver the disclaimer to the person in control of the estate usually the executor or trustee. Complete the disclaimer within nine months of the death of the person leaving the property. Do not accept any benefit from the property you're disclaiming.

In the law of inheritance, wills and trusts, a disclaimer of interest (also called a renunciation) is an attempt by a person to renounce their legal right to benefit from an inheritance (either under a will or through intestacy) or through a trust.A disclaimer of interest is irrevocable.