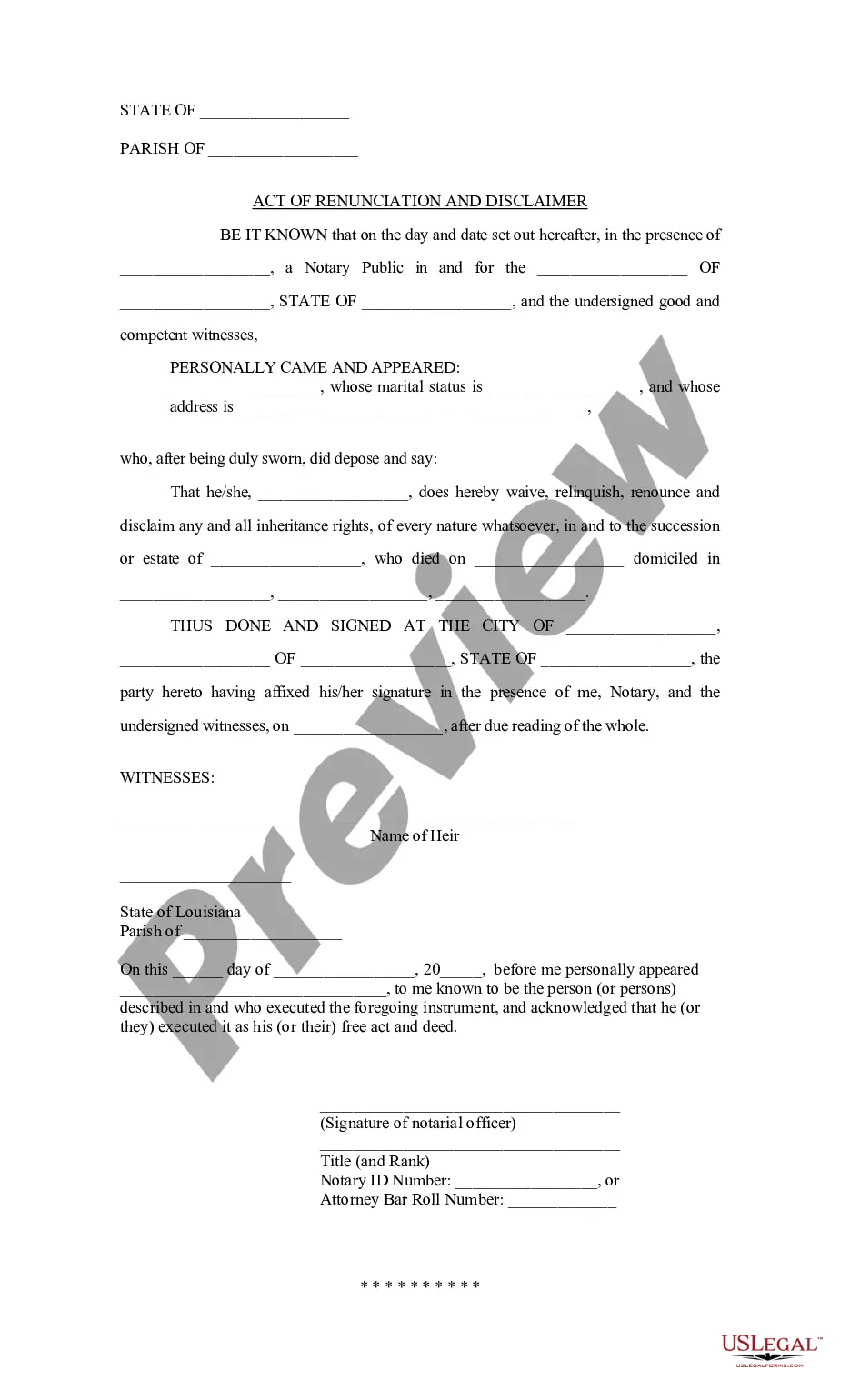

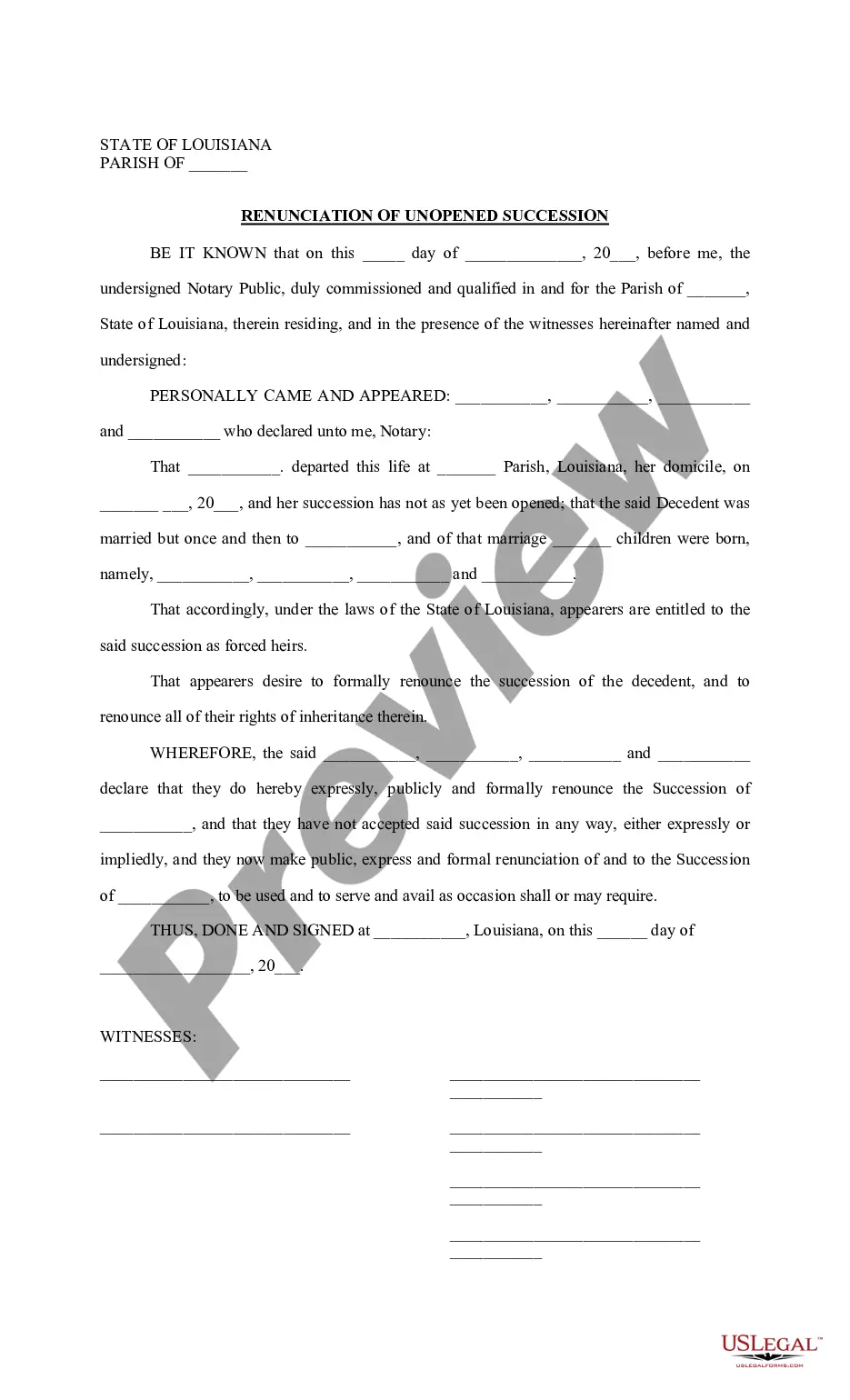

Louisiana Act of Renunciation and Disclaimer

Overview of this form

The Act of Renunciation and Disclaimer allows an heir or legatee to formally waive all rights to an inheritance from a decedent's estate. This document is crucial for individuals who choose not to accept their inheritance, either to avoid potential tax implications or to allow the estate to be distributed according to different wishes. Unlike a will or trust, this form specifically focuses on the renunciation of inheritance rights and is particularly relevant in Louisiana law, where specific rules regarding such disclaimers apply.

What’s included in this form

- Identification of the heir or legatee renouncing their inheritance.

- Detailed information about the decedent, including name, date of death, and residence.

- A statement of waiver, specifying that the heir relinquishes all rights to the estate.

- Signatures of the parties involved, including witnesses and a notary public.

- Clear indication of the location and date of signing.

Common use cases

This form is essential when an heir decides they do not wish to accept their share of an estate. Reasons may include personal financial circumstances, avoidance of estate taxes, or a desire to let other beneficiaries inherit the assets. It is particularly important in situations where the estate has liabilities that may exceed its assets, making acceptance of the inheritance undesirable.

Intended users of this form

This form is intended for individuals who meet the following Criteria:

- Individuals identified as heirs or legatees in a decedent's estate.

- Anyone wishing to legally disclaim their rights to an inheritance.

- Residents of Louisiana or those dealing with estates governed by Louisiana law.

Instructions for completing this form

- Identify the notary public who will oversee the signing process.

- Enter the names and addresses of the heir and the decedent.

- Clearly state the heir's intention to waive and relinquish inheritance rights.

- Obtain the necessary witness signatures during the signing ceremony.

- Ensure to complete the form in the presence of the notary, who will validate the document.

Notarization guidance

This document requires notarization to meet legal standards. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available 24/7.

Typical mistakes to avoid

- Failing to include the full name of the decedent or heir.

- Not having the form signed in front of a notary public.

- Leaving out witness signatures, which may invalidate the form.

- Neglecting to check state-specific legal requirements before use.

Why use this form online

- Convenience of immediate access and downloading at any time.

- Editability allows users to customize the document to their specific needs.

- Reliability of templates drafted by licensed attorneys ensures compliance.

- Easy navigation through the form to avoid omissions or errors.

Legal requirements by state

This form is designed specifically to adhere to Louisiana's laws regarding renunciation, as outlined in La. R.C.C. 947 and the Internal Revenue Code Section 2518. It is crucial to ensure compliance with these regulations before completing the form.

Form popularity

FAQ

If an Executor doesn't want to act during Probate, then they can 'renounce' from their role. This means that they are giving up the role of Executor and its responsibilities, and this is done using a document called a Deed of Renunciation.

A succession (probate) is required when there is no other method to transfer a deceased person's assets to their heirs.If someone who owns real estate in Louisiana dies while domiciled in another state, a succession will have to be opened to transfer the Louisiana property to the heirs.

In the law of inheritance, wills and trusts, a disclaimer of interest (also called a renunciation) is an attempt by a person to renounce their legal right to benefit from an inheritance (either under a will or through intestacy) or through a trust.A disclaimer of interest is irrevocable.

A letter of renunciation is a form in the style of a letter signed by the holder named on an allotment letter who wishes to renounce his/her right to the shares specified in the allotment.

Disclaim Inheritance, Definition In a nutshell, it means you're refusing any assets that you stand to inherit under the terms of someone's will, a trust or, in the case of a person who dies intestate, the inheritance laws of your state.

A beneficiary of an estate, whether by Will or the laws of intestacy is perfectly within their rights to reject their inheritance. Beneficiaries may wish to vary dispositions of property following death in order to redirect benefits to other family members who are more in need or less well provided for and to save tax.

If you refuse to accept an inheritance, you will not be responsible for inheritance taxes, but you'll have no say in who receives the assets in your place. The bequest passes either to the contingent beneficiary listed in the will or, if that person died without a will, according to your state's laws of intestacy.

DiSalvo. My condolences on your situation. A qualified renunciation (meaning one which qualifies as a true disclaimer for federal gift and estate tax purposes) is irrevocable, so not, you should not be able to revoke your disclaimer.

When you relinquish property, you don't get any say in who inherits in your place. If you want to control who gets the inheritance, you must accept it and give it to that person. If you relinquish the property and the deceased didn't name a back-up heir, the court will apply state law to decide who inherits.