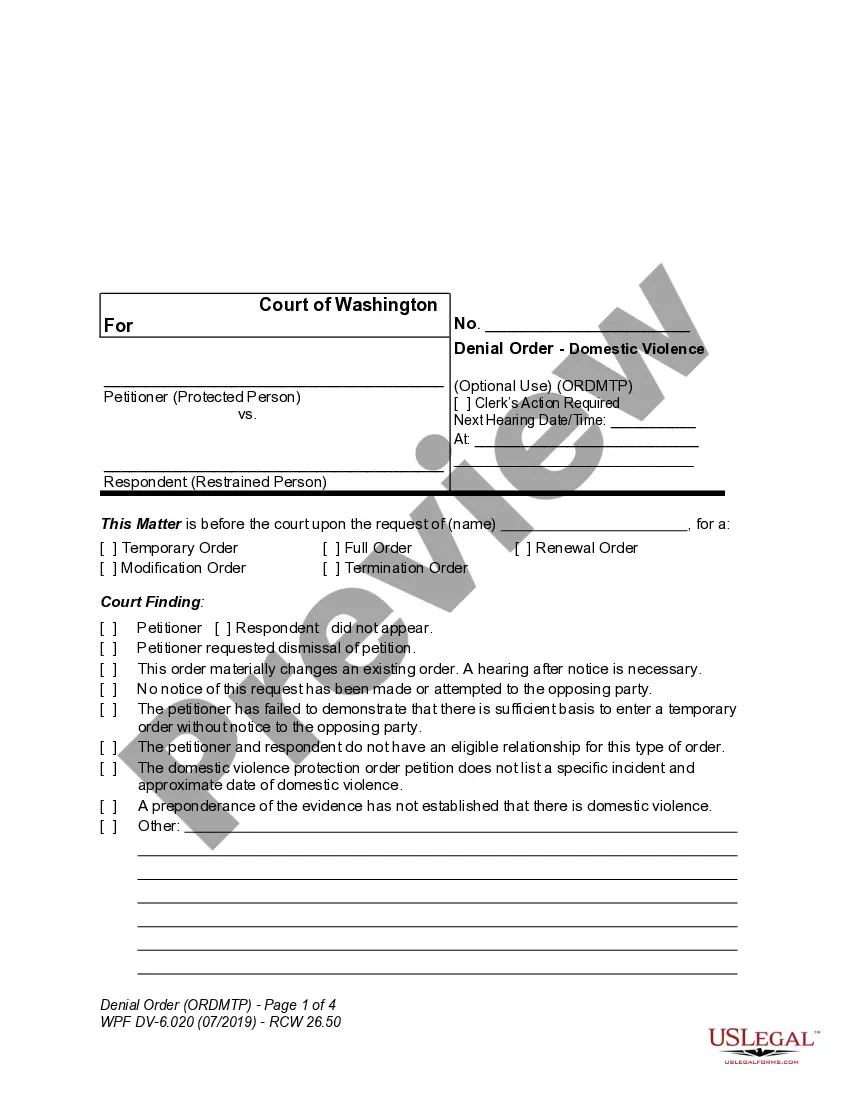

This office lease form states that a guaranty in which a corporate guarantor has the authority of the signatory to bind a corporation. This guaranty gives the guarantor full power, authority and legal right to execute and deliver this guaranty and that this guaranty constitutes the valid and binding obligation of the guarantor.

Kentucky Authority of Signatory to Bind the Guarantor

Description

How to fill out Authority Of Signatory To Bind The Guarantor?

US Legal Forms - one of several largest libraries of lawful varieties in America - provides a wide array of lawful papers themes you can down load or print out. Making use of the internet site, you can find a large number of varieties for business and person uses, sorted by groups, suggests, or keywords.You can get the newest versions of varieties much like the Kentucky Authority of Signatory to Bind the Guarantor within minutes.

If you already possess a monthly subscription, log in and down load Kentucky Authority of Signatory to Bind the Guarantor in the US Legal Forms library. The Obtain key will appear on every single kind you look at. You have access to all in the past downloaded varieties in the My Forms tab of your bank account.

If you would like use US Legal Forms initially, listed below are easy recommendations to obtain began:

- Ensure you have picked out the right kind for your personal metropolis/area. Select the Review key to analyze the form`s content. Read the kind explanation to ensure that you have chosen the appropriate kind.

- In the event the kind does not match your requirements, utilize the Search industry towards the top of the display screen to discover the one that does.

- In case you are happy with the form, verify your decision by clicking on the Buy now key. Then, opt for the prices plan you like and give your accreditations to register to have an bank account.

- Procedure the financial transaction. Make use of your charge card or PayPal bank account to perform the financial transaction.

- Select the format and down load the form in your product.

- Make adjustments. Fill out, modify and print out and signal the downloaded Kentucky Authority of Signatory to Bind the Guarantor.

Every single template you put into your money lacks an expiration time and it is your own property for a long time. So, if you would like down load or print out another version, just check out the My Forms segment and click on around the kind you want.

Get access to the Kentucky Authority of Signatory to Bind the Guarantor with US Legal Forms, probably the most considerable library of lawful papers themes. Use a large number of specialist and condition-specific themes that meet your business or person demands and requirements.

Form popularity

FAQ

Guarantees are a contractual arrangement where one party (the guarantor) agrees to answer for the liability of another party (the principal) to another party (the guaranteed party). Guarantors have various rights usually conferred in equity against the principal, the guaranteed party and any co-guarantors.

The guarantee clause provides that if the buyer defaults the guarantor will perform those obligations (and this will include the obligation to pay the purchase price to the seller). The guarantor also indemnifies the seller against any losses or liability incurred because of the buyer's default.

A guarantor is a party that guarantees another party's debt. A guarantor is sometimes called a surety. These contracts involve a promise to pay for the debt of another if that person doesn't pay the debt. A statute of frauds is a state law that covers certain types of oral contracts.

The Guarantor hereby waives the benefits of diligence, presentment, demand for payment, any requirement that the Trustee or the Holder of such Security exhaust any right or take any action against the Company or any other Person, the filing of claims with a court in the event of insolvency or bankruptcy of the Company, ...

Criteria For Releasing the Guarantee Remember, removing the guarantor means that their property no longer serves as collateral, so the lender wants to have some other form of security for the loan. Guarantors security can still be removed at above 80% LVR but LMI will be applicable in most cases.

Being a guarantor involves helping someone else get credit, such as a loan or mortgage. Acting as a guarantor, you ?guarantee? someone else's loan or mortgage by promising to repay the debt if they can't afford to. It's wise to only agree to being a guarantor for someone you know well.

The guarantor unconditionally guarantees the payment obligations of the obligor (the borrower or debtor) for the benefit of the beneficiary (the lender or creditor). This Standard Clause has integrated notes with important explanations and drafting and negotiating tips.