Minnesota Agreement Replacing Joint Interest with Annuity

Description

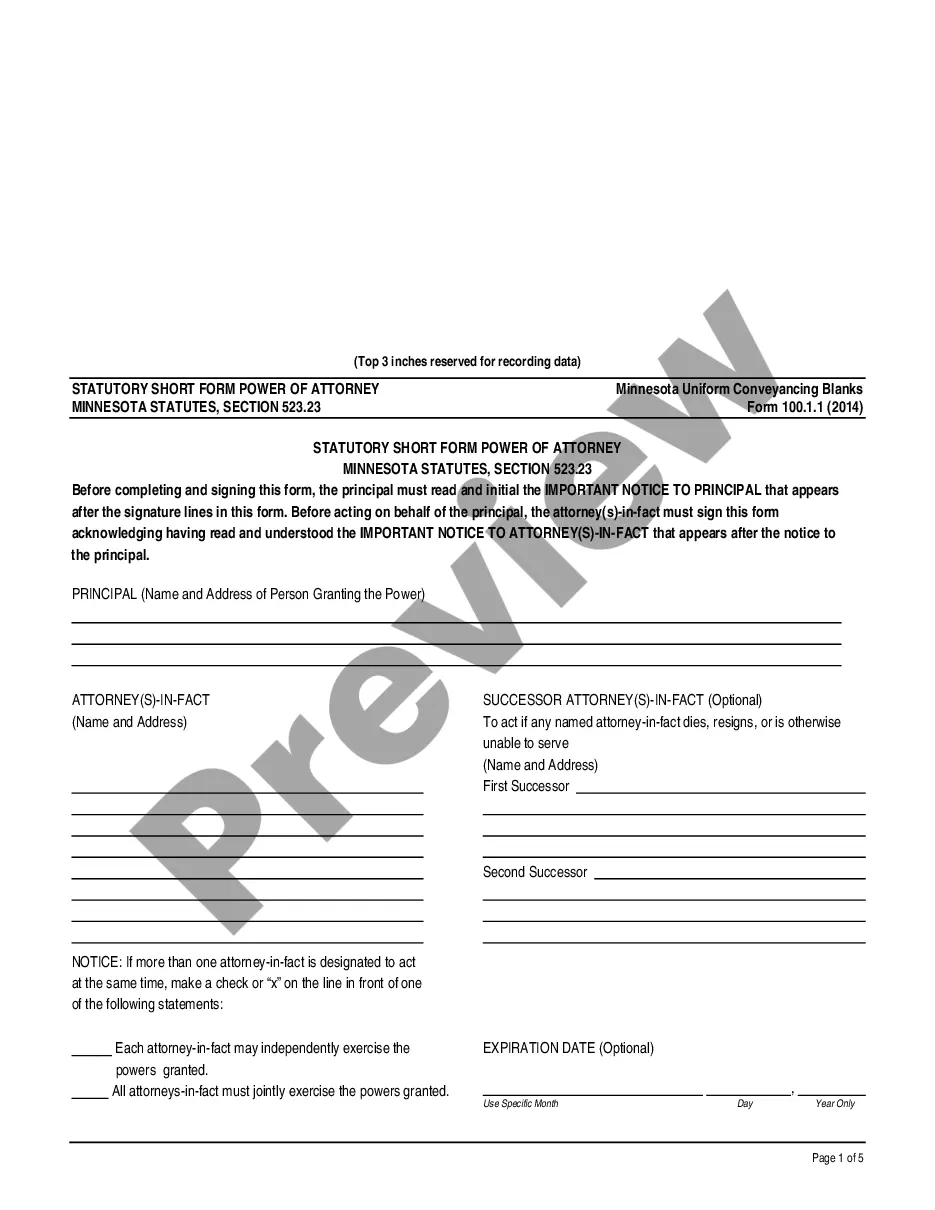

How to fill out Agreement Replacing Joint Interest With Annuity?

It is feasible to invest multiple hours online trying to locate the legal document format that meets the federal and state requirements you desire.

US Legal Forms provides a vast array of legal documents that have been assessed by experts.

You can indeed obtain or print the Minnesota Agreement Replacing Joint Interest with Annuity from my services.

If available, use the Review button to examine the document format as well.

- If you already possess a US Legal Forms account, you may Log In and click the Obtain button.

- After that, you may complete, modify, print, or sign the Minnesota Agreement Replacing Joint Interest with Annuity.

- Every legal document format you acquire belongs to you indefinitely.

- To retrieve another copy of the purchased form, navigate to the My documents section and click the relevant button.

- If you are accessing the US Legal Forms site for the first time, follow the straightforward instructions below.

- First, ensure you have selected the correct document format for the state/city of your choice.

- Review the form details to confirm that you have chosen the correct form.

Form popularity

FAQ

"To assure full disclosure to the public of all material and relevant information". One purpose of the Rules Governing Advertisement of Life Insurance and Annuities is to assure full disclosure to the public of all material and relevant information.

DEFINITION. REPLACEMENT is any transaction where, in connection with the purchase of New Insurance or a New Annuity, you LAPSE, SURRENDER, CONVERT to Paid-up Insurance, Place on Extended Term, or BORROW all or part of the policy loan values on an existing insurance policy or an annuity.

For scheduled premium policies, life insurance companies have to have a grace period of at least 31 days. Flexible premium policies have grace periods of at least 61 days.

The purpose of this regulation is to set forth minimum standards and guidelines to assure a full and truthful disclosure to the public of all material and relevant information in the advertising of life insurance policies and annuity contracts.

Replacement. - means any transaction in which new life insurance or a new annuity is purchased and, as a result, the existing life insurance or annuity has been or will be any of the following. - lapsed, forfeited, surrender, or otherwise terminated.

This fact sheet provides you with important information about Minnesota's law governing life insurance policies. What is the suicide clause? Most life insurance policies have what is called a suicide clause. This is a time period when death benefits under a life insurance policy will not be paid out due to a suicide.

The purpose of this regulation is: (1) To regulate the activities of insurers and producers with respect to the replacement of existing life insurance and annuities. (b) Reduce the opportunity for misrepresentation and incomplete disclosure.

A replacement occurs when a new policy or contract is purchased and, in connection with the sale, you discontinue making premium payments on the existing policy or contract, or an existing policy or contract is surrendered, forfeited, assigned to the replacing insurer, or otherwise terminated or used in a financed

Under Minnesota law, you have a ten day free look period to inspect life insurance policies. If you return a life insurance policy within the free look period, the insurance company must cancel the policy and refund all the premiums paid.

The replacing insurance company must require from the producer a list of the applicant's life insurance or annuity contracts to be replaced and a copy of the replacement notice provided to the applicant, and send each existing insurance company a written communication advising of the proposed replacement.