Nebraska Agreement Replacing Joint Interest with Annuity

Description

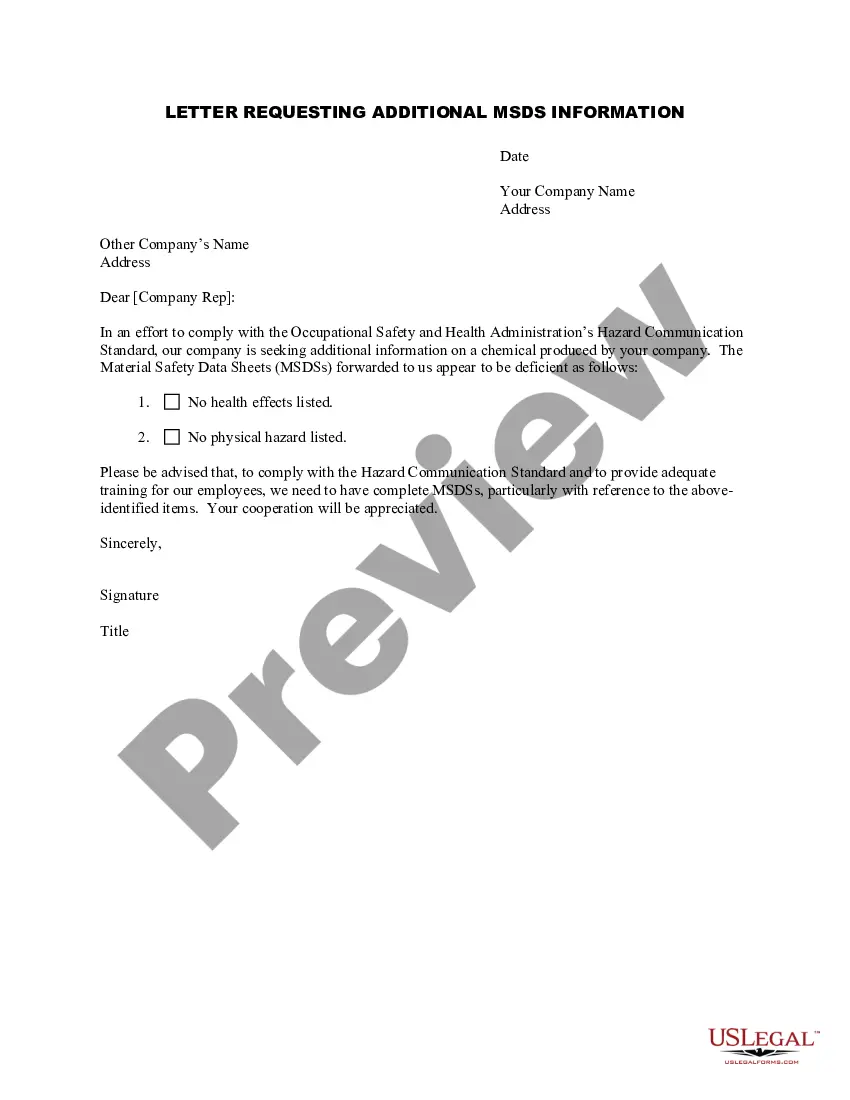

How to fill out Agreement Replacing Joint Interest With Annuity?

US Legal Forms - one of the largest repositories of authorized documents in the USA - provides a vast selection of sanctioned document templates that you can download or print.

By utilizing the website, you will discover numerous forms for both business and personal uses, categorized by divisions, claims, or keywords. You can find the latest versions of documents like the Nebraska Agreement Replacing Joint Interest with Annuity in just moments.

If you already have a subscription, Log In and download the Nebraska Agreement Replacing Joint Interest with Annuity from the US Legal Forms library. The Obtain button will be visible on every form you view. You can access all previously downloaded documents from the My documents section of your account.

Complete the transaction. Use your credit card or PayPal account to finalize the payment.

Select the format and download the form to your device. Make edits. Fill out, modify, print, and sign the downloaded Nebraska Agreement Replacing Joint Interest with Annuity. Every template you save to your account has no expiration date and is yours indefinitely. Therefore, if you need to download or print another copy, simply go to the My documents section and click on the form you require. Access the Nebraska Agreement Replacing Joint Interest with Annuity with US Legal Forms, the most comprehensive collection of authorized document templates. Utilize a multitude of professional and state-specific templates that cater to your business or individual needs and requirements.

- To start using US Legal Forms for the first time, here are simple instructions.

- Ensure you have selected the correct form for your city/county.

- Click the Review button to examine the form's contents.

- Check the document information to ensure you have selected the appropriate form.

- If the form does not meet your requirements, utilize the Search box at the top of the screen to find one that fits.

- If you are satisfied with the form, confirm your choice by clicking on the Acquire now button.

- Next, choose the pricing plan you prefer and provide your details to create an account.

Form popularity

FAQ

Changing the OwnerThe owner of a nonqualified annuity can sell the policy to a new owner and treat the sale proceeds as ordinary income. The current owner can give the annuity to a new owner and pay taxes on the excess of the surrender value above the cost basis.

A joint life annuity allows you and your spouse to receive monthly income payments for as long as you both live. Once you pass away, your surviving spouse will receive payments for the rest of their life, but it will only amount to a smaller amount of your original payment.

The new owner of the annuity can start receiving payments, change beneficiaries, and cash out the policy whenever they want. To give the annuity away, you simply contact the insurance company and state that you want to gift the ownership of the annuity policy to someone else or a trust.

Joint & Survivor AnnuitiesA common type of annuity with joint annuitants is a joint and survivor annuity. This is often purchased by married couples and can provide income for two people, with payment based on the lives of the owner and spouse, who is the joint annuitant.

An annuity owner may also share ownership of the annuity with another person. Jointly owned annuities are similar to annuities owned by a single person in that the death benefit is triggered by the death of one of the owners.

Annuitants & Annuity Owners Usually, they purchase the annuities for themselves and are, therefore, also the annuitants. But some annuity contracts allow the owner to name two annuitants, and they're referred to as joint annuitants. Married couples often choose this option.

The owner is the person who buys an annuity. An annuitant is an individual whose life expectancy is used as for determining the amount and timing when benefits payments will start and cease. In most cases, though not all, the owner and annuitant will be the same person.

Joint life annuities A Joint Life annuity will pay you an income for the rest of your life. It will then go on to pay an income to your spouse, civil partner, or chosen beneficiary for the rest of their life after you die.

When an annuity contract transfers from one individual to another, the transferred amount is treated as a distribution. The original owner is taxed on any tax-deferred gain and possibly subject to a 10% penalty.

A joint and survivor annuity can be purchased with registered or non-registered funds. Using non-registered funds means only the interest portion of the annuity payment will be taxed and the interest income may qualify for the Pension Income Tax Credit.