Kansas Assignment of Interest in Trust

Description

How to fill out Assignment Of Interest In Trust?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a selection of legal form templates that you can download or print.

By using the website, you can find thousands of forms for professional and personal purposes, categorized by type, state, or keywords. You can access the latest forms such as the Kansas Assignment of Interest in Trust within moments.

If you already possess a subscription, Log In and download the Kansas Assignment of Interest in Trust from the US Legal Forms library. The Download button will be visible on each form you view. You can access all previously downloaded forms in the My documents section of your account.

Complete the transaction. Use your Visa or Mastercard or PayPal account to finalize the transaction.

Select the format and download the form to your device. Make modifications. Fill out, edit, print, and sign the downloaded Kansas Assignment of Interest in Trust. Each document added to your account does not have an expiration date and is yours indefinitely. So, if you wish to download or print another version, just visit the My documents section and click on the form you need. Access the Kansas Assignment of Interest in Trust with US Legal Forms, the largest collection of legal document templates. Utilize thousands of professional and state-specific templates that fulfill your business or personal needs and requirements.

- If you're new to US Legal Forms, here are simple steps to get you started.

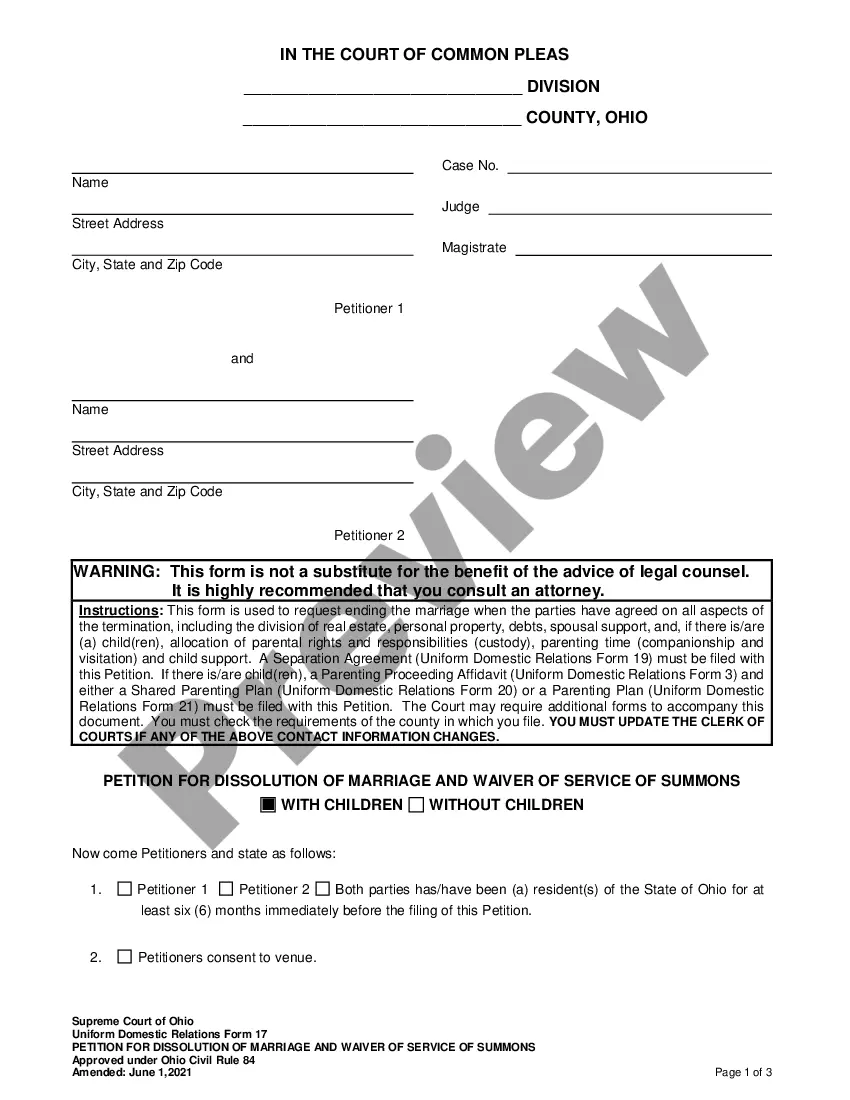

- Confirm that you have selected the correct form for your city/state.

- Click the Review button to examine the form’s content.

- Check the form details to ensure that you have chosen the correct one.

- If the form does not suit your needs, use the Search field at the top of the screen to find the appropriate one.

- Once you're satisfied with the form, confirm your selection by clicking on the Get now button.

- Next, select your preferred payment plan and provide your information to register for an account.

Form popularity

FAQ

In a trust, the ownership interest typically lies with the trustee, who is responsible for managing the assets on behalf of the beneficiaries. The Kansas Assignment of Interest in Trust can further clarify how these interests are distributed among the beneficiaries. The trustee must act in the best interest of the beneficiaries, ensuring that assets are handled according to the trust's terms. Understanding this structure helps you navigate trust agreements effectively.

Assignments, however, almost never apply to a beneficiary's interests in a trust. Usually, a trust prohibits beneficiaries from assigning their interest in the trust before distribution. The anti-assignment provision protects undistributed trust assets from claims by a beneficiary's creditors.

To transfer real property into your Trust, a new deed reflecting the name of the Trust must be executed, notarized and recorded with the County Recorder in the County where the property is located. Care must be taken that the exact legal description in the existing deed appears on the new deed.

A beneficiary can also transfer his interest in the trust property and every person to whom a beneficiary transfers his interest acquires the rights and liabilities of the beneficiary at the date of the transfer.

An equitable interest is an interest held by virtue of an equitable title (a title that indicates a beneficial interest in property and that gives the holder the right to acquire formal legal title) or claimed on equitable grounds, such as the interest held by a trust beneficiary.2 The equitable interest is a right

UDT stands for under declaration of trust," and this indicates that the grantor and the trustee are the same individual. The grantor maintains control over the assets they've placed into the trust, and they can only do that if the trust is revocable.

When your mortgage lender decides he wants to sell your mortgage loan to another lender, your mortgage lender will sign an assignment of deed of trust in favor of the new lender. This assignment gives the new lender the same lien on your property that your original lender had under the mortgage loan.

Most mortgage lenders in California secure the mortgage loan with a deed of trust. An assignment of deed of trust allows that lender to sell the loan to a different lender.

Trust Interest means the interest of a beneficiary in an irrevocable express trust (other than an employee benefit plan) created either by written trust instrument or by statute, but does not include any interest retained by the settlor.

An assignment of trust deed is a document that lenders use when they sell loans secured by trust deeds. While they can freely sell the promissory notes between themselves, the trust deeds that give them the right to foreclose have to be assigned with a legal document.