Mississippi Agreement Replacing Joint Interest with Annuity

Description

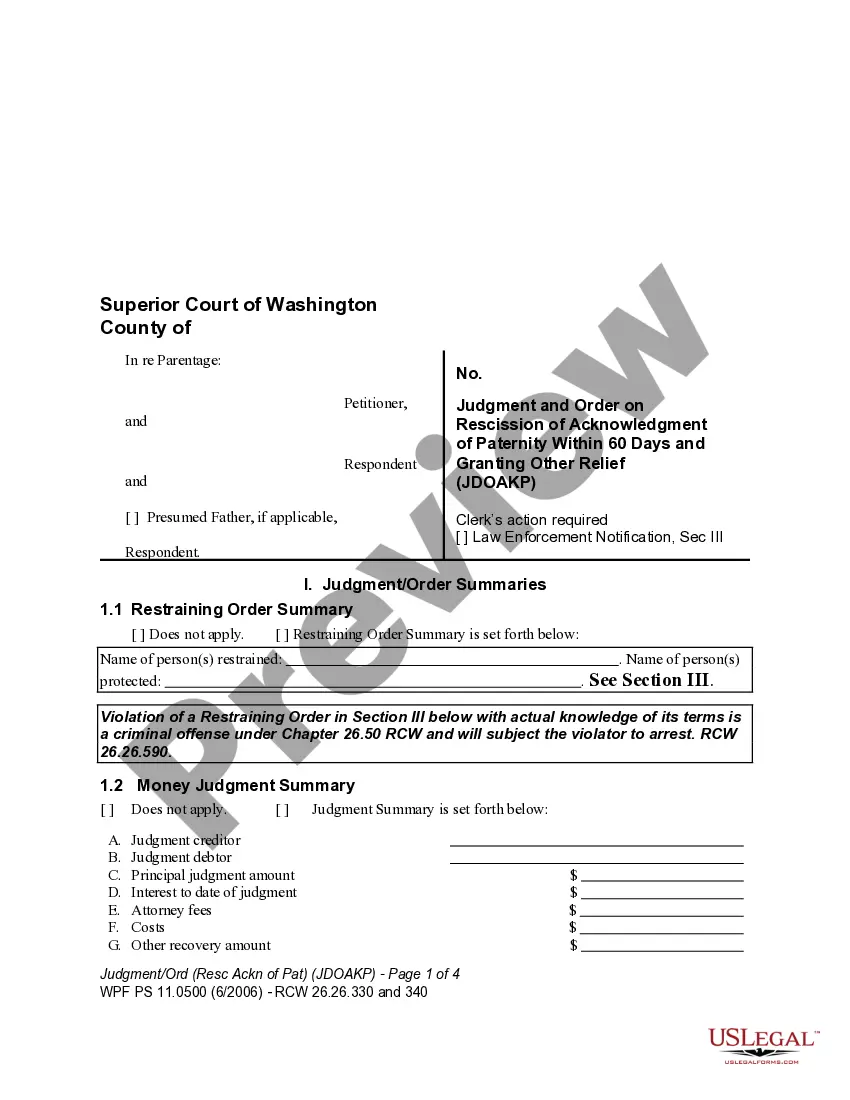

How to fill out Agreement Replacing Joint Interest With Annuity?

If you wish to finalize, obtain, or generate legal document templates, utilize US Legal Forms, the primary collection of legal documents available online.

Benefit from the site's user-friendly search feature to locate the forms you need.

A selection of templates for commercial and personal purposes are categorized by types and states, or keywords.

Step 4. Once you have identified the form you need, click the Purchase now button. Choose the pricing plan you prefer and provide your details to create an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to process the payment.

- Utilize US Legal Forms to find the Mississippi Agreement Substituting Joint Interest with Annuity in just a few clicks.

- If you are already a US Legal Forms user, sign in to your account and click the Download button to access the Mississippi Agreement Substituting Joint Interest with Annuity.

- You can also access forms you previously downloaded from the My documents section of your account.

- If you are utilizing US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the correct form for your city/state.

- Step 2. Use the Preview option to review the contents of the form. Be sure to read the explanation carefully.

- Step 3. If you are dissatisfied with the form, use the Search bar at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

(The SECURE Act does not impact non-qualified annuities.) The SECURE Act increases the age at which an individual is generally required to begin taking RMDs from their employer-sponsored retirement plan and/or traditional IRA, from age 70½ to 72. This change applies to individuals born after June 30, 1949.

After an annuitant dies, insurance companies distribute any remaining payments to beneficiaries in a lump sum or stream of payments. It's important to include a beneficiary in the annuity contract terms so that the accumulated assets are not surrendered to a financial institution if the owner dies.

Annuities Can Be Complex.Your Upside May Be Limited.You Could Pay More in Taxes.Expenses Can Add Up.Guarantees Have a Caveat.Inflation Can Erode Your Annuity's Value.The Bottom Line.

An annuity is a way to supplement your income in retirement. For some people, an annuity is a good option because it can provide regular payments, tax benefits and a potential death benefit. However, there are potential cons for you to keep in mind. The biggest of these is simply the cost of an annuity.

Annuities Held Within 401(k) PlansOne unique feature of the Secure Act is a provision that allows employers to more widely offer annuity options within 401(k) plans. An annuity is a financial product that guarantees retirees a steady stream of income, similar to a pension or Social Security.

You can not lose money in Fixed Annuities. Fixed annuities do not participate in any index or market performance but offer a fixed interest rate similar to a CD.

An annuity is not a security; however, the money in an annuity account will most definitely be invested in some of the underlying financial securities mentioned above.

The main drawbacks are the long-term contract, loss of control over your investment, low or no interest earned, and high fees. There are also fewer liquidity options with annuities, and you have to wait until age 59.5 to withdraw any money from the annuity without penalty.

The second primary impact of the SECURE Act involves changes to IRA distributions, including the elimination of stretch IRA options for future non-spouse beneficiaries this applies to annuities included in retirement plans. Unless an annuity made payments before the enactment date of the SECURE Act (Jan.

An annuity is a contract between you and an insurance company that requires the insurer to make payments to you, either immediately or in the future. You buy an annuity by making either a single payment or a series of payments.