Connecticut Assignment of Interest in Trust

Description

How to fill out Assignment Of Interest In Trust?

You can spend hours online attempting to locate the legal document template that meets the federal and state regulations you will require.

US Legal Forms offers thousands of legal templates that are evaluated by professionals.

You can easily obtain or print the Connecticut Assignment of Interest in Trust from their service.

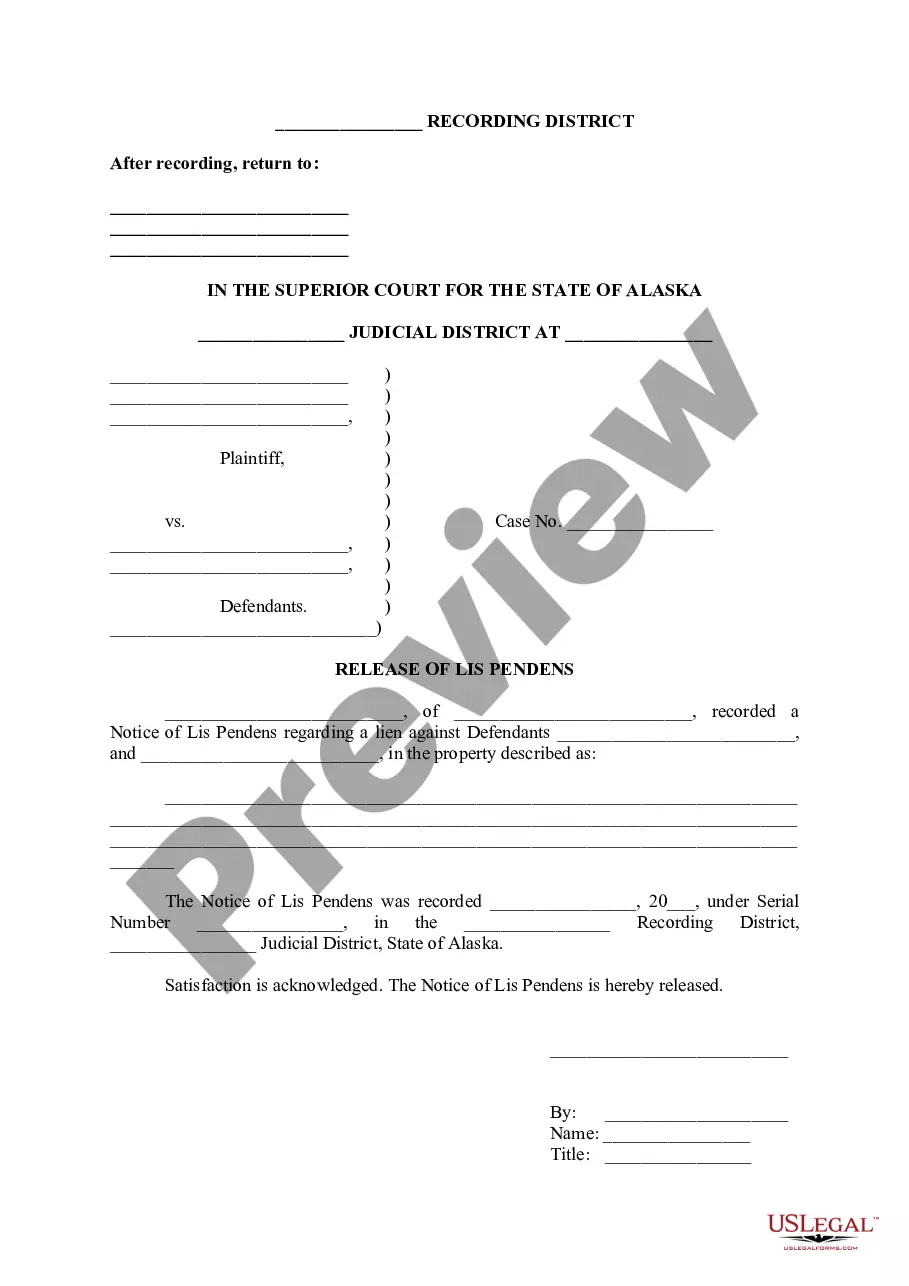

If available, utilize the Preview button to review the document template as well.

- If you already possess a US Legal Forms account, you can Log In and select the Download button.

- After that, you can complete, modify, print, or sign the Connecticut Assignment of Interest in Trust.

- Each legal document template you purchase is yours forever.

- To obtain another version of any purchased form, navigate to the My documents tab and click on the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the straightforward instructions below.

- First, ensure that you have selected the correct document template for your desired region/city.

- Check the form details to confirm you have chosen the appropriate form.

Form popularity

FAQ

The interest a trust generates varies based on investment choices and market conditions. When you create a Connecticut Assignment of Interest in Trust, the earnings depend largely on the types of assets held within the trust. It's essential to review these investment options regularly to optimize returns. For clarity and assistance regarding trust management, consider checking out uslegalforms' extensive resources.

Ownership interest in a trust is held by the trustee, but it is managed for the benefit of the beneficiaries. The trustee has the legal authority to make decisions regarding the trust assets. However, the true beneficiaries are those who receive the advantages or distributions from the trust. Knowing about Connecticut Assignment of Interest in Trust enables you to grasp how ownership is structured within trusts.

The beneficial (or equitable) interest in the trust property is held by the beneficiaries of the trust. The beneficial interest entitles the beneficiary to enjoy the beneficial interest and enforce the trust under the terms of the instrument.

Usually, a trust prohibits beneficiaries from assigning their interest in the trust before distribution. The anti-assignment provision protects undistributed trust assets from claims by a beneficiary's creditors. Next, disclaimers are used when a beneficiary, or heir, refuses to accept a gift or inheritance.

The rule against perpetuities is a legal rule in the Anglo-American common law that prevents people from using legal instruments (usually a deed or a will) to exert control over the ownership of private property for a time long beyond the lives of people living at the time the instrument was written.

These states are Alaska (repealed the rule for vesting of property interests), Delaware (repealed entirely for personal property interest held in trust; 110 year rule for real property held directly in trust), Idaho, Kentucky (repealing the rule interests in real or personal property), New Jersey, Pennsylvania, Rhode

The Connecticut Qualified Dispositions in Trust Act is also part of the new Connecticut Uniform Trust Code. This Act creates a new type of trust available in Connecticut, which is the Domestic Asset Protection Trust (DAPT).

Law Against Perpetuities Now, the Act extends the Connecticut's 90 years all the way out to 800 years!

A beneficial interest is the right to receive benefits on shares held by another party. Beneficial interest is often referred to in matters concerning trusts, whereby one has a vested interest in the trust's assets. A beneficial interest is that right which a person has in a contract made with another (third party).

The common law Rule against Perpetuities is English in origin and was first promulgated centuries ago. The modern version of the Rule has been altered in California by statute. California has enacted the Uniform Statutory Rule Against Perpetuities, which supersedes the old common law rule.