Contract for Deed Questionnaire

About this form

The Contract for Deed Questionnaire is designed to help individuals understand their legal rights and obligations in a contract for deed agreement. This form contains important prompts that guide users in identifying their specific issues and concerns, facilitating a smoother interaction with legal professionals. Unlike other forms, this questionnaire focuses on gathering essential information and evaluating issues before seeking legal assistance, which can ultimately lead to reduced costs and more effective representation.

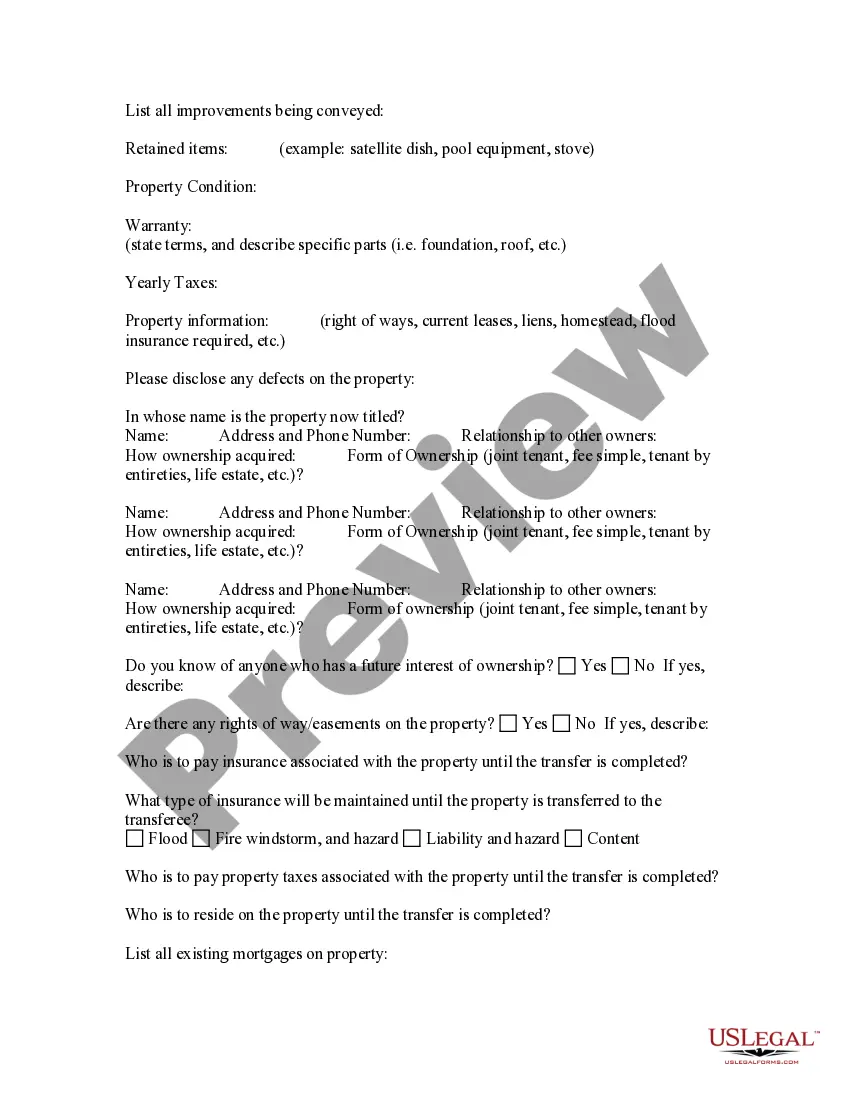

Main sections of this form

- Contact information for all parties involved in the transaction.

- Details about the property, including location and description.

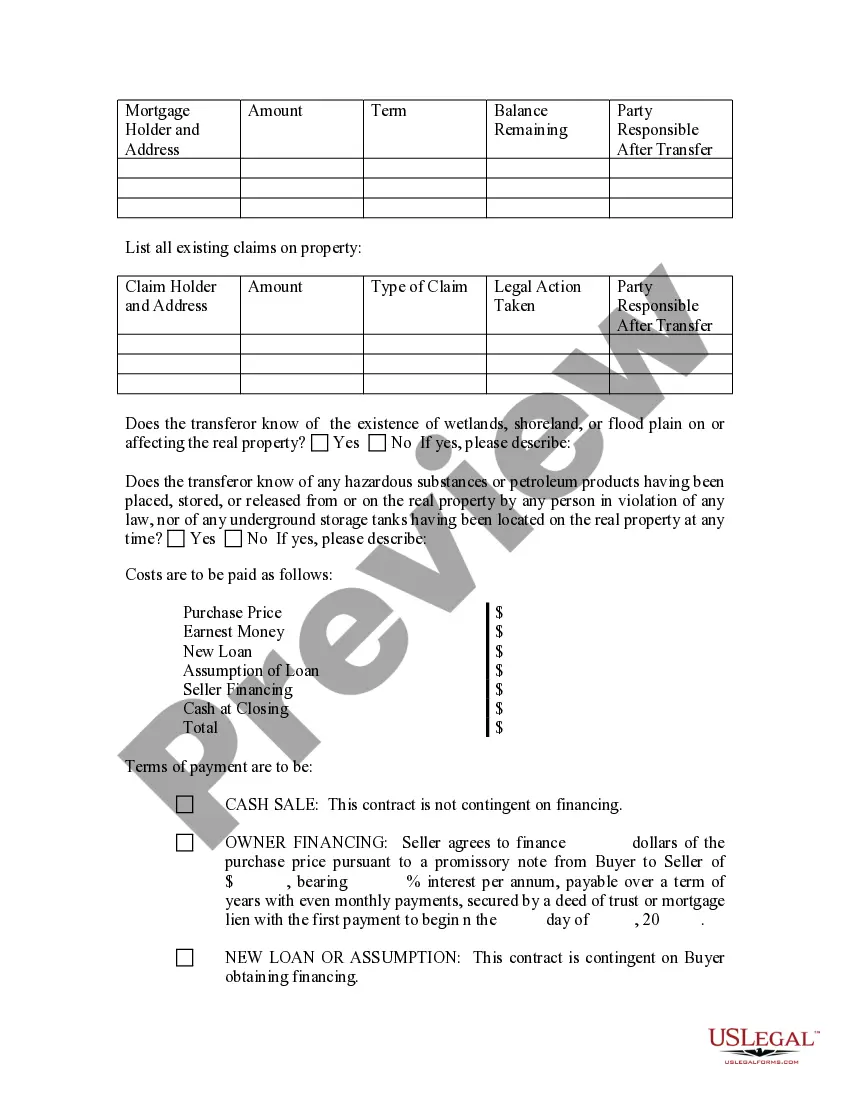

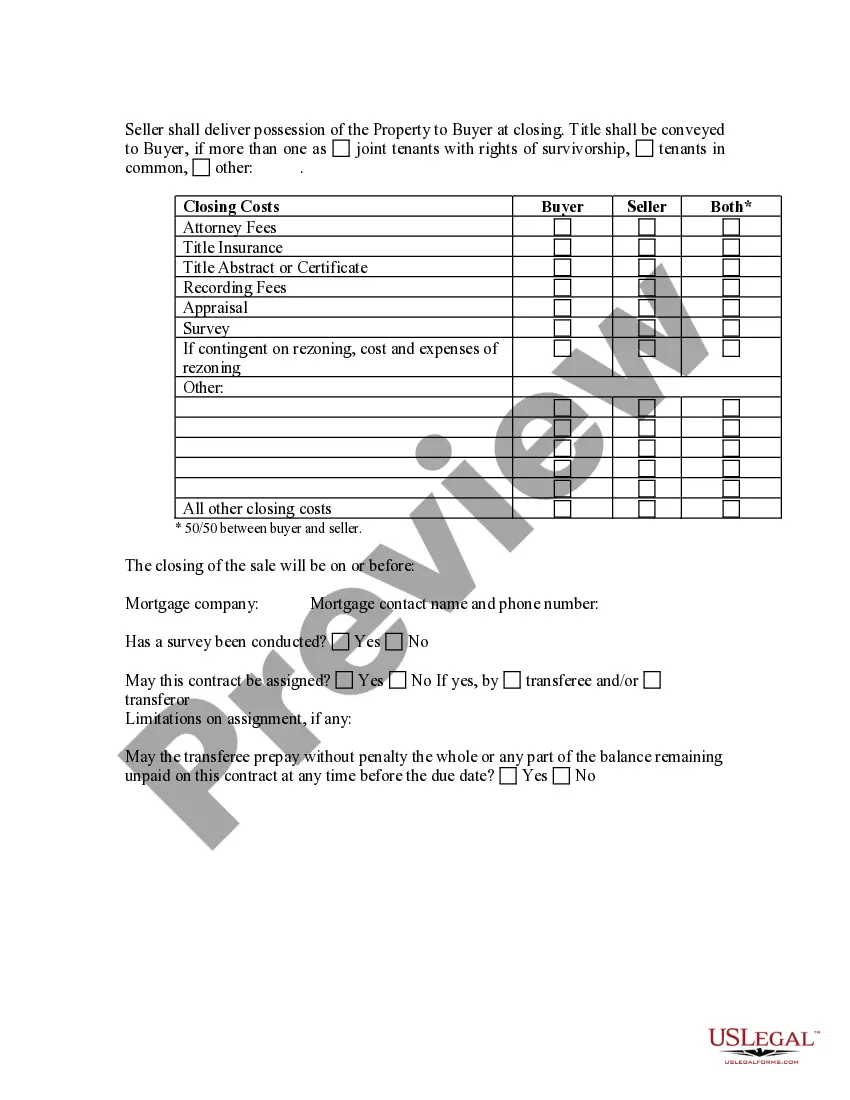

- Financial terms such as purchase price, down payment, and payment schedule.

- Relevant deadlines for payments and documentation.

- Potential issues or concerns to consider before entering into the contract.

Situations where this form applies

This questionnaire is useful when negotiating or drafting a contract for deed, particularly if you are uncertain about certain terms or conditions. It is ideal for individuals looking to buy or sell property under a contract for deed arrangement, as well as for attorneys preparing for initial client meetings who need to gather critical information efficiently.

Who can use this document

This questionnaire is intended for:

- Individuals buying or selling property through a contract for deed.

- Attorneys who need to gather information from new clients regarding their real estate transactions.

- Anyone looking to better understand the implications and responsibilities of entering into a contract for deed.

Completing this form step by step

- Identify and list all parties to the contract, along with their contact information.

- Provide a detailed description of the property involved in the contract.

- Specify the financial terms, including the purchase price and down payment.

- Outline the payment schedule, including due dates and amounts.

- Consider and list any potential issues or concerns that may arise during the transaction.

Notarization guidance

Notarization is generally not required for this form. However, certain states or situations might demand it. You can complete notarization online through US Legal Forms, powered by Notarize, using a verified video call available anytime.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes to avoid

- Failing to include all parties' contact information.

- Omitting crucial property details, which can lead to disputes later.

- Leaving out specifics regarding payment terms, such as dates and amounts.

- Not addressing potential issues beforehand, causing delays in the process.

Advantages of online completion

- Convenient access to a structured format that saves time.

- Easy to edit and customize based on individual circumstances.

- Reliable information drafted by licensed attorneys, ensuring legal compliance.

Looking for another form?

Form popularity

FAQ

Purchase price. Down payment. Interest rate. Number of monthly installments. Responsibilities of the buyer and seller. Legal remedies for the seller if the buyer does not make payments.

Generally, contract for deed sellers use IRS Form 6252 to report installment sales in the year in which they take place. You also use Form 6252 during each year you receive income from your contract for deed.

Interest rates on land contracts can vary dramatically, and buyers and sellers ultimately call the shots on the loan's rate. That said, interest rates typically stay under 12%, Smith said. Federal loan regulations, as well as state usury laws, restrict sellers from overcharging interest fees.

Contract for Deed Seller Financing. A contract for deed is used by some sellers who finance the sale of their homes. Seller's Ownership Liability. Buyer Default Risk. Seller Performance. Property Liens Could Hinder Purchase.

The buyer must record the contract for deed with the county recorder where the land is located within four months after the contract is signed. Contracts for deed must provide the legal name of the buyer and the buyer's address.

A land contract should spell out the purchase price, down payment, payment schedule, installment amount, interest rate, loan term and balloon payment amount, if applicable. Responsible party for home repairs. The buyer and seller agree upfront on who will make and pay for home repairs.

A contract for deed is an agreement for buying property without going to a mortgage lender. The buyer agrees to pay the seller monthly payments, and the deed is turned over to the buyer when all payments have been made.

A disadvantage to the seller is that a contract for deed is frequently characterized by a low down payment and the purchase price is paid in installments instead of one lump sum. If a seller needs funds from the sale to buy another property, this would not be a beneficial method of selling real estate.

The interest rate on a contract for deed loan is typically 3% - 6% higher than the rate on regular mortgage. A higher interest rate means a higher monthly mortgage payment plus you are also responsible for property taxes and insurance even though you do not own the property.