Contract for Deed

Overview of this form

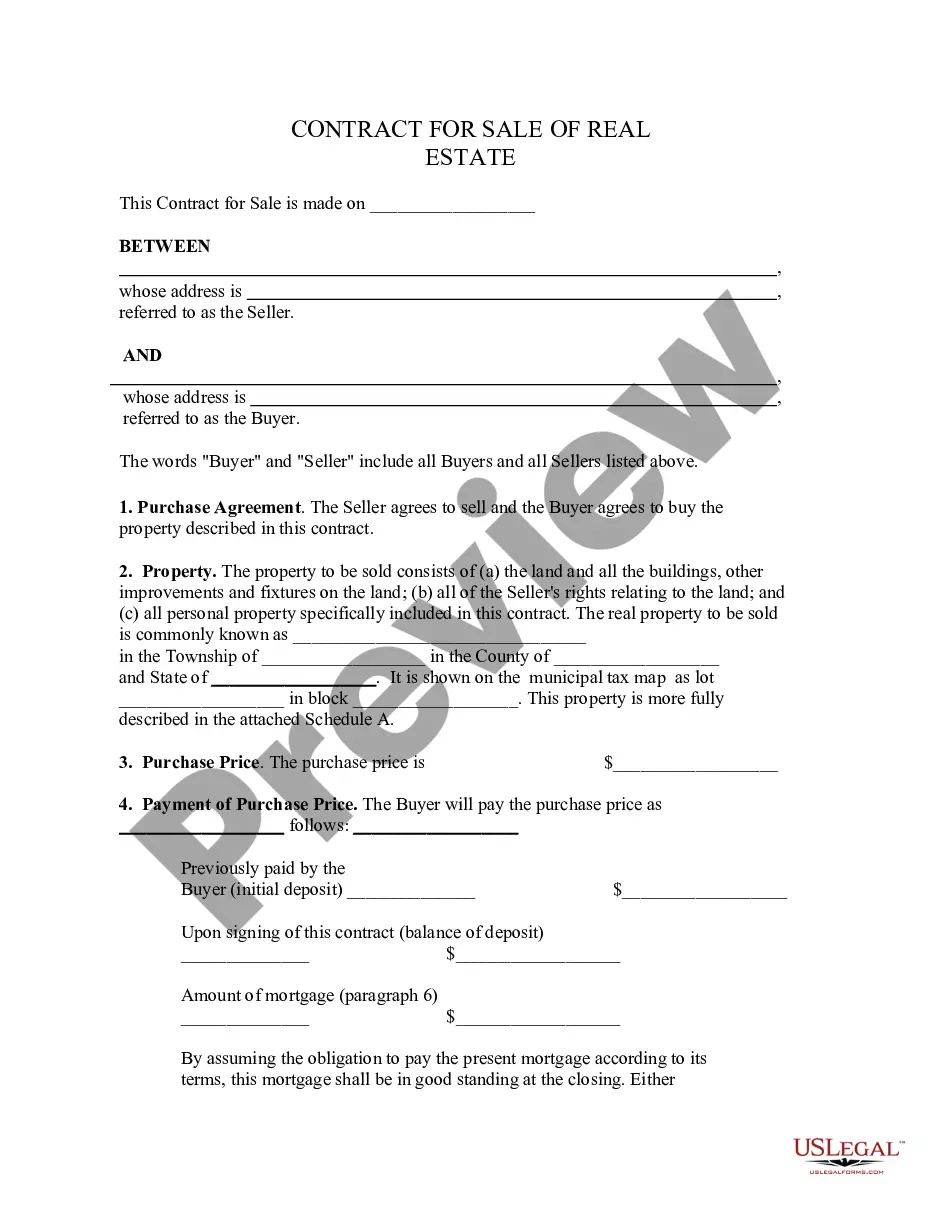

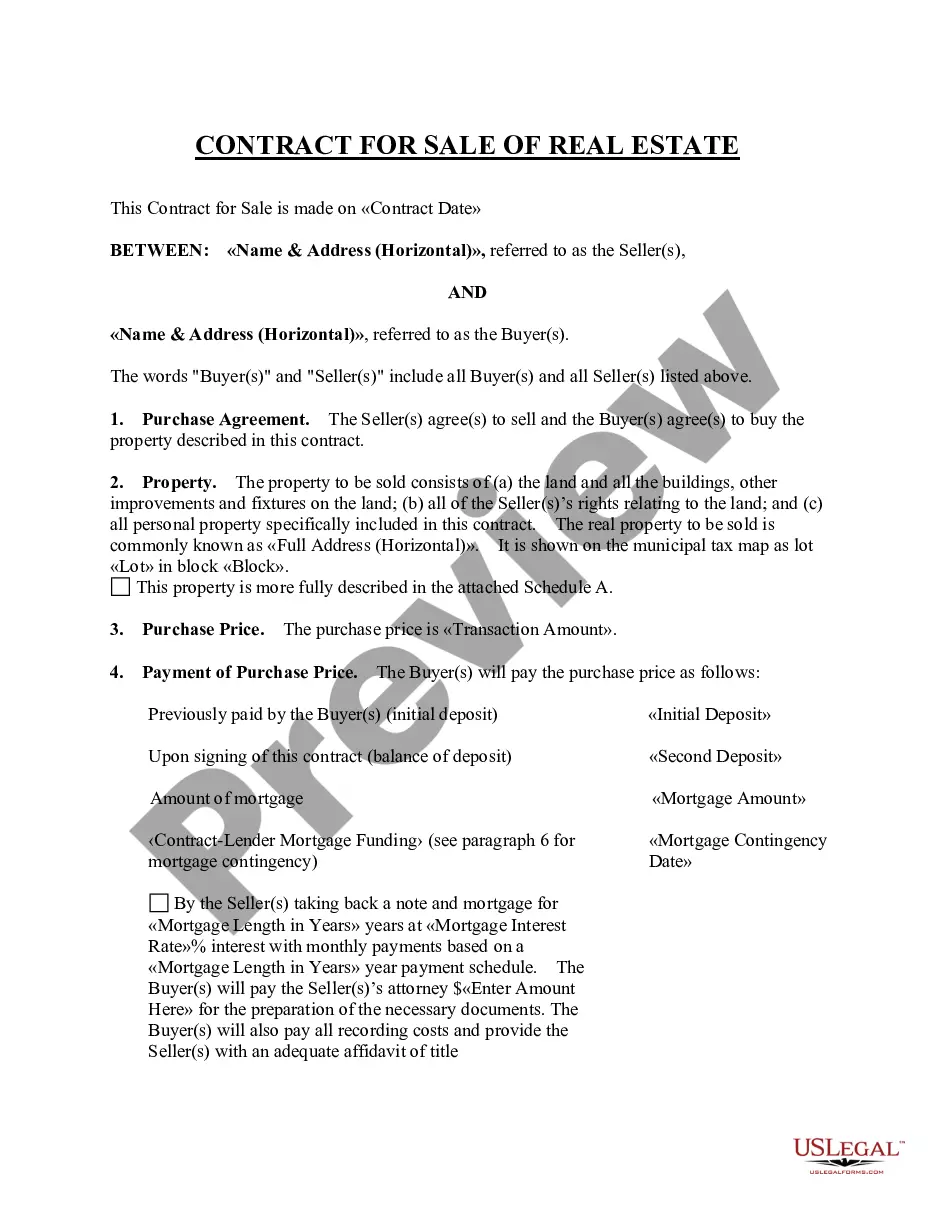

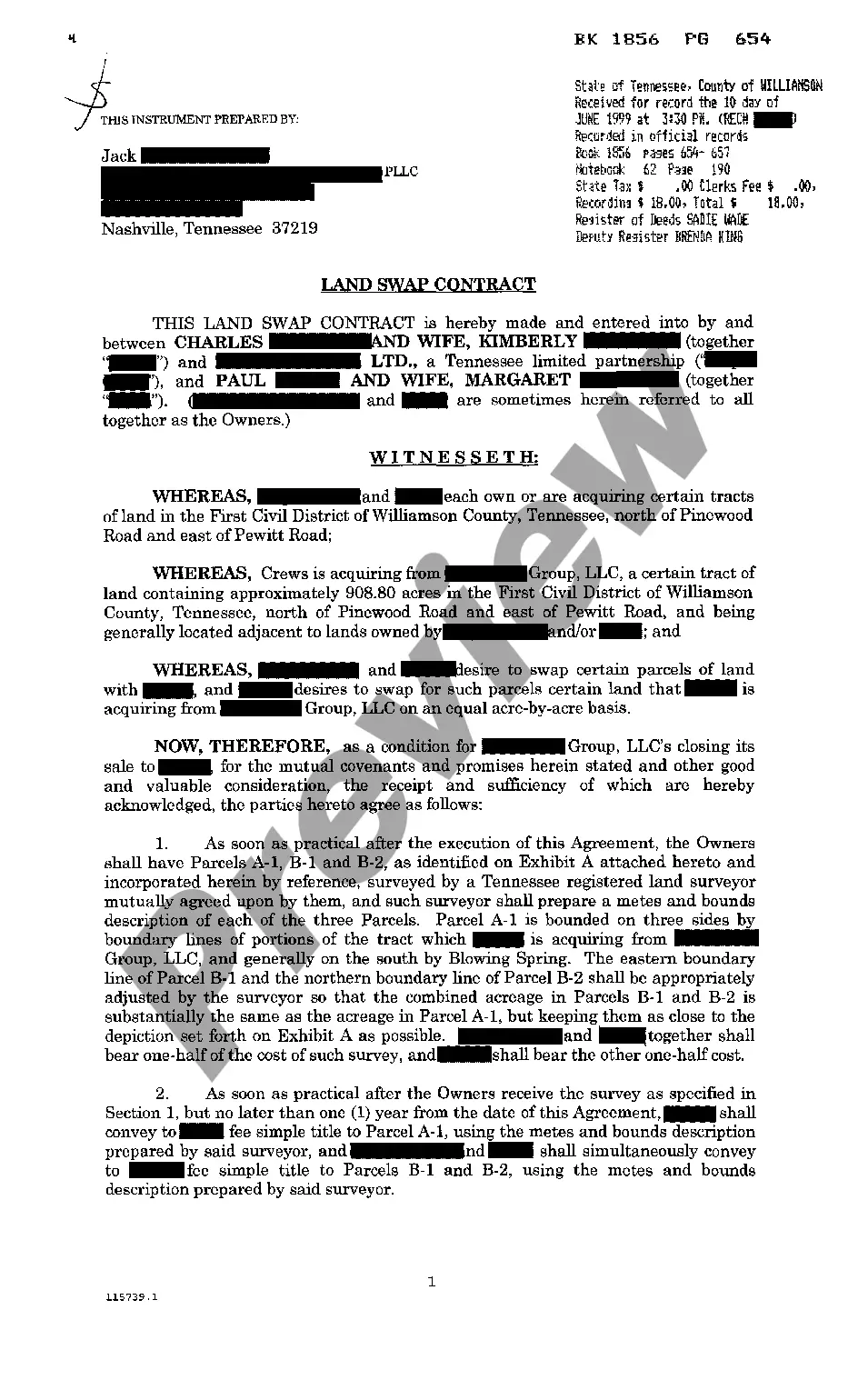

A Contract for Deed is a legal document used in owner financing for the purchase of real estate. Unlike a traditional sale where the buyer receives title to the property, this agreement allows the seller to retain title until the buyer has completed payment as agreed. This form sets out the specific terms for payment and the eventual transfer of ownership.

Key parts of this document

- Identification of parties: Names of the seller(s) and buyer(s).

- Sale of property: Detailed description of the property being sold.

- Purchase price and payment terms: Breakdown of payment amounts, schedule, and interest rates.

- Security clause: The contract serves as security for payment obligations.

- Condition of improvements: Acceptance of the property "as is" without warranties from the seller.

- Default terms: Conditions under which the seller may take action if the buyer fails to meet obligations.

Common use cases

This form is suitable in situations where a buyer wishes to purchase real property but is unable to secure traditional financing through banks or mortgage lenders. It allows for flexibility in payment schedules and terms, making it a favorable option for buyers who may face credit challenges.

Intended users of this form

- Buyers looking for alternative financing options to purchase property.

- Sellers willing to act as the lender in a real estate transaction.

- Individuals familiar with real estate transactions who need a structured payment plan.

Completing this form step by step

- Identify the parties: Fill in the names of the seller(s) and buyer(s).

- Specify the property: Provide a thorough description of the property, including county and state.

- Enter purchase price and payment terms: Clearly state the total purchase price and detail payment schedules.

- Review security and maintenance clauses: Understand the obligations related to property maintenance and defaults.

- Include signatures: Ensure all parties sign the document to make it legally binding.

Notarization guidance

Notarization is required for this form to take effect. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes to avoid

- Failing to include accurate property descriptions can lead to disputes.

- Not specifying payment due dates can create confusion.

- Skipping necessary signatures which may invalidate the contract.

- Assuming no legal advice is needed, which could result in overlooking important obligations.

Why use this form online

- Immediate access to a legally sound Contract for Deed template.

- Editability allows customization to fit specific transaction needs.

- Secure and reliable, ensuring confidentiality and data protection.

Looking for another form?

Form popularity

FAQ

The interest rate on a contract for deed loan is typically 3% - 6% higher than the rate on regular mortgage. A higher interest rate means a higher monthly mortgage payment plus you are also responsible for property taxes and insurance even though you do not own the property.

A contract for deed is an agreement for buying property without going to a mortgage lender. The buyer agrees to pay the seller monthly payments, and the deed is turned over to the buyer when all payments have been made.

The Difference Between Renting to Own and a Contract for Deed. Renting to own usually means renting now, with an option to buy later. When you make this kind of deal, you are still a tenant, and the seller is still a landlord, until the final purchase. A contract for deed is very different.

Contract for Deed Seller Financing. A contract for deed is used by some sellers who finance the sale of their homes. Seller's Ownership Liability. Buyer Default Risk. Seller Performance. Property Liens Could Hinder Purchase.

A disadvantage to the seller is that a contract for deed is frequently characterized by a low down payment and the purchase price is paid in installments instead of one lump sum. If a seller needs funds from the sale to buy another property, this would not be a beneficial method of selling real estate.

The average length of a Contract for Deed is five years, but it can be for any amount of time that the buyer and seller agree on. Interest rates on a Contract for Deed are not regulated, so they can be as high or as low as the buyer and seller can agree on.

Interest rates on land contracts can vary dramatically, and buyers and sellers ultimately call the shots on the loan's rate. That said, interest rates typically stay under 12%, Smith said. Federal loan regulations, as well as state usury laws, restrict sellers from overcharging interest fees.

Contract for Deed Seller Financing. A contract for deed is used by some sellers who finance the sale of their homes.Seller's Ownership Liability.Buyer Default Risk.Seller Performance.Property Liens Could Hinder Purchase.