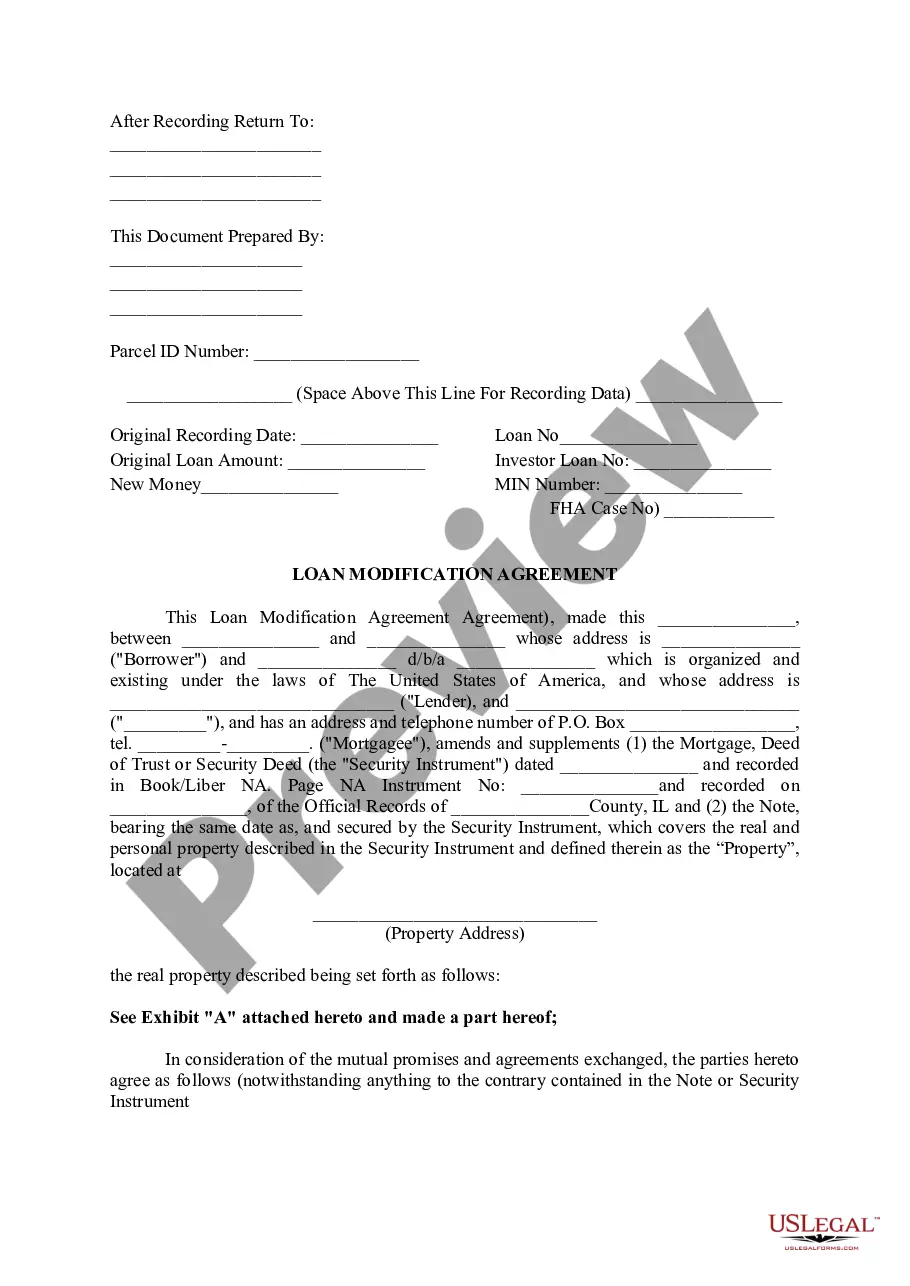

Illinois Loan Modification Agreement

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

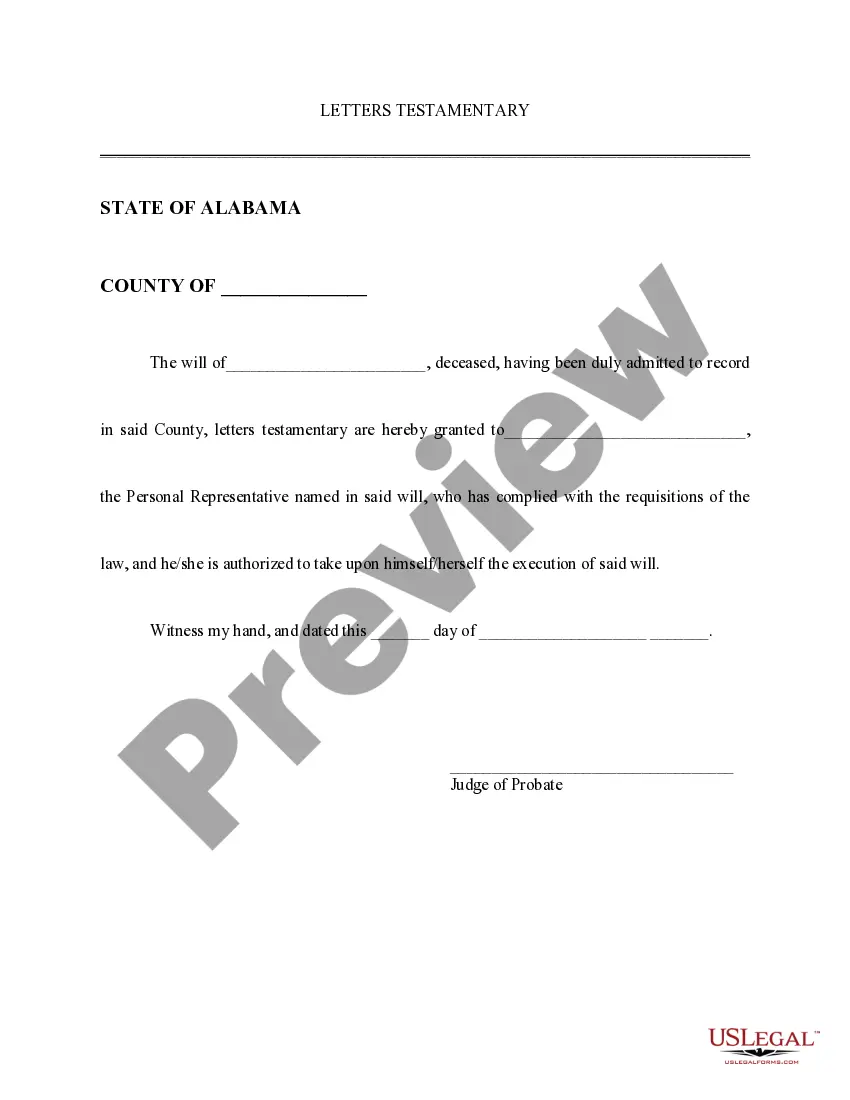

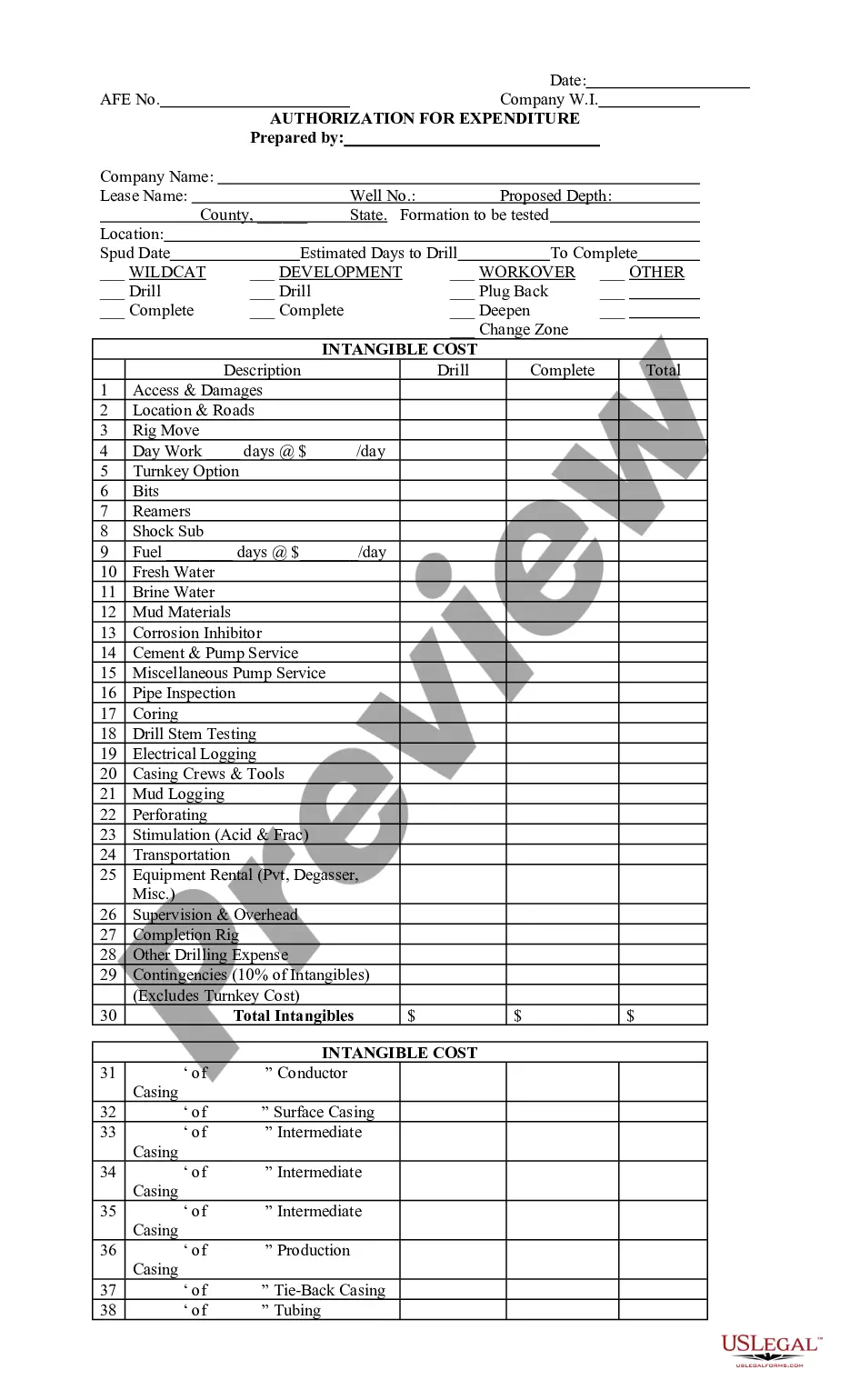

Looking for another form?

How to fill out Illinois Loan Modification Agreement?

Utilize US Legal Forms to acquire a printable Illinois Loan Modification Agreement.

Our court-acceptable forms are created and routinely updated by experienced attorneys.

Ours is the most comprehensive forms library online and offers cost-effective and precise templates for clients and lawyers, along with small to medium-sized businesses.

Press Buy Now if it is the document you need. Set up your account and pay through PayPal or a credit card. Download the form to your device and feel free to reuse it as needed. Use the search function if you want to locate another document template. US Legal Forms provides thousands of legal and tax templates and packages for both business and personal requirements, including the Illinois Loan Modification Agreement. Over three million users have successfully utilized our service. Choose your subscription plan and obtain high-quality forms with just a few clicks.

- The documents are sorted into state-specific categories, and a portion of them can be previewed before being downloaded.

- To retrieve templates, users must possess a subscription and Log Into their account.

- Click Download next to any template you desire and access it in My documents.

- For those without a subscription, follow these tips to swiftly locate and download the Illinois Loan Modification Agreement.

- Confirm that you have the appropriate template for the state required.

- Examine the document by reviewing the description and utilizing the Preview feature.

Form popularity

FAQ

Yes, probably. In California, a law called the Homeowner Bill of Rights (HBOR) generally gives borrowers the right to appeal a modification denial. Under HBOR, in most cases, if the servicer denies a borrower's application to modify a first lien loan, the borrower can appeal.

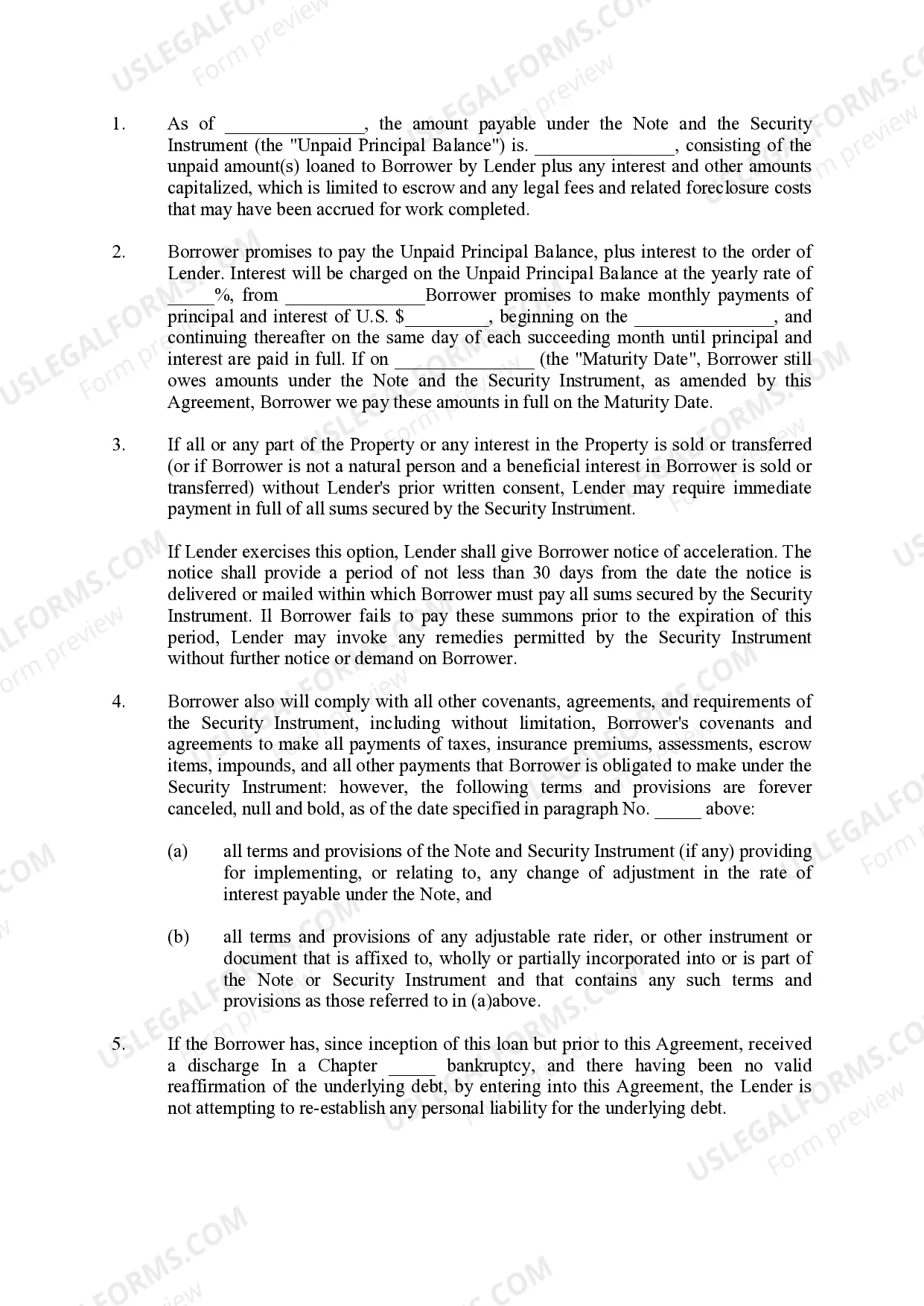

A loan modification is a change that the lender makes to the original terms of your mortgage, typically due to financial hardship. The goal is to reduce your monthly payment to an amount that you can afford, which you can achieve in a variety of ways.

Some of the most common types of hardship are: job loss, pay reduction, underemployment, declining business revenue, death of a coborrower, illness, injury, and divorce.

A lender may agree to a loan modification during a settlement procedure or in the case of a potential foreclosure.A loan modification agreement is a long-term solution. A loan modification may involve a reduced interest rate, a longer period to repay, a different type of loan, or any combination of these.

The loan modification underwriter will analyze and review the particular circumstances which justify a loan modification. The underwriter will evaluate and assess the borrower's financial status, current income and asset situation and ability to pay.

When you've successfully completed your trial modification payments, your mortgage loan servicer will send you a loan modification agreement. That agreement needs to be signed by you, stamped and signed by a notary, and sent back to your servicer.Some banks even offer a notary who will come to your home.

Be at least one regular mortgage payment behind or show that missing a payment is imminent. Provide evidence of significant financial hardship, for reasons such as:

Suspend past due amounts. Bring your account current. Adjust your interest rate. Lower your minimum payments. Modify your loan. Agree to a short sale of a home. Consider a settlement option.