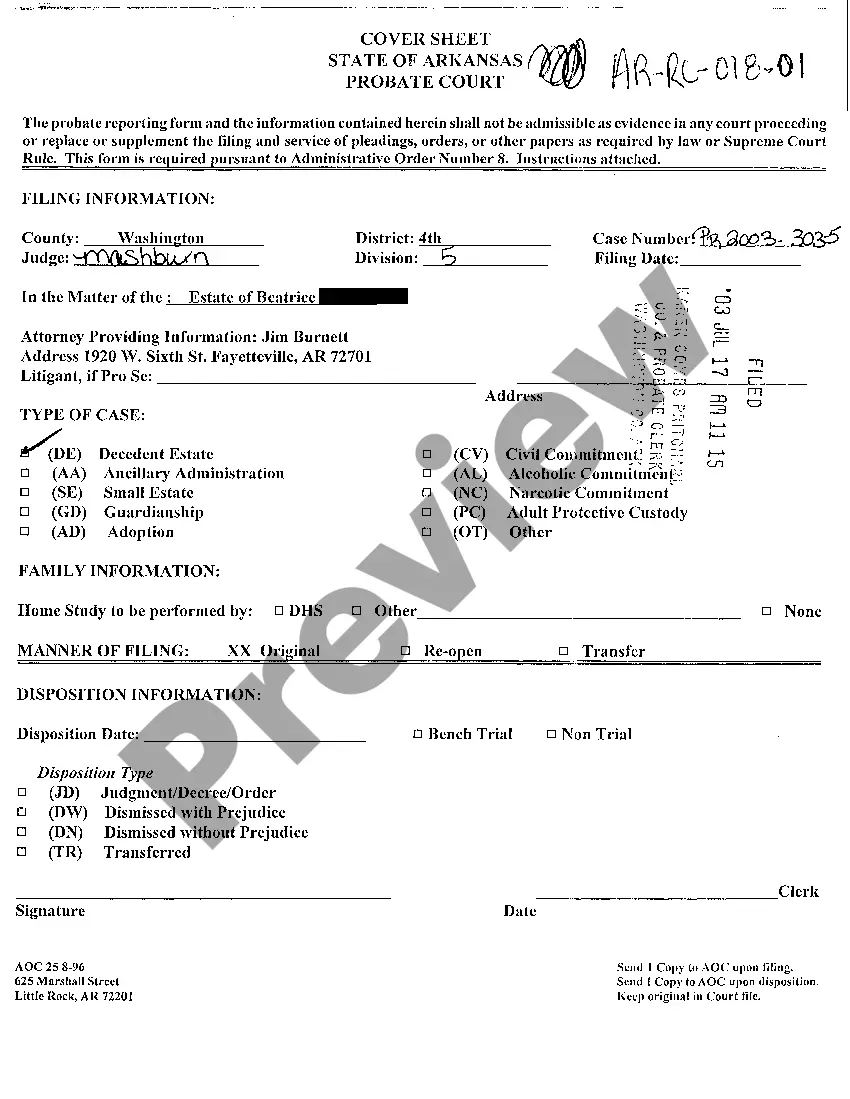

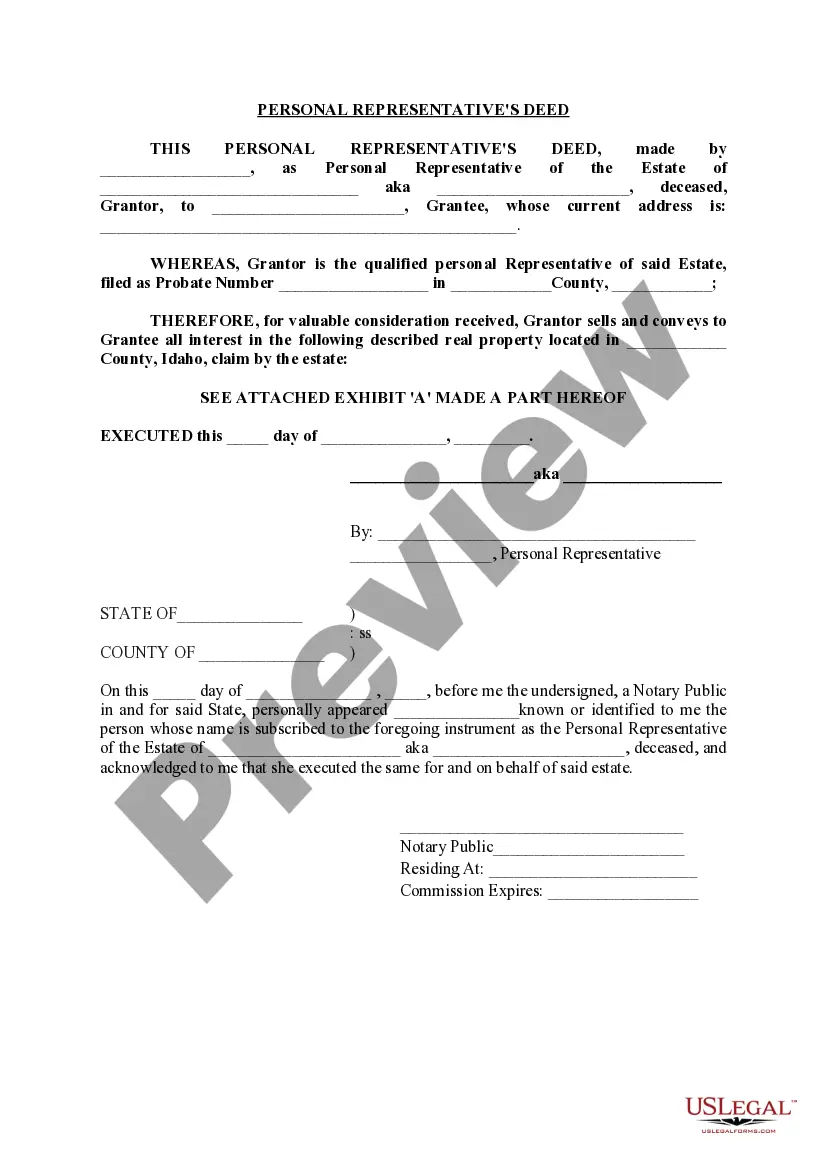

Idaho Personal Representative's Deed

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Idaho Personal Representative's Deed?

Utilize US Legal Forms to obtain a printable Idaho Personal Representative’s Deed. Our court-acceptable forms are created and frequently updated by proficient attorneys.

Ours is the most extensive Forms repository online and offers cost-effective and precise examples for clients, legal experts, and small to medium-sized businesses.

The templates are categorized by state and many can be previewed prior to download.

Create your account and complete payment via PayPal or credit card. Download the form to your device and feel free to reuse it multiple times. Use the Search field if you wish to find another document template. US Legal Forms provides thousands of legal and tax templates and packages for business and personal requirements, including Idaho Personal Representative’s Deed. Over three million users have successfully utilized our service. Select your subscription plan and access high-quality forms in just a few clicks.

- To download samples, clients must possess a subscription and must Log In to their account.

- Click Download next to any template you desire and locate it in My documents.

- For those lacking a subscription, follow these steps to swiftly locate and download the Idaho Personal Representative’s Deed.

- Verify that you are getting the correct template corresponding to the required state.

- Examine the document by reading the description and using the Preview feature.

- Click Buy Now if it’s the document you are seeking.

Form popularity

FAQ

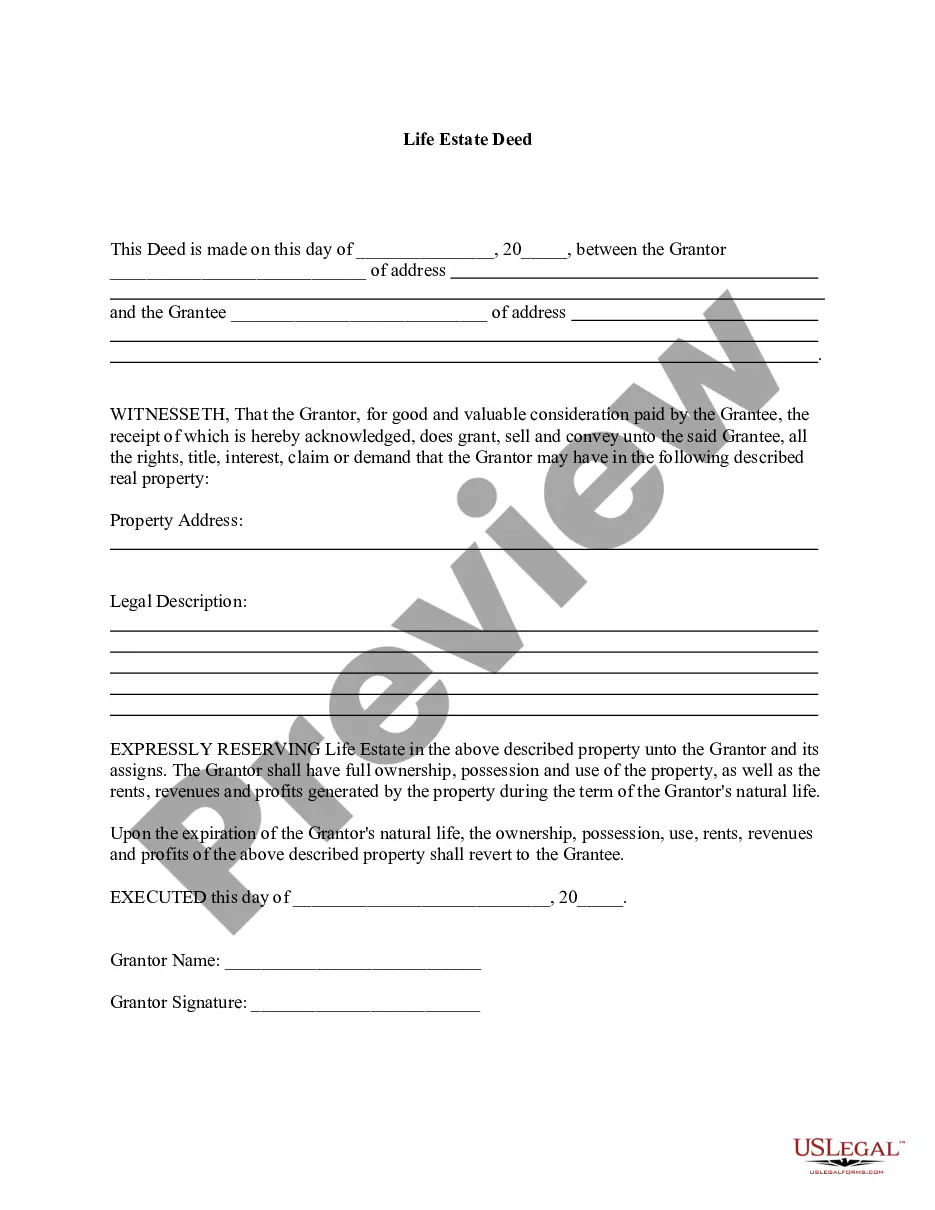

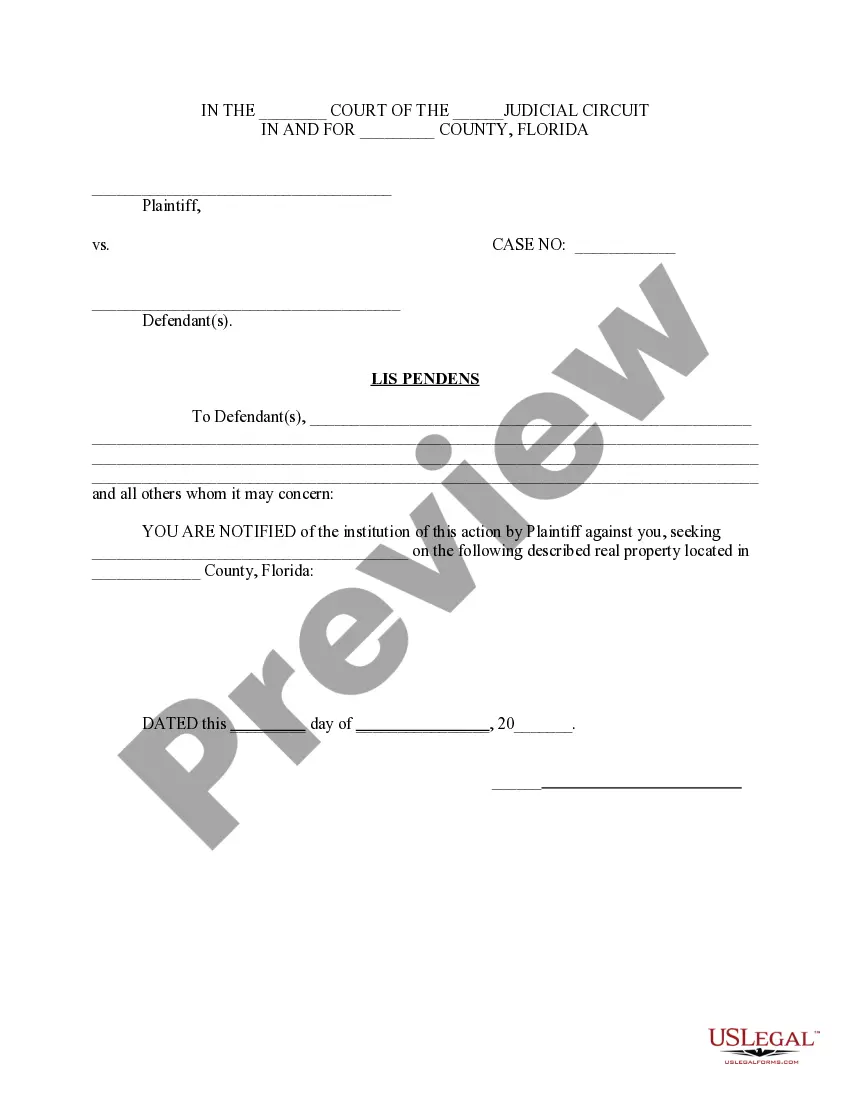

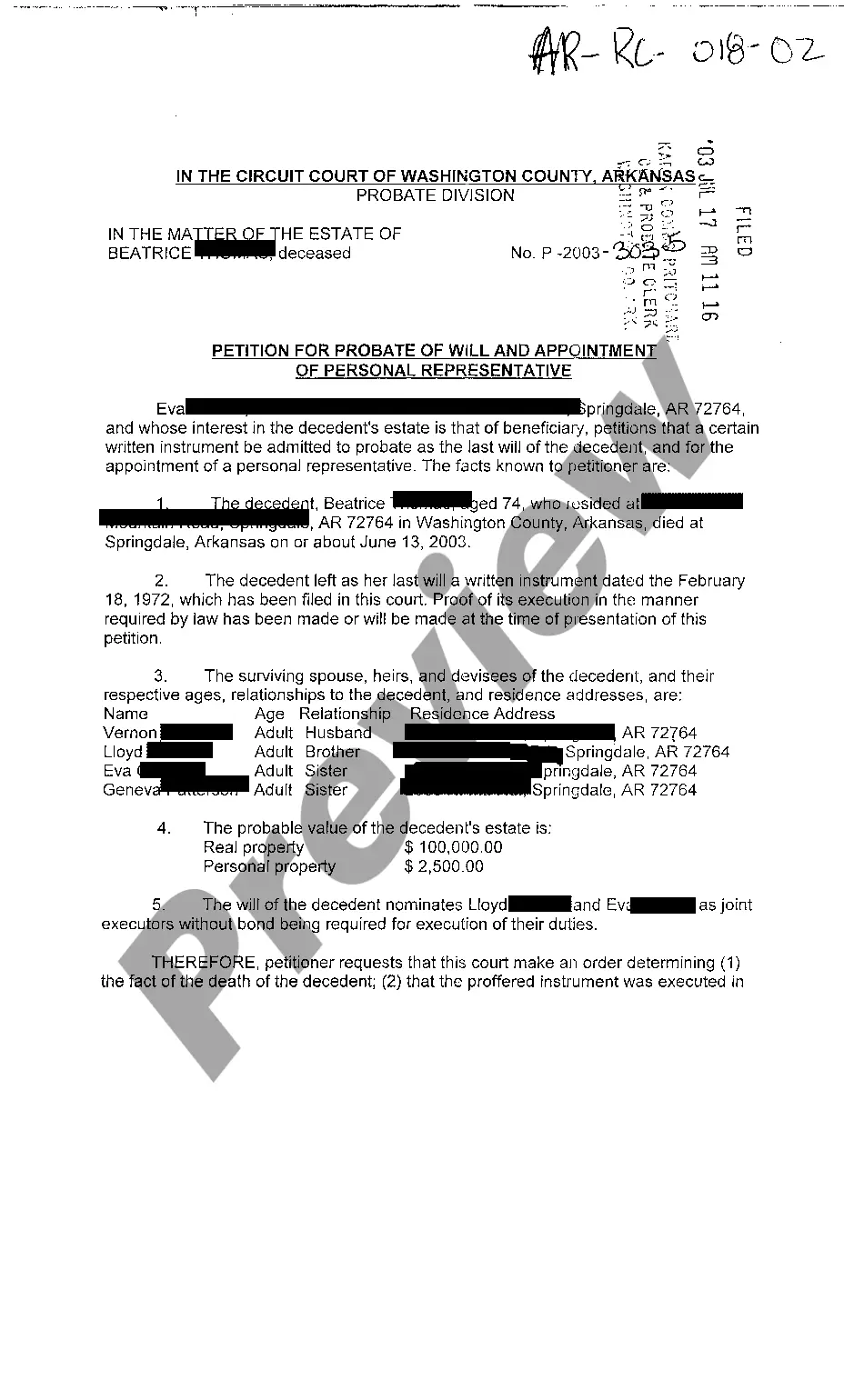

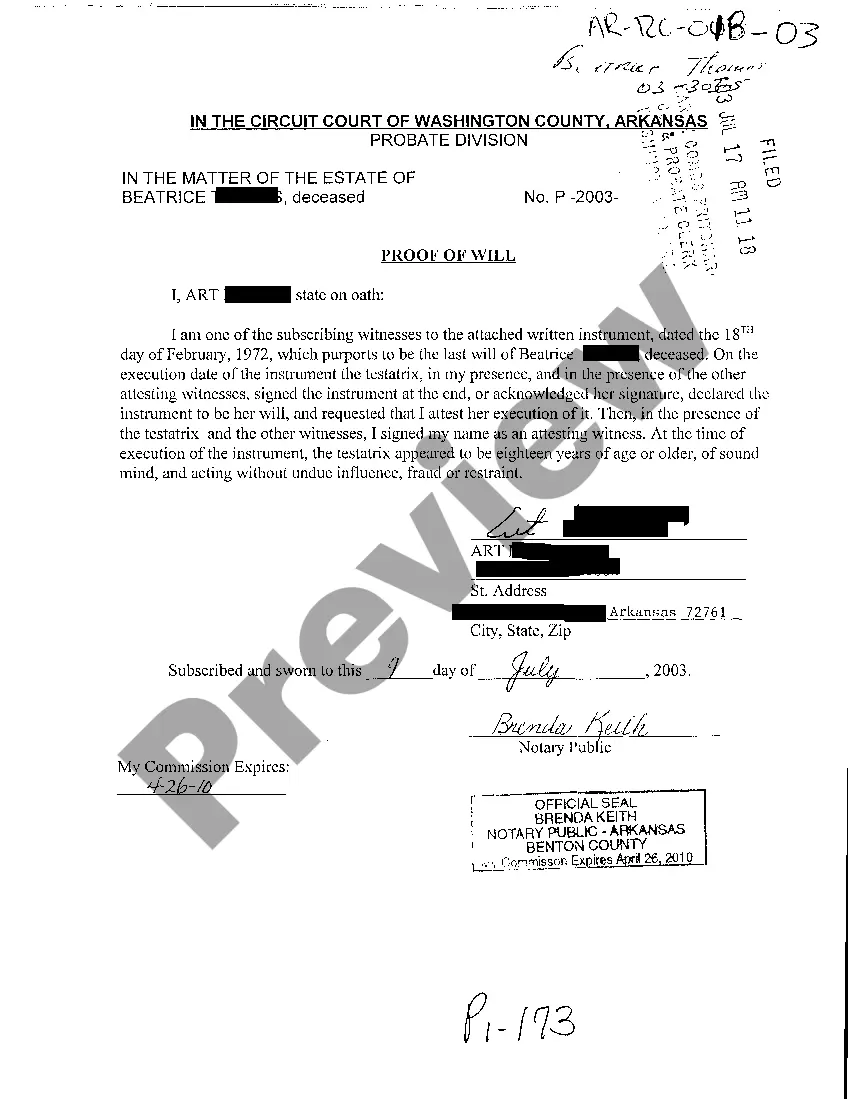

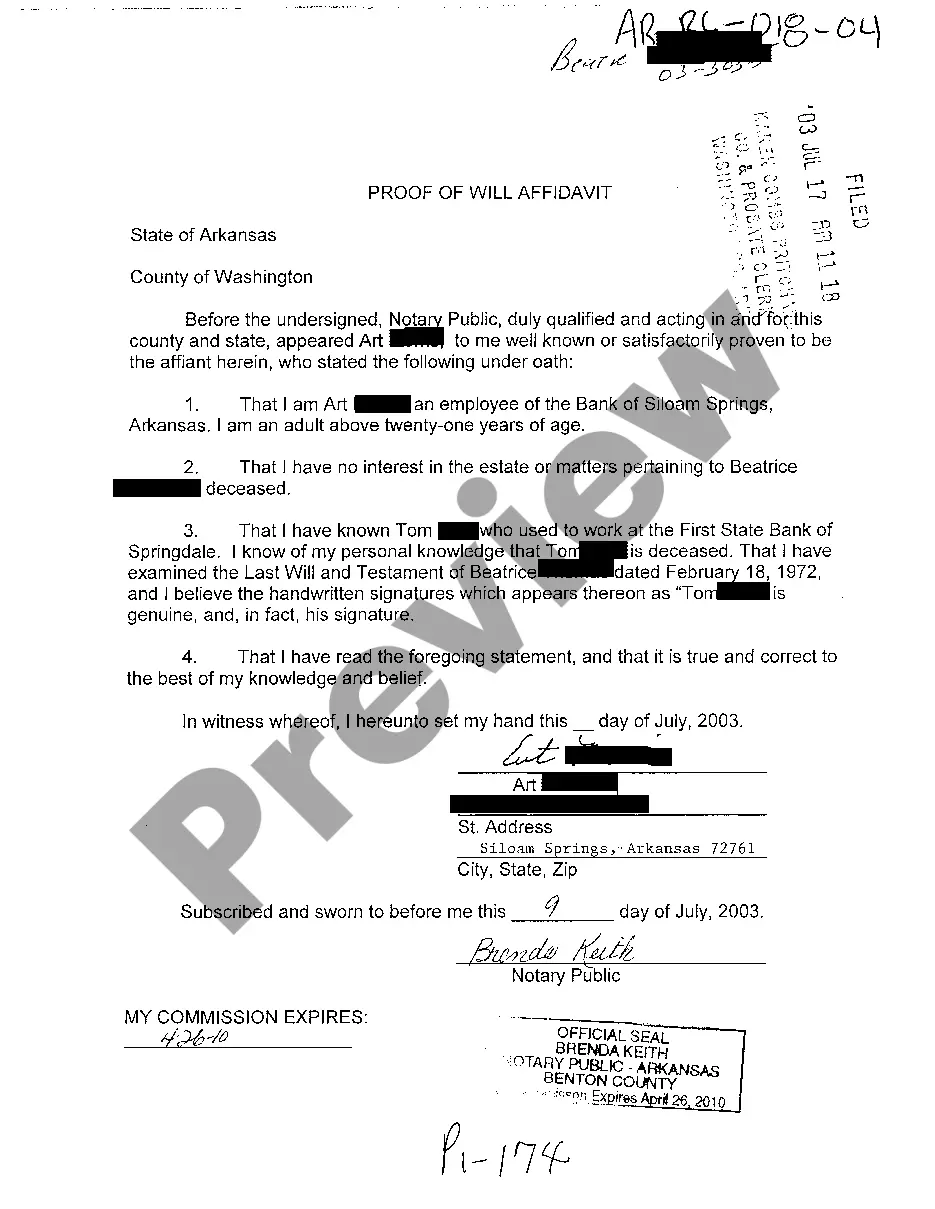

Personal representative's distributive deeds are used to transfer ownership of real property from a testate estate.Each situation is unique, however, so contact an attorney with specific questions or for complex cases.

The personal representative can be an individual or a bank or trust company, subject to certain restrictions. To qualify to serve as a personal representative, an individual must be either a Florida resident or, regardless of residence, a spouse, sibling, parent, child, or other close relative of the decedent.

A personal representative deed and warranty deed are the same only in that they both convey ownership of land. The types of title assurance that the different deeds provide to the new owner are very different.

Used to transfer property rights from a deceased person's estate. Involves Probate Court. Like a Quit Claim deed, there are no warranties. Generally, the Personal Representative is unwilling to warrant or promise anything relating to property that he/she has never personally owned.

Let's start with the definition of a deed: DEED: A written instrument by which one party, the Grantor, conveys the title of ownership in property to another party, the Grantee. A Warranty Deed contains promises, called covenants, that the Grantor makes to the Grantee.

In a Non-Warranty Deed, the seller gives no warranties.In a Non-Warranty or Quitclaim Deed, the seller merely is giving the buyer whatever rights, if any, that the seller has in the property and the seller makes no warranties of any nature about the seller's rights in the property.

In order to provide finality to the termination of a trust or the closing of an estate, the form of deed given by a personal representative or a trustee simply calls for the seller to convey as opposed to convey and warrant the property.Again, all the buyer gets is whatever the trust or estate owned.

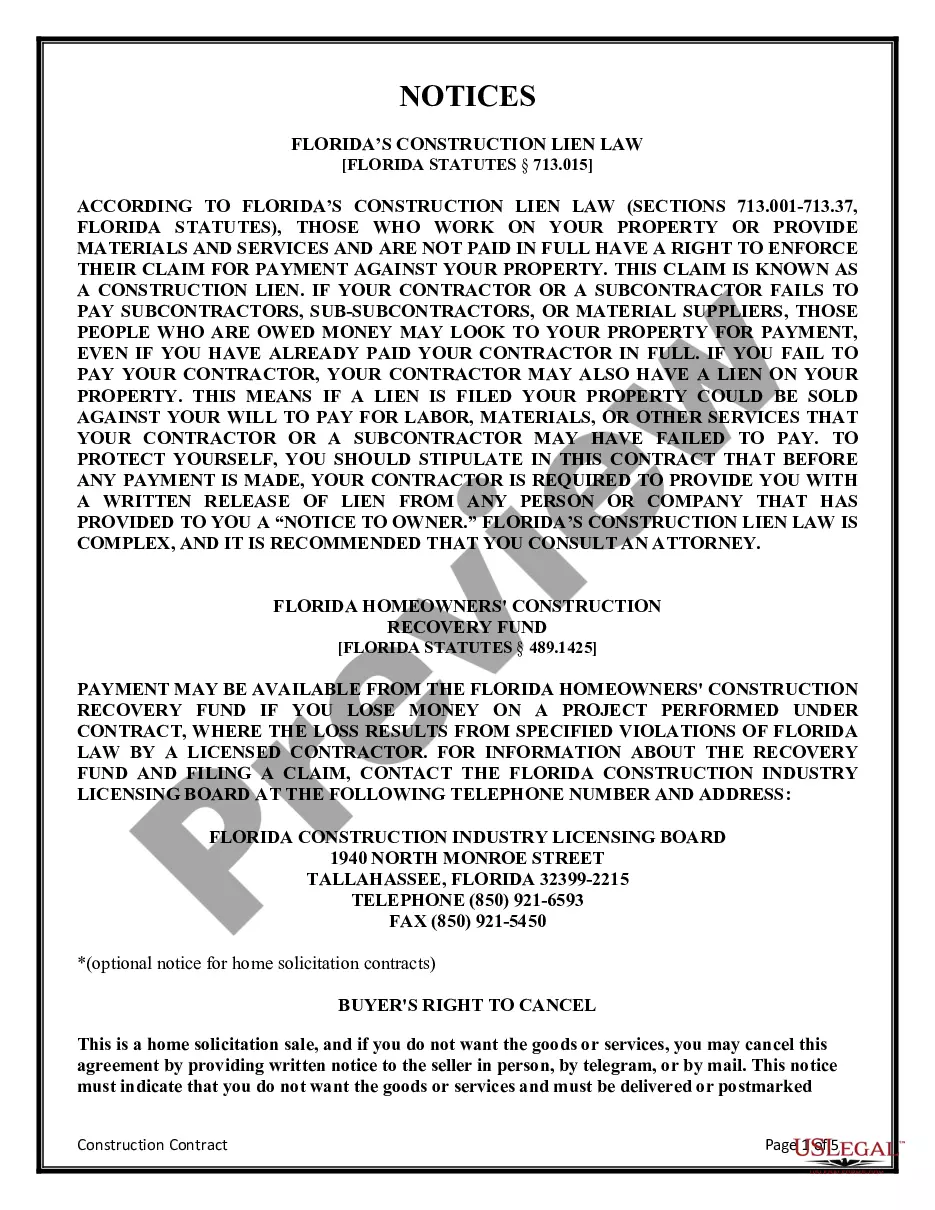

According to Florida Probate Code 733.612, a personal representative, acting reasonably for the benefit of the interested persons, may properly sell, mortgage, or lease any personal property of the estate or any interest in it for cash, credit, or for part cash or part credit, and with or without security for the