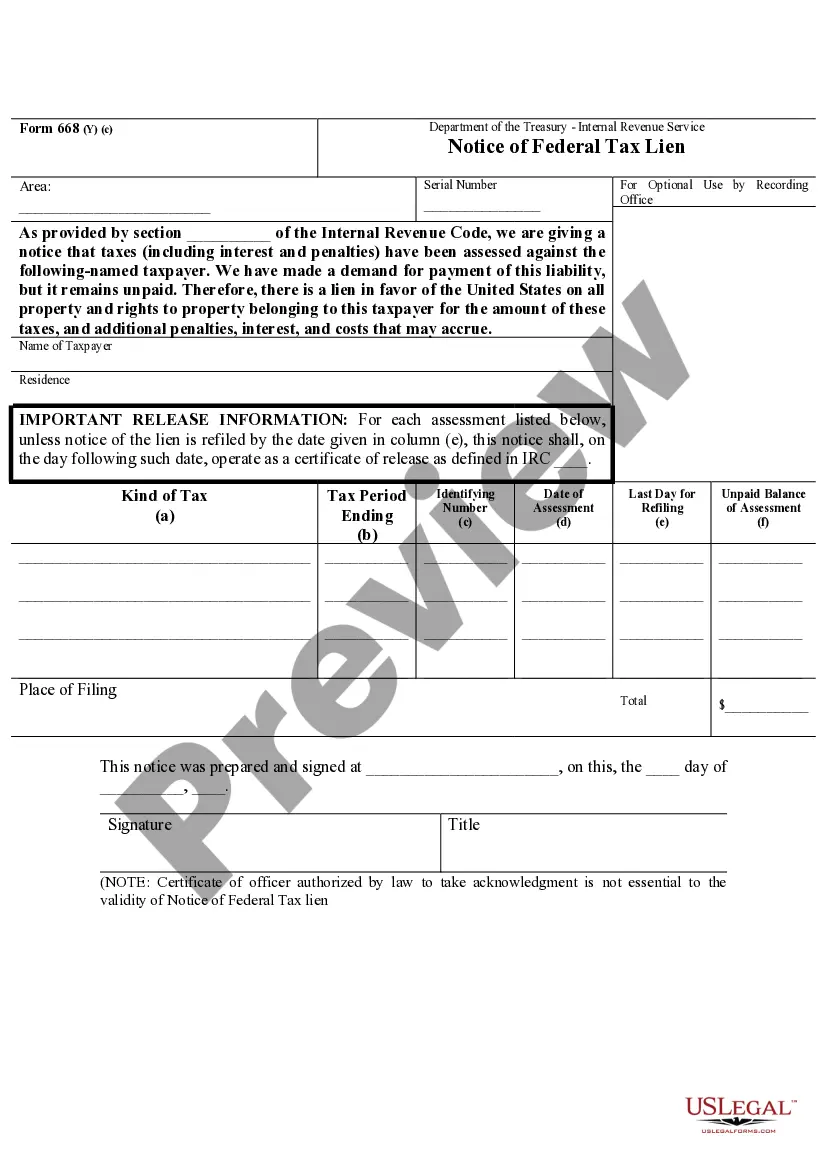

Arkansas Department of the Treasury -Internal Revenue ServiceNotice of Federal Tax Lien

Description

to taxpayer for taxes, and additional penalties, interest, and costs that may accrue.

How to fill out Arkansas Department Of The Treasury -Internal Revenue ServiceNotice Of Federal Tax Lien?

Using examples from the Arkansas Department of the Treasury - Internal Revenue Service crafted by experienced lawyers helps you avoid issues when filing documents.

Just download the template from our site, complete it, and ask a legal expert to review it.

This can assist you in saving significantly more time and energy compared to seeking legal advice to create a document entirely from the beginning according to your needs.

Utilize the Preview option and read the description (if available) to determine if this particular template is needed; if so, just click Buy Now.

- If you’ve already purchased a US Legal Forms subscription, just Log In to your account and revisit the sample page.

- Locate the Download button next to the templates you are browsing.

- After downloading a template, you will find all your saved examples in the My documents tab.

- If you do not have a subscription, it’s not an issue.

- Just follow the steps below to create an account online, acquire, and complete your Arkansas Department of the Treasury - Internal Revenue Service template.

- Verify and ensure that you are downloading the appropriate state-specific form.

Form popularity

FAQ

To perform a federal tax lien search, you can visit your local county clerk's office or access online databases that catalog public records of liens. Many jurisdictions provide online search capabilities, allowing for quick access to lien information. Alternatively, the IRS website also offers resources to help you understand your tax status. Using tools available through uslegalforms can further support your search process for a notice of federal tax lien when interacting with the Arkansas Department of the Treasury - Internal Revenue Service.

A notice of federal tax lien is officially filed with the county clerk's office or relevant local authority in the taxpayer's jurisdiction. This filing keeps a public record accessible to creditors and potential buyers. When the IRS files a lien, it ensures transparency regarding the taxpayer's financial obligations. Consequently, it's important to stay informed through the Arkansas Department of the Treasury - Internal Revenue Service to manage your tax responsibilities properly.

Federal tax liens are recorded in the local courthouse or the office of the county recorder in the area where the taxpayer lives or operates their business. This public recording helps other creditors identify any existing claims against the taxpayer's property. The IRS also maintains a database of tax liens, making it crucial to be aware of your rights and obligations. Utilizing resources from the Arkansas Department of the Treasury - Internal Revenue Service can aid in managing these liens effectively.

Yes, you can file Arkansas state taxes online through various platforms. The Arkansas Department of Finance and Administration provides an online system to facilitate this process, making it easier for taxpayers. This option allows for quicker processing of your returns and enhances accuracy in filing. Additionally, using an IRS-approved e-filing option can streamline the entire tax payment process.

The IRS files a notice of federal tax lien with the local government where you reside or conduct business. This step is crucial because it secures the government's claim against your property. By filing the notice with local authorities, it publicly informs interested parties about the IRS's legal right to your assets. This process often begins through the Arkansas Department of the Treasury - Internal Revenue Service.

An Arkansas state tax lien is a legal claim against your property due to unpaid state taxes. This lien serves as a notice to others that the state has a right to your property to recover the owed taxes. If you receive a Notice of Federal Tax Lien from the Arkansas Department of the Treasury -Internal Revenue Service, it indicates serious consequences for unresolved tax debts. To address these issues, tools like US Legal Forms can provide guidance on managing and resolving tax liens efficiently.

Certain entities and individuals can be exempt from sales tax in Arkansas. For example, nonprofit organizations, certain government entities, and some educational institutions often qualify for this exemption. Additionally, specific goods and services may also be exempt, depending on state regulations. Understanding the qualifications for sales tax exemptions can help you manage your finances more effectively, especially when dealing with the Arkansas Department of the Treasury -Internal Revenue Service Notice of Federal Tax Lien.

Receiving a certificate of release of federal tax lien signifies that the Arkansas Department of the Treasury - Internal Revenue Service has settled your tax debt. This document officially removes the lien from your credit history and confirms that you have fulfilled your obligations. It is vital to keep this certificate for your records, as it can help clear any lingering tax issues. You may also consider using legal forms from platforms like uslegalforms to ensure everything is processed correctly.

Yes, IRS tax liens are considered public information and can be accessed by anyone. This transparency allows potential creditors, financial institutions, and others to see if you have outstanding tax obligations. Having a lien as public information can sometimes complicate transactions like buying a home or obtaining loans. It’s advisable to address any liens promptly to protect your financial standing.

You will receive a notice of federal tax lien in the mail from the Arkansas Department of the Treasury - Internal Revenue Service if one has been filed against you. The notice contains important details about the lien, including the amount owed and steps you can take. If you suspect you may have a lien and have not received a notice, you should reach out to your local tax office for clarification.