Release of Judgment Lien

What this document covers

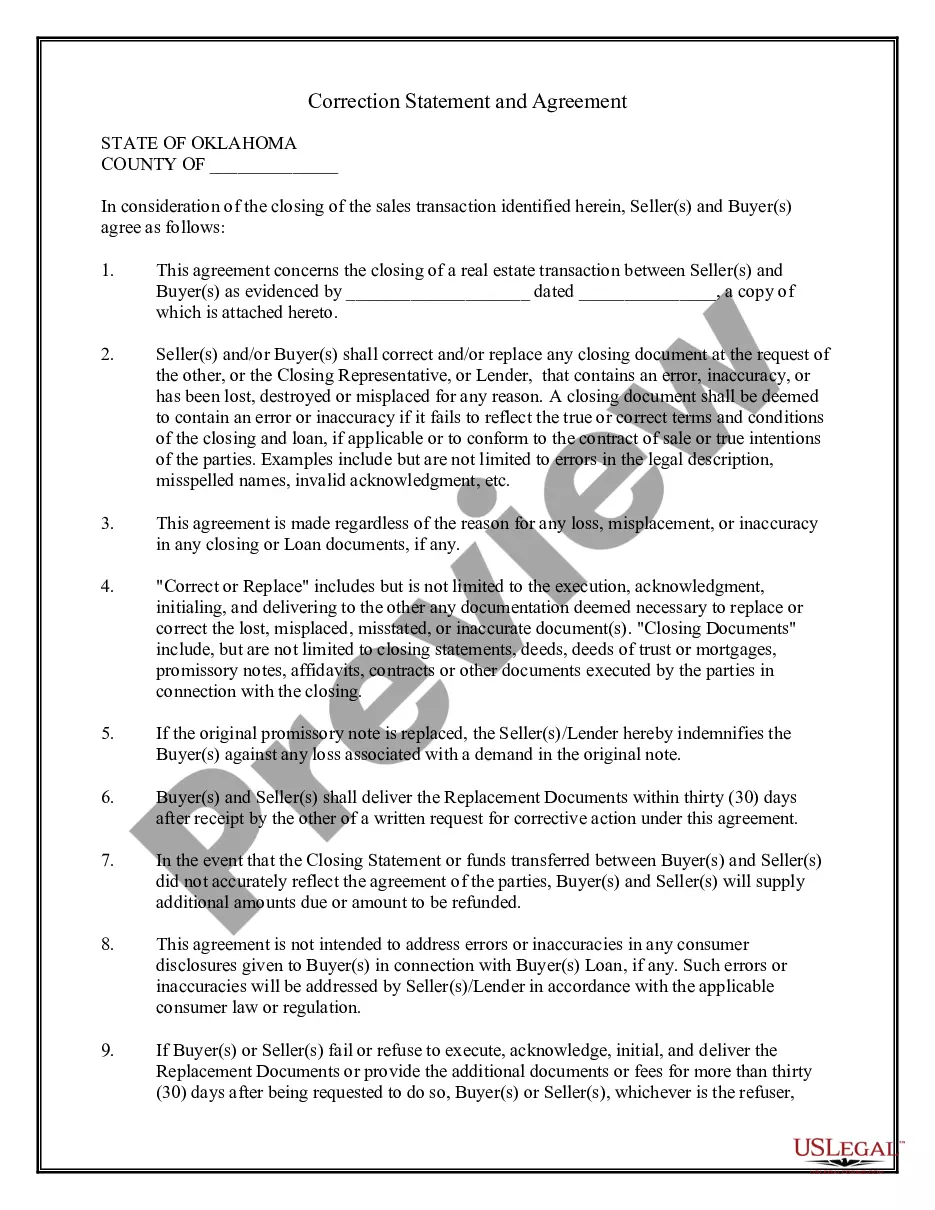

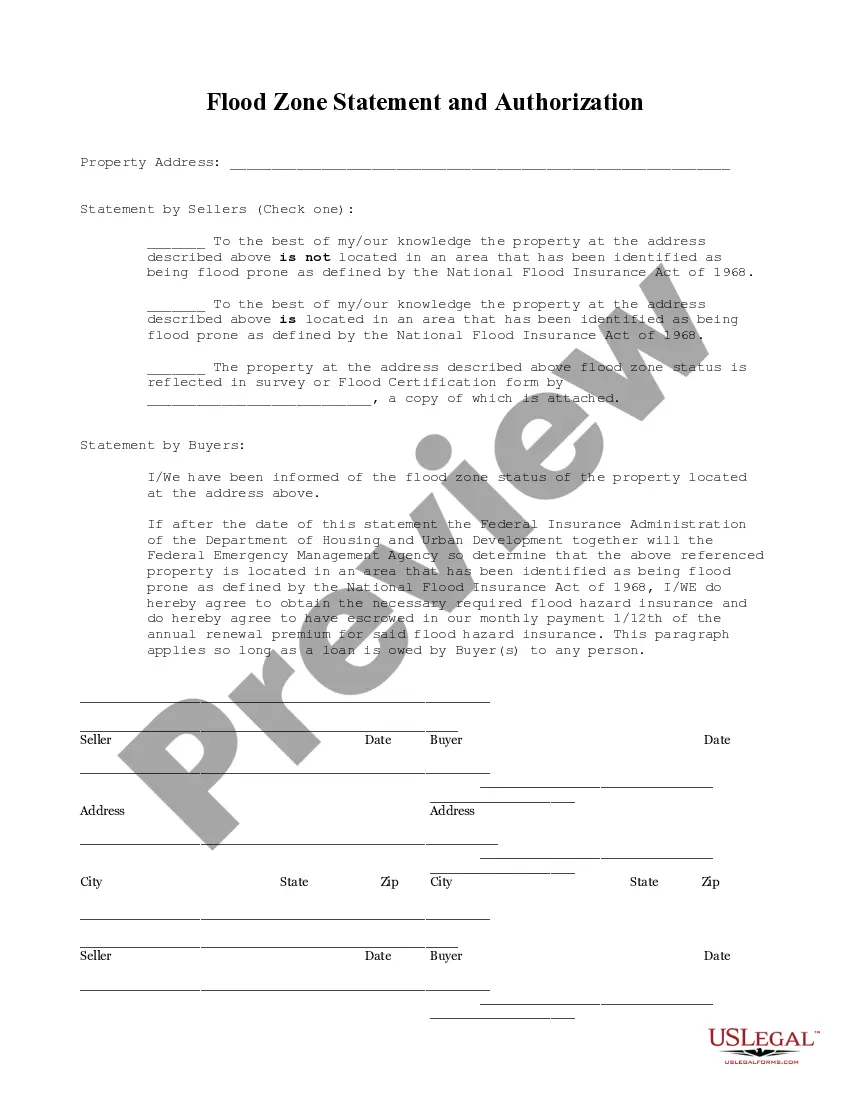

The Release of Judgment Lien is a legal document that allows the owner of real property to formally remove a judgment lien that has been placed against them. This form signifies the full satisfaction of a judgment by the creditor and eliminates any related claims on the property. It is essential for ensuring that the property can be sold or refinanced without the encumbrance of the judgment lien, distinguishing it from similar forms that may not explicitly address lien releases.

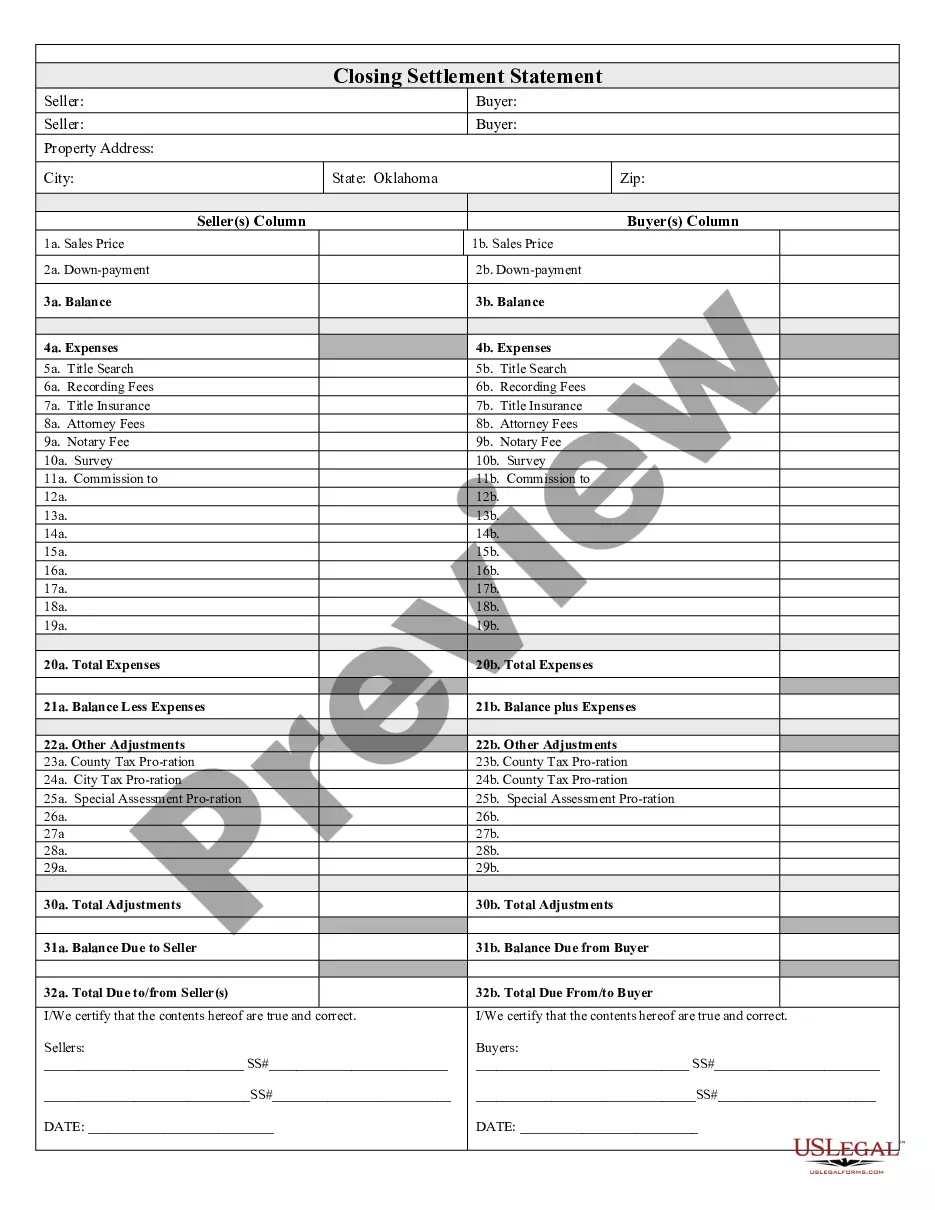

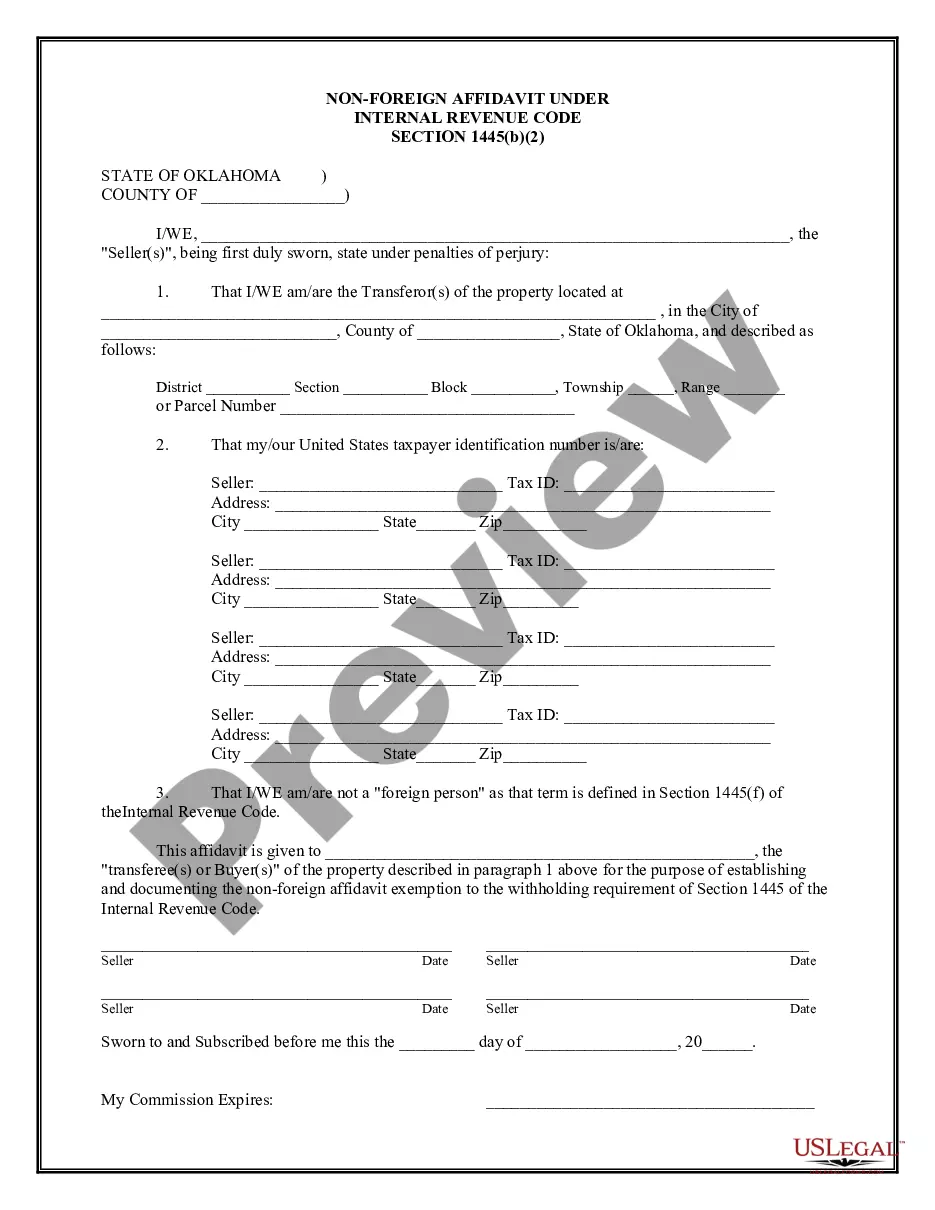

Main sections of this form

- Name and address of the judgment creditor.

- Name and address of the judgment debtor.

- Date of the judgment and its cause number.

- Style of the case and court information.

- Details of the abstract of judgment recording.

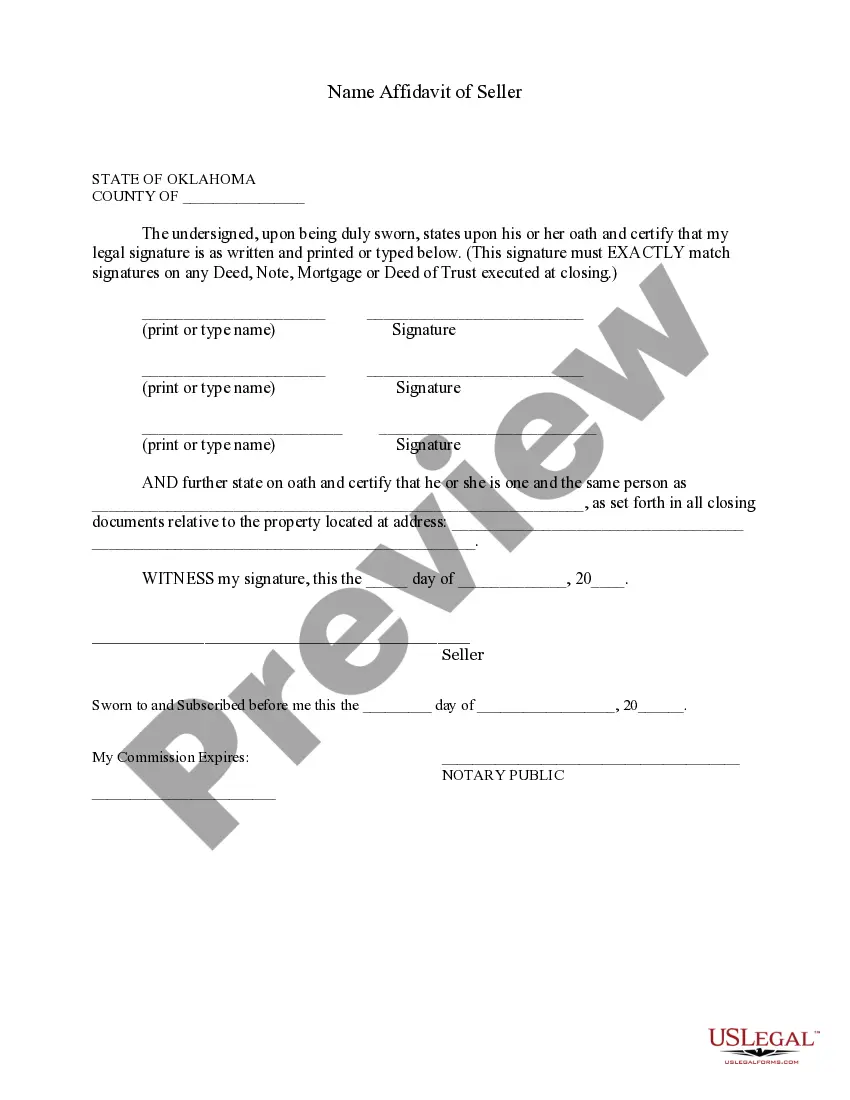

- Signature and acknowledgment by the judgment creditor.

- Notary acknowledgment section.

When to use this document

This form should be used when a judgment creditor has received full payment or satisfaction for a judgment against a debtor. It is particularly relevant during property transactions where a lien's presence could hinder the sale or refinancing of the property. Using this form promptly ensures that any restrictions on the property are lifted, facilitating smoother transactions.

Who this form is for

- Judgment creditors who want to release a lien after payment has been made.

- Property owners who wish to clear their title for sale or refinancing purposes.

- Real estate professionals assisting with property transactions involving lien issues.

How to complete this form

- Identify and fill in the names and addresses of the judgment creditor and debtor.

- Enter the date of the judgment and the corresponding cause number.

- Provide the style of the case and the court information where the judgment was registered.

- Document the abstract of judgment recording information.

- Have the judgment creditor sign the form to acknowledge satisfaction of the judgment.

- Complete the notary acknowledgment section, if required, to validate the document.

Does this document require notarization?

This form must be notarized to be legally valid. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes to avoid

- Failing to include complete information about the creditor and debtor.

- Not properly signing the document, which can invalidate the release.

- Omitting the necessary court details and cause number.

- Neglecting the notary acknowledgment if required by local law.

Benefits of completing this form online

- Convenient access to professionally drafted legal forms for immediate use.

- Editable fields to customize the document to your specific situation.

- Reliable legal templates created by licensed attorneys, ensuring compliance with legal standards.

Looking for another form?

Form popularity

FAQ

In most cases, getting a judgment release will require you to pay off the debt, including any interest and court costs. Once the final payment is received by the lender, they will issue the judgement release. It is also possible to get a judgement released by making special arrangements with the lender.

If the judgment creditor does not immediately file an Acknowledgement of Satisfaction of Judgment (EJ-100) when the judgment is satisfied, the judgment debtor may make a formal written demand for the creditor to do so. The judgment creditor has 15 days after receiving the debtor's request to serve the acknowledgement.

Request the court to validate the judgment. Verify information provided from the court. Dispute any inaccuracies found. Consider professional help.

In order to vacate a judgment in California, You must file a motion with the court asking the judge to vacate or set aside the judgment. Among other things, you must tell the judge why you did not respond to the lawsuit (this can be done by written declaration).

The debtor must get a discharge or release of the abstract of judgment to remove the lien from the home. Contact the judgment creditor shown on the abstract. Arrange to pay the debt in full or negotiate payments. Ask the creditor for a discharge if paying in full.