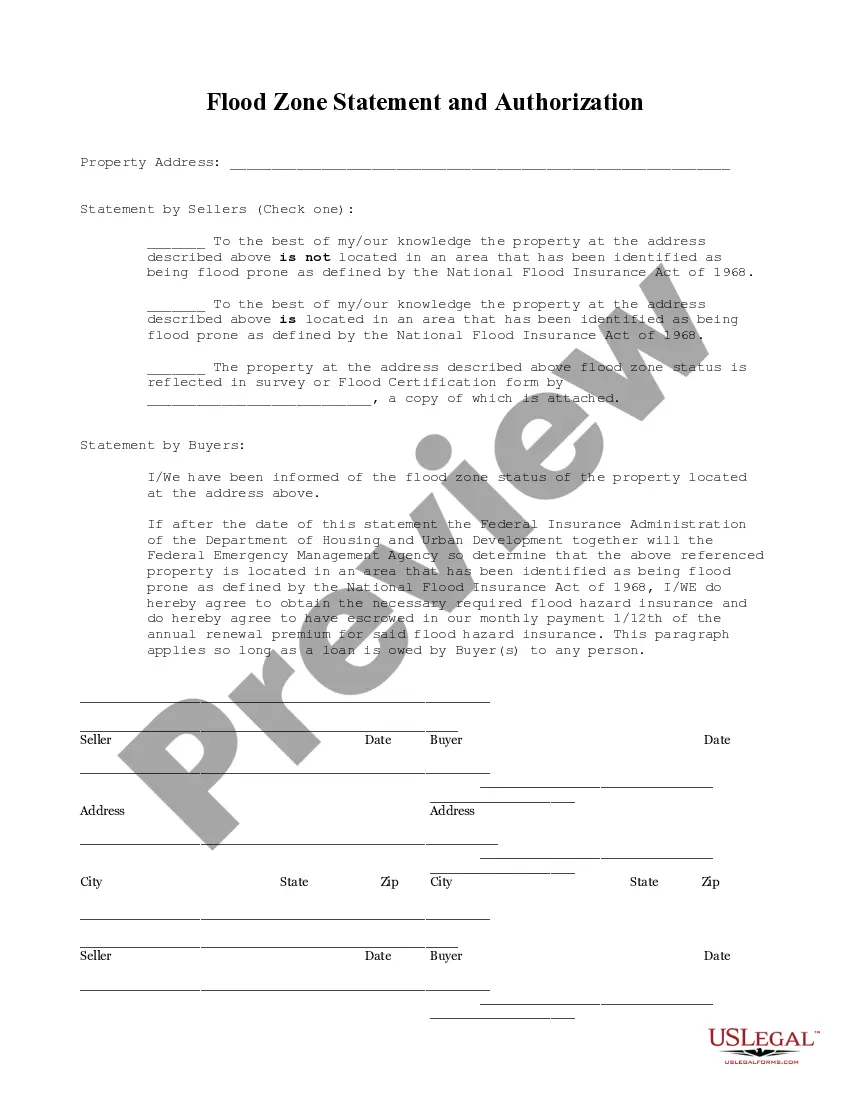

Oklahoma Flood Zone Statement and Authorization

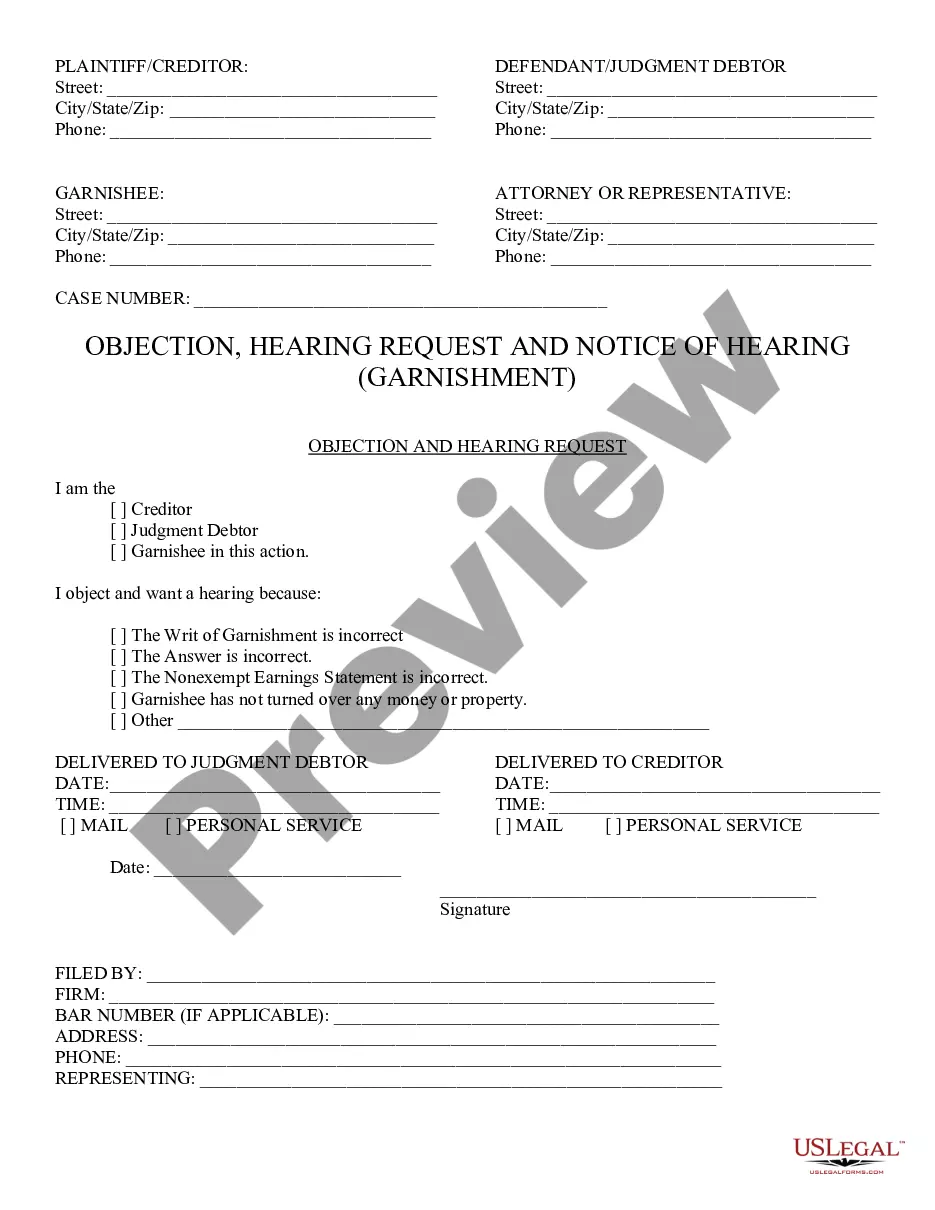

About this form

The Flood Zone Statement and Authorization is a legal document used by property sellers and buyers to disclose and acknowledge the flood zone status of a property. This form is distinctive as it not only confirms whether a property is in a flood-prone area but also requires buyers to agree to obtain flood hazard insurance if the property is later identified as being in such a zone. This ensures transparency and protection for both parties regarding any potential flood risks associated with the property.

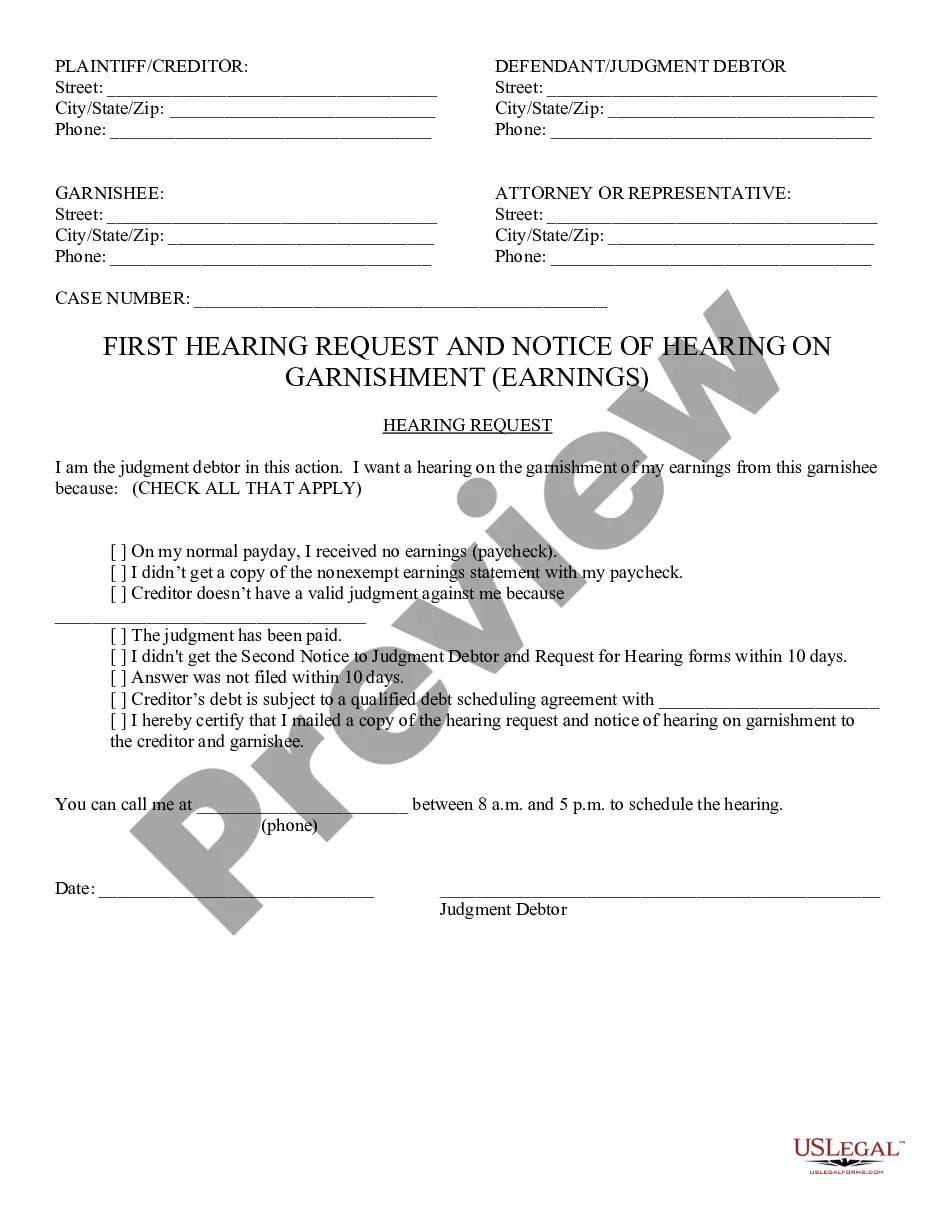

Key parts of this document

- Property Address: Field to specify the exact location of the property.

- Seller's Statement: A declaration by the seller indicating the flood zone status of the property.

- Buyer's Acknowledgment: A section where buyers acknowledge the flood zone status and agree to obtain insurance if required.

- Signature Lines: Areas for both the seller and buyer to sign and date the document.

When to use this form

This form should be used during real estate transactions when a property is being sold. It is particularly important for properties located in areas that may be flood-prone, as it helps ensure that buyers are aware of any flood risks and are prepared to obtain flood insurance if necessary. Utilizing this form can prevent disputes related to flooding issues after the sale is completed.

Who should use this form

- Property sellers who need to disclose the flood zone status of their property.

- Home buyers who wish to confirm the flood zone status before completing the purchase.

- Real estate agents and brokers facilitating property sales that may involve flood risks.

Instructions for completing this form

- Identify the property by entering the full address in the designated field.

- Check the applicable statement regarding the flood zone status of the property.

- If necessary, reference any attached survey or Flood Certification form.

- Have both the seller and the buyer sign and date the form to acknowledge their understanding and agreement.

- Ensure that addresses and pertinent information are accurately filled in to avoid any legal issues.

Does this document require notarization?

Notarization is not commonly needed for this form. However, certain documents or local rules may make it necessary. Our notarization service, powered by Notarize, allows you to finalize it securely online anytime, day or night.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes to avoid

- Failing to accurately disclose the flood zone status of the property.

- Not attaching the necessary survey or Flood Certification form if the property is in a flood zone.

- Leaving signature or date fields incomplete, which can render the document invalid.

Why use this form online

- Convenience of downloading and completing the form at any time.

- Editability allows you to tailor the form to your specific transaction needs.

- Access to reliable legal templates drafted by licensed attorneys for accuracy and compliance.

Looking for another form?

Form popularity

FAQ

Zone A. Zone A is the flood insurance rate zone that corresponds to the I-percent annual chance floodplains that are determined in the Flood Insurance Study by approximate methods of analysis.

Built-in-compliance grandfathering: Grandfathering is also available after the new flood map's effective date, but only for properties that were built in compliance with the floodplain regulations at the time of construction. This is known as built in compliance grandfathering and requires additional documentation.

1Your local floodplain manager: Your local floodplain manager may already have a certificate on file.2The seller of your property: If you're buying a property, the sellers may already have the certificate, and you can ask them for it before purchasing.What Is An Elevation Certificate for Flood Insurance? - ValuePenguin\nwww.valuepenguin.com > elevation-certificate-flood-insurance

A number of factors are considered when determining your flood insurance premium. These factors include: the amount and type of coverage being purchased, location and flood zone, and the design and age of your structure.

Evidence of flood insurance Completed and executed NFIP Flood Insurance Application PLUS a copy of the Borrower's premium check or agent's paid receipt.

A variance is a grant of relief by a participating community from the terms of its floodplain management regulations. If no variance was granted, a statement to that effect signed by the applicant or the applicant's representative is required.

NFIP Direct facilitates the issuance and administration of NFIP insurance policies on behalf of the Federal Emergency Management Agency (FEMA), an agency of the Department of Homeland Security.NFIP Direct currently consists of approximately 650,000 active policies distributed by a network of more than 30,000 agents.

You may file a flood insurance appeal directly to the Federal Emergency Management Agency (FEMA), the federal agency that oversees the National Flood Insurance Program (NFIP). On appeal, FEMA will work with you and your insurer to gather the claim facts, review the policy, and provide an appeal decision.