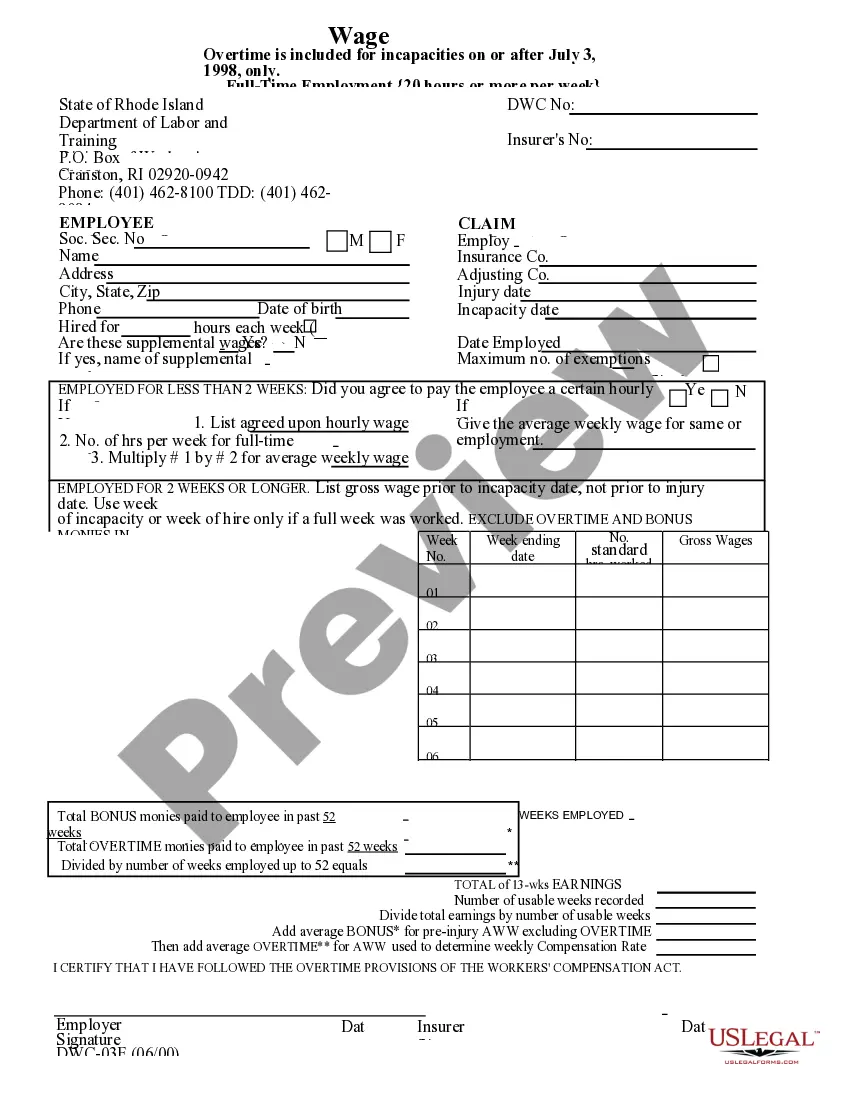

Rhode Island Wage Transcript

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

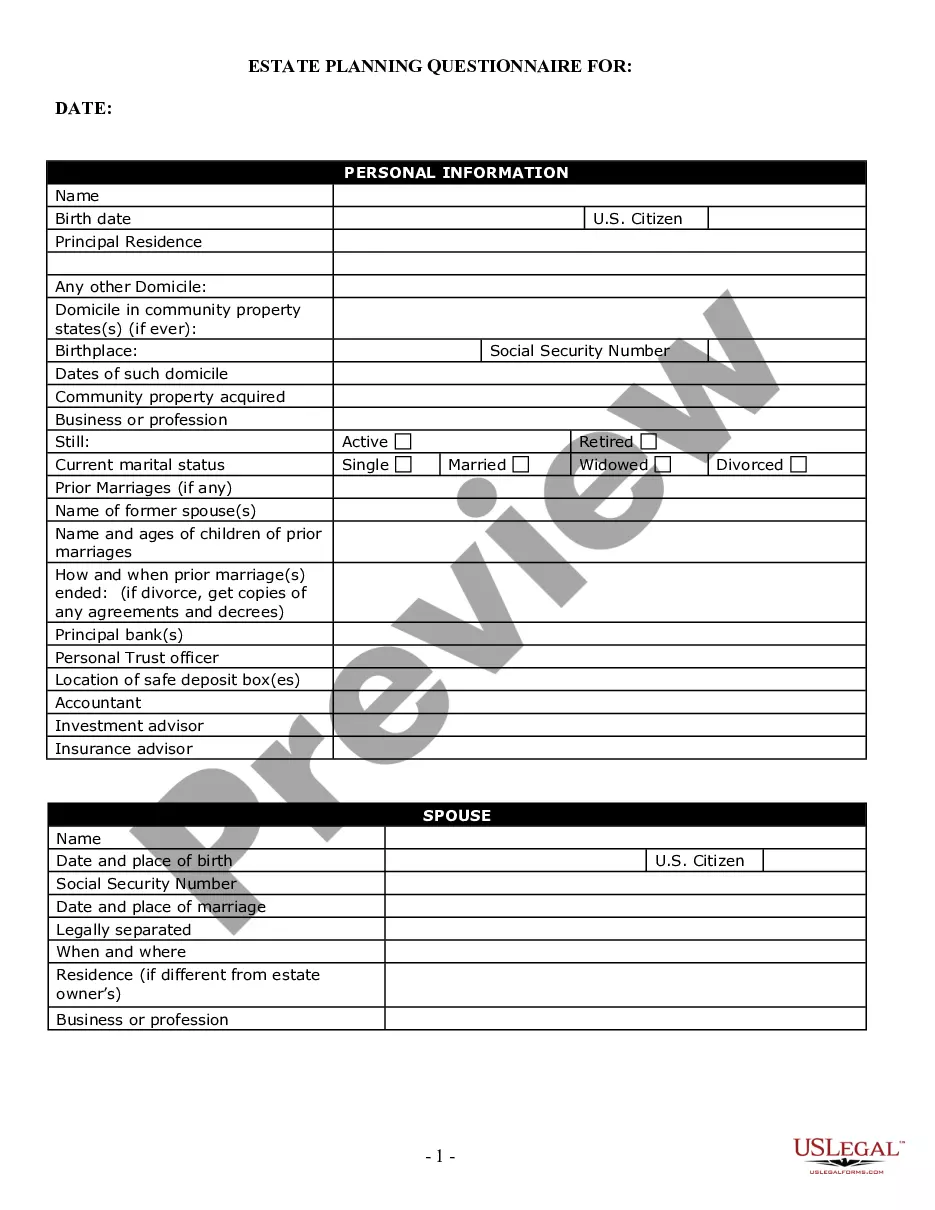

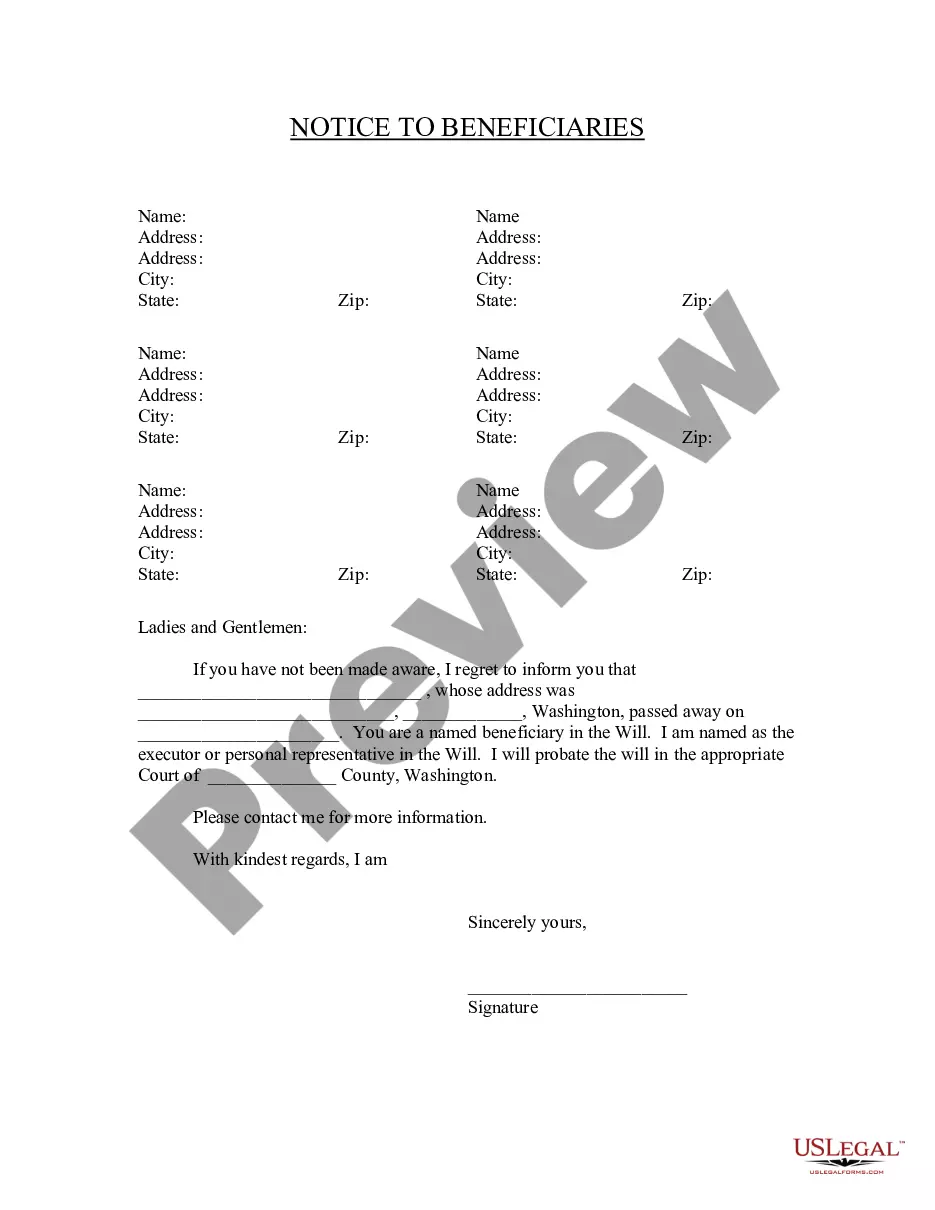

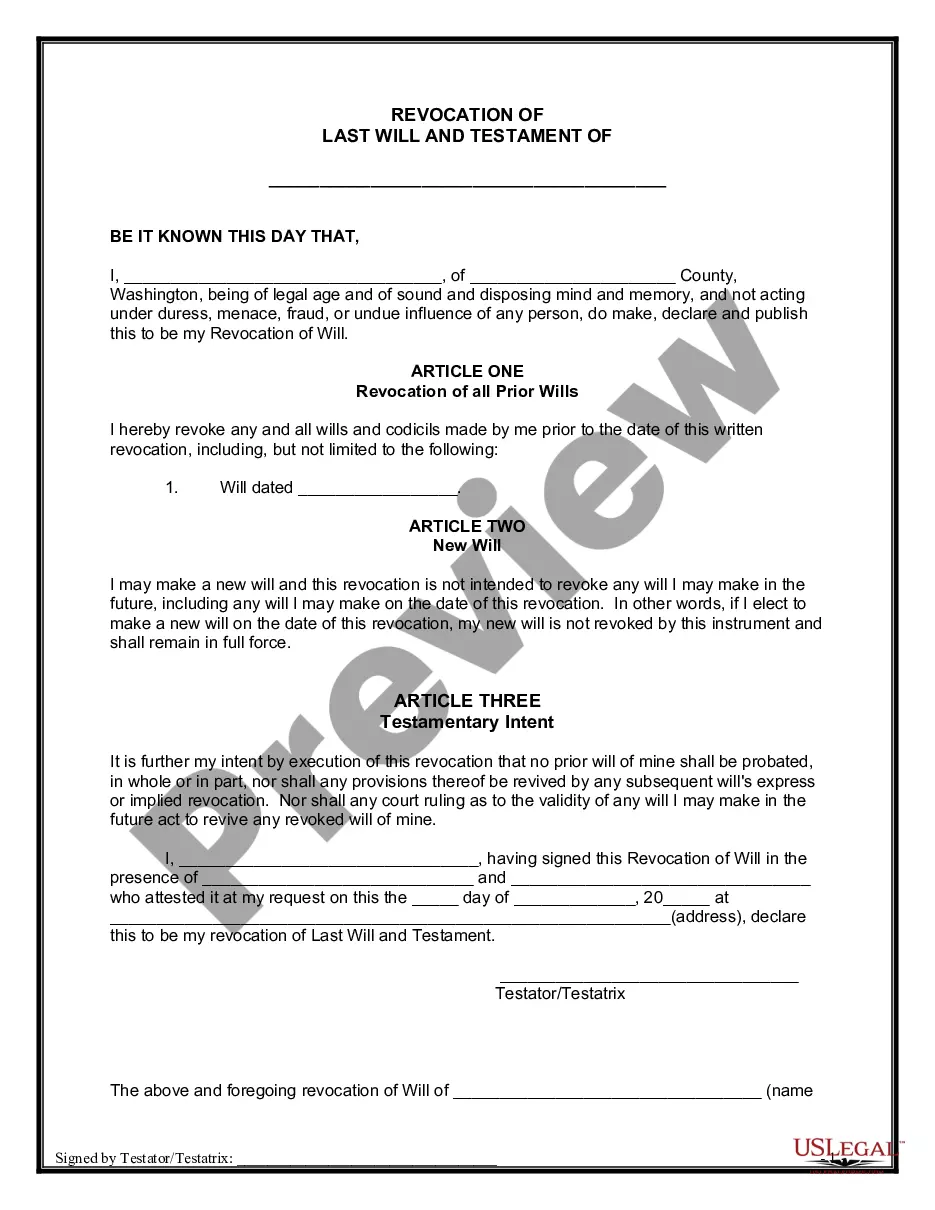

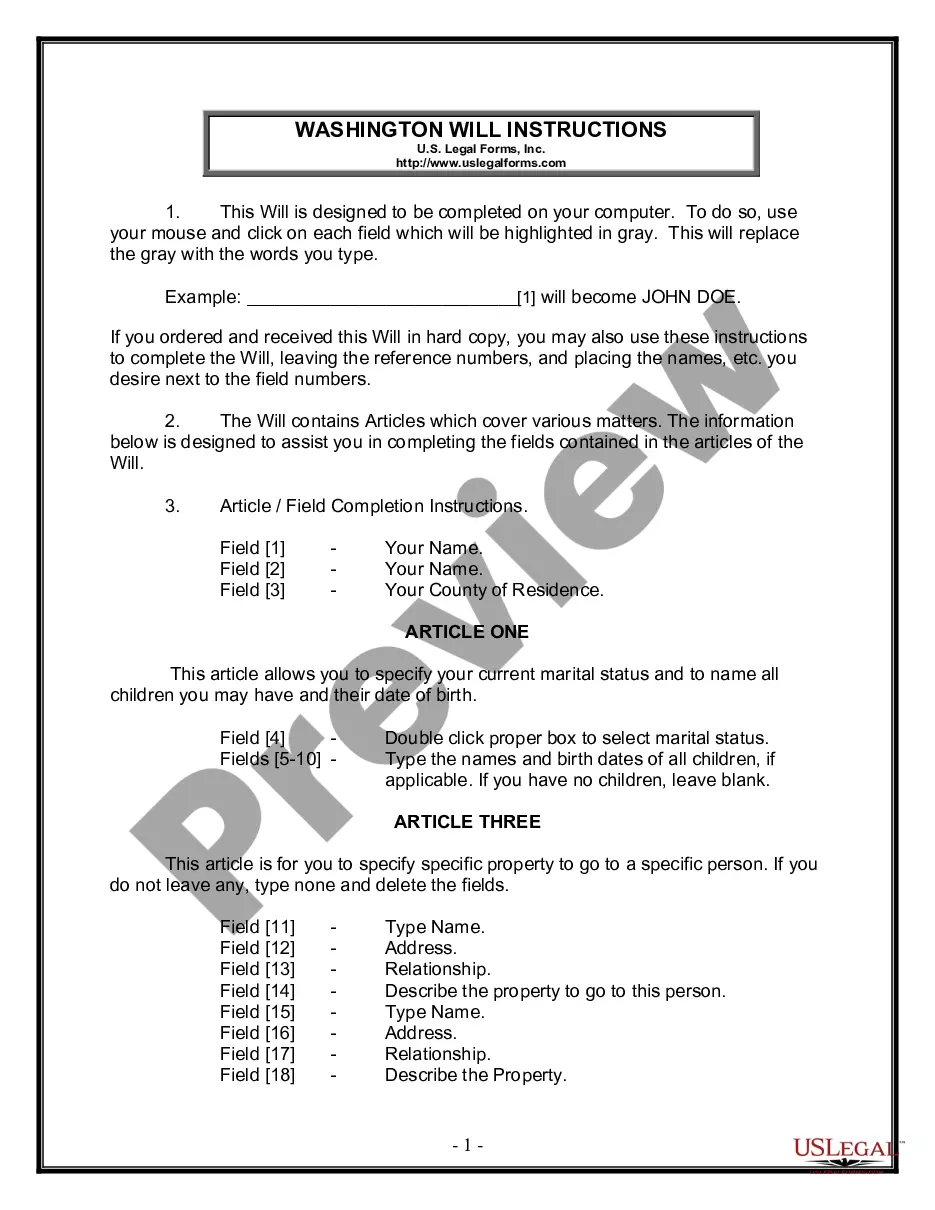

How to fill out Rhode Island Wage Transcript?

Use US Legal Forms to obtain a printable Rhode Island Wage Transcript. Our court-admissible forms are drafted and regularly updated by professional attorneys. Our’s is the most extensive Forms library on the internet and offers reasonably priced and accurate samples for consumers and attorneys, and SMBs. The templates are categorized into state-based categories and some of them might be previewed prior to being downloaded.

To download samples, customers need to have a subscription and to log in to their account. Press Download next to any form you want and find it in My Forms.

For those who don’t have a subscription, follow the following guidelines to quickly find and download Rhode Island Wage Transcript:

- Check out to ensure that you get the right template in relation to the state it is needed in.

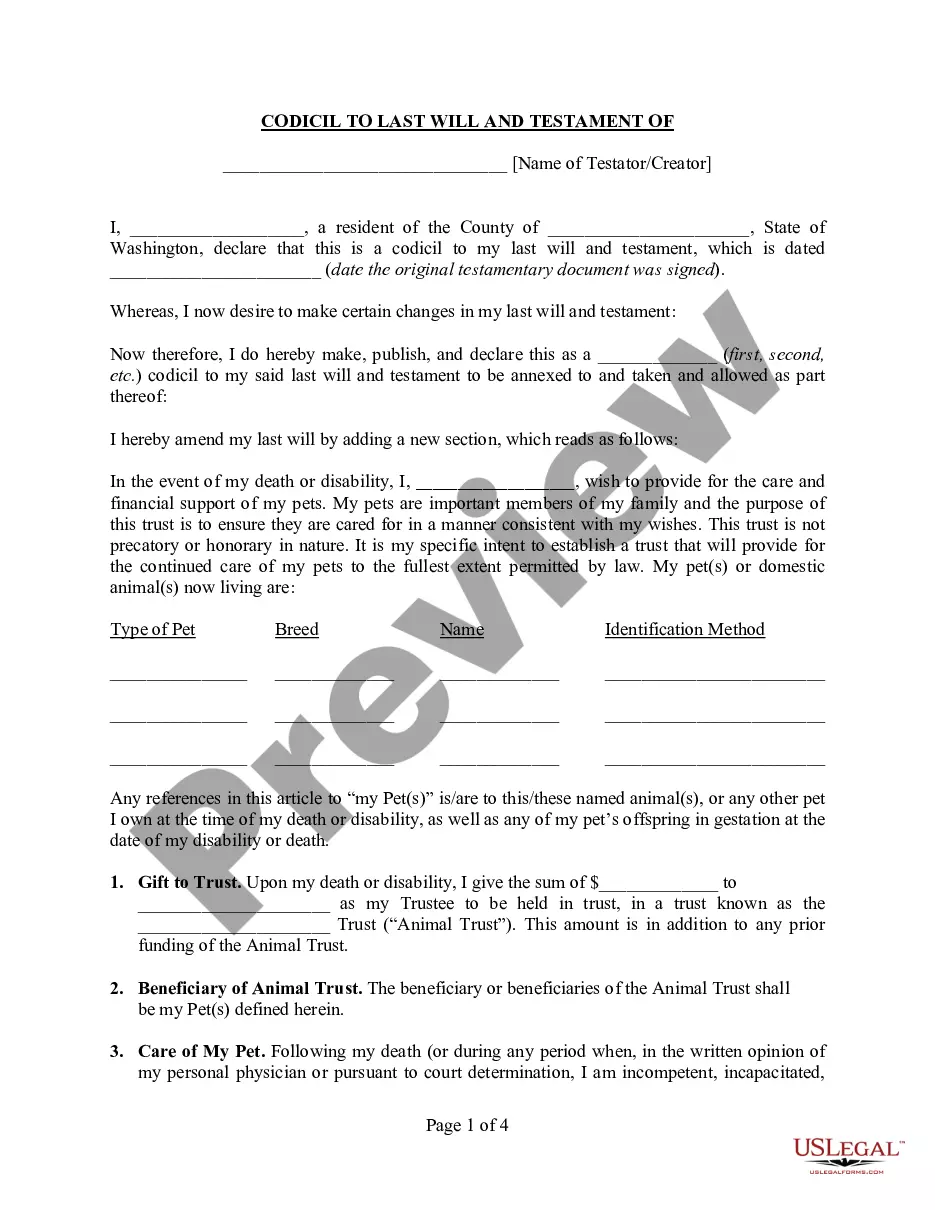

- Review the document by reading the description and by using the Preview feature.

- Hit Buy Now if it’s the template you want.

- Create your account and pay via PayPal or by card|credit card.

- Download the form to the device and feel free to reuse it many times.

- Use the Search field if you need to find another document template.

US Legal Forms offers a large number of legal and tax templates and packages for business and personal needs, including Rhode Island Wage Transcript. More than three million users already have utilized our platform successfully. Select your subscription plan and have high-quality forms in a few clicks.

Form popularity

FAQ

Raising the federal minimum wage to $15 per hour would increase wages for 17 million U.S. workers, according to the Congressional Budget Office. Another 10 million additional workers earning slightly above $15 per hour would be affected.

NY minimum wage for general workers 31, 2020, the general hourly minimum wage in New York is: $15 in New York City (As it has been since Dec. 31, 2019) $14 in Westchester County and on Long Island (Up from $13)

On October 1, 2020, the Rhode Island minimum wage increased to $11.50, up from $10.50. Governor Gina Raimondo signed the bill raising the wage into law in March 2020. An estimated 25,000 to 30,000 Rhode Islanders earn the minimum wage, according to the state's Department of Labor and Training.

Most recently, Florida voted during the November elections to increase the state's minimum wage to $15 per hour by 2026.

The state Senate on Wednesday moved Rhode Island closer to a $15-an-hour minimum wage. In the end, after extending the timeline, the senators voted 30 to 6 to raise the state's minimum wage from $11.50 an hour in stages from $12.25 on Jan. 1, 2022, to $13 on Jan. 1, 2023, to $14 a year on Jan.

As part of the Spending Review 2020, Chancellor of the Exchequer, Rishi Sunak, announced that, as per the Low Pay Commission's (LPC) recommendations, which were made at the end of October 2020, the National Living Wage (NLW) and National Minimum Wage (NMW) rates will increase from April 1 2021.

Employers subject to the Fair Labor Standards Act must pay the current Federal minimum wage of $7.25 per hour.

Beginning October 1, 2020, the minimum wage that employers must pay Rhode Island employees increases to $11.50 per hour.