Oklahoma Closing Statement

Understanding this form

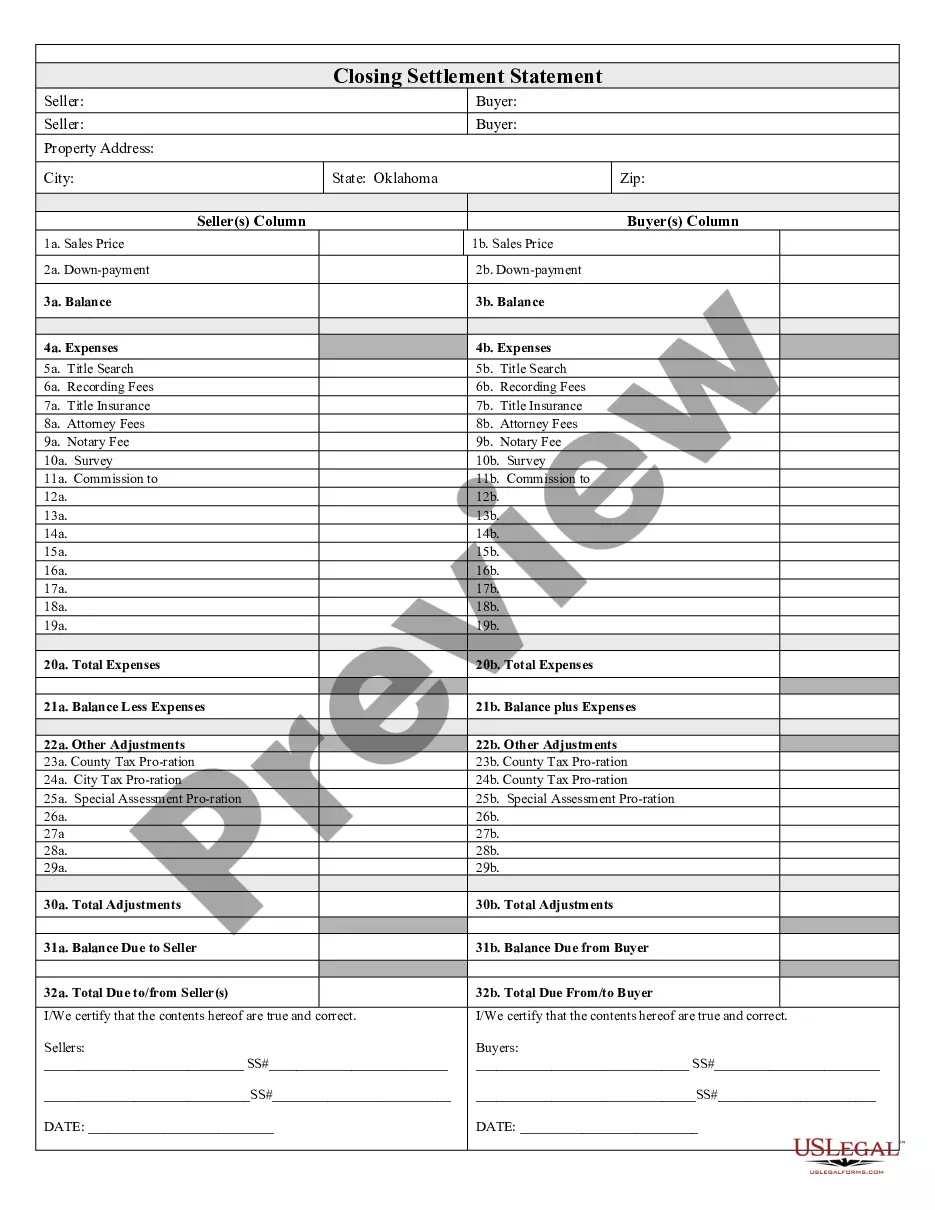

The Closing Statement is a crucial document used in real estate transactions, particularly for cash sales or transactions that involve owner financing. This form outlines the financial details pertaining to the sale, including total expenses, the balance due to or from the parties involved, and any adjustments that may be necessary. Unlike other real estate documents, the Closing Statement provides an itemized account of all costs, ensuring transparency for both the seller and the buyer.

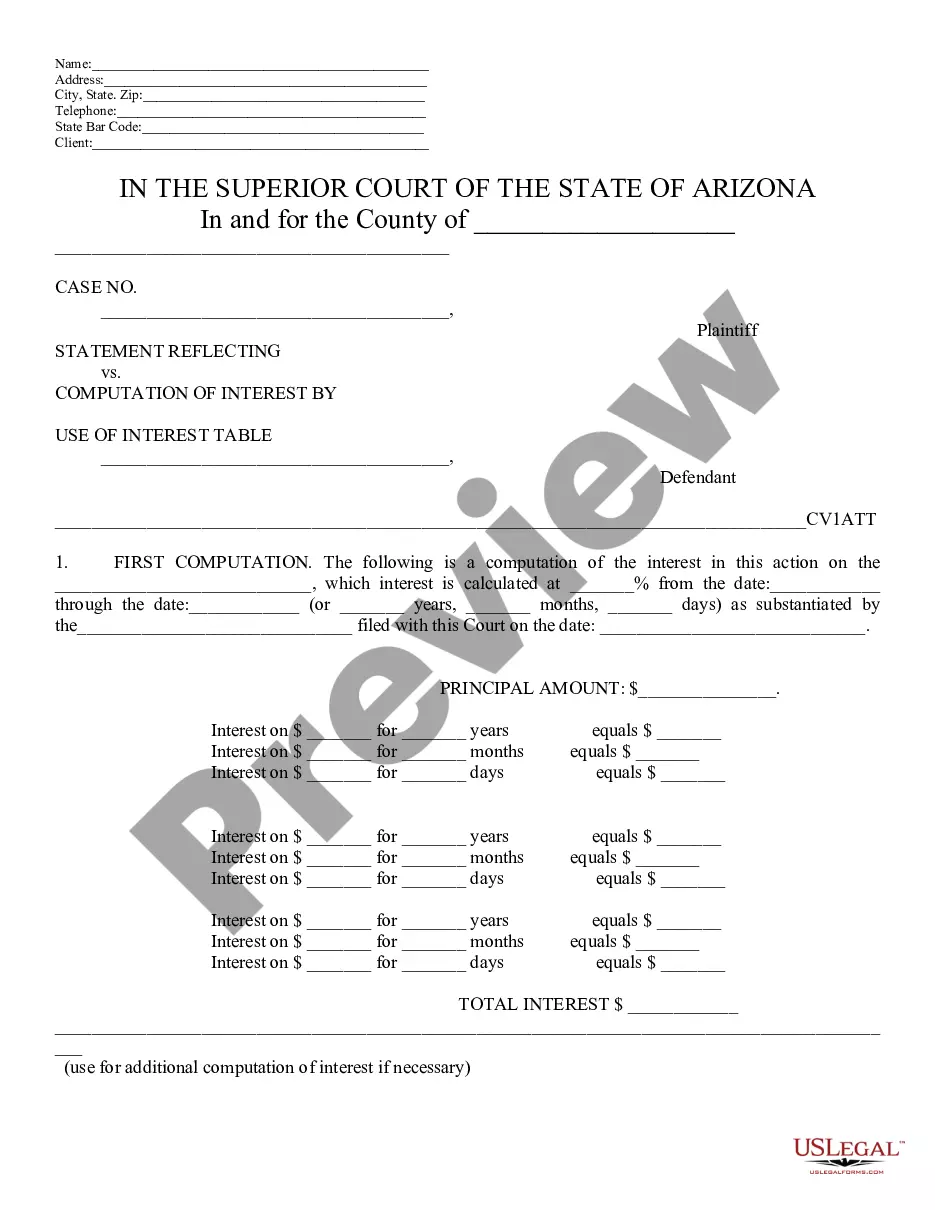

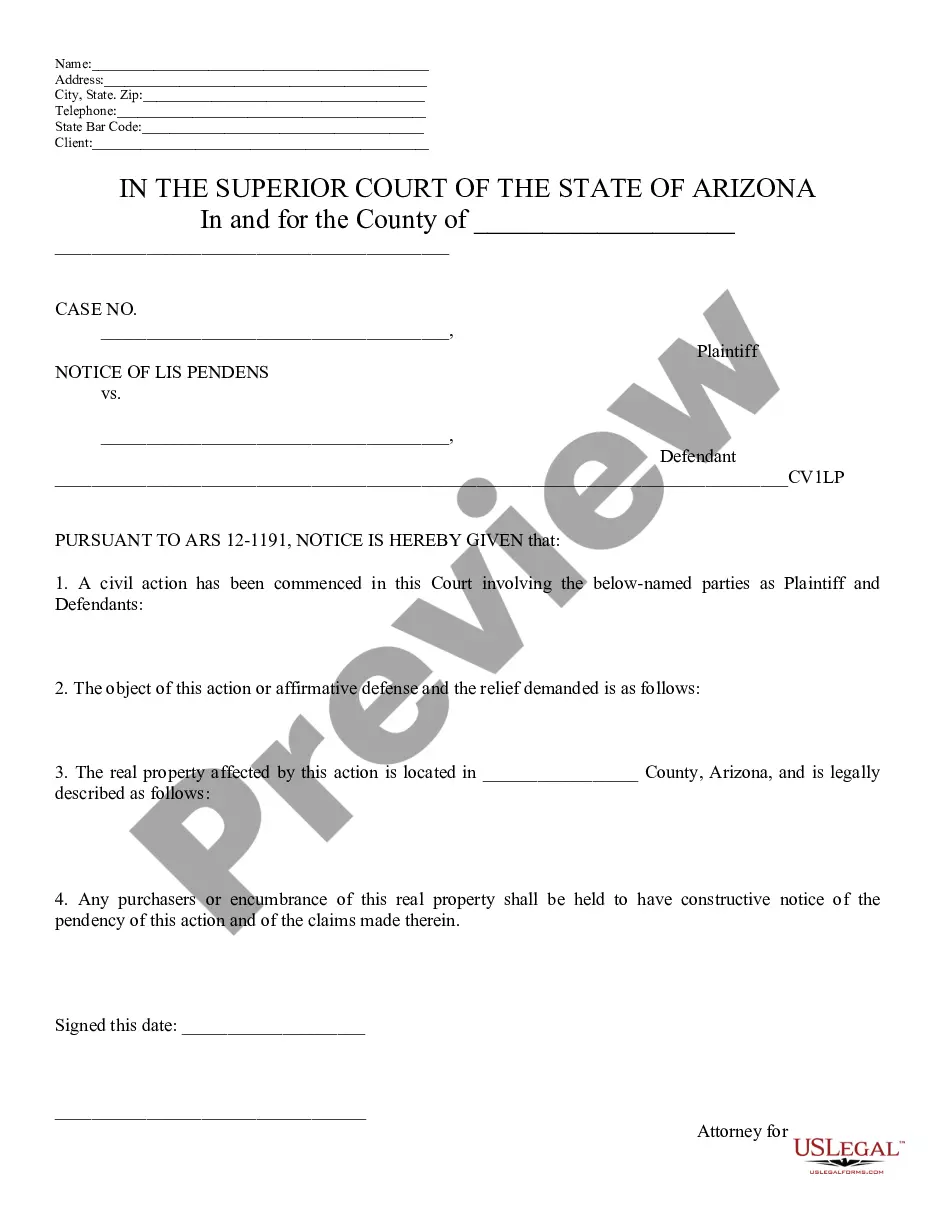

Key components of this form

- Section for listing total expenses and associated costs of the transaction.

- Details on title search, recording fees, and title insurance.

- Fields to account for attorney fees, notary fees, and any special assessments.

- Sections that calculate overall balances due to/from the seller and buyer.

- Area for signatures from both the seller and the buyer to certify the accuracy of the document.

When to use this form

This form is used during the closing phase of a real estate transaction. You should complete the Closing Statement when a property is sold for cash or under owner financing. It's necessary for finalizing the sale, ensuring all expenses and balances are clearly documented and agreed upon by both parties.

Who this form is for

- Home sellers who are finalizing a cash sale or owner-financed transaction.

- Home buyers involved in a cash purchase or owner financing agreement.

- Real estate agents and attorneys managing the transaction process.

Instructions for completing this form

- Identify and enter the names and contact information of the seller(s) and buyer(s).

- Detail the property being sold, including its address and any relevant identifiers.

- Itemize all expenses associated with the transaction in their designated fields.

- Calculate totals involving balances due to or from the seller and buyer, including any necessary tax prorations.

- Ensure all parties sign and date the document, certifying the accuracy of the information provided.

Does this document require notarization?

In most cases, this form does not require notarization. However, some jurisdictions or signing circumstances might. US Legal Forms offers online notarization powered by Notarize, accessible 24/7 for a quick, remote process.

Typical mistakes to avoid

- Failing to include all relevant expenses, which can lead to disputes later.

- Not obtaining signatures from both parties, which renders the document invalid.

- Incorrectly calculating balances due, which can affect the transaction closing.

- Neglecting to consider state-specific regulations that may affect certain fees.

Why use this form online

- Convenient access to customizable templates that can be downloaded immediately.

- Editability ensures you can tailor the form to fit your specific transaction details easily.

- Reliability provides confidence that you are using an attorney-drafted template compliant with legal standards.

Form popularity

FAQ

The Mortgage Promissory Note. The Mortgage / Deed of Trust / Security Instrument. The deed (for property transfer). The Closing Disclosure. The initial escrow disclosure statement. The transfer tax declaration (in some states)

A settlement statement is also known as a HUD-1 form or a closing statement. Until 2015, when the rules changed, this form was provided twice. First, within three business days of applying for a mortgage loan, the borrower receives one in the mail with the person's estimated closing costs.

A closing agent prepares the closing statement, which is settlement sheet. It's a comprehensive list of every expense that the buyer and seller must pay to complete the real estate transaction. Fees listed on this sheet include commissions, mortgage insurance, and property tax deposits.

The HUD-1 settlement statement. The closing agent prepares this accounting of all the money involved in the transaction. Certificate of title. The deed. Loan payoff. Mechanic's liens. Bill of sale. Statement of closing costs. Statement of information.

The most important originals are the purchase agreement, deed, and deed of trust or mortgage. In the event originals are destroyed, you might be able to get certified copies of these documents from the lender or closing company, but you don't want to rely on others' recordkeeping systems unless you have to.

Double-check the loan amount, loan type, loan term, interest rate, monthly payment amount, whether there is a prepayment penalty, whether you are paying points or receiving credits, and other key details. Compare the Annual Percentage Rate (APR) on the Closing Disclosure to the APR listed on your Loan Estimate.

If you live where a title or escrow company agent handles closing and there are two meetings, it's likely that the seller and the seller's agent or attorney will sign paperwork at one meeting and the buyer, accompanied by her agent or attorney, will sign at a separate meeting.

The Deed: public record of the ownership of the property It often includes a description of the property and signed by both parties. Deeds are the most important documents in your closing package because they contain the statement that the seller transfers all rights and stakes in the property to the buyer.

Keys, codes, and garage door openers to the house. Cashier's checks for closing costs and repair credits. Personal checkbook. Time, date, and location of the closing. Government-issued identification. Your writing hand (and maybe your lucky pen)