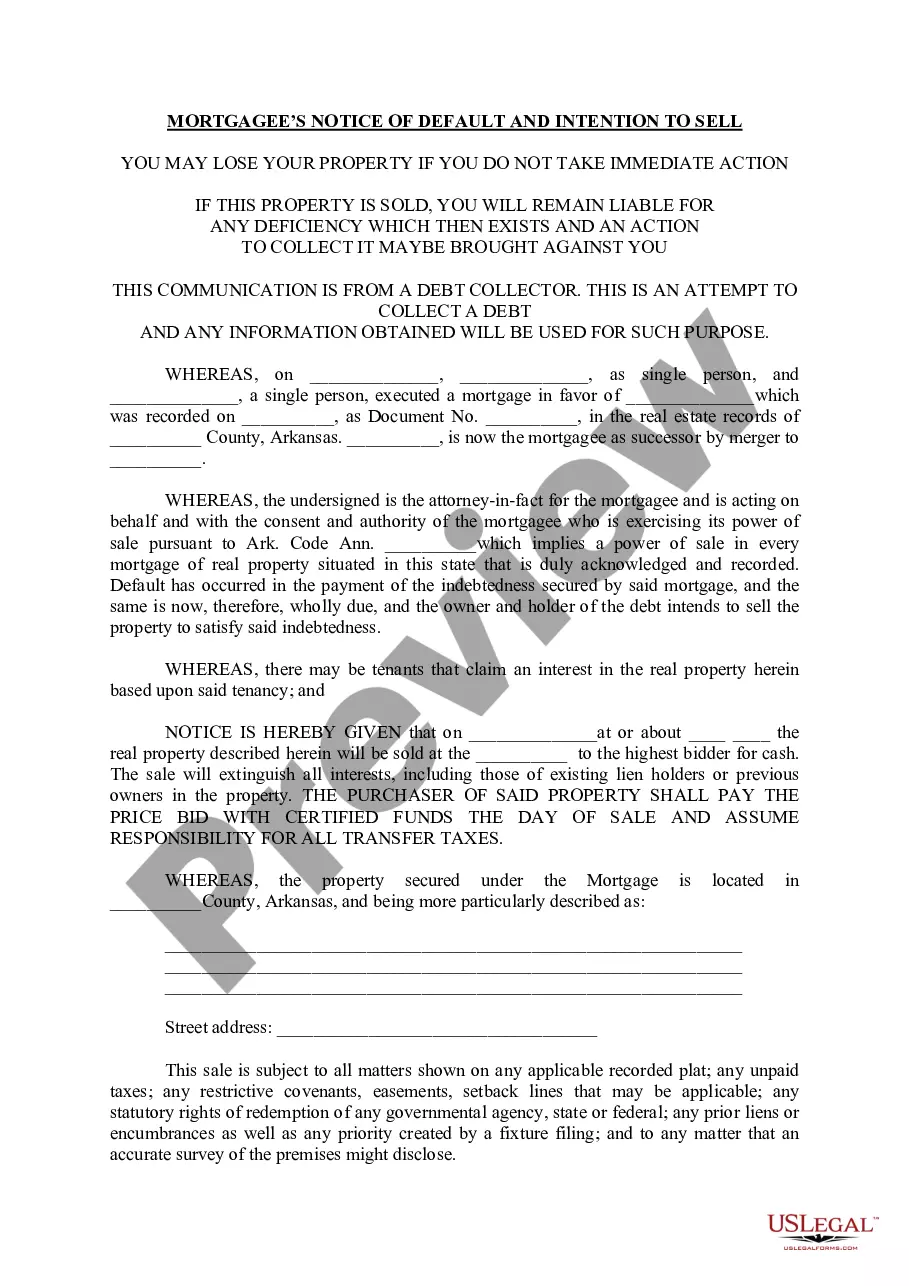

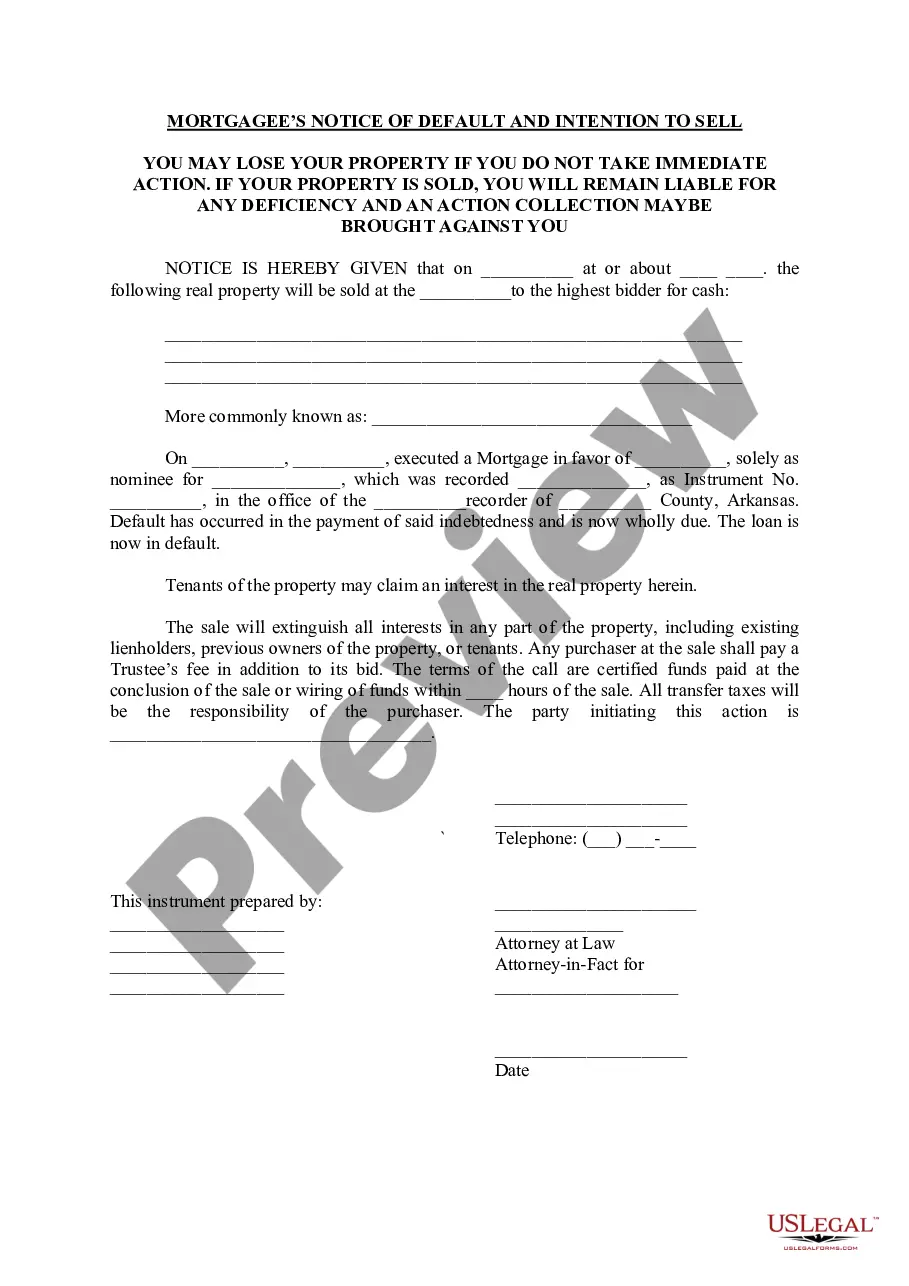

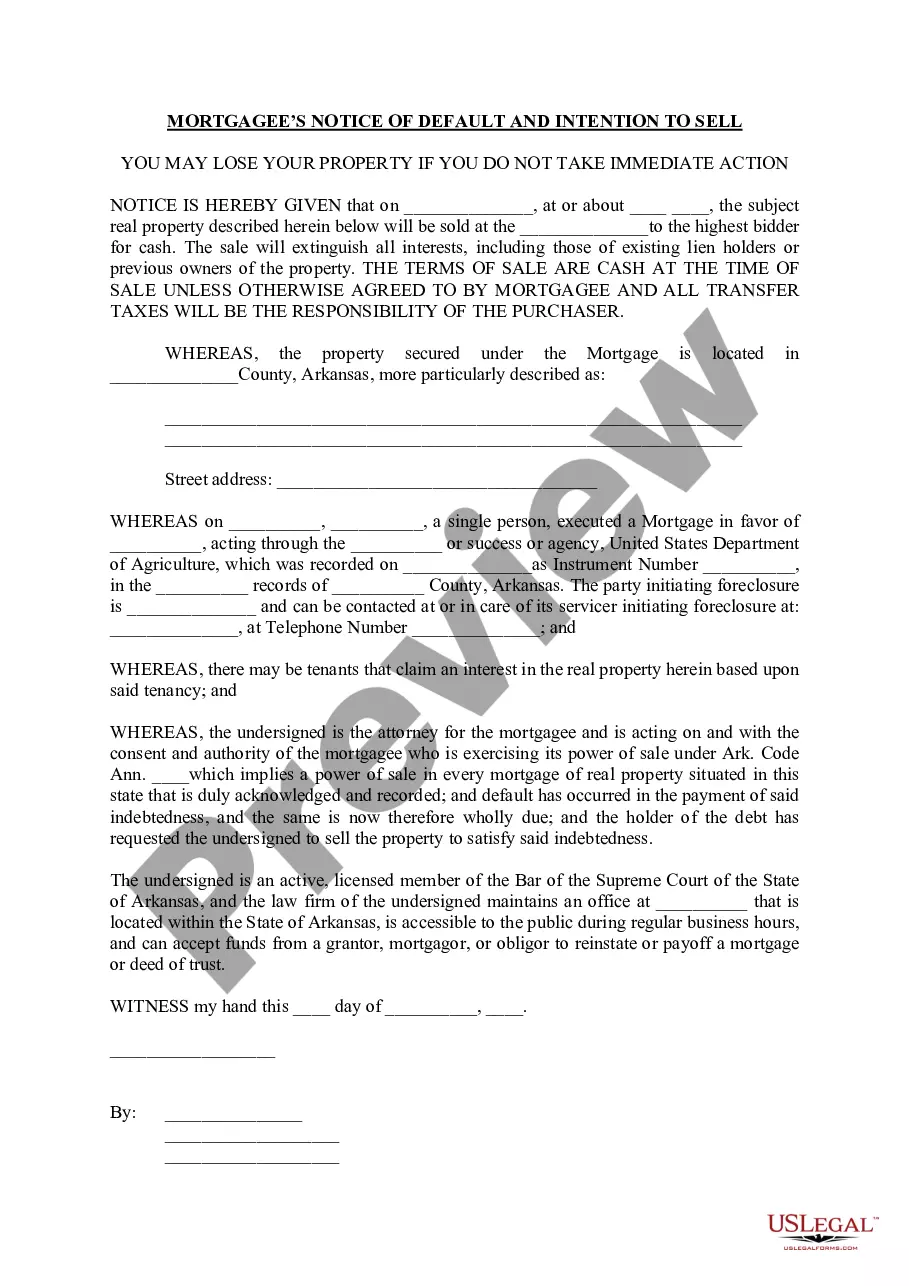

Arkansas Mortgagee's Notice of Default And Intention to Sell

Description

How to fill out Arkansas Mortgagee's Notice Of Default And Intention To Sell?

Utilizing the Arkansas Mortgagee’s Notification of Default And Intent to Sell templates crafted by experienced attorneys helps you avert complications when filling out documents.

Simply obtain the template from our website, complete it, and seek a legal expert to confirm it.

This approach will save you considerably more time and expenses than hiring legal assistance to create a file for you.

Make use of the Preview feature and examine the description (if provided) to determine if this particular sample is necessary, and if so, just click Buy Now.

- If you are already a subscriber to US Legal Forms, just access your account and return to the sample page.

- Locate the Download button adjacent to the template you are reviewing.

- After downloading a document, you will find your saved examples in the My documents section.

- If you do not have a subscription, there is no need for concern.

- Simply follow the instructions below to create an account online, obtain, and complete your Arkansas Mortgagee’s Notification of Default And Intent to Sell template.

- Verify that you are downloading the correct state-specific form.

Form popularity

FAQ

In Arkansas, a lender typically files an Arkansas Mortgagee's Notice of Default And Intention to Sell after three missed payments. However, this can vary depending on the lender's policies. It's crucial to look into your mortgage agreement for specific terms. Ignoring the situation may lead to serious consequences, including foreclosure.

Yes, Arkansas allows a redemption period after foreclosure. Under the Arkansas Mortgagee's Notice of Default And Intention to Sell, homeowners typically have up to one year to redeem the property by paying off the debt. This period offers a crucial opportunity for homeowners to reclaim their property even after a foreclosure sale has been completed.

The foreclosure process in Arkansas begins with the issuance of the Arkansas Mortgagee's Notice of Default And Intention to Sell. This notice informs the homeowner of the default and the intention to proceed with foreclosure. Generally, the lender must follow legal steps, including giving notice, conducting a sale, and allowing a redemption period, all aimed at resolving the mortgage default.

In a foreclosure, the homeowner typically bears the greatest loss, facing potential homelessness and damage to their credit score. Additionally, the lender loses the investment made in the property, especially during the foreclosure process following the Arkansas Mortgagee's Notice of Default And Intention to Sell. Both parties endure financial stresses, highlighting the importance of exploring options early on.

The notice of default doesn't affect your credit file, but when the account defaults this will be recorded.If the debt is regulated by the Consumer Credit Act, you must be sent a default notice warning letter and have time to act on it before the default is recorded on your credit file.

A notice of default is the first step to a bank or mortgage lender's foreclosure process.If the mortgage is not paid up to date, the lender will seize the home. A notice of default is also known as a reinstatement period, notice of public auction, or notice of foreclosure.

A few potential ways to stop a foreclosure include reinstating the loan, redeeming the property before the sale, or filing for bankruptcy. (Of course, if you're able to work out a loss mitigation option, like a loan modification, that will also stop a foreclosure.)

After the lender files the Notice of Default, you get 90 days to bring your past-due bill current. After the 90 days pass, the lender files a Notice of Sale with the clerk. The Notice of Sale displays the location, date and time of the sale. It lists the trustee's name and contact information.

In Arkansas, lenders may foreclose on deeds of trusts or mortgages in default using either a judicial or non-judicial foreclosure process. However, an appraisal of the property must be made prior to the schedule date of foreclosure.