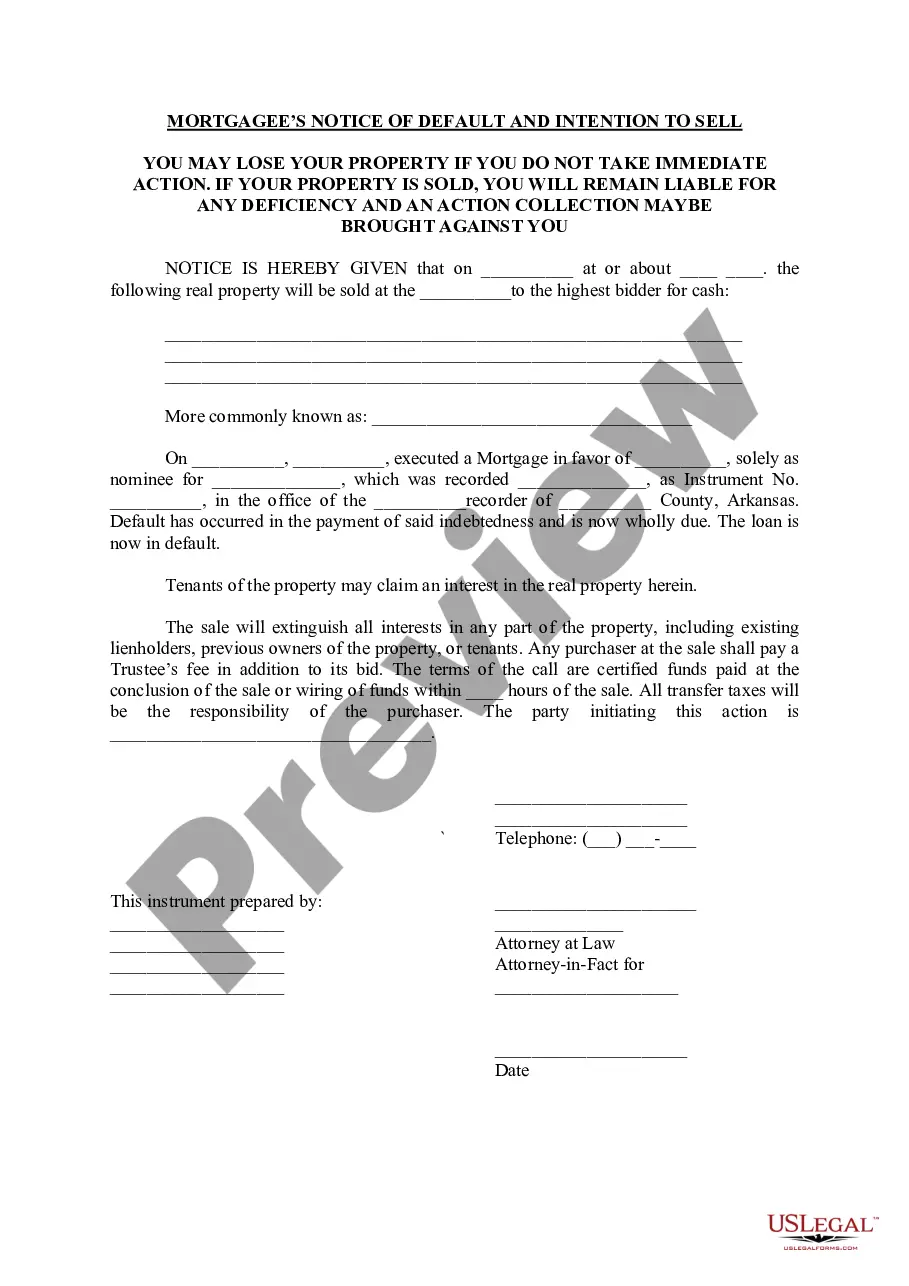

Arkansas Mortgagee's Notice of Default and Intention to Sell

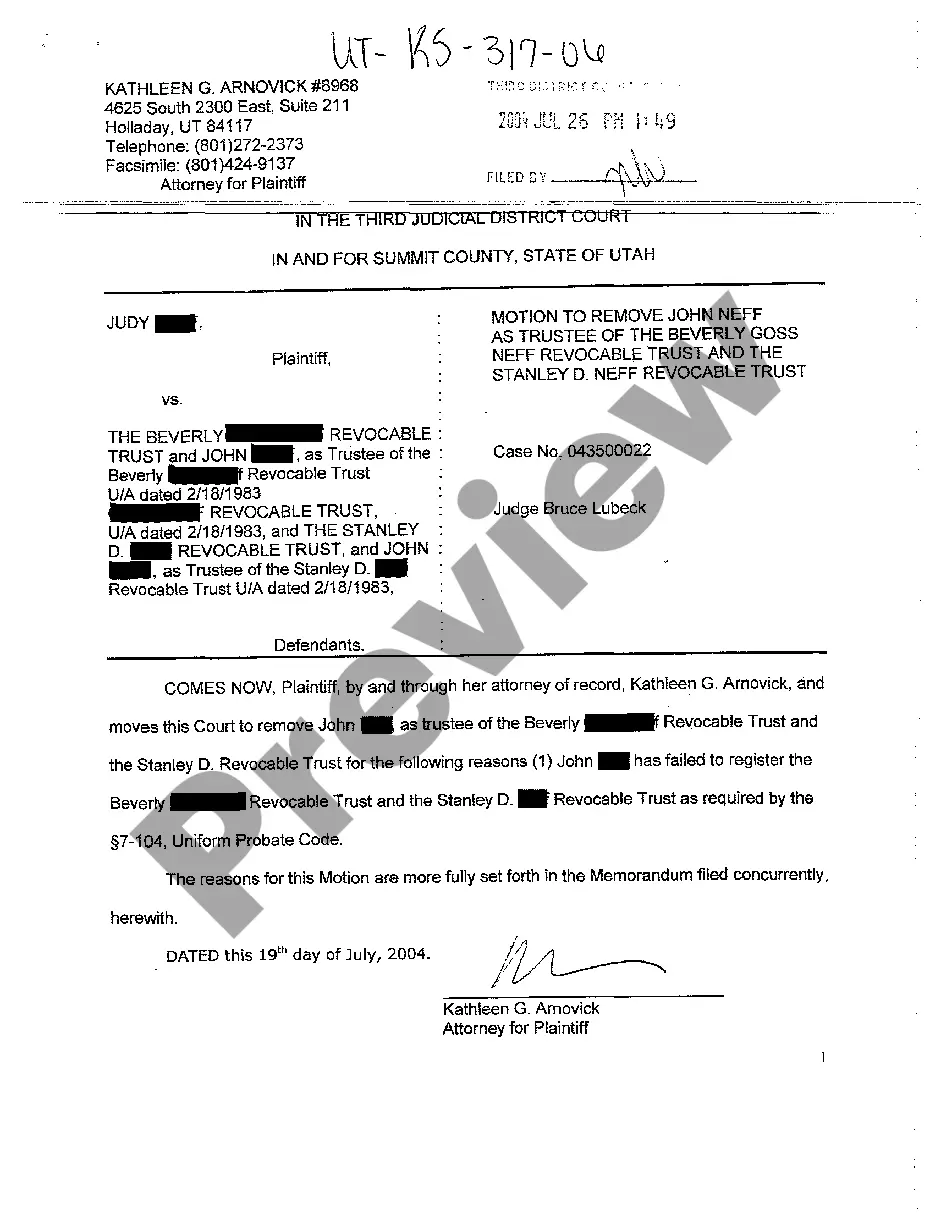

Description

How to fill out Arkansas Mortgagee's Notice Of Default And Intention To Sell?

Employing Arkansas Mortgagee’s Notice of Default and Intention to Sell templates crafted by experienced attorneys provides you the chance to evade complications when filing paperwork.

Simply download the template from our site, complete it, and ask a lawyer to review it. This approach will save you considerably more time and expenses than trying to find legal assistance to create a document tailored to your needs independently.

If you already possess a US Legal Forms subscription, simply Log In to your account and navigate back to the sample page. Locate the Download button adjacent to the templates you are examining. After downloading a document, you will find all of your saved templates in the My documents section.

Once you have completed all the steps mentioned above, you will be able to fill out, print, and sign the Arkansas Mortgagee’s Notice of Default and Intention to Sell template. Remember to verify all entered information for accuracy before submitting or sending it out. Minimize the time devoted to document preparation with US Legal Forms!

- If you do not have a subscription, it’s not an issue. Just adhere to the following step-by-step instructions to create an online account, acquire, and complete your Arkansas Mortgagee’s Notice of Default and Intention to Sell template.

- Verify and ensure that you are obtaining the right state-specific form.

- Utilize the Preview function and check the description (if provided) to determine if this specific example is necessary for you, and if it is, click Buy Now.

- Use the Search bar to find an additional template if needed.

- Select a subscription that aligns with your requirements.

- Proceed with your credit card or PayPal.

- Choose a file format and download your document.

Form popularity

FAQ

A deed in lieu of foreclosure is an alternative to foreclosure where a homeowner voluntarily transfers the property title back to the lender. This option is often pursued when the borrower cannot keep up with payments and wants to avoid the long foreclosure process. By opting for a deed in lieu, you can mitigate potential damage to your credit score and resolve the default status associated with the Arkansas Mortgagee's Notice of Default and Intention to Sell. However, consulting a legal expert is advisable to understand any tax implications or future obligations.

The simplest solution for a foreclosure often lies in proactive communication with your lender. If you have received an Arkansas Mortgagee's Notice of Default and Intention to Sell, taking immediate steps to discuss payment plans or hardship programs can prevent further escalation. You might also consider selling the property willingly before it goes to auction as a practical alternative. Engaging with experts can facilitate a more straightforward resolution tailored to your needs.

The duration of the foreclosure process in Arkansas can vary based on several factors, including the lender's actions and the homeowner's response. Typically, the entire process can take anywhere from a few months to over a year. Once the Arkansas Mortgagee's Notice of Default and Intention to Sell is issued, the timeline largely depends on whether the homeowner takes steps to rectify the situation. Engaging with foreclosure prevention options early can potentially shorten this duration.

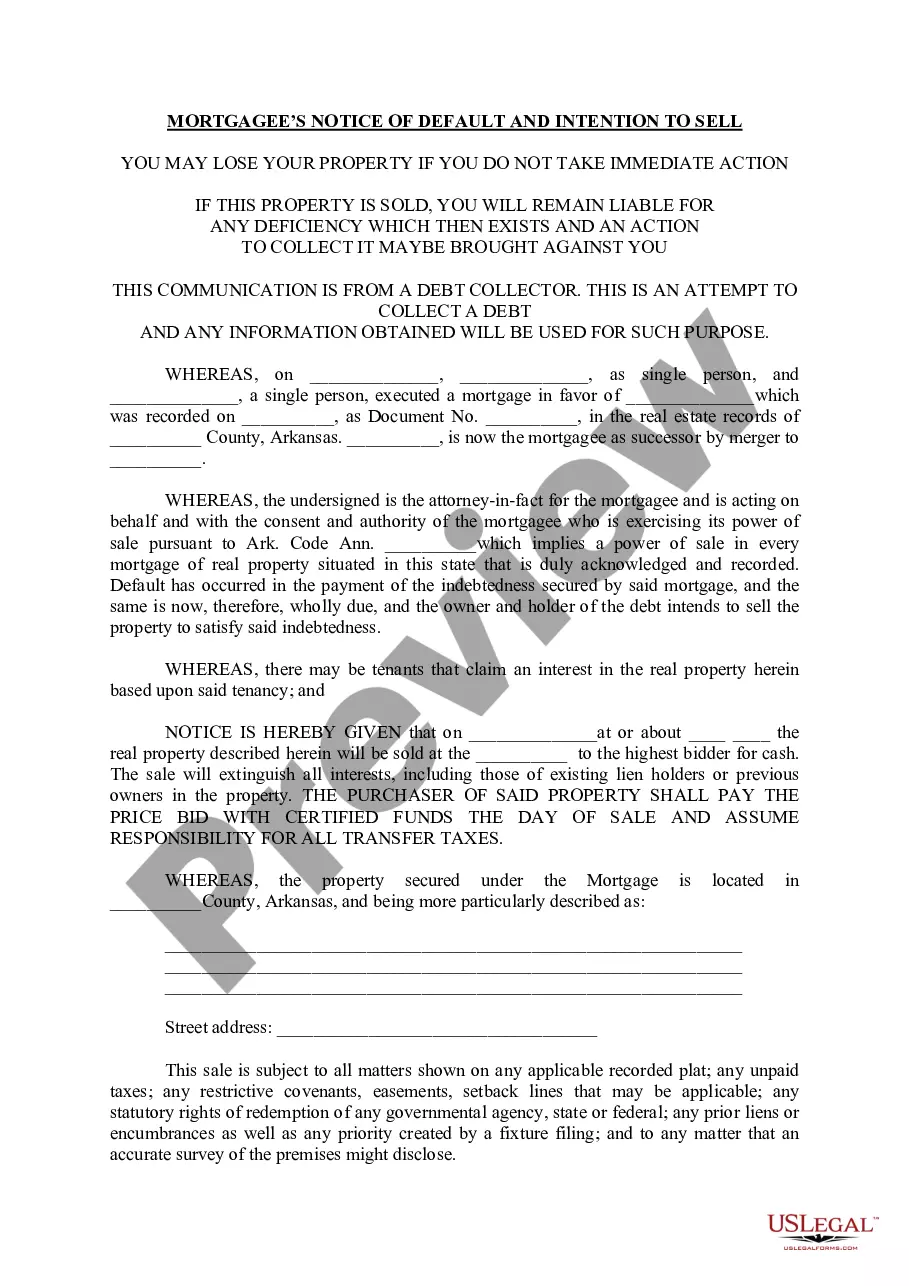

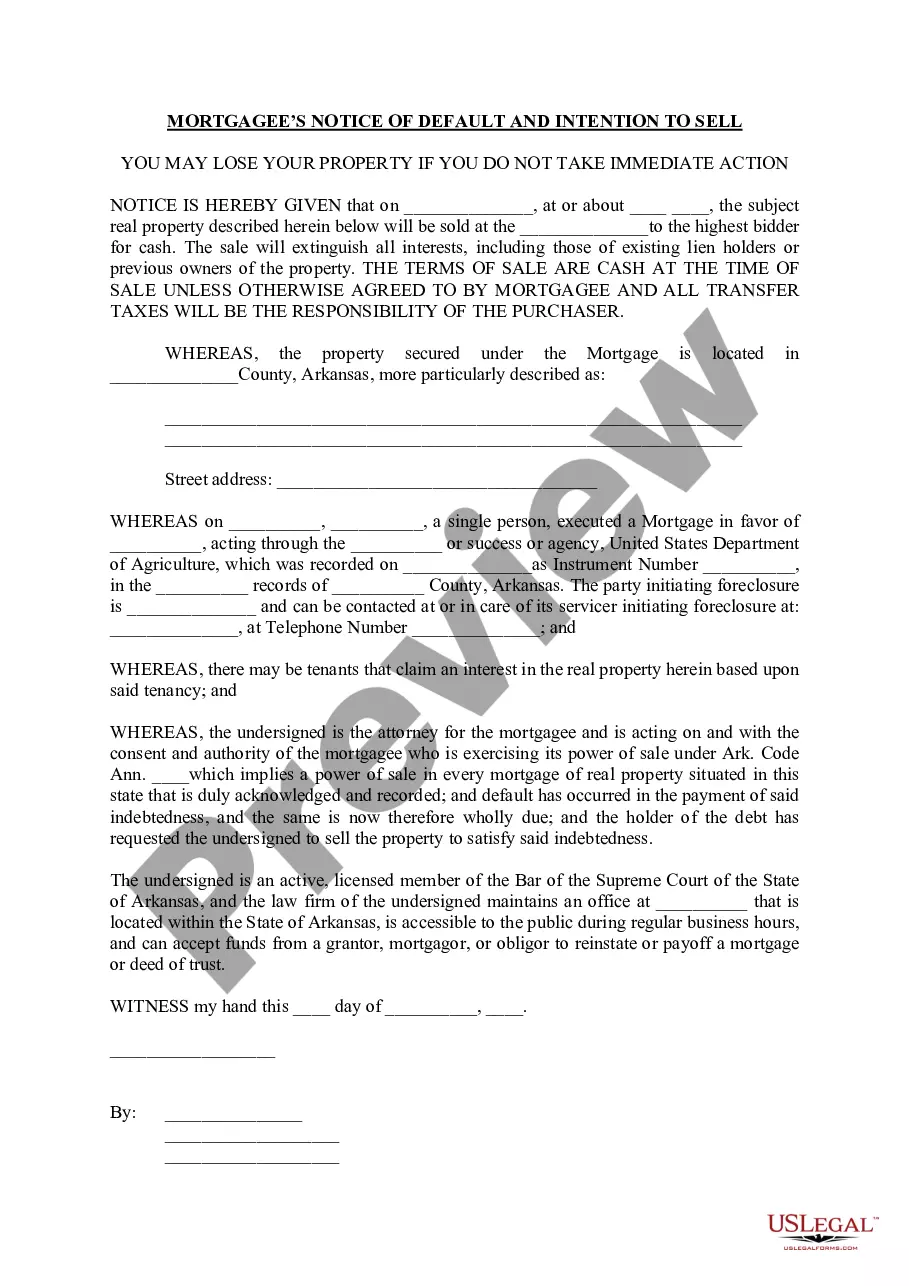

The foreclosure process in Arkansas typically begins with the issuance of the Arkansas Mortgagee's Notice of Default and Intention to Sell. Following this, the lender can proceed with a non-judicial foreclosure, which involves a public auction of the property. Homeowners generally receive at least 30 days' notice before the auction date, allowing them time to seek alternatives or negotiate with lenders. This structured process ensures transparency and provides necessary information to affected homeowners.

In Arkansas, the foreclosure process is governed by state laws that provide specific guidelines for lenders and borrowers. The Arkansas Mortgagee's Notice of Default and Intention to Sell is a critical document that lenders must issue before initiating foreclosure proceedings. This notice informs homeowners of the default status and the lender's intent to sell the property if the debt remains unpaid. Understanding these laws can help homeowners navigate their options and rights.

In a foreclosure, the homeowner usually suffers the most, as they face the loss of their property and significant financial strain. Additionally, foreclosure can negatively impact credit scores, making it harder to secure future financing. Lenders also incur losses, but with the Arkansas Mortgagee's Notice of Default and Intention to Sell, they take steps to recover their investments. Consider consulting resources from USLegalForms to understand your rights and options during foreclosure.

In Arkansas, a mortgagee can issue the Arkansas Mortgagee's Notice of Default and Intention to Sell after a borrower misses a series of payments, typically three. This notice indicates the lender's intention to initiate foreclosure proceedings. It is crucial to address missed payments promptly to avoid reaching this stage. Seeking assistance from a legal professional or using services like USLegalForms can help you navigate the situation effectively.