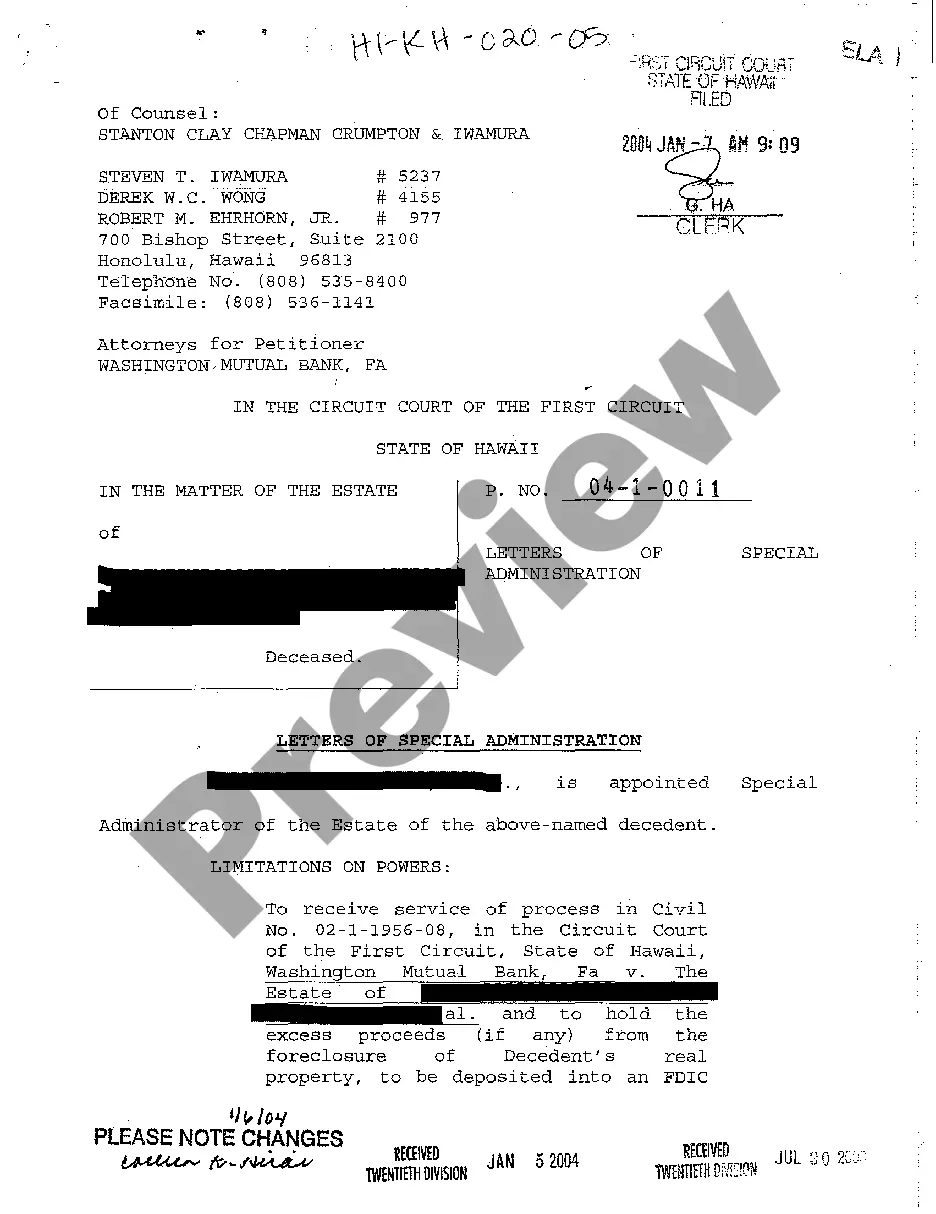

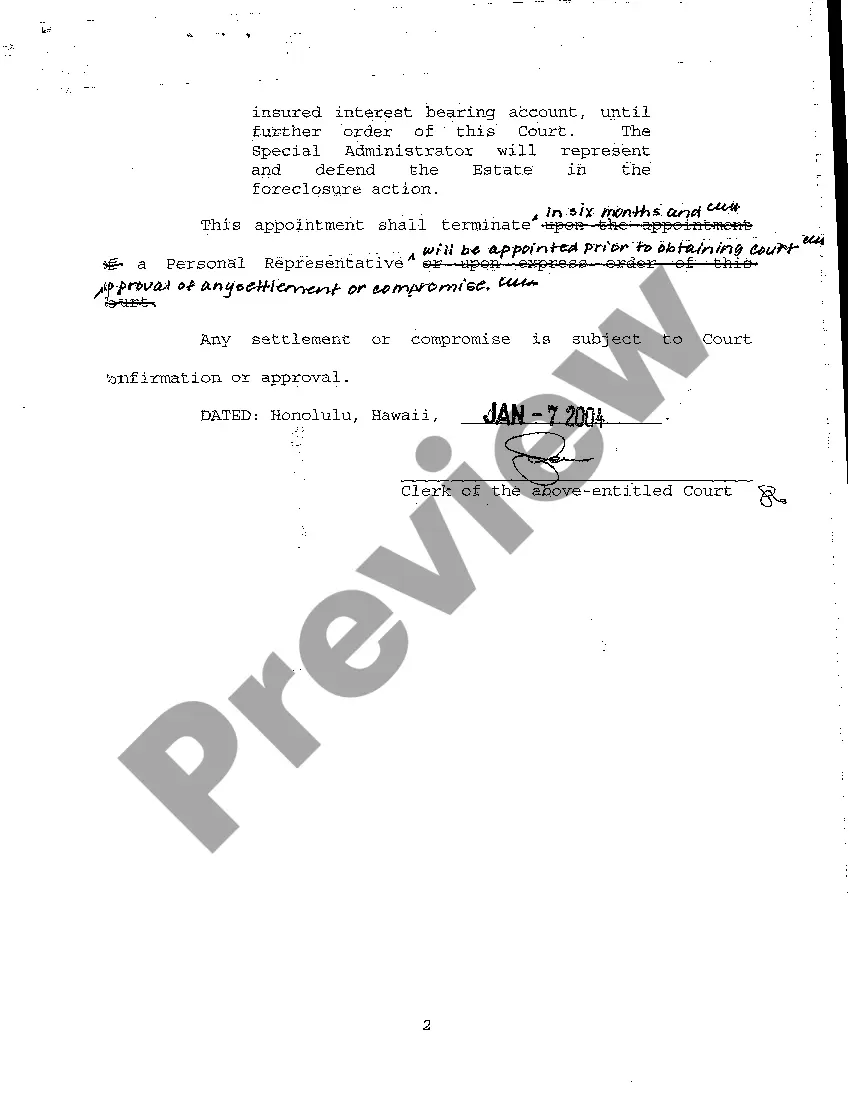

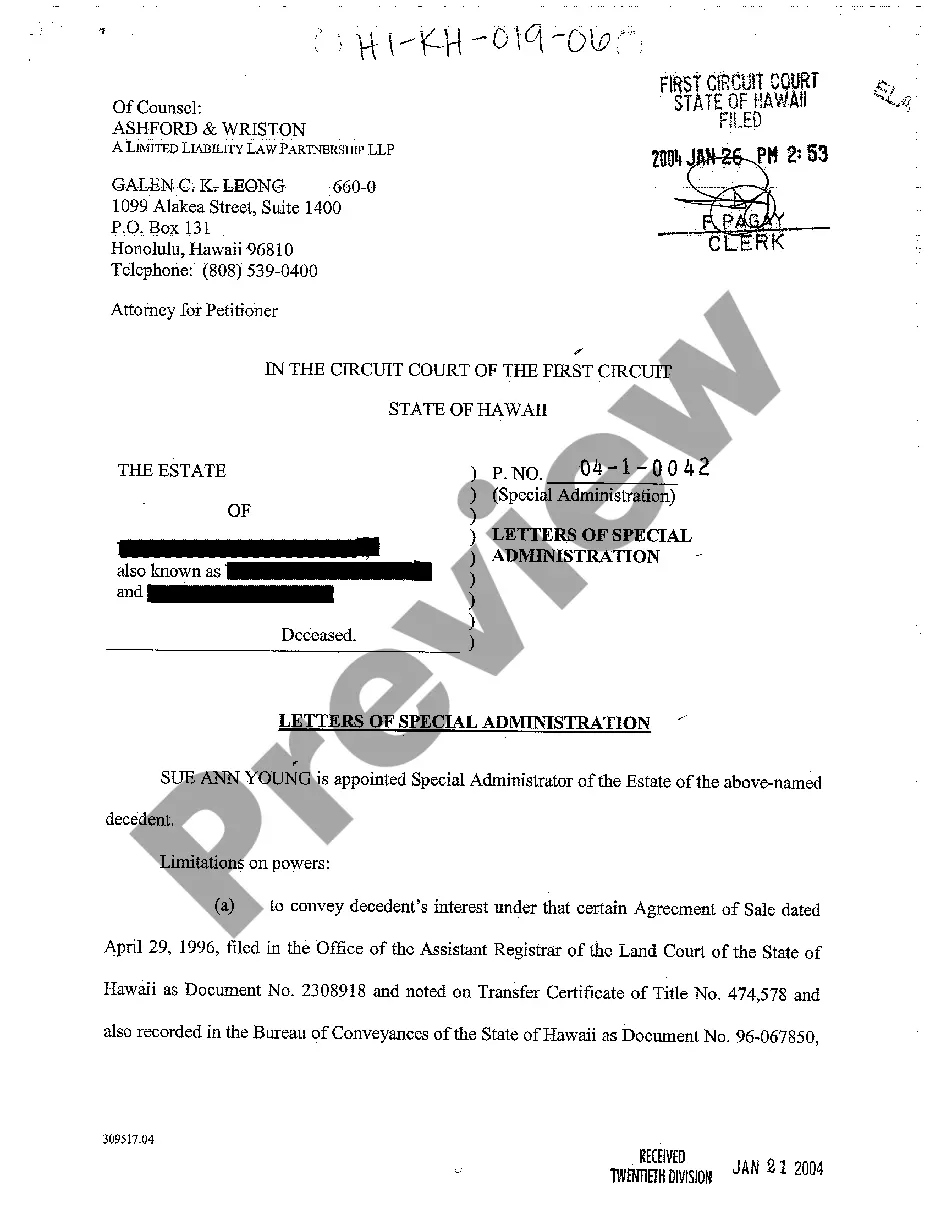

Hawaii Letters of Special Administration

Description

How to fill out Hawaii Letters Of Special Administration?

Among the many paid and free instances available online, you cannot be certain of their precision.

For instance, who created them or if they possess the qualifications necessary to address your requirements.

Always stay composed and utilize US Legal Forms!

Select Buy Now to commence the purchase process or find an alternative sample using the Search field located in the header.

- Find Hawaii Letters of Special Administration templates crafted by skilled legal professionals and avoid the costly and lengthy process of searching for a lawyer only to pay them to prepare a document that you can easily locate yourself.

- If you hold a subscription, Log In to your account and locate the Download button adjacent to the form you are looking for.

- You will also have the ability to view your previously purchased documents in the My documents section.

- If this is your first time using our website, follow the instructions below to quickly obtain your Hawaii Letters of Special Administration.

- Ensure that the document you see is applicable in your area.

- Review the file by consulting the description using the Preview feature.

Form popularity

FAQ

In Hawaii, the threshold for an estate to go to probate is generally $100,000 in total assets. However, if real estate is involved, it may require probate regardless of the estate's total value. If you're dealing with a complex estate situation, utilizing Hawaii Letters of Special Administration may offer clarity and direction through the probate process.

An alternative to a letter of testamentary is a letter of special administration. This document is issued when there is an urgent need to manage an estate, especially if the executor named in the will cannot act right away. For those navigating such scenarios, understanding Hawaii Letters of Special Administration is crucial to efficient estate management.

To obtain an updated letter of testamentary, you must file a petition with the probate court in the jurisdiction where the deceased resided. It's essential to provide all necessary documentation that supports your request. If you find this process overwhelming, the Hawaii Letters of Special Administration can assist you in securing the necessary updates quickly and efficiently.

A letter of testamentary is often referred to as a probate letter. This legal document grants an executor authority to manage a deceased person’s estate. Understanding Hawaii Letters of Special Administration can help you navigate situations where a letter of testamentary is needed, particularly when the deceased did not leave a will.

To avoid probate in Hawaii, consider establishing a living trust or holding assets jointly with rights of survivorship. These methods can help bypass traditional probate, allowing for smoother asset transfer upon death. Additionally, you can utilize Hawaii Letters of Special Administration to manage immediate matters effectively. Proper planning can simplify the process and protect your estate.

In Hawaii, you must file for probate within three years after the death of the individual. This process ensures that the decedent's estate is settled according to their wishes and the law. If you need to get started, consider obtaining Hawaii Letters of Special Administration, which can help manage the estate before the full probate process begins. Acting promptly will protect the estate and help avoid complications.

Hawaii does not set a strict financial threshold for initiating probate, but having an estate with assets valued over $100,000 usually prompts the process. This threshold may include real estate, bank accounts, and personal property. Utilizing Hawaii Letters of Special Administration may be advantageous in managing estates without going through full probate. It is advisable to seek professional guidance to navigate these thresholds effectively.

While Hawaii does not impose a minimum estate value that requires probate, estates with significant assets often face this necessity. If an estate consists mainly of real estate or bank accounts in the deceased's name, probate becomes relevant. The use of Hawaii Letters of Special Administration can facilitate the administration of these assets swiftly. Understanding your estate's specifics can guide you on whether to pursue probate.

Probate in Hawaii generally gets triggered when a person passes away, and that individual leaves behind assets solely in their name. Factors such as estate value and types of assets can influence whether probate is required. The process can be simplified through Hawaii Letters of Special Administration, which help manage assets and resolve the estate promptly. Engaging with a knowledgeable attorney can streamline every step of the probate process.

In Hawaii, there is no specific minimum estate value that necessitates probate. However, if the estate includes assets exceeding $100,000, the probate process often becomes essential. Managing the estate effectively becomes crucial in such cases, and using Hawaii Letters of Special Administration can assist in expediting matters. It's beneficial to consult with a legal professional to understand the best route for handling your estate.