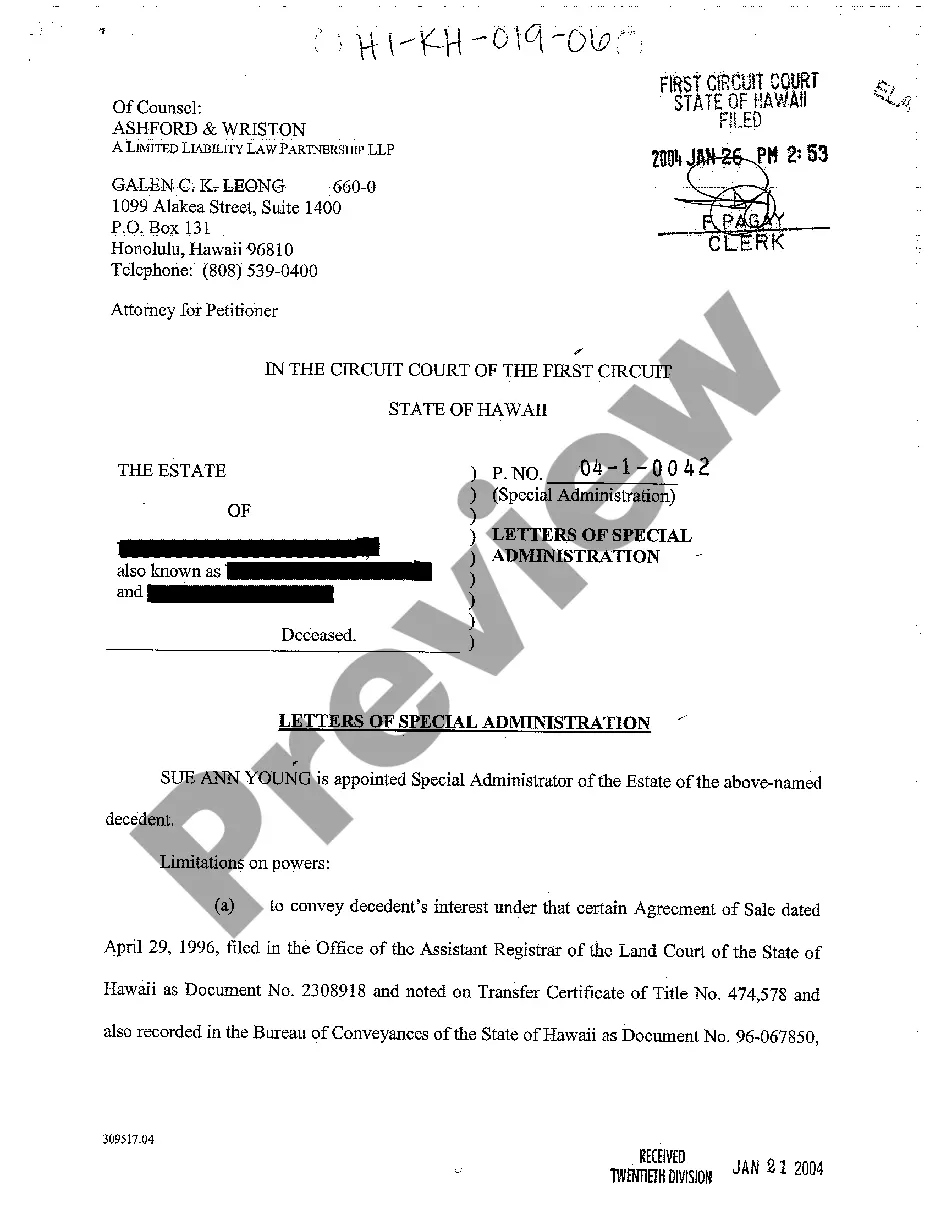

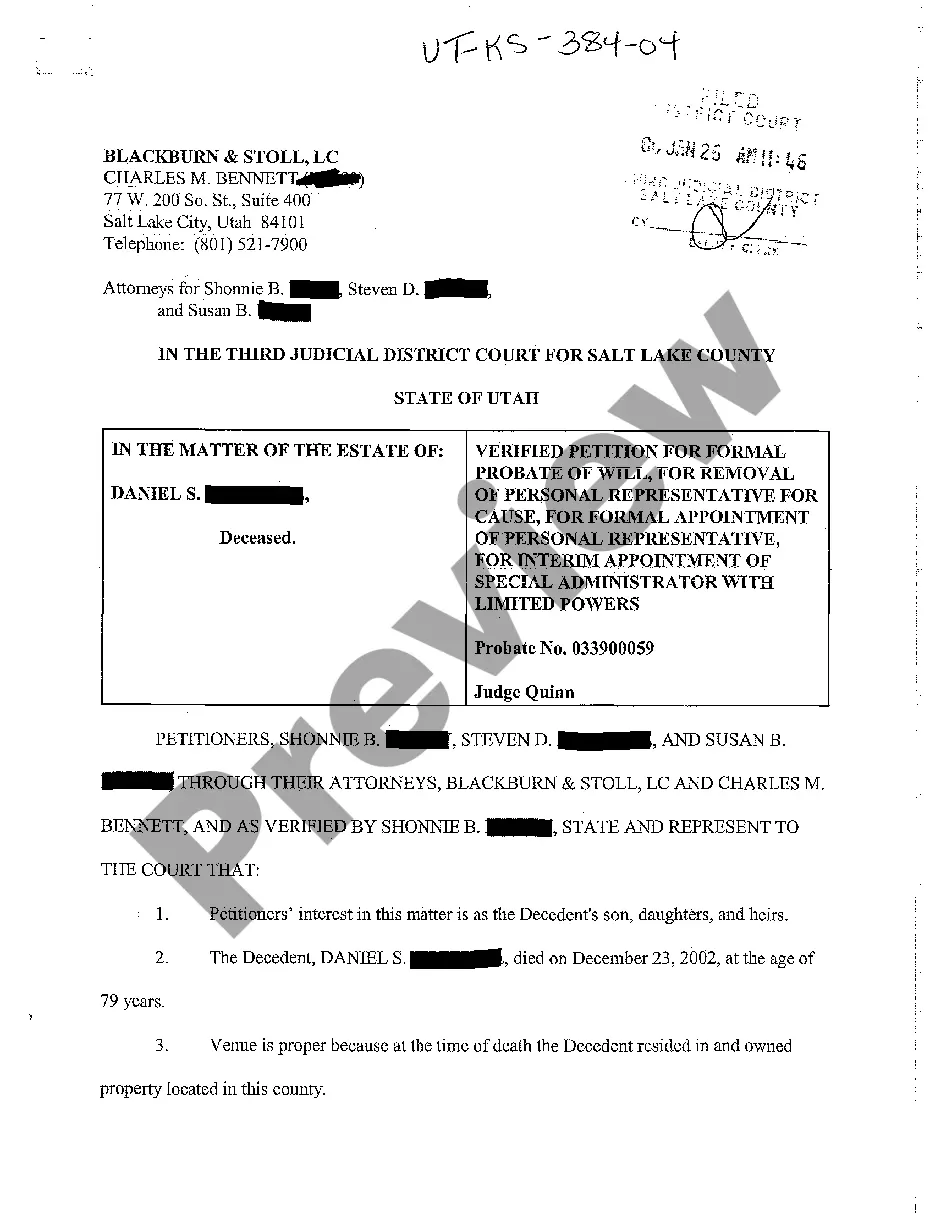

Hawaii Letters of Special Administration

Description

How to fill out Hawaii Letters Of Special Administration?

Amid numerous complimentary and premium examples available online, it is difficult to guarantee their precision and dependability. For instance, who created them or whether they possess the expertise to handle the tasks you require them for.

Always stay calm and choose US Legal Forms! Obtain Hawaii Letters of Special Administration forms crafted by experienced legal professionals, and avoid the costly and time-consuming task of searching for an attorney and subsequently paying them to draft a document that you can easily acquire yourself.

If you have a subscription, Log In to your account and locate the Download button by the file you seek. You will also have access to your previously acquired templates in the My documents section.

Once you have registered and purchased your subscription, you can utilize your Hawaii Letters of Special Administration as often as required or while it remains valid in your state. Modify it with your choice of offline or online editor, complete it, sign it, and produce a hard copy. Achieve more for less with US Legal Forms!

- Ensure the file you find is applicable in your state.

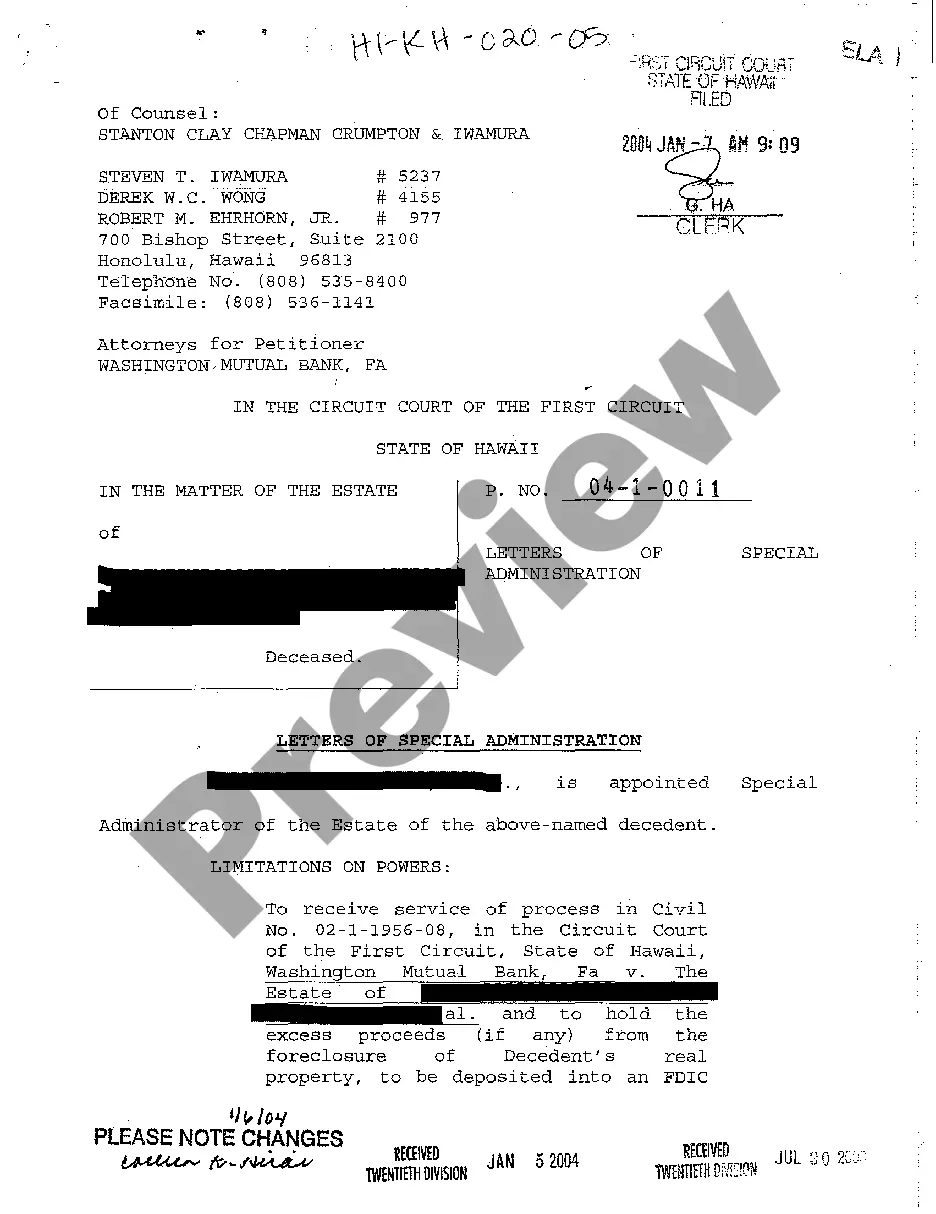

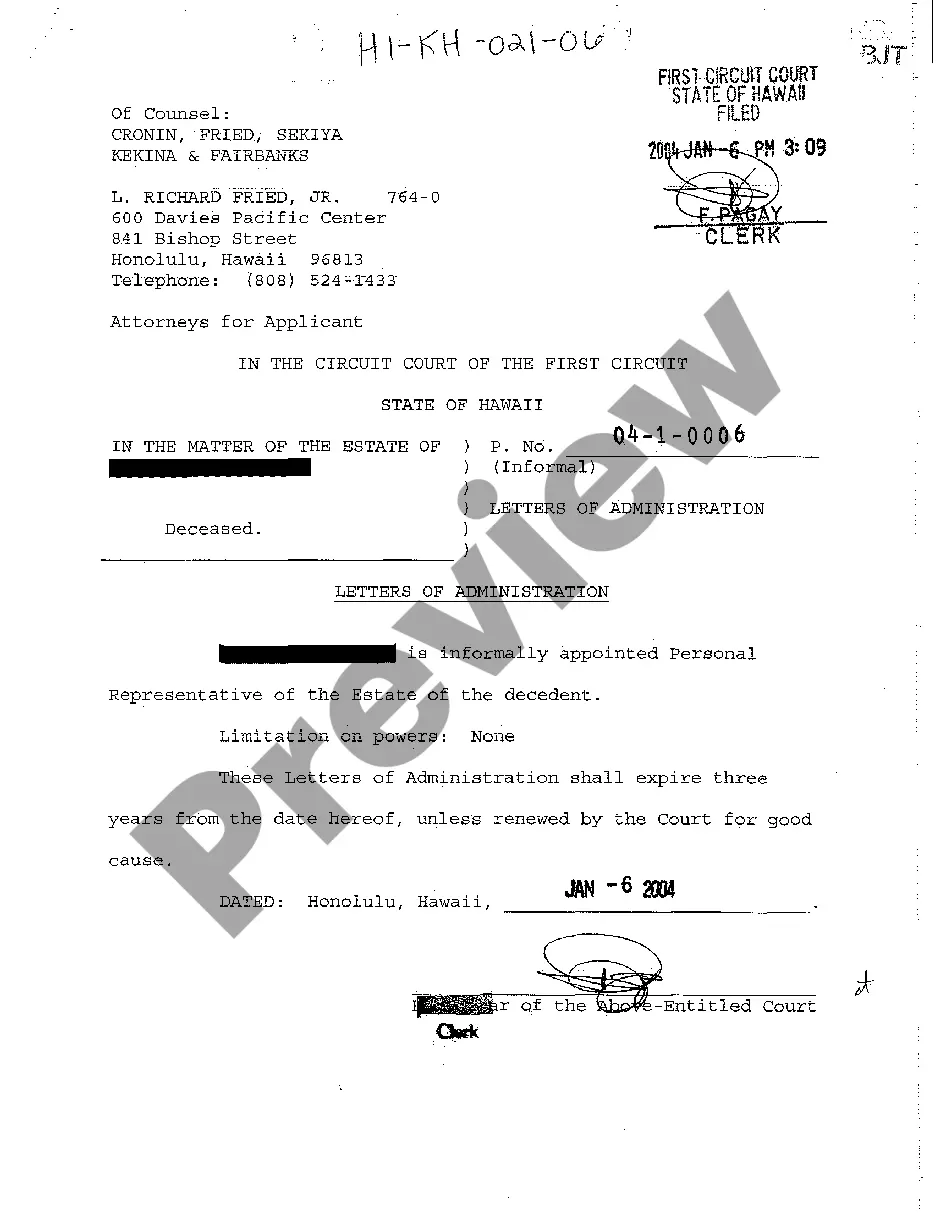

- Review the template by checking the description using the Preview option.

- Click Buy Now to initiate the ordering process or search for another template using the Search box in the header.

- Select a pricing plan and set up an account.

- Purchase the subscription with your credit/debit card or PayPal.

- Download the form in the desired format.

Form popularity

FAQ

The probate threshold in Hawaii determines the minimum value of an estate that necessitates formal probate proceedings. Currently, this threshold is set at $100,000 for personal property and $200,000 for real property. Knowing about Hawaii Letters of Special Administration can be helpful, especially if your estate falls below these thresholds, as it may allow for a simplified or expedited process.

Rule 48 in Hawaii relates to the procedures involved in the probate process, specifically addressing the duty to give notice in cases of estates. This rule ensures that interested parties receive proper notification regarding significant actions related to the estate, helping to maintain transparency and fairness. Familiarity with Hawaii Letters of Special Administration can assist you in navigating these procedural requirements effectively.

A letter of special administration with general powers in Hawaii grants an individual authority to manage the estate of a deceased person when there is no valid will or appointed personal representative. This letter allows the administrator to perform various necessary tasks, such as paying debts and managing assets, without waiting for full probate proceedings to commence. Understanding Hawaii Letters of Special Administration is crucial for ensuring that estate matters are handled efficiently and in compliance with state laws.

The threshold for probate in Hawaii is typically set at $100,000. If the total value of the estate exceeds this amount, the probate process becomes essential to legally distribute the assets. Knowing this threshold empowers families to plan accordingly. Additionally, in situations demanding swift action, Hawaii Letters of Special Administration can provide the tools necessary to address urgent estate matters effectively.

Hawaii requires that an estate must be valued over $100,000 to initiate probate proceedings. Estates below this threshold may use simpler processes, allowing for swifter resolution. However, it's wise to assess the estate's details carefully to determine the best course of action. In some cases, Hawaii Letters of Special Administration might be necessary to address specific needs efficiently.

Rule 42 outlines the requirements for the appointment of a personal representative in Hawaii probate cases. This rule specifies how individuals can be nominated or appointed to handle the probate process. Familiarity with Rule 42 can facilitate smoother estate management. If urgent circumstances arise, obtaining Hawaii Letters of Special Administration ensures prompt attention to critical matters.

In Hawaii, an estate must typically be valued at over $100,000 for it to enter probate. If the estate value falls below this amount, the process may be streamlined or avoided altogether. Understanding the estate's worth and the implications on probate can help families protect their assets efficiently. In cases requiring immediate attention, Hawaii Letters of Special Administration may provide an essential solution.

To obtain letters of testamentary in Hawaii, the named executor must file an application with the probate court. This includes submitting the deceased's will and relevant documents to validate authority over the estate. Once granted, these letters empower the executor to act on behalf of the estate, including obtaining Hawaii Letters of Special Administration if urgent actions are necessary.

Yes, in Hawaii, there is a threshold that determines whether an estate must go through probate. If the total value of the estate exceeds $100,000, it generally requires probate to ensure proper asset distribution. However, smaller estates may qualify for alternatives that could simplify the process. Considering Hawaii Letters of Special Administration can also be a valuable option for those needing to proceed swiftly.

Rule 50 in Hawaii outlines the procedures for the modification of the court's orders during the probate process. It addresses how parties may request changes to the guidelines established for handling the estate. Understanding Rule 50 can simplify navigating the probate process, especially when seeking Hawaii Letters of Special Administration to address urgent matters.