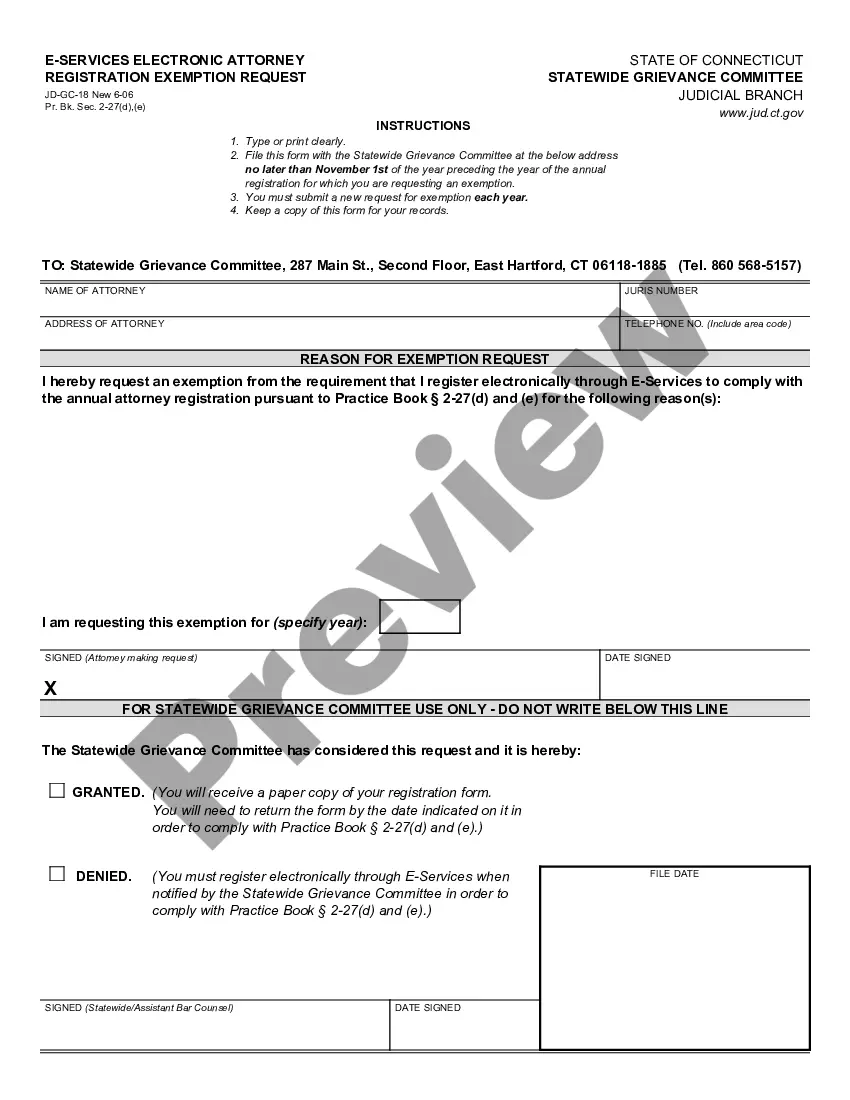

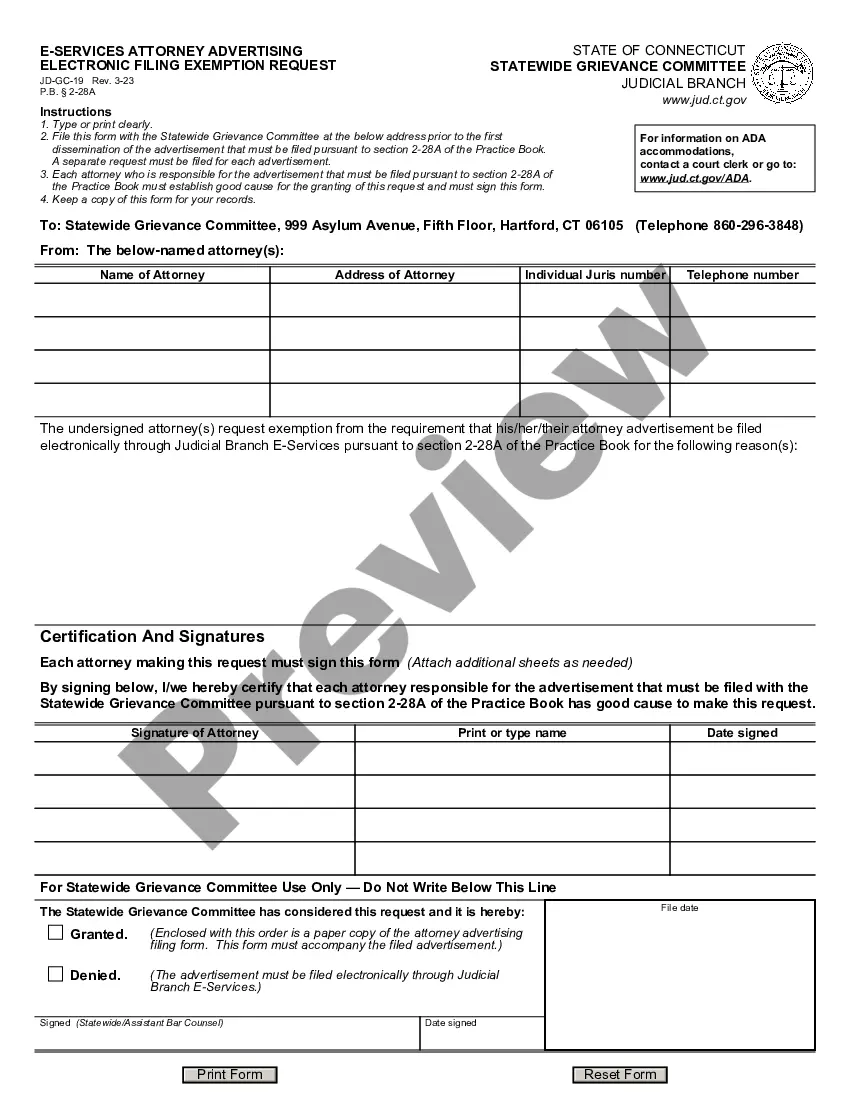

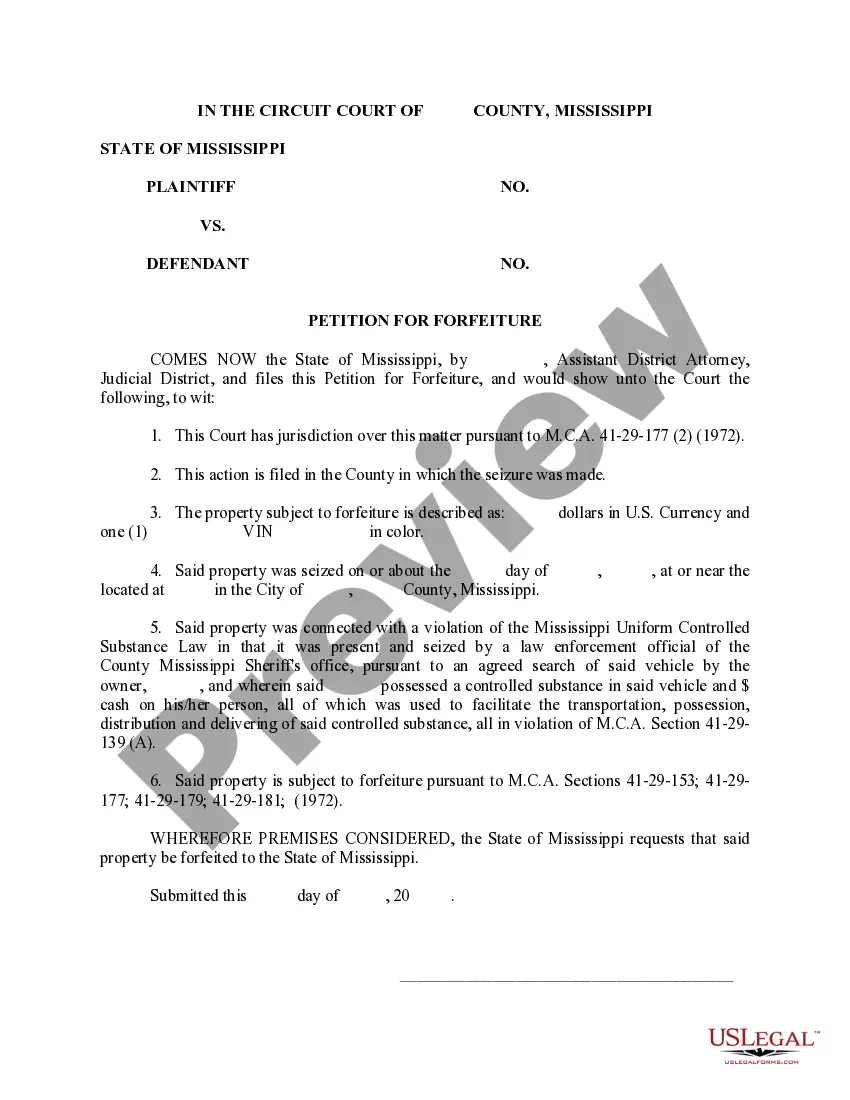

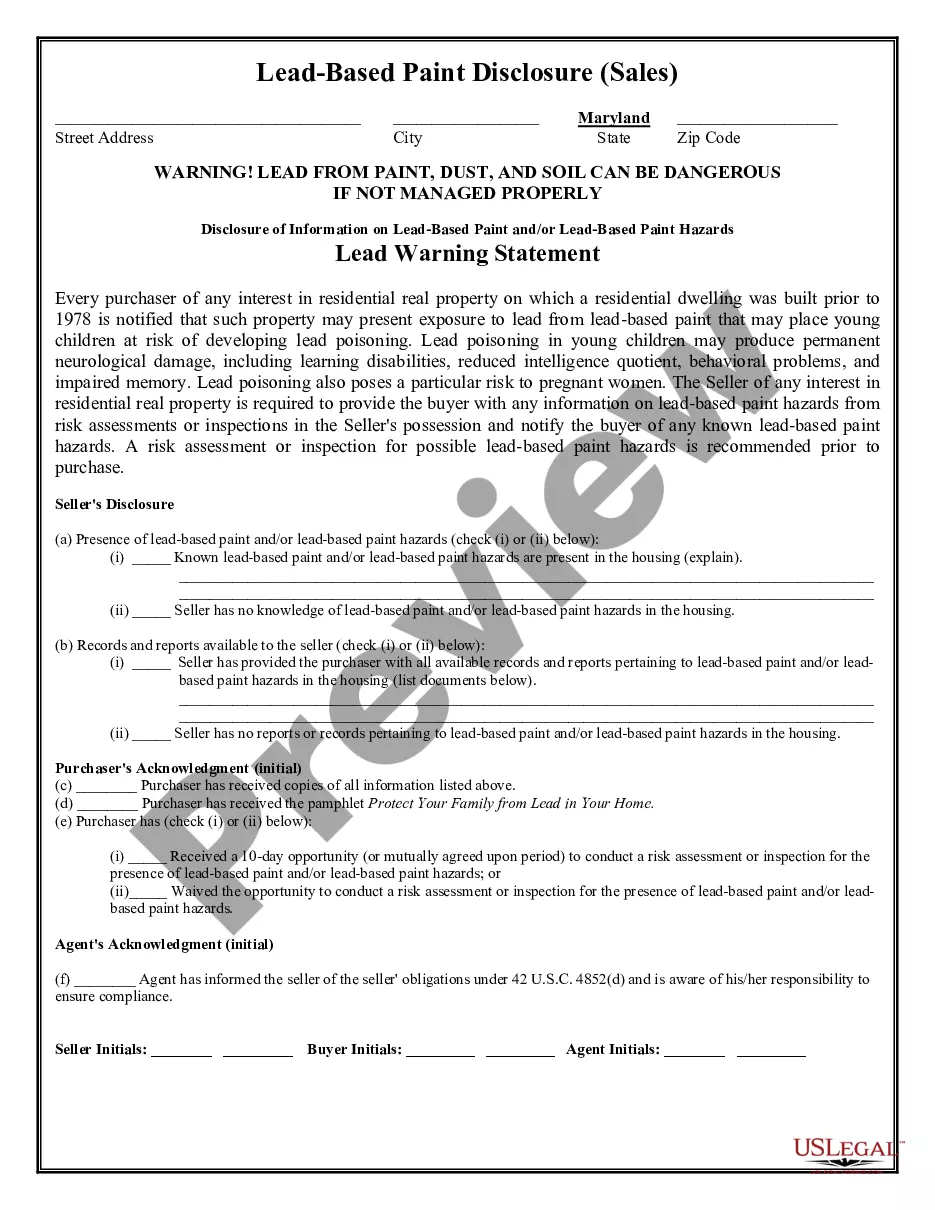

The Connecticut Request for Exclusion From Electronic Services Requirement is a form used by businesses in Connecticut to request an exemption from the electronic services' requirement for certain taxes. The electronic services' requirement applies to businesses that are registered with the Department of Revenue Services (DRS) and makes them responsible for filing, paying, and remitting certain taxes electronically. The form can be used for the following types of filing requirements: 1. Sales and Use Tax: Exemption is requested for filing, paying, and remitting sales and use taxes electronically. 2. Withholding Tax: Exemption is requested for filing, paying, and remitting employer withholding taxes electronically. 3. Pass-Through Entity Withholding Tax: Exemption is requested for filing, paying, and remitting pass-through entity withholding taxes electronically. 4. Estimated Income Tax: Exemption is requested for filing, paying, and remitting estimated income tax payments electronically. 5. Other Electronic Services: Exemption is requested for filing, paying, and remitting any other taxes electronically. The form must be signed by an authorized representative of the business, and must include the date, business name, and the specific taxes for which the exemption is requested. It must also include the reason for the exemption request and the signature of the authorized representative. Once the form is completed, the business must submit it to the DRS. If the exemption is granted, the business will not be required to file, pay, and remit the specified taxes electronically.

Connecticut Request for Exclusion From Electronic Services Requirement

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Connecticut Request For Exclusion From Electronic Services Requirement?

Completing official documents can be quite a strain if you lack readily available fillable templates. With the US Legal Forms online repository of formal documents, you can be confident in the blanks you acquire, as all are compliant with federal and state regulations and are verified by our professionals.

Acquiring your Connecticut Request for Exclusion From Electronic Services Requirement from our platform is straightforward. Previously registered users with an active subscription just need to Log In and hit the Download button once they locate the appropriate template. Later, if necessary, users can access the same form from the My documents section of their account. However, even if you are new to our service, creating an account with a valid subscription will only take a few minutes. Here’s a brief guide for you.

Have you not tried US Legal Forms yet? Subscribe to our service today to quickly and easily obtain any formal document whenever necessary, and maintain your paperwork systematically!

- Document compliance assessment. You should carefully examine the content of the form you wish and verify whether it aligns with your requirements and adheres to your state's laws. Previewing your document and reviewing its overall description will assist you in doing just that.

- Alternative search (optional). If you notice any discrepancies, explore the library via the Search tab at the top of the page until you discover a suitable template, and click Buy Now when you find the one you need.

- Account setup and form acquisition. Sign up for an account with US Legal Forms. After verifying your account, Log In and choose your most appropriate subscription plan. Make a payment to continue (PayPal and credit card choices are available).

- Template download and subsequent use. Select the file format for your Connecticut Request for Exclusion From Electronic Services Requirement and click Download to store it on your device. Print it for manual completion of your paperwork, or utilize a comprehensive online editor to prepare an electronic version more swiftly and efficiently.

Form popularity

FAQ

To obtain court documents in Connecticut, begin by visiting the website of the Connecticut Judicial Branch. You can search for cases and access documents online. If you are seeking an exemption, the Connecticut Request for Exclusion From Electronic Services Requirement may apply. For comprehensive needs, consider using US Legal Forms, where you can find resources and guides related to court documents and the exclusion request process.

When writing a letter to request an excuse from jury duty, be clear and concise. Begin by stating your name, address, and jury summons information. Describe your reasons for requesting an exemption, noting any relevant details about the Connecticut Request for Exclusion From Electronic Services Requirement if it applies. Finally, ensure to sign and date your letter, providing the court with an accurate correspondence.

While there is no guaranteed way to avoid jury duty selection, you can ensure your information is current and correct. Update your voter registration and check for eligibility requirements. Additionally, if you qualify for the Connecticut Request for Exclusion From Electronic Services Requirement, it may help you avoid selection. Remember, providing any requested information during the jury selection process is crucial.

Getting excused from jury duty in Connecticut involves formally requesting an exemption through the court. It is essential to indicate your reasons, which must be compelling for the judge to consider your request. This is where the Connecticut Request for Exclusion From Electronic Services Requirement can help. Be proactive in providing any necessary documentation to support your claim.

To get excused from jury duty in Connecticut, you must submit a request to the court, clearly stating your reasons. You may need to complete forms or provide supporting documentation. The Connecticut Request for Exclusion From Electronic Services Requirement can serve as a basis for your request if applicable to your situation. Make your case as strong and clear as possible to increase your chances of being excused.

The best excuse for being excused from jury duty in Connecticut usually involves genuine hardships such as medical issues or pre-existing commitments. Make sure to communicate your circumstances clearly with the court. Additionally, utilizing the Connecticut Request for Exclusion From Electronic Services Requirement may offer a valid reason to be excused. Each case will be evaluated individually, so ensure you provide appropriate documentation.

In Connecticut, if your scheduled jury duty is canceled, you typically do not need to report. However, it is important to check for notifications from the court. If you were previously summoned during this period, it may still count as your jury duty obligation. Keep in mind the implications of the Connecticut Request for Exclusion From Electronic Services Requirement when managing your obligations.

If you fail to respond to a jury duty summons in Connecticut, you may face a fine. Generally, the penalty can be as high as $500 depending on the circumstances. To avoid this fine, consider applying for the Connecticut Request for Exclusion From Electronic Services Requirement if you qualify. Staying informed about your responsibilities ensures you maintain compliance with the law.

Filing pro se in Connecticut requires you to complete the necessary court forms and submit them to the appropriate court. It's essential to understand the rules and procedures governing your specific case to avoid pitfalls. Utilizing platforms like USLegalForms can help guide you through the process and ensure compliance with the Connecticut Request for Exclusion From Electronic Services Requirement.

If you need to postpone your jury duty in Connecticut, contact the jury office as soon as possible. They typically require a valid reason for postponement, such as illness or a scheduling conflict. Additionally, make sure to follow any specific instructions provided in your jury summons to process your request effectively.