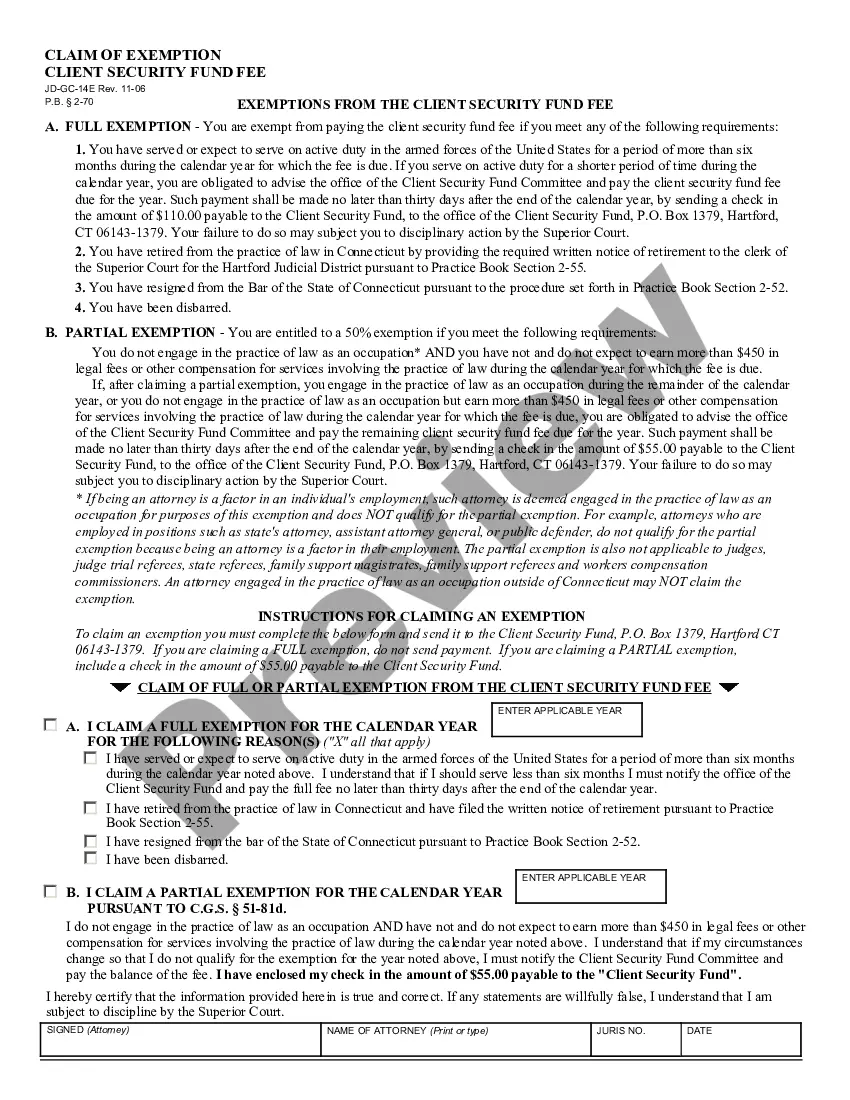

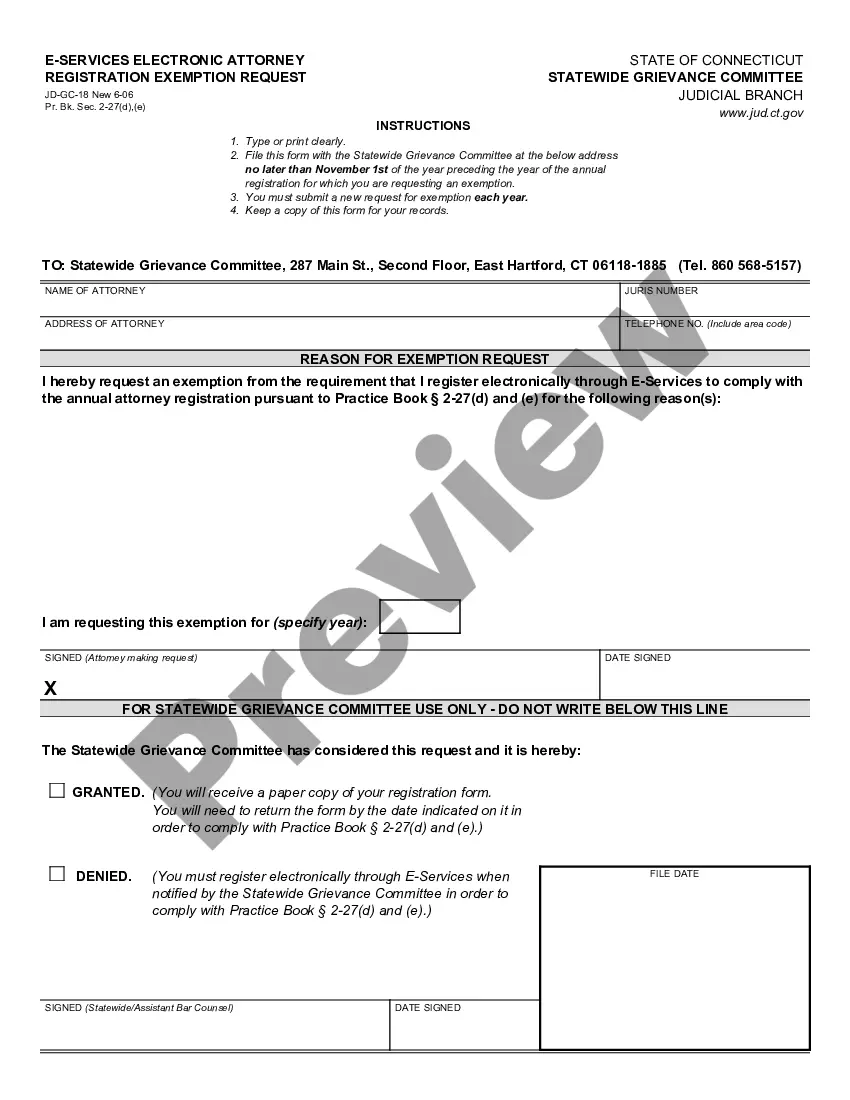

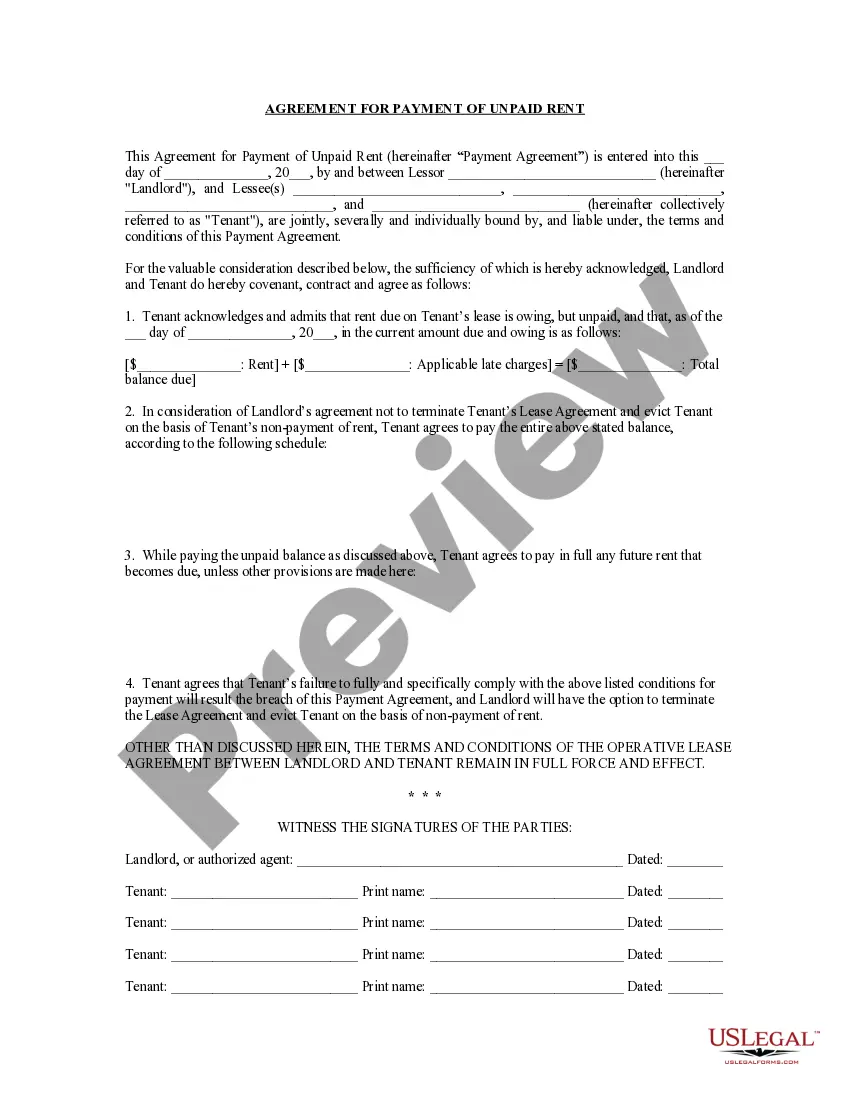

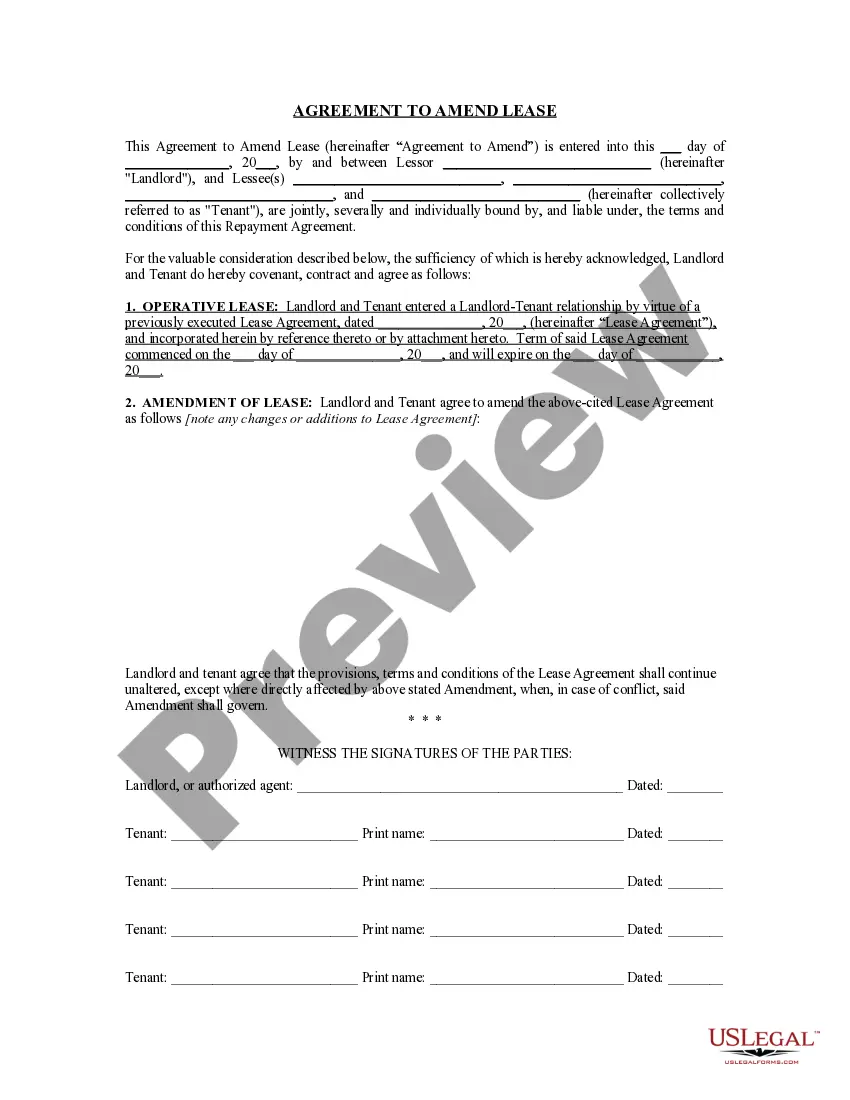

This is an official form from the Connecticut Court System, which complies with all applicable laws and statutes. USLF amends and updates forms as is required by Connecticut statutes and law.

Connecticut E-Services Attorney Advertising Electronic Filing Exemption Request

Description

How to fill out Connecticut E-Services Attorney Advertising Electronic Filing Exemption Request?

The greater the number of documents you are required to produce - the more anxious you become.

You can find countless Connecticut E-Services Attorney Advertising Electronic Filing Exemption Request templates online, but you are unsure which ones to rely on.

Eliminate the frustration and simplify finding examples with US Legal Forms. Obtain expertly drafted forms that are designed to meet state requirements.

Access each document you acquire in the My documents section. Simply navigate there to prepare a new copy of your Connecticut E-Services Attorney Advertising Electronic Filing Exemption Request. Even with professionally crafted templates, it’s still wise to consider asking a local attorney to review the completed form to ensure your document is correctly filled out. Achieve more for less with US Legal Forms!

- Confirm that the Connecticut E-Services Attorney Advertising Electronic Filing Exemption Request is applicable in your state.

- Verify your selection by reading the description or by utilizing the Preview mode if available for the selected document.

- Press Buy Now to initiate the registration process and select a pricing plan that suits your needs.

- Supply the necessary information to create your profile and pay for the order with your PayPal or credit card.

- Select a convenient file format and obtain your document.

Form popularity

FAQ

For Connecticut attorney registration inquiries, you can reach the appropriate office at 860-568-5100. This number connects you to knowledgeable staff, ready to assist with your questions regarding registration and compliance. Keeping your registration updated is vital if you are considering the Connecticut E-Services Attorney Advertising Electronic Filing Exemption Request. They can guide you through the necessary steps.

Form Cert 119 is the official Connecticut exemption certificate used to indicate eligibility for sales tax exemptions on specific types of purchases. This form is vital for tax-exempt organizations, as it clarifies that they should not incur sales tax on qualified purchases. Properly using Form Cert 119 can streamline your purchasing process. If you require assistance with your Connecticut E-Services Attorney Advertising Electronic Filing Exemption Request, consider leveraging resources available in the US Legal platform.

A withholding exemption certificate indicates that an employee qualifies for exemptions from income tax withholding. This document is crucial for workers who anticipate their taxable income will be low enough to avoid tax liability. It's essential to file correctly to ensure compliance and to avoid tax issues later on. For guidance, you may consider contacting a professional experienced in Connecticut E-Services Attorney Advertising Electronic Filing Exemption Request.