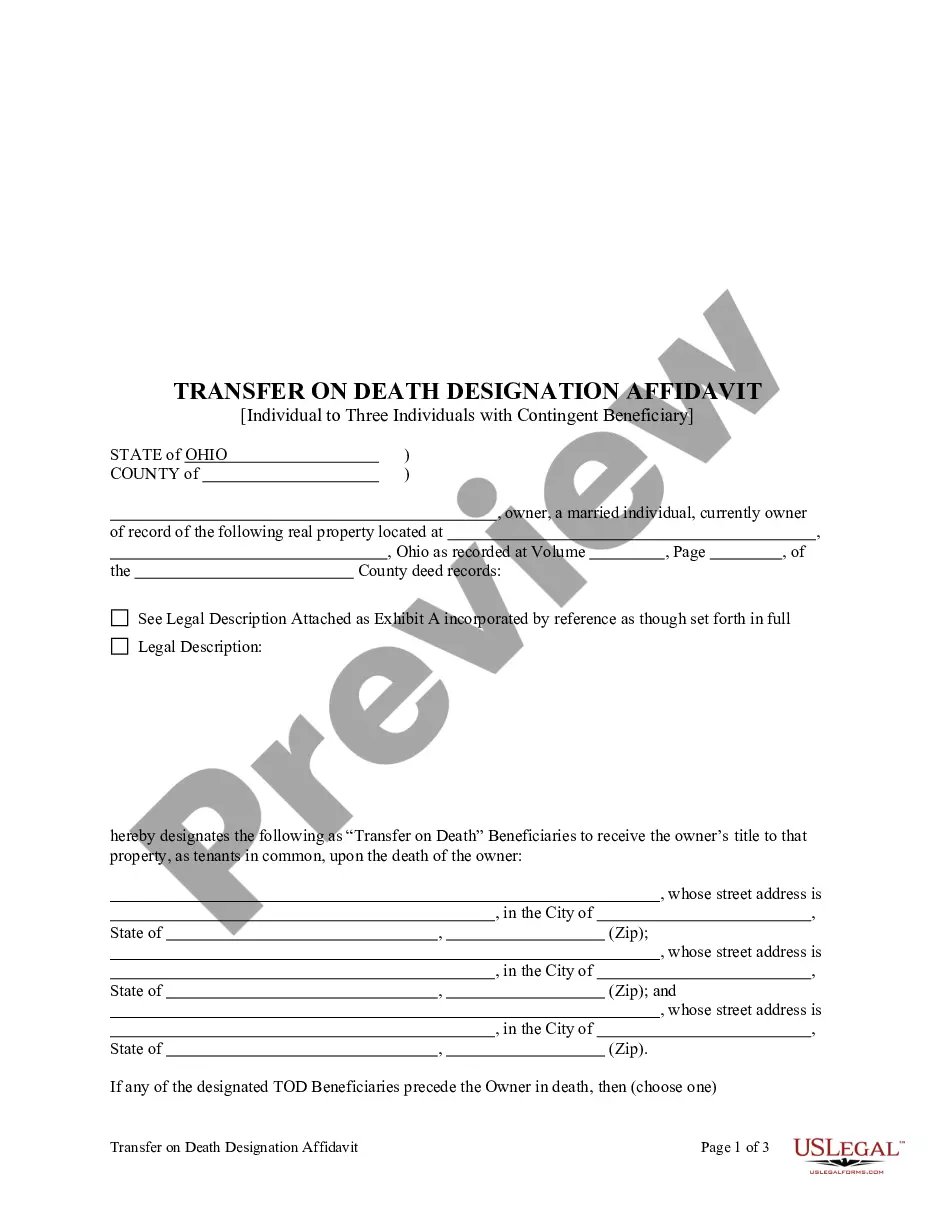

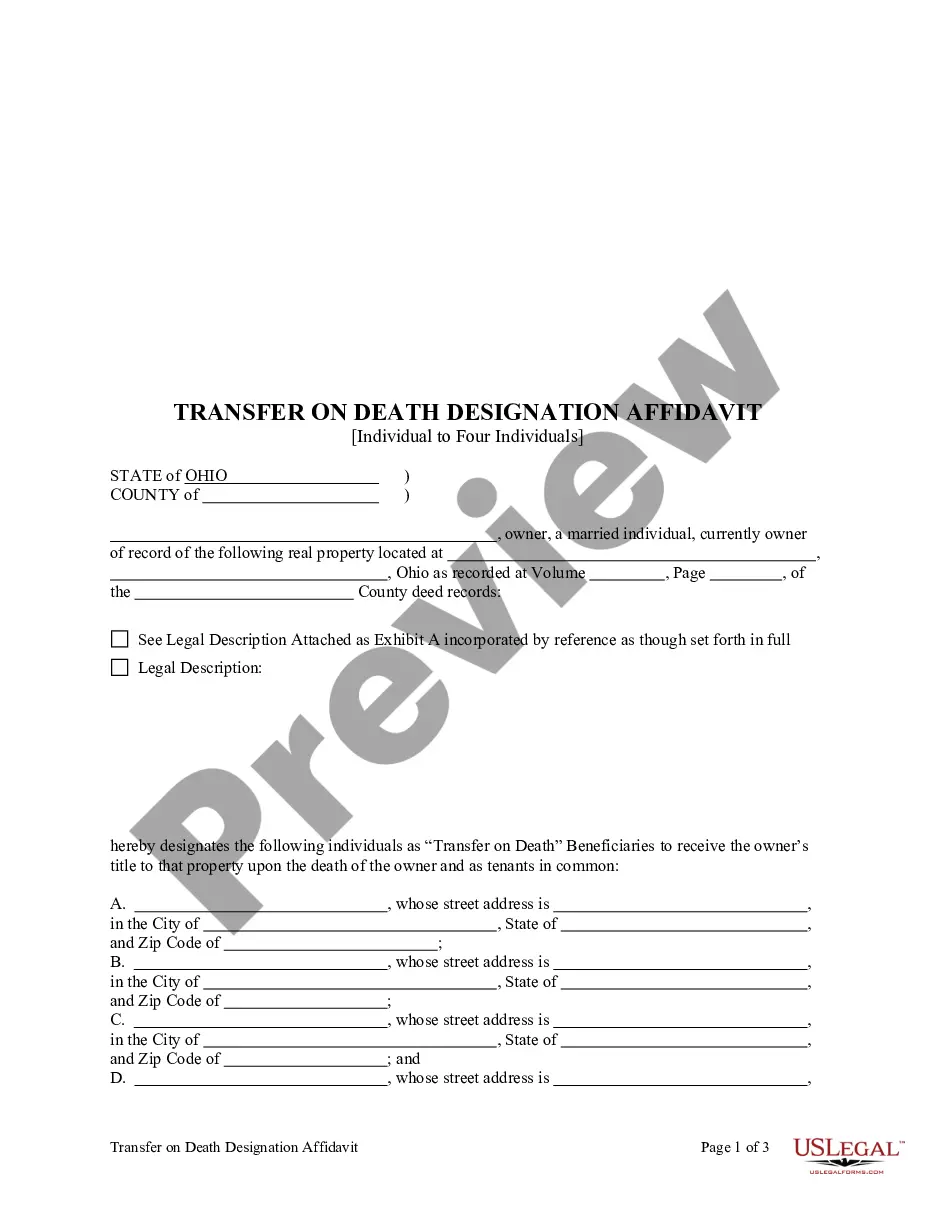

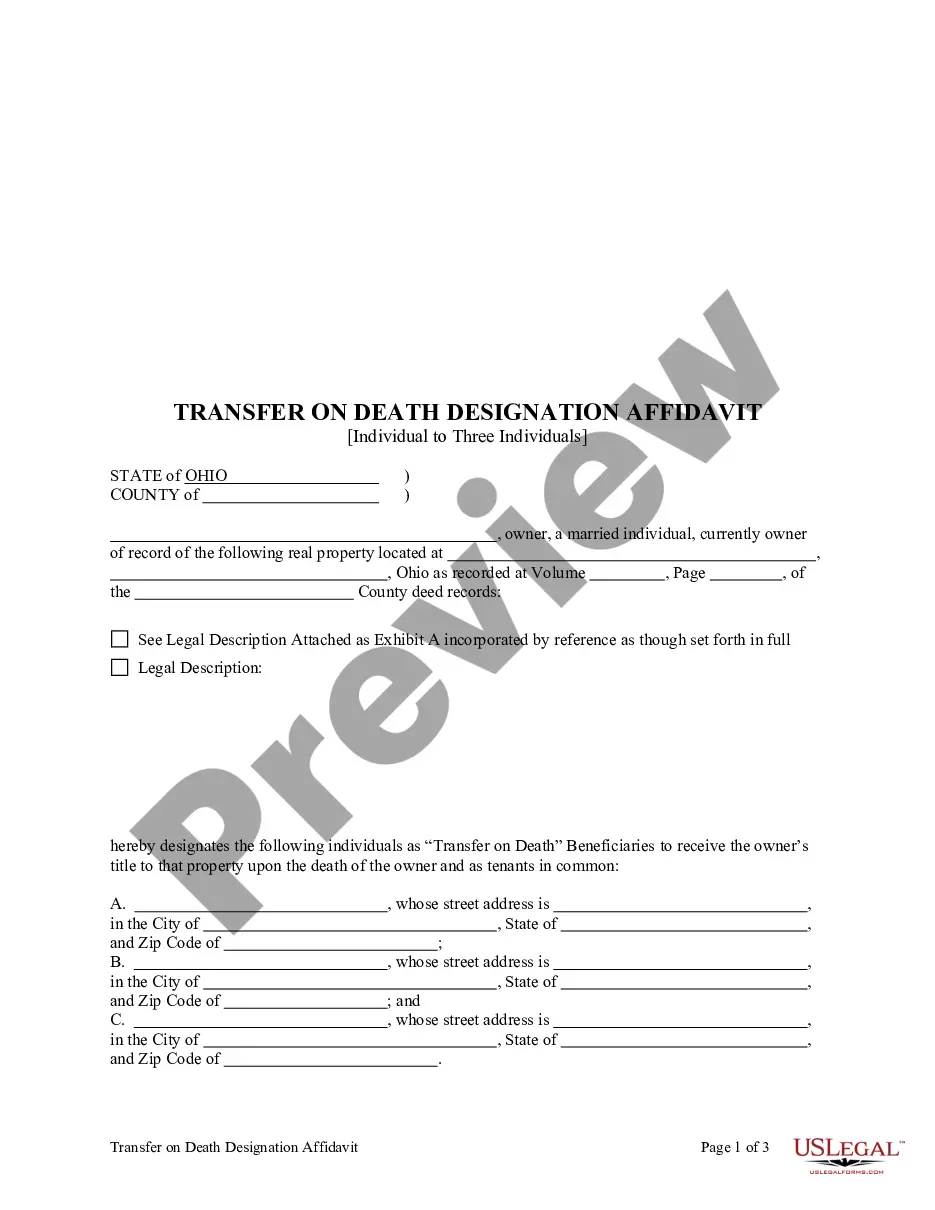

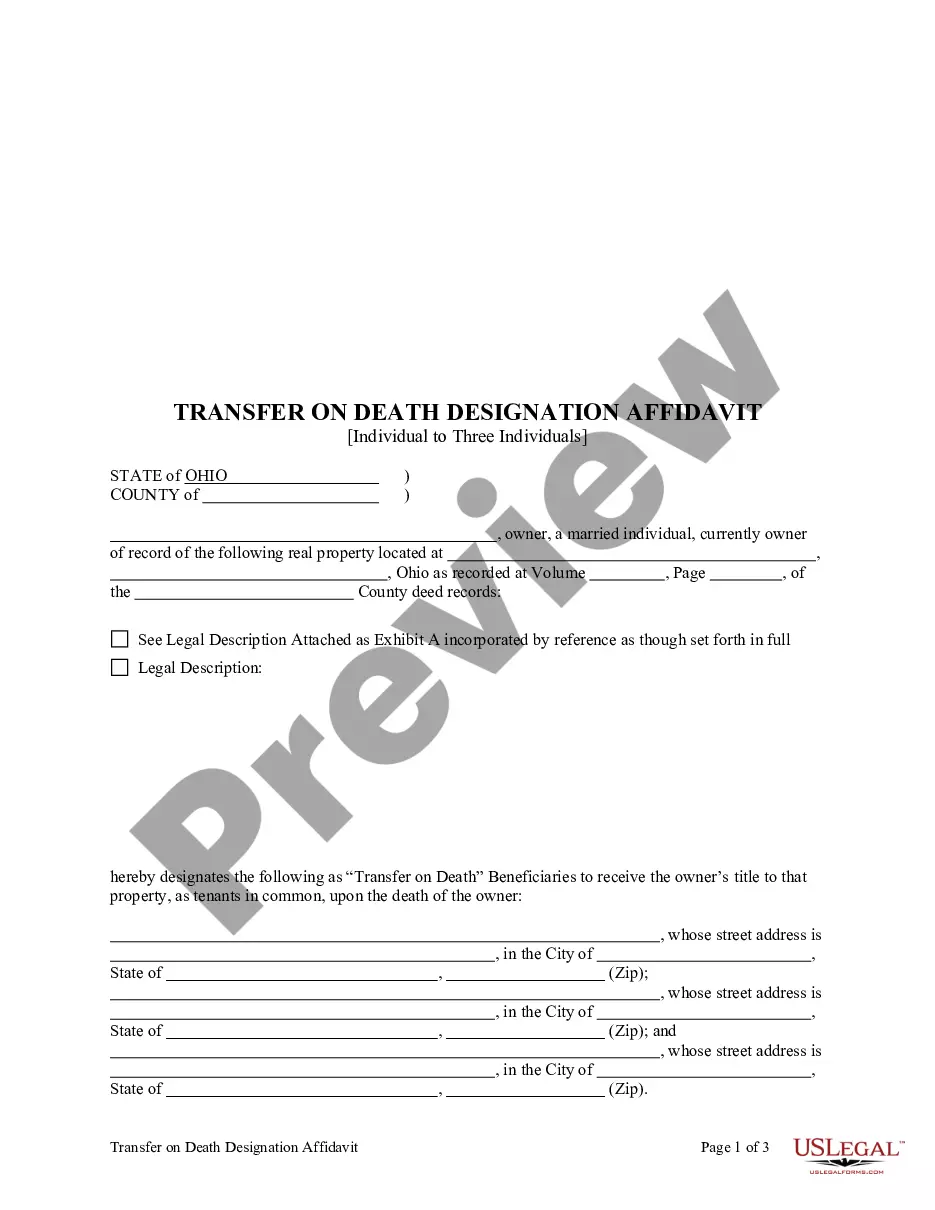

Transfer on Death Designation Affidavit from Individual to Three Individuals: This affidavit is used to transfer the title of a parcel of land, attaching any existing covenants, upon the death of the Owner/Affiant to the designated beneficiaries that survive the Owner/Affiant. It should be signed in front of a Notary Public. The form includes provision for an alternate beneficiary in the event a designated beneficiary predeceases the affiant/owner. The designation of the beneficiary in an affidavit of transfer on death may be revoked or changed at any time, without the consent of that designated transfer on death beneficiary, by the owner of the interest by executing in accordance with Chapter 5301. of the Ohio Revised Code and recording a transfer on death designation affidavit conveying the grantor's entire, separate interest in the real property to one or more persons, including the Owner/Affiant, with or without the designation of another transfer on death beneficiary.

Ohio Transfer on Death Designation Affidavit - TOD from Individual to Three Individuals with Alternate Beneficiary

Description

Key Concepts & Definitions

Transfer on Death Designation Affidavit (TOD): A legal document that allows property owners in the United States to pass their real estate directly to a beneficiary upon their death without the need for probate. Real Property: Refers to land and any permanently attached improvements to it, such as buildings, houses, and other structures. Deceased Owner: The original owner of the property who has passed away, enabling the transfer of the property through the TOD. County Auditor and Recorder: Local government officials who handle property records and documentation, including the recording of TOD affidavits.

Step-by-Step Guide to Completing a TOD Affidavit

- Consult with an Attorney: Contact a real estate attorney or your local bar association for guidance specific to your states laws.

- Complete the Affidavit: Fill out the TOD designation affidavit, which includes details such as the property description and beneficiary information.

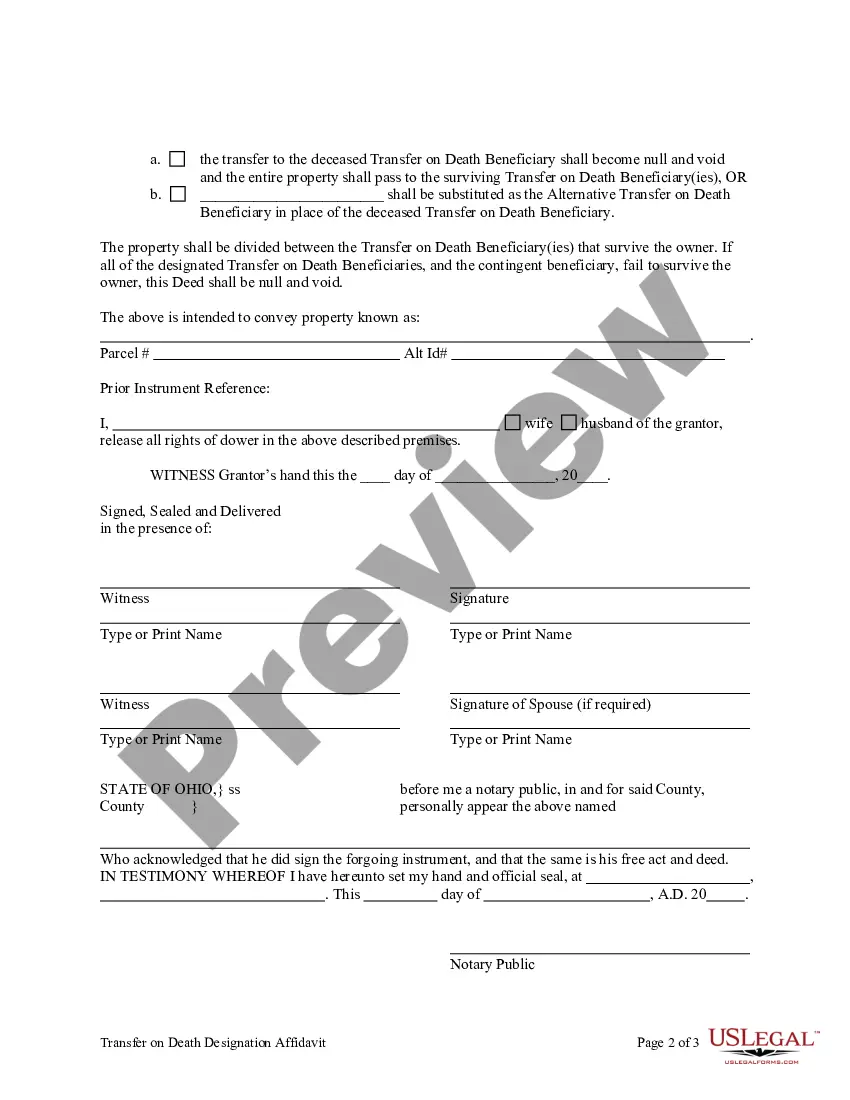

- Notarization: Have the document notarized to validate the signatures.

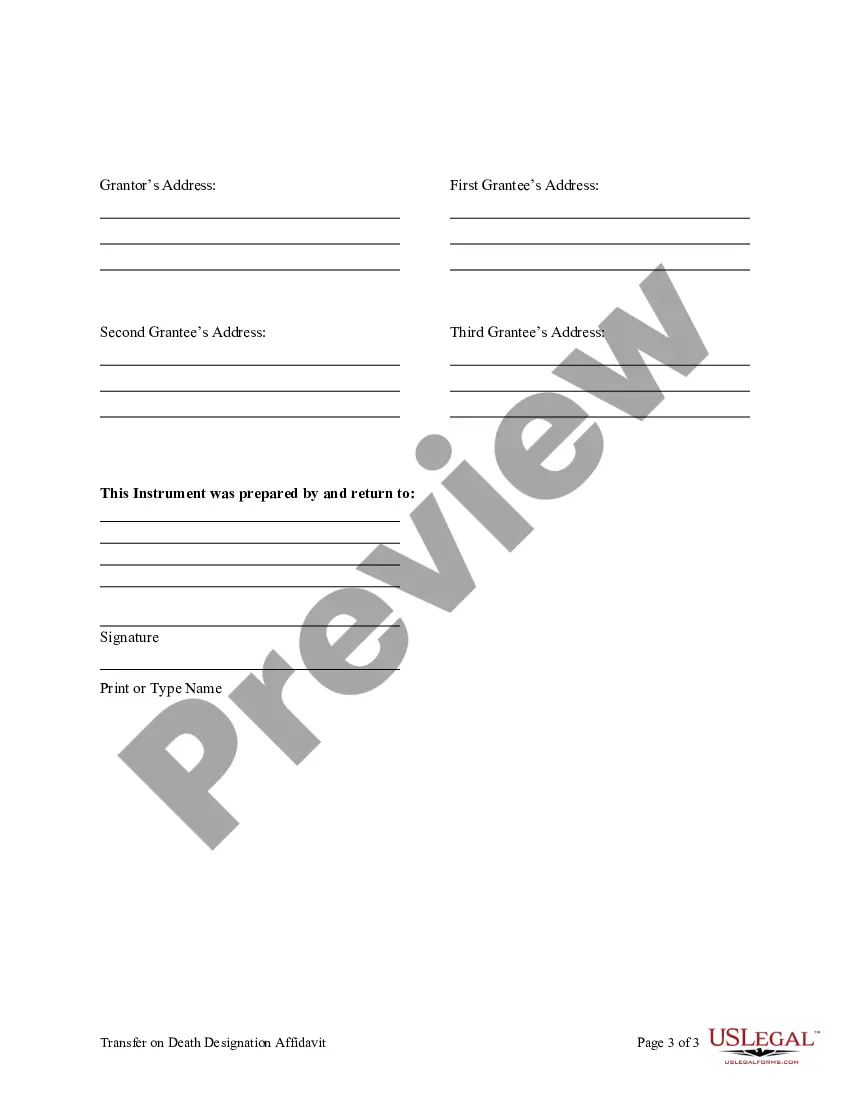

- Record the Affidavit: File the affidavit with your local county recorders office to officially register the death designation.

- Notify the Beneficiary: Inform the beneficiary of the TOD designation to ensure they are aware of their inheritance.

Risk Analysis of Using a TOD Affidavit

- Potential for Disputes: TOD can lead to disputes among potential heirs or between the beneficiaries and other family members.

- Legal Challenges: Improperly prepared or recorded TOD affidavits may be subject to legal challenges, which could delay the transfer of property.

- Changes in Circumstances: Changes in the property owners intentions or beneficiary circumstances not updated in the TOD might complicate the property transfer upon death.

Key Takeaways

Using a 'Transfer on Death Designation Affidavit' can streamline the process of transferring property upon death, bypassing the often lengthy and complex probate process. Proper completion and recording of the TOD affidavit are crucial to ensure it is legally binding and enforceable. Potential users should be aware of the risks involved, including the possibility of disputes and the need for precise documentation.

Best Practices

- Regular Reviews: Regularly review and update your TOD affidavit to reflect any changes in your decisions or beneficiary circumstances.

- Clear Description: Ensure that all descriptions and legal terminology in the affidavit are clear and accurately reflect the property and party intentions.

- Professional Guidance: Seek professional legal guidance to navigate state-specific laws and ensure the TOD affidavit is drafted and recorded correctly.

Common Mistakes & How to Avoid Them

- Incorrect Information: Double-check all entries in the affidavit for accuracy. Errors can lead to delays or invalidation of the document.

- Failing to File: Its not enough to simply sign a TOD affidavit; it must be officially filed with the appropriate county office.

- Neglecting Legal Advice: Failing to consult with a real estate lawyer can result in mistakes in adhering to your states specific laws and requirements.

How to fill out Ohio Transfer On Death Designation Affidavit - TOD From Individual To Three Individuals With Alternate Beneficiary?

In terms of filling out Ohio Transfer on Death Designation Affidavit - TOD from Individual to Three Individuals with Alternate Beneficiary, you most likely think about a long procedure that requires getting a perfect sample among a huge selection of similar ones and then being forced to pay an attorney to fill it out for you. Generally speaking, that’s a sluggish and expensive choice. Use US Legal Forms and choose the state-specific form within just clicks.

If you have a subscription, just log in and click on Download button to get the Ohio Transfer on Death Designation Affidavit - TOD from Individual to Three Individuals with Alternate Beneficiary sample.

If you don’t have an account yet but want one, stick to the point-by-point guideline listed below:

- Be sure the document you’re getting applies in your state (or the state it’s needed in).

- Do it by reading through the form’s description and also by clicking on the Preview function (if available) to find out the form’s information.

- Click on Buy Now button.

- Choose the appropriate plan for your budget.

- Sign up to an account and select how you want to pay out: by PayPal or by card.

- Save the file in .pdf or .docx format.

- Find the record on the device or in your My Forms folder.

Skilled lawyers work on creating our samples to ensure that after downloading, you don't need to bother about editing and enhancing content material outside of your personal details or your business’s info. Join US Legal Forms and get your Ohio Transfer on Death Designation Affidavit - TOD from Individual to Three Individuals with Alternate Beneficiary document now.

Form popularity

FAQ

An account holder may choose to list both of their children as equal beneficiaries. However, an account holder can also choose to list individuals in unequal amounts. For example, you could designate a primary beneficiary to receive 50 percent of the funds and two secondary beneficiaries who receive 25 percent each.

A TOD designation supersedes a will. For bank accounts, you can set up a similar account known as payable-on-death, sometimes referred to as a Totten trust. Your beneficiaries can't touch the account while you're alive, and you're free to change beneficiaries or close the accounts at any time.

Using an Affidavit of Death to Claim Real Estate from a California Transfer on Death Deed. Transfer on death deeds allow individual landowners to transfer their real estate when they die, without a will or the need for probate distribution.

TOD account holders can name multiple beneficiaries and divide assets any way they like.However, the beneficiaries have no access or rights to a TOD account while its owner is alive. Those beneficiaries can also be changed at any time, so long as the TOD account holder is deemed mentally competent.

Accounts or assets with named beneficiaries may be transferred without going through the probate process.If there is a TOD on the account, the assets will only go to the beneficiary if both joint owners pass away. In either case, the asset will not likely go through probate.

Fill in information about you and the TOD beneficiary. provide a description of the property. check over the completed deed. sign the deed in front of a notary public, and.

Yes. Ohio law allows individuals who do not need the estate administration benefits of a trust agreement to avoid Probate on the transfer of real property by executing a legal document called a Transfer-On-Death (TOD) Designation Affidavit.

On a nonretirement account, designating a beneficiary or beneficiaries establishes a transfer on death (TOD) registration for the account. For an individual account, a TOD registration generally allows ownership of the account to be transferred to the designated beneficiary upon your death.