Lease Purchase Report

What this document covers

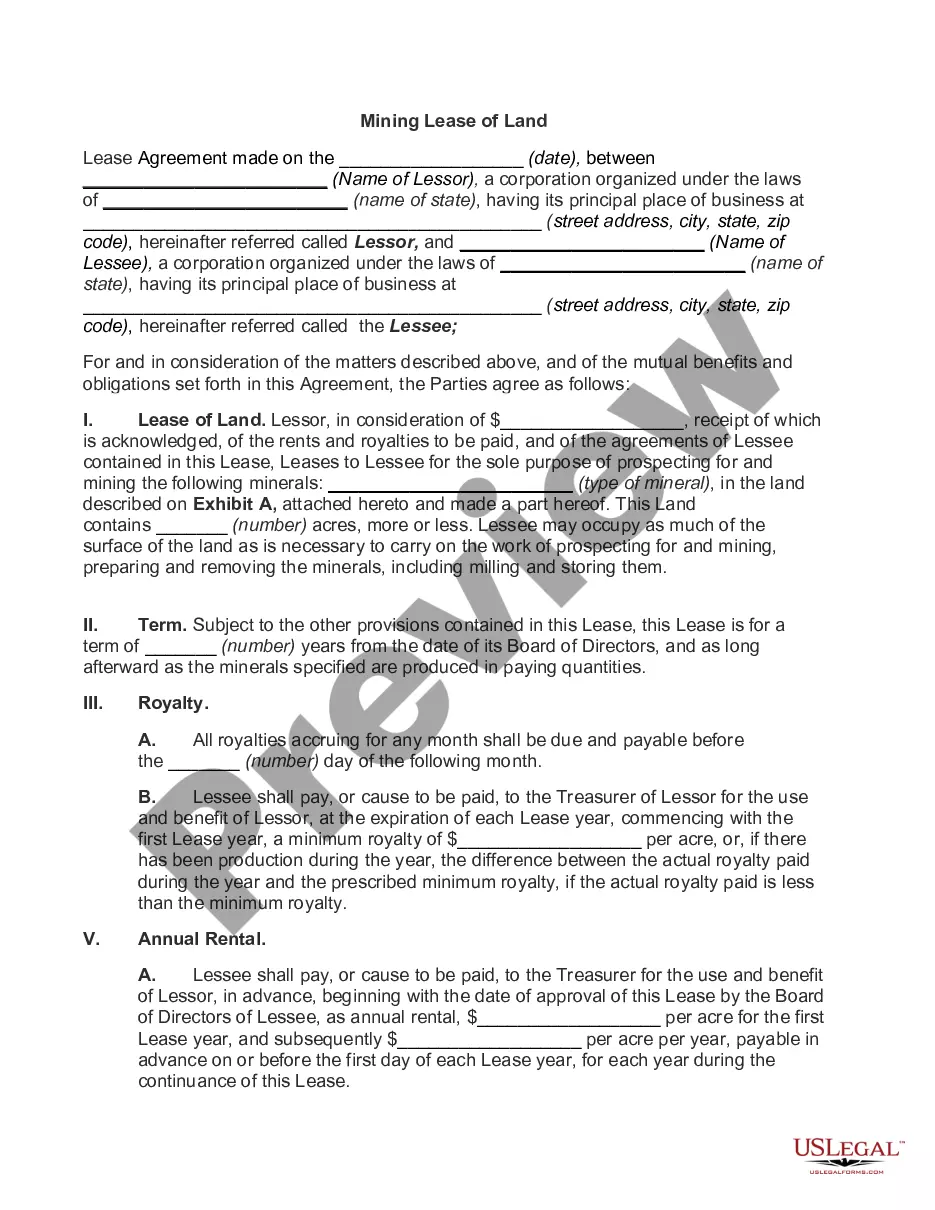

The Lease Purchase Report is a legal document used in real estate transactions, specifically for oil, gas, and mineral interests. It captures essential information about sellers and purchasers entering into a lease purchase agreement, making it clear who is obligated to sell or buy property, either during or at the end of a lease term. This form differs from standard purchase agreements by detailing terms specific to leasing scenarios, particularly in the context of mineral rights.

What’s included in this form

- Prospect number and county details

- Seller and purchaser information, including names and contact details

- Effective date, expiration date, and acquisition date

- Financial terms such as bonus, rental amount, and mineral interests

- Clauses relating to drilling and surface damage

- Title documentation and encumbrances related to the property

When to use this form

This form is necessary when engaging in a lease purchase agreement for real estate involving mineral interests. It is commonly used by sellers and purchasers who wish to formalize an agreement to buy or sell properties that include rights to oil, gas, or minerals. Use this form to ensure all relevant details are recorded and acknowledged, reducing the risk of disputes and ensuring clarity on the transaction terms.

Who should use this form

This form is intended for:

- Property owners looking to lease their land for minerals

- Buyers interested in acquiring mineral rights

- Real estate professionals working in oil, gas, and mineral fields

- Attorneys advising clients on real estate transactions involving lease agreements

How to prepare this document

- Identify the parties involved: Clearly list the seller and purchaser's names and contact information.

- Specify the property: Include details and descriptions of the property or mineral rights being leased or purchased.

- Enter the effective date and expiration date: Clearly indicate when the agreement begins and ends.

- Detail financial terms: Provide the agreed-upon bonus, rental amount, and other monetary considerations.

- Include required clauses: Address any specific legal provisions such as drilling and surface damage clauses.

Notarization requirements for this form

Notarization is not commonly needed for this form. However, certain documents or local rules may make it necessary. Our notarization service, powered by Notarize, allows you to finalize it securely online anytime, day or night.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes

- Failing to include all parties' information accurately.

- Not specifying the property clearly, leading to potential disputes.

- Leaving out critical financial terms or miscalculation of amounts.

- Not understanding or including necessary legal clauses pertinent to the transaction.

- Neglecting to update dates and terms as necessary, which could invalidate the agreement.

Why use this form online

- Convenience: Easily download and complete the form at any time.

- Editability: Customize the form to fit your specific situation or requirements.

- Reliability: Ensure that the form is up-to-date and legally compliant as drafted by licensed attorneys.

Looking for another form?

Form popularity

FAQ

A lease purchase agreement in real estate is a rent-to-own contract between a tenant and a landlord for the former to purchase the property at a later point in time.Both parties agree to what the purchasing price of the home will be at the end of the lease term.

Lease-option contracts give you the right to buy the home when the lease expires, while lease-purchase contracts require you to buy it. You pay rent throughout the lease, and in some cases, a percentage of the payment is applied to the purchase price.

A lease-option-to-buy arrangement can be a solution for some potential homebuyers, but it's not right for everyone. If you're not certain that you're going to be able to purchase the rental home at the end of the lease period, you might be better served with a standard rental agreement.

If you opt for a lease buyout when your lease is up, the price will be based on the car's residual value the purchase amount set at lease signing, based on the predicted value of the vehicle at the end of the lease. This amount may also be called the buyout amount or purchase option price.

If you take out a lease purchase agreement on a new car, you agree from the outset that at the end of the contract, you will purchase the vehicle. It enables you to eventually buy a new car, without having to find the entire amount up front.

A lease-option-to-buy arrangement can be a solution for some potential homebuyers, but it's not right for everyone. If you're not certain that you're going to be able to purchase the rental home at the end of the lease period, you might be better served with a standard rental agreement.

A rent-to-own home is a house you can buy through a rent-to-own agreement.As part of the contract, the seller agrees to hold a designated amount of money of each rent payment to go toward the buyer's equity in the home when they purchase it.

The difference between a lease option and lease purchase agreement is that the lease option only obligates the seller to sell. A lease purchase agreement commits both parties to the sale barring breach of contract or the buyer's inability to secure a mortgage.

The Basic Structure of a Lease Purchase In a lease purchase contract, the buyer and seller agree to a lease period followed by sale of the property when the lease ends. This type of agreement combines both a lease and a purchase with the tenant/purchaser securing the option to purchase the house.