Texas Divorce Worksheet and Law Summary for Contested or Uncontested Case of over 25 pages - Ideal Client Interview Form

What this document covers

This Divorce Worksheet and Law Summary is a comprehensive package designed for individuals contemplating a divorce, whether contested or uncontested. It includes essential information on divorce procedures, key definitions, and worksheets to gather financial details and personal information. This form differs from other divorce-related documents by providing a structured approach for individuals and their attorneys to streamline consultations and prepare for divorce proceedings effectively.

Main sections of this form

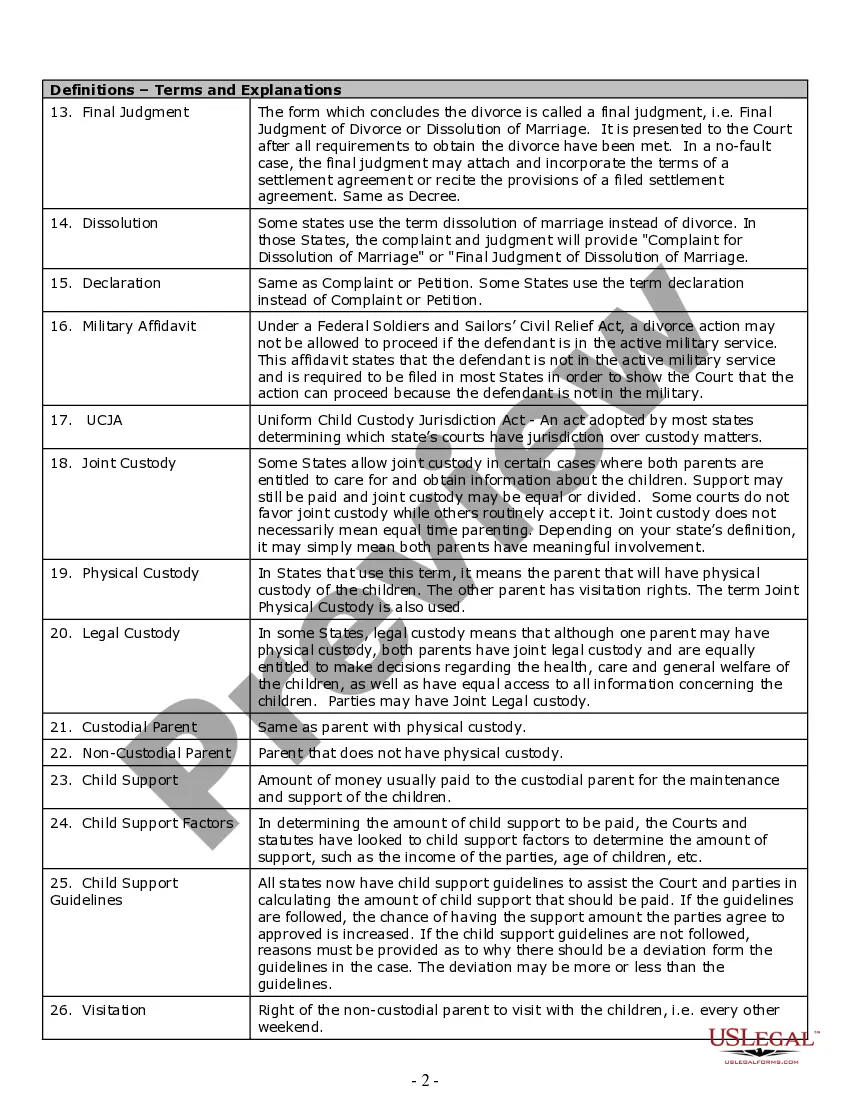

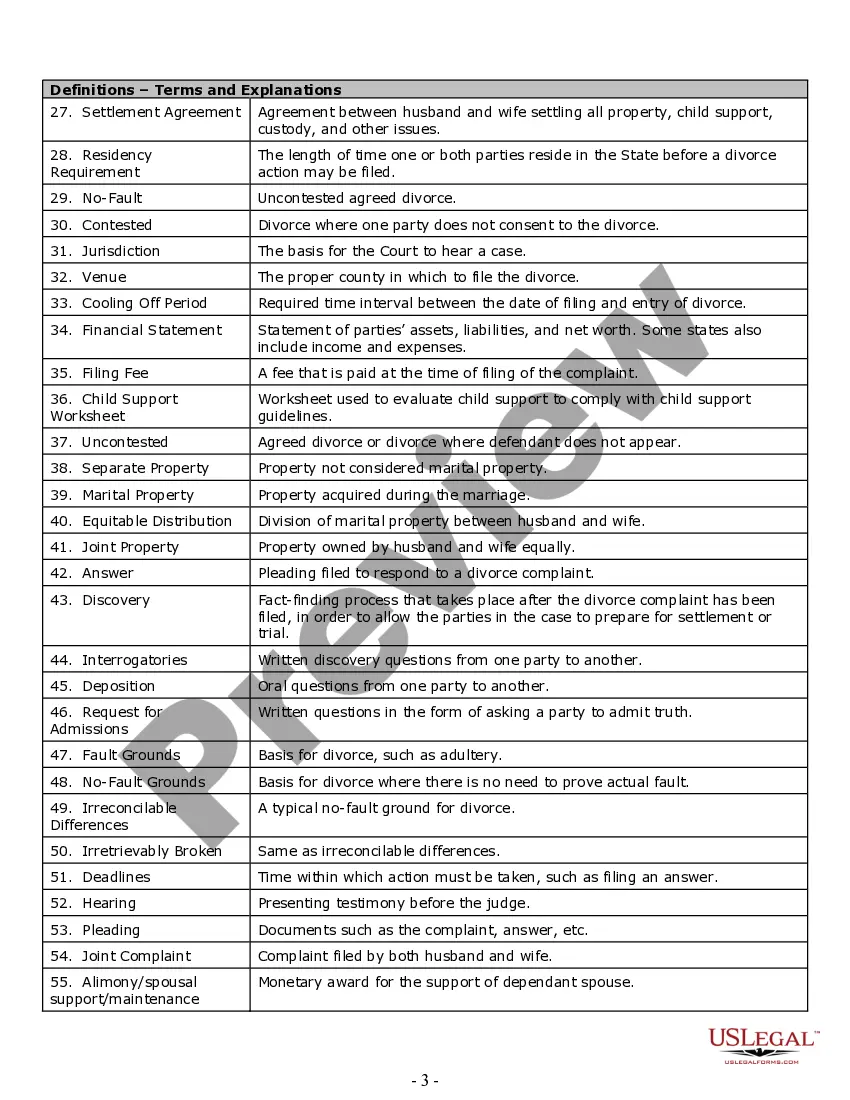

- Definitions of key legal terms related to divorce.

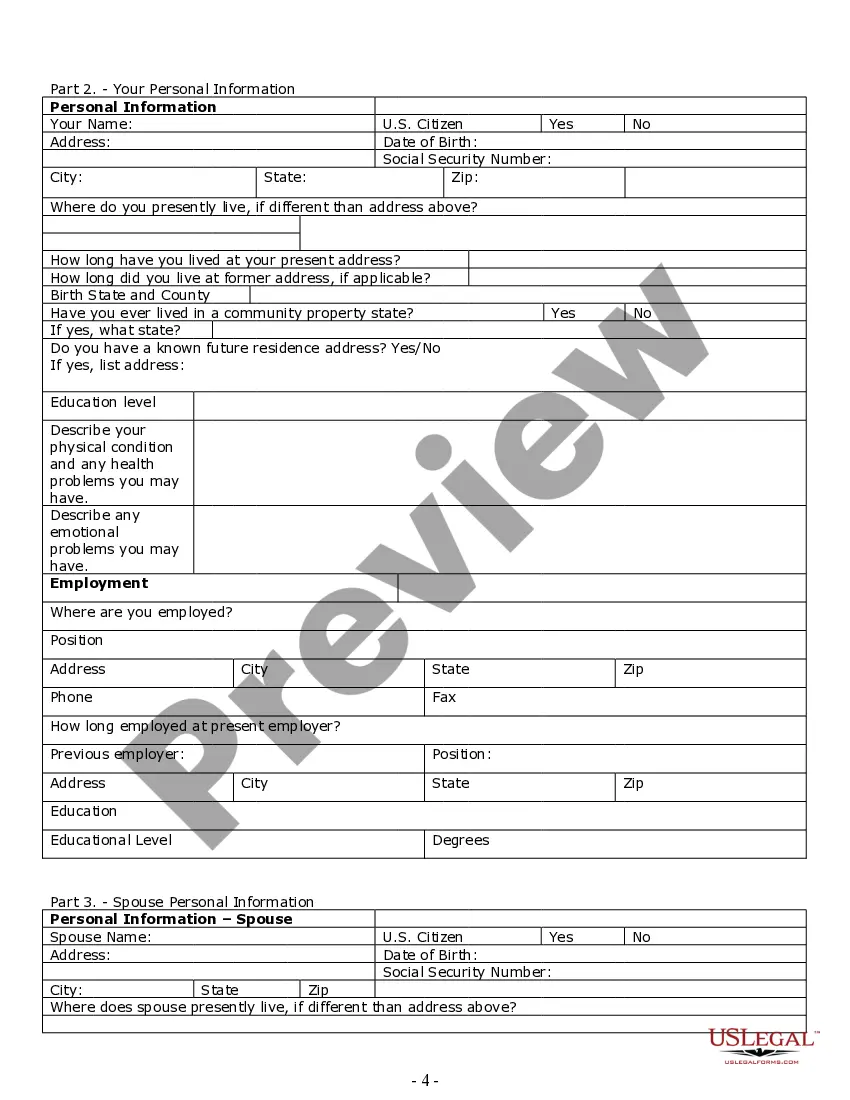

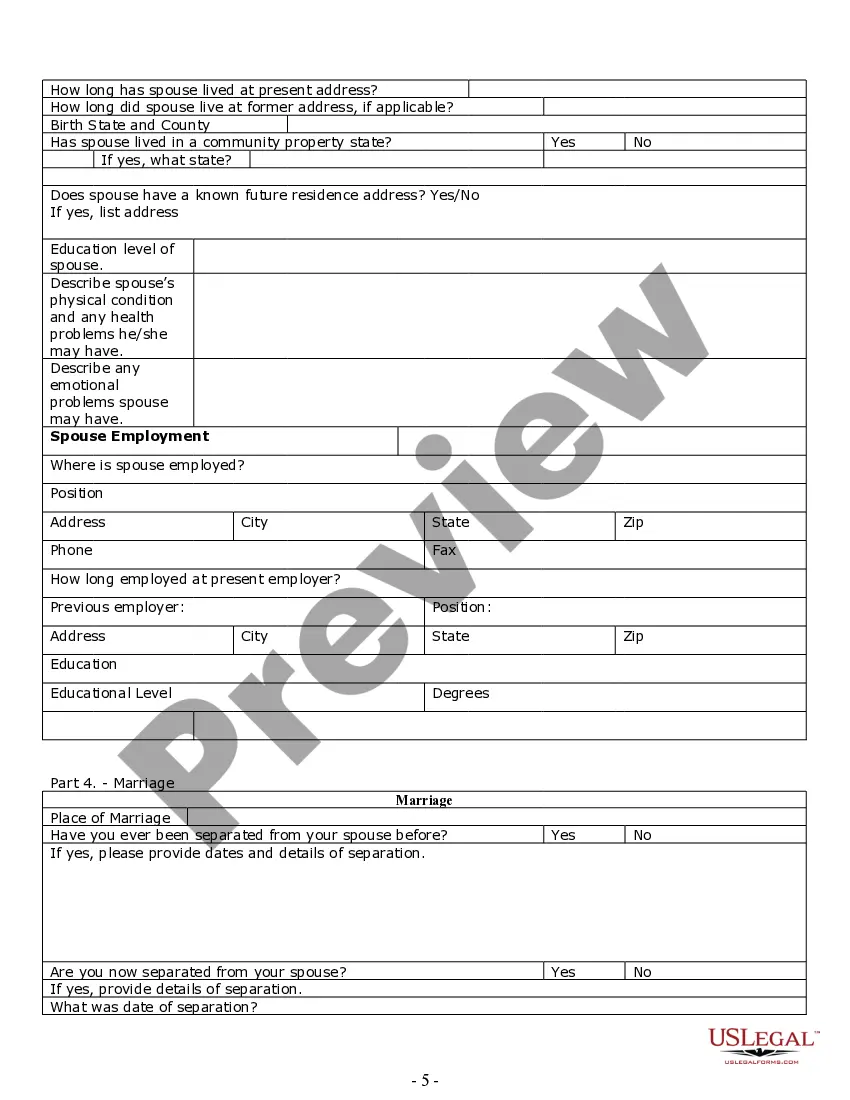

- Personal information sections for both parties involved.

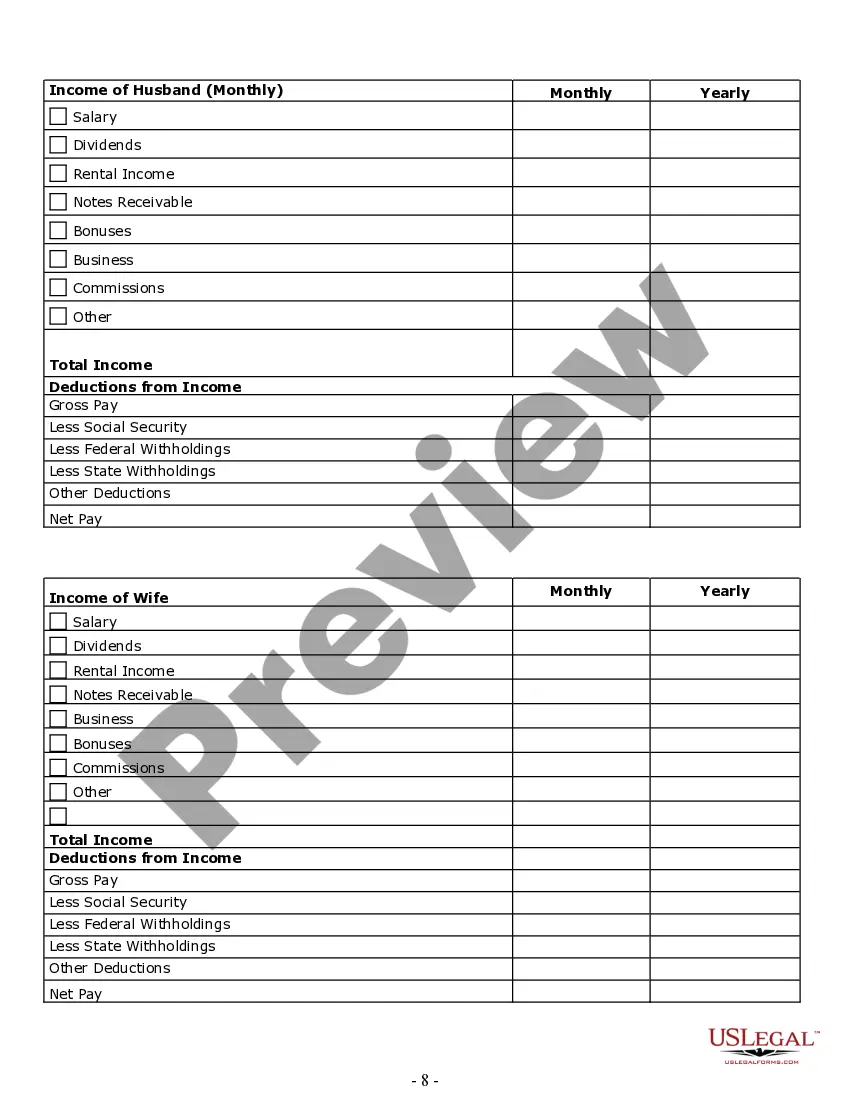

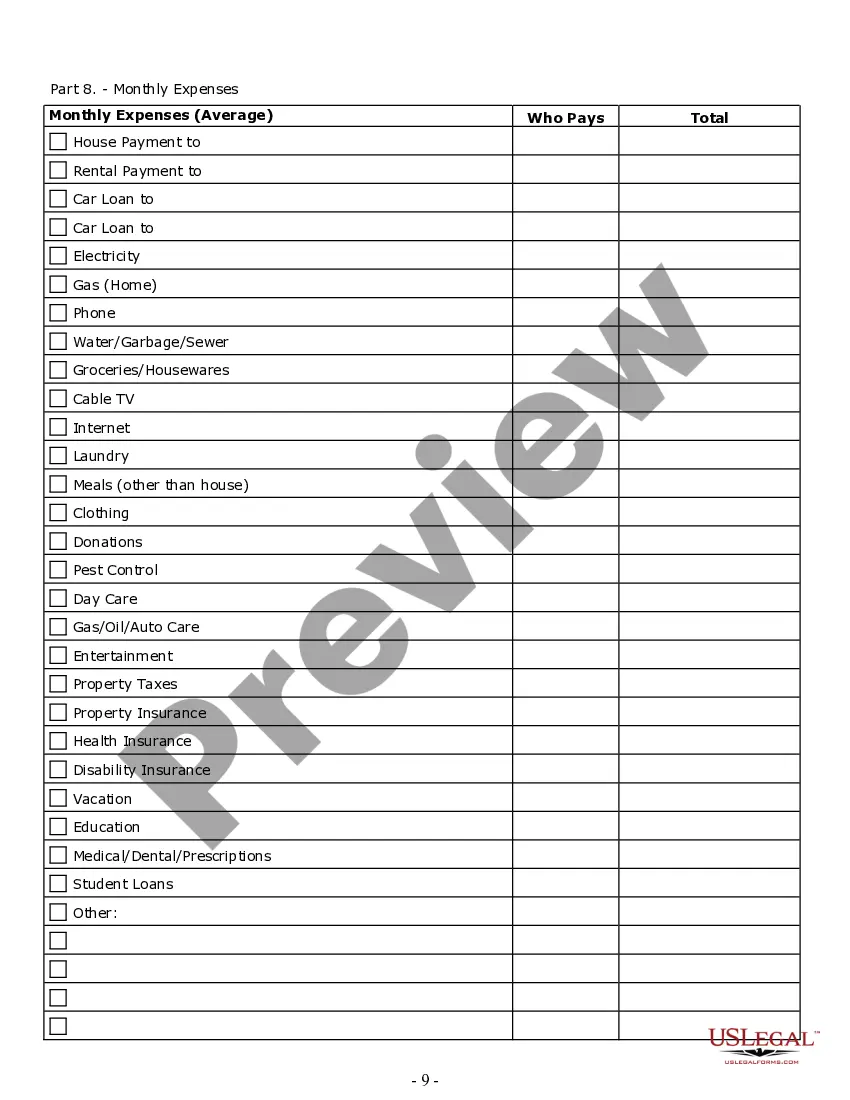

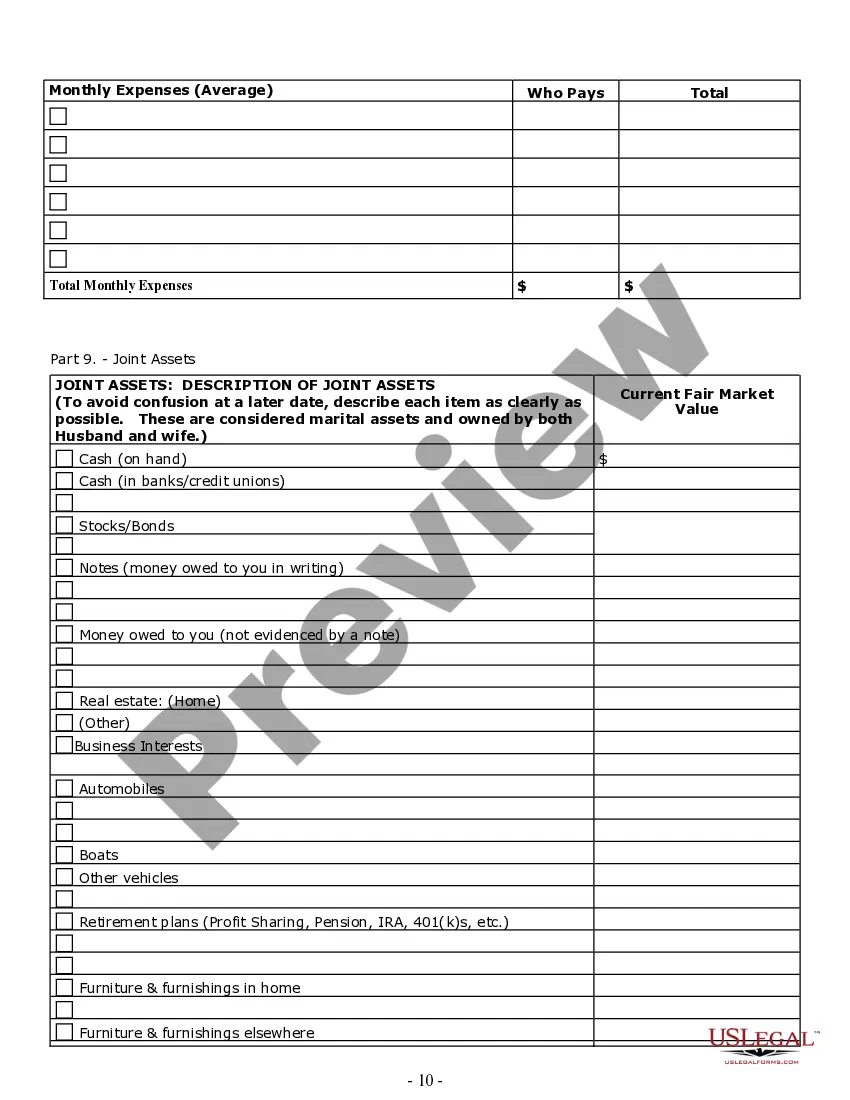

- Detailed financial worksheets summarizing income, expenses, and assets.

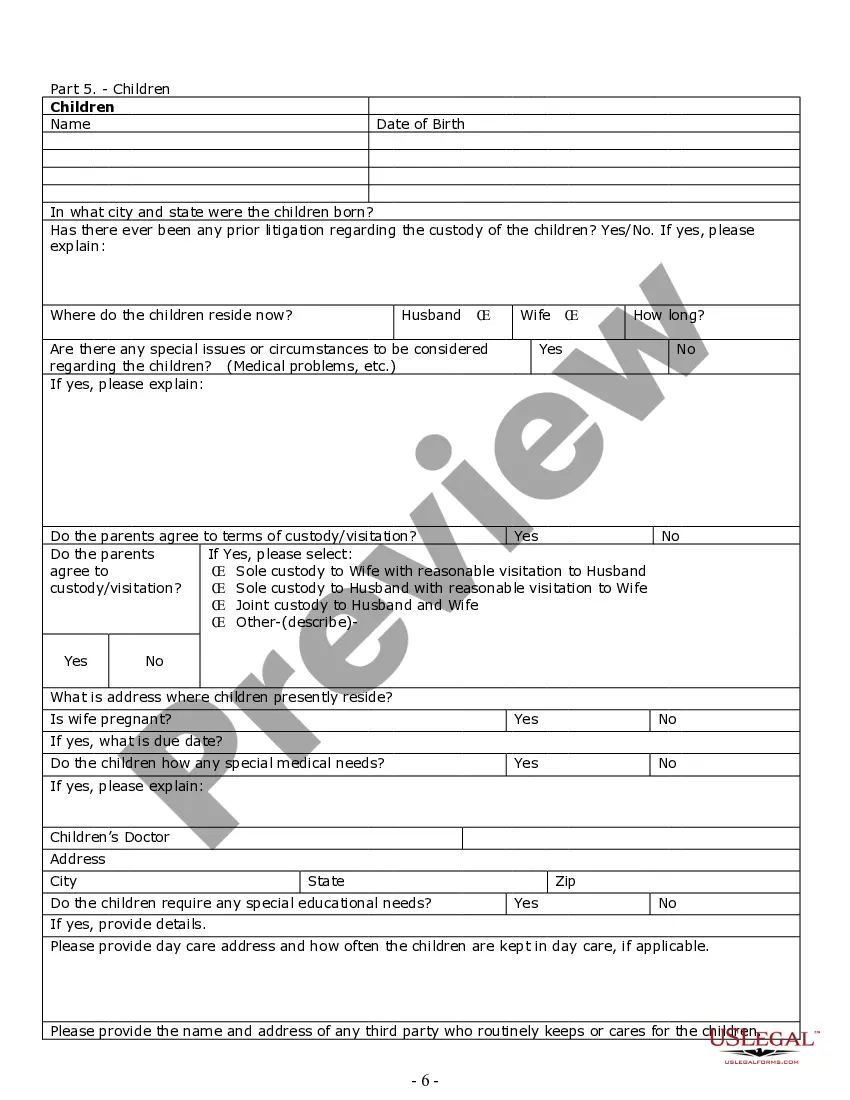

- Child custody and support considerations, including visitation arrangements.

- Instructions for finalizing the divorce process and potential court appearances.

When to use this form

This form should be used when you are considering a divorce and need to gather important personal and financial information. It is particularly helpful for individuals preparing for their initial consultation with a divorce attorney or for those looking to manage their divorce proceedings without legal representation. This form is useful in both contested and uncontested divorce scenarios.

Who this form is for

- Individuals considering divorce, either contested or uncontested.

- Clients preparing for a consultation with a family law attorney.

- Persons managing their own divorce proceedings.

- Anyone needing a structured format for documenting financial and personal details pertinent to divorce.

Completing this form step by step

- Start by filling in your personal information including your name, address, and date of birth.

- Provide your spouse's information in the designated sections.

- Document important details about children (if applicable) such as names and living arrangements.

- Complete the financial sections detailing both joint and separate assets, liabilities, and monthly expenses.

- Review definitions and instructions regarding child support and custody arrangements.

Does this document require notarization?

In most cases, this form does not require notarization. However, some jurisdictions or signing circumstances might. US Legal Forms offers online notarization powered by Notarize, accessible 24/7 for a quick, remote process.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Mistakes to watch out for

- Failing to provide complete and accurate financial information.

- Not reviewing state-specific divorce laws and requirements.

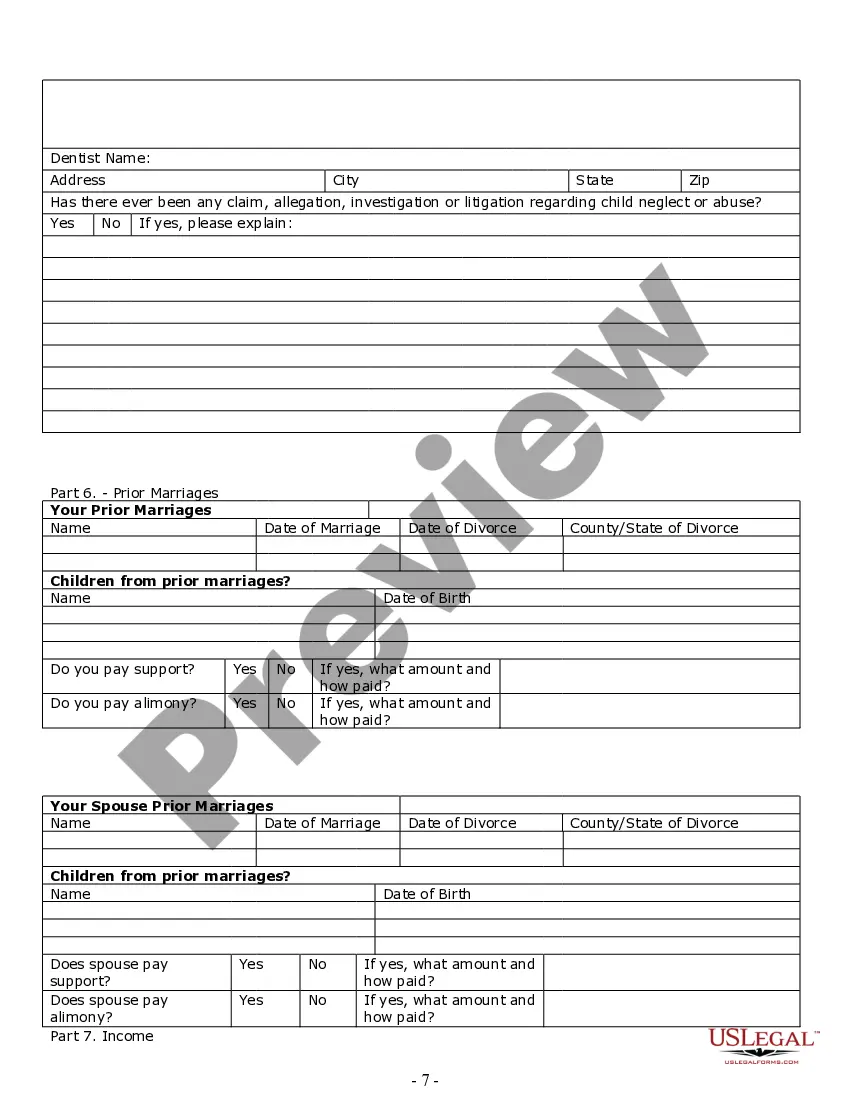

- Overlooking important sections related to children, such as custody and support arrangements.

- Leaving out previous marriage details that may affect current proceedings.

Why use this form online

- Convenience of completing the form at your own pace.

- Immediate access to required legal documents without the need for in-person visits.

- Editable formats that allow you to make necessary adjustments as your situation changes.

- Reliability of documents drafted by licensed attorneys ensuring legal validity.

Summary of main points

- The Divorce Worksheet helps simplify the divorce preparation process.

- Gathering financial and personal information is crucial before meeting with legal counsel.

- This form can be used in contests and uncontested divorce cases alike.

- Ensure to check state-specific regulations when preparing for your divorce.

Looking for another form?

Form popularity

FAQ

Meet Texas's Residency Requirements. Get a Petition of Divorce. Sign and Submit the Petition. Deliver a Petition Copy to Your Spouse. Finalize Settlement Agreement. Attend Divorce Hearing.

Under California's community property rules, retirement plans like all assets of the marriage must be divided in half. For 401(k) and other pension plans, this means that the non-participant spouse shall receive 50 percent of the value of the retirement plan accrued during the length of the marriage.

To be eligible, you must have been married 10 years or longer and meet other requirements.

How long do you have to be separated before you can file for divorce in Texas? There is no separation requirement to file for divorce in Texas. As long as one spouse has been a domiciliary of the state for six months and a resident of the county for 90 days, the divorce can be filed.

This is done via a court order called a qualified domestic relations order (QDRO). If your spouse is entitled to half or a portion of your pension, it would be withdrawn at the time of the divorce settlement and transferred into their own retirement account, usually an IRA.

You can receive up to 50% of your spouse's Social Security benefit. You can apply for benefits if you have been married for at least one year. If you have been divorced for at least two years, you can apply if the marriage lasted 10 or more years. Starting benefits early may lead to a reduction in payments.

Under California law, your marital assets will be split 50/50. That, unfortunately, will likely include your 401(k).

In Texas, the courts presume that all property and income that either spouse obtained during the course of the marriage belongs equally to both spouses. This means that the state will equally divide the couple's assets between them in the divorce process.

Texas is not a 50/50 community property state. The Texas Family Code requires a just and right division of community property. Judges may divide 55/45 or 60/40 if they see bad behavior on one side, or if there are fault grounds (adultery, cruelty, etc.), or if there is disparity in earning capabilities.