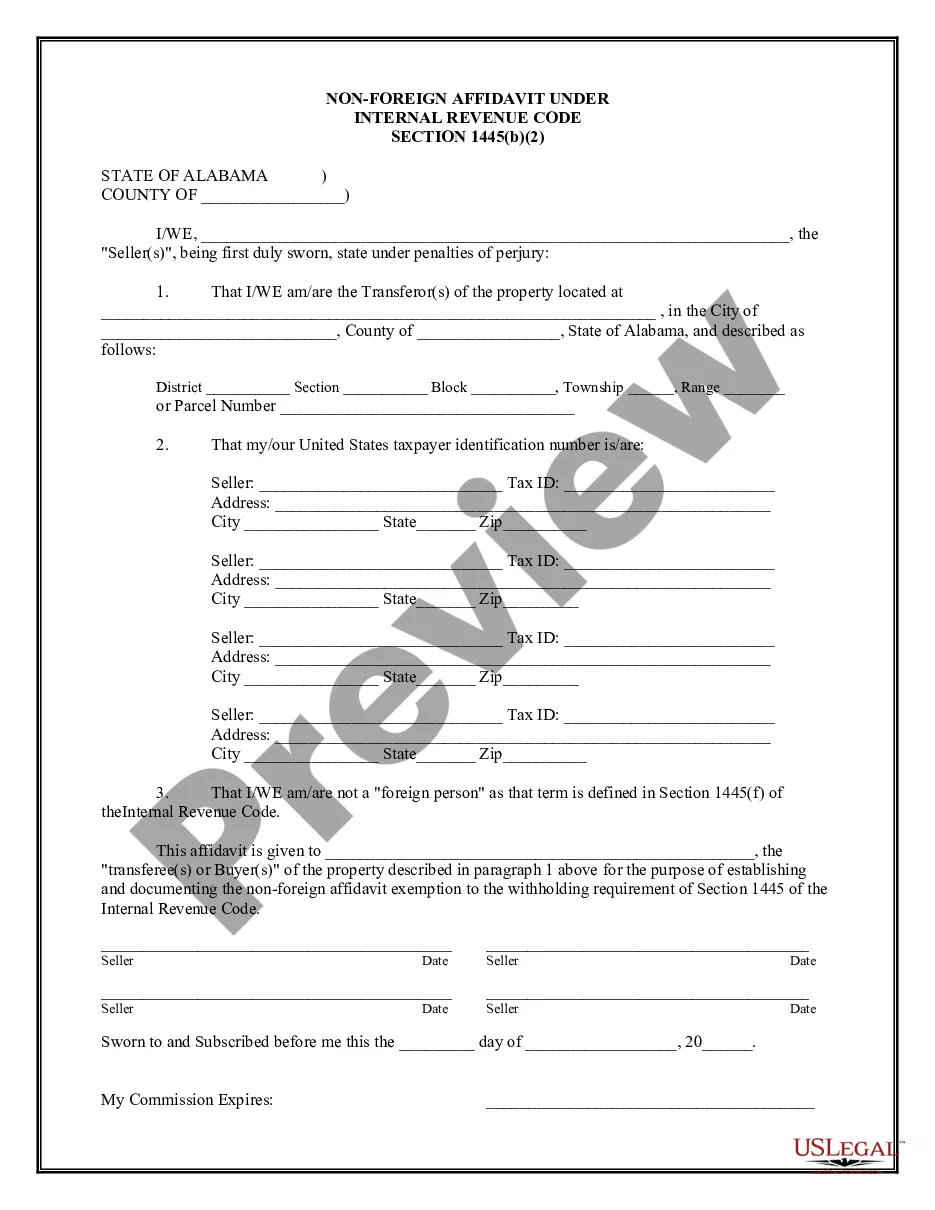

Alabama Non-Foreign Affidavit Under IRC 1445

What is this form?

The Non-Foreign Affidavit Under IRC 1445 is a legal document used by sellers of real estate to declare that they are not considered "foreign persons" under the Internal Revenue Code. This form is critical in real estate transactions to avoid withholding taxes that may otherwise apply to foreign sellers. By completing this affidavit, sellers can ensure compliance with tax regulations while providing buyers with the necessary documentation to proceed with the transaction without tax complications.

Main sections of this form

- Identification of the seller(s) and their taxpayer identification numbers.

- Description of the property being sold, including its location and legal designations.

- A declaration of non-foreign status as required by IRC Section 1445.

- Certification of the affidavit through a notarized signature.

- Name of the buyer or transferee for whom the affidavit is submitted.

Common use cases

This form should be used when selling real estate in the United States, particularly when the seller is a U.S. resident or entity. It is necessary to complete this affidavit to confirm non-foreign status, thereby exempting the seller from withholding tax requirements under Section 1445. Utilizing this form is crucial in any transaction involving a property sale where withholding could be applicable if the seller were identified as foreign.

Who this form is for

This form is intended for:

- Individuals or entities selling real property in the U.S.

- Taxpayers who are required to verify their non-foreign status.

- Real estate agents and attorneys assisting sellers in real estate transactions.

How to complete this form

- Identify all sellers and provide their full names and taxpayer identification numbers.

- Describe the property being sold, including the address and any relevant legal identifiers.

- Clearly state that the seller(s) are not foreign as defined under IRC Section 1445.

- Fill in the buyer's name, who will receive this affidavit.

- Sign the affidavit in front of a notary public to finalize the document.

Is notarization required?

Notarization is required for this form to take effect. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes

- Omitting the taxpayer identification numbers of sellers.

- Failing to accurately describe the property, which can lead to legal complications.

- Not having the form notarized, which is essential for validity.

- Incorrectly declaring foreign status, which may result in unnecessary tax withholding.

Advantages of online completion

- Convenience of immediate access and download from any location.

- Editability allows for customization according to specific transaction details.

- Reliability of attorney-drafted templates ensures legal compliance.

Looking for another form?

Form popularity

FAQ

An example of a FIRPTA statement is a formal declaration made by a seller, asserting that they are not a foreign person. This statement is crucial for buyers to comply with tax regulations during property transactions. By submitting an Alabama Non-Foreign Affidavit Under IRC 1445, the seller provides the necessary evidence to exempt the buyer from withholding taxes that apply to foreign transactions, promoting a smoother real estate deal.

A foreign person under section 1445 is typically an individual or entity that is not a U.S. citizen or resident alien. When buying or selling property in the United States, it’s important to determine if the seller qualifies as a foreign person. This classification affects tax implications for the buyer, necessitating the completion of an Alabama Non-Foreign Affidavit Under IRC 1445 to affirm the seller's status.

A foreign person affidavit is vital for a purchaser as it clarifies the seller's tax status and informs the buyer of any potential withholding obligations. If the seller cannot prove they are not a foreign person, the buyer may face unexpected tax consequences. By completing the Alabama Non-Foreign Affidavit Under IRC 1445, purchasers can protect themselves and ensure smooth transactions.

One way to get around FIRPTA requirements is by ensuring the seller provides a valid non-foreign affidavit, which confirms they are not a foreign person. This helps buyers avoid any withholding taxes associated with the sale. For those navigating this process, resources like USLegalForms can provide guidance on obtaining the Alabama Non-Foreign Affidavit Under IRC 1445 efficiently.

A foreign affidavit is a declaration that certifies an individual or entity is considered foreign for tax purposes. This document is essential for compliance with the Foreign Investment in Real Property Tax Act (FIRPTA), as it influences tax withholding during real estate transactions. Understanding the implications of a foreign affidavit is crucial, especially for buyers and sellers involved with properties under the Alabama Non-Foreign Affidavit Under IRC 1445.

Typically, the seller provides the FIRPTA affidavit as part of the transaction paperwork. However, real estate professionals, such as attorneys or title agents, can assist in preparing this document to ensure it meets all necessary legal requirements. Utilizing a reliable platform like USLegalForms can help streamline this process and provide templates for the Alabama Non-Foreign Affidavit Under IRC 1445.

Yes, a letter of Affidavit generally requires notarization to verify the identity of the person signing it and to lend authenticity to the document. This step is crucial for legal proceedings and official records, ensuring that the information presented is truthful and accurate. Notarization helps safeguard against potential disputes, especially in real estate transactions. USLegalForms provides easy access to notary services to assist with this process.

Yes, a FIRPTA Affidavit typically needs to be notarized to validate the identity of the signer and ensure the document's authenticity. Notarization adds a layer of credibility, which is important for legal compliance in real estate transactions. This requirement helps prevent fraud and protects all parties involved. You can find notary services conveniently through USLegalForms.

foreign Affidavit is a legal document that states an individual or organization is not classified as a foreign entity under FIRPTA. This affidavit is necessary to exempt the transaction from taxation withheld on the sale of real property. The document is vital for protecting both the seller and buyer in real estate dealings. You can easily prepare this affidavit through USLegalForms, ensuring you meet all legal requirements.

Typically, the seller signs the FIRPTA certificate, affirming their non-foreign status. The buyer may also be involved in the signing process to acknowledge the seller’s declaration. This step is crucial to ensure transparency in the transaction and compliance with federal tax regulations. Utilizing platforms like USLegalForms can streamline the signing process by providing templates and guidance.